5% inflation in US and bonds rallying...wait, what?

TMC #4! Don't act surprised, I told you there is no regime change. Also, a refresher on how QE actually works.

We had the ECB meeting last Thursday and the most relevant highlight was for sure the below headline which hit the tapes soon after the press conference ended.

Ok, that was a good joke :)

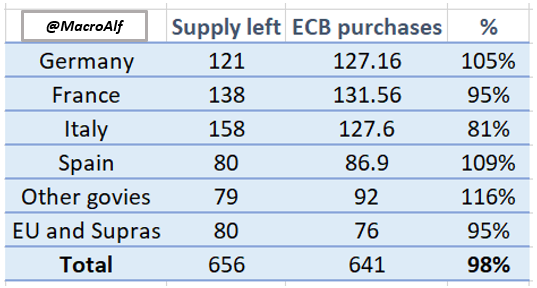

The ECB reaffirmed a sustained pace of QE purchases throughout Q3 as well, basically unchanged versus their already augmented Q2 pace (read: 100 bn net purchases per month from July to September). I thought to run few numbers on how relevant that number was when compared to the Eurozone government borrowing needs left to fulfill in 2021.

It’s big.

Assuming a mild slowdown in purchases in Q4, the ECB is still going to buy ALL the government bond supply left for 2021.

Ok, so bond yields tumbled. It’s very difficult for a risk taker to be short fixed income through the summer, and here is why.

The graph above from Goldman Sachs shows the carry and roll down for the next 3 months in being long bonds. The red quadrant shows 5y and 10y Italian government bonds and Treasuries.

The main point is that owning these bonds makes you money if nothing happens. Being short these bonds costs you money if nothing happens.

The ECB and the Fed are trying hard to tell you that they want to make sure nothing happens. So, if you were short on the ‘‘regime change’’ narrative, you now have to run and cover your shorts (buy bonds) and lick your wounds.

Ok, stop with the victory laps and the ‘‘I told you there is no regime change’’ and let’s talk about what actually QE is. There is a lot of confusion out there.

The ECB can’t buy bonds directly from governments. Governments issue these bonds in primary auctions or syndicated deals and mostly dealers/banks/pension funds/insurances purchase them.

The Central Bank comes in with QE: it creates reserves out of thin air and bids up the price (and down the yields) until those buyers sell them the bonds. The buyers now have a new portfolio of less bonds and more newly created reserves ultimately sitting by default back at the Central Bank.

Alhambra Investments shows it very neatly in the below diagram (FRBNY is the Fed).

So the Central Bank forcefully changed the composition of the bank portfolio from 100 Treasuries and 0 reserves to 0 Treasuries and 100 reserves.

There is no money creation involved when a Central Bank does QE, just a swap between bonds and reserves.

The entity that created new money in the diagram above is the federal government, under the assumption the newly issued marketable debt was not covered by taxes but rather net deficit spending.

Now, you might wanna argue that banks can take the newly created reserves and lend them out. No, that’s not how it works.

Reserves are irrelevant for bank lending.

When a bank lends, it does not use reserves. It credits your account with newly created money, and the money from your new loan will ultimately be deposited somewhere else in the banking system again. No use of existing reserves.

See for yourself the inexistent relationship between a zillion bank reserves that were created in Japan via QE and bank lending.

Base money is mostly bank reserves created with QE.

Bank loans are…well, the loans that supposedly could have been executed using these reserves. Except you don’t lend reserves out, that’s not how it works.

Sorry, I always get heated up when it’s about QE.

20 years of global QE under our belt and still people think that if creating 1 trillion reserves was not enough to lend them out, maybe creating 1 quadrillion reserves will be enough. Sure.

If you liked this article, please subscribe to this free newsletter.

The newsletter is sent out 2x a week, but if you want to see more regular updates you can follow me on Linkedin and Twitter.

All opinions expressed here are strictly my own. This is not investment advice.

The individual bank can use reserves to buy assets from another bank or to withdraw cash from the central bank, however, these remedies do not work for the banking system on aggregate.

The main benefit of the QE on the economy is an indirect one ie pushing mortgages rates lower which leads households to buy properties as they have the feeling to buy it cheaper. It boosts house prices, leads to spendings to refurbish the property and creates a wealth effect at least measured in terms of fiat currency. Of course the main drawback is that those who cannot or do not want play that game do not get the wealth effect and wealth gap increases... Only outlier is Japan with lower houses prices