5 rules to not suck at this game

TMC #14! Only 5-10% manage to generate consistent excess returns over a long period of time and they all religiously follow a set of rules.

10’ reading time (hopefully well spent)

Good morning everybody and welcome back to The Macro Compass!

As the market is trading sideways and I am on holidays (yes, again…I am Italian after all!), I thought to put out a piece about how to not suck at the game of generating excess returns. I believe these guidelines are true for both short-term oriented traders and long-term investors trying to outperform benchmarks.

Before we jump right in, the podcast with Market Huddle is out! Here is the link for Youtube (chart pack included), or you can also find it in audio-only format on Spotify and Apple - just look for The Market Huddle episode 141 or type in my name. It’s a slightly longer format (1h30m I believe) where Kevin Muir does not hold any horses back when it’s about asking questions or fighting my narrative. He has been a risk taker out there and that makes him a fantastic host. Enjoy!

Now, let’s look at these 5 rules not to suck at this game.

Rule #1: be realistic

Generating excess returns is an almost sure way to become rich - you either exponentially increase your capital or you find someone to sponsor you and you get a % payout of very large returns. Approximately this:

But that’s not that simple. You gotta be realistic.

First of all, commissions and other frictional costs eat away a part of your profits. You have to be able to generate excess returns after these frictional costs.

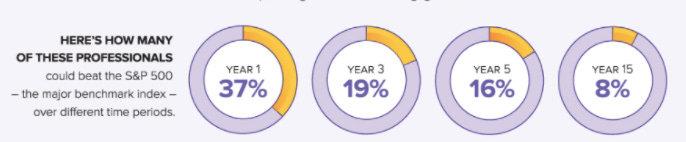

Second, about any investor is trying to achieve the same outcome. This makes it very close to a zero-sum game. The chart below shows how difficult it is:

Third, bear in mind most investors lending you capital are looking for you to generate excess returns adjusted for risk. They care about the volatility of your performance and the drawdowns you face. Taking more risk to make more returns is not enough.

Bottom line: be realistic. It’s a tough game.

Rule #2: find or build skewed risk-reward opportunities

One of the main things to understand in trading/investing is that you will not be right 100% of the times. You will have some successful trades, and some crap ones.

At the end of the year your P&L will look like the following, whether you are Paul Tudor Jones or somebody trading in his/her free time:

P&L = (% winning trades * P&L winning trades) - (% losing trades * P&L losing trades)

In principle, you can make money by being right <50% of the times, as long as your losses are small and the P&L of your few winning trades is large enough.

How do you make sure of that? You focus on skewed risk/reward opportunities.

A simple way to imagine this is to visualize the payoff of a long option position.

If you are long call, the worst that can happen to you is losing your premium. You know that amount in advance, your risk is capped…but your reward to the upside is potentially much larger. Skewed risk/reward.

There are of course other built-in strategies to achieve skewed risk/reward trades by construct, but you don’t have to be forced into options to achieve this.

There is another way, the good old way…

Rule #3: cut your losses and let your profits run

This is probably the ‘‘grandma advice’’ in generating alpha. Walk in a trading floor and ask a couple of seasoned traders what do they do before setting up a trade: I can guarantee the answer will 99% be ‘‘I set my stop loss’’.

I find this to be the best piece of advice I’ve ever gotten.

If you are able to do this, you won’t be stuck in that single terrible investment decision that will ruin your entire year P&L and hit your ability to take risks. You will just treat every trade like the other, and stop out when it’s time. No hard feelings.

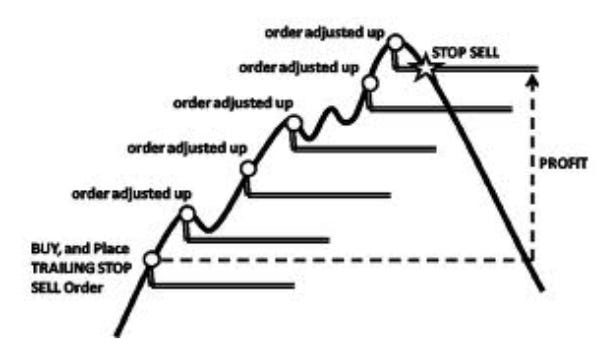

The real trick here is to use ‘‘trailing stops’’.

If you find yourself in a good trade, trailing stops will also help you to keep your profits running as long as the trend is favorable. And they will of course limit your downside if the trend reverses.

If you feel you are getting stopped out too often and losing too much money, maybe it’s because you are not adhering to rule #4 that much…

Rule #4: size your positions correctly

Most people would just use the same size for each trade. Whatever the instrument is: EUR/USD, a short-end bond, a utility stock, or Bitcoin.

No guys, that’s as bad as putting ketchup on pasta (yeah, really bad).

The size of your position and where you put your stop loss should be proportional to how volatile is the underlying instrument and how volatile is the market lately.

The first step should be: how much am I ready to lose on this trade? And the answer should be a small % of your remaining capital.

The second step should be: how big of a move do I need in this instrument given its volatility to hit my stop? Let’s size the position accordingly.

Basically, don’t put 1% stops on BTC and invest 20% of your remaining account at each round. That’s not trading/investing, that’s gambling.

Rule #5: watch out with diversification and proxy hedging

‘‘I don’t use stop losses because my portfolio diversifiers are going to protect my downside risk’’.

Heard this few times, and it might work for a while…as long as (negative) correlations hold. But often these accounts are wiped out when correlations start to weaken.

Mind you, you don’t need the correlation to break completely and even change sign. You just need the correlation coefficient to start weakening and the first cracks will appear straight away.

Diversification and proxy hedging are important in a portfolio/trading strategy, but in my opinion they should complement stop losses rather than replacing them.

The best way to hedge your risk…is to sell your risk.

Bonus quotes!

Three more quotes I now fully own in my investment approach. They were all shared by the proper guys: hedge fund portfolio managers and/or serious risk takers.

Never be emotionally attached to a trade or a view of the world: stop out from the trade, and stop your ego out too. Be adaptive: if facts change, your opinion has to change too.

If you have a great macro story and the facts are there to back it but the market is not paying attention…your trade won’t work. If nobody cares and the narrative is not there, just be patient.

For every trade in your portfolio, ask yourself every day ‘‘with the set of info I have and given today’s price, would I enter the same trade today?’’. If the answer is no, then why do you have the trade on?

The summer reading list

Got few questions on the best macro/finance books I ever read. Let’s start from:

The Holy Grail of Macroeconomics (by Richard Koo): you got to understand Japan to understand where the Western world might be heading to 20 years later

Inside the House of Money (by Steven Drobny): a series of great interviews to serious risk-takers in this business; you will find more trading quotes and tons of funny finance stories too

Pragmatic Capitalism (by Cullen Roche): a short and sweet summary of what ‘‘money’’ is and how the banking system really works

If you liked this article, why not share it with your (social) network?

This community is growing very quickly, but still…The more, the merrier!

You can share on several platforms clicking on the button below.

If you are not subscribed yet and you’d like to receive updates directly in your inbox, you can subscribe clicking on the button below.

I generally publish 1-2x a week (Monday + sometimes Thursday) covering weekly market developments, posting trade ideas and digging deep into broad macro topics.

For free, without ads.

See you at the next update!

This is why I only trade options. You define the risk you want to take. For example a synthetic option at Delta 0.8 and a ATM put you know your worst case scenario. Bottom line is you don't get the direction right on the stock it's hard to make money.

Anyone else keep track of excess losses from ignoring stops? I print it out in a huge font size and keep it as a sign next to my screen. I know entire hedge funds have blown up and careers ended by refusing to take losses.