‘‘It is VERY premature to think about a pause in our interest rate hiking cycle’’

Jerome Powell - FOMC November press conference

Hi all, and welcome back to The Macro Compass!

We finally got a pivot - but it wasn’t the one many investors were hoping for.

At the FOMC press conference, Powell pivoted from hawkish to…more hakwish.

Through the use of 3 unambiguous punchlines, Chairman Powell made sure to convey one clear message: we will get it done, whatever it takes.

As investors entered the meeting with a complacent attitude and the initial press release seemed to back the idea of a ‘‘dovish pause’’, the press conference served as an abrupt awakening to the new/old reality: this is not the time to reload on (risk) assets.

In this article, we will:

Go through the Fed meeting and the bond market reaction, step by step;

Discuss how the reiterated Fed hawkish stance will interact with the liquidity backdrop ahead (Treasury buybacks, QT, reverse repo etc), and how this affects portfolio strategies goind forward.

Keeping At It

Actually, before we jump right in.

Dear community: mark your calendars.

November 10th, 2022.

An email from The Macro Compass you really don’t want to miss.

Back to it: the press release seemed to be dovish.

But as soon as Powell started speaking, things dramatically changed.

Jerome threw 3 major punchlines that inequivocally signalled to investors that yes, there was a pivot.

But not the one they were looking for.

The pivot was from hawkish to…more hawkish.

Let’s go through these 3 key moments.

#1: It’s Very Premature

‘‘It’s very premature to think about a pause in our interest rate hiking cycle’’.

I suspect Powell looked at his screens before entering the press conference room and saw rates rallying, the USD weakening, equities zooming higher.

And he must have been very much…p*ssed.

Indeed, in the Q&A session he used one of the very first chance he had to completely dispel the idea of a ‘‘dovish pause’’ in the Fed hiking cycle.

The Fed is setting policy looking at core inflation and the labor market - those are coincident to lagging indicators, which means the Fed is driving the car looking in the rearview mirror.

But as my mentor often said, investors trading based on what Central Banks should do are bound to underperform - as the labor market remains hot and core PCE is trending at 5% annualized rates, there is no evidence at all that would support a data-driven Fed pause, let alone a pivot.

It’s not about what the Fed should do, but what they will do.

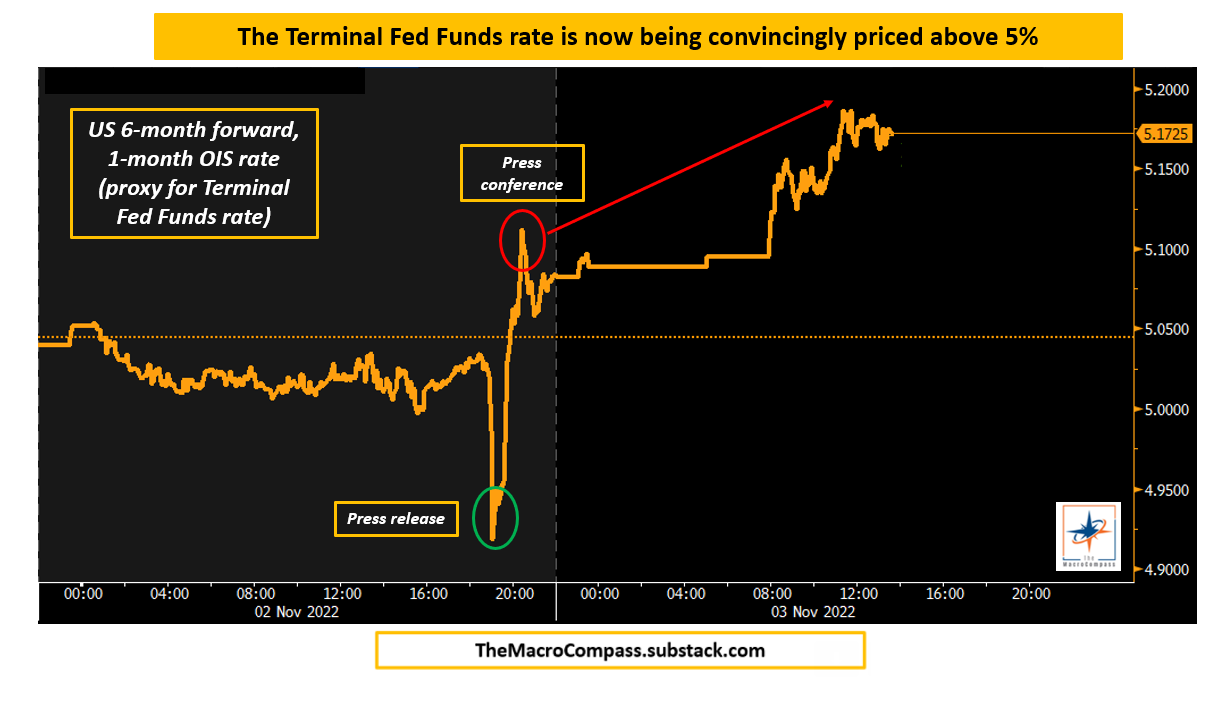

Check for yourself how markets digested Powell’s first punchline: the Fed Funds terminal rate aggressively moved higher and never looked back.

A more aggressive Fed in the short-term is likely to cause more long-lasting economic damage in the long-term, and this is reflected in relentlessly flattening yield curves.

Here is where we stand in the Overnight Index Swaps (OIS) curve:

2s5s: -60 bps (inverted since April)

2s10s: -86 (inverted since March)

5s30s: -77 (inverted since March)

US Treasury curve slopes are also inverted across the board.

But to show there is no room for nuances, Powell cherry-picked a very special curve slope: gaslighting at its best, in an attempt to dismiss evident and persistent curve inversions as a reason to slow down.

Yet JPow can’t gaslight the TMC community - here is the long term chart of Powell’s preferred curve slope: the 18-month forward 3-month rates minus prevailing 3-month rates (using OIS, as it should be done).

It might not be inverted (yet), but it soon will.

#2: Higher For Longer: Got It?

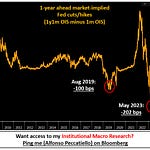

'‘The incoming data since our last meeting suggest the terminal rate of Fed Funds will be higher than previously expected (4.63%), and we will stay the course until the job is done''.

The other ‘‘pivot’’ dimension investors were looking for was a remark of financial stability risks that arise from keeping rates in the 5% area for too long - effectively, a step back from the higher for longer mantra.

They got the opposite.

Powell reiterated the Fed will ‘‘stay the course’’ and ‘‘keep at it’’ until the job is done - did you know that ‘‘Keeping At It’’ is the name of one of Volcker’s books?!

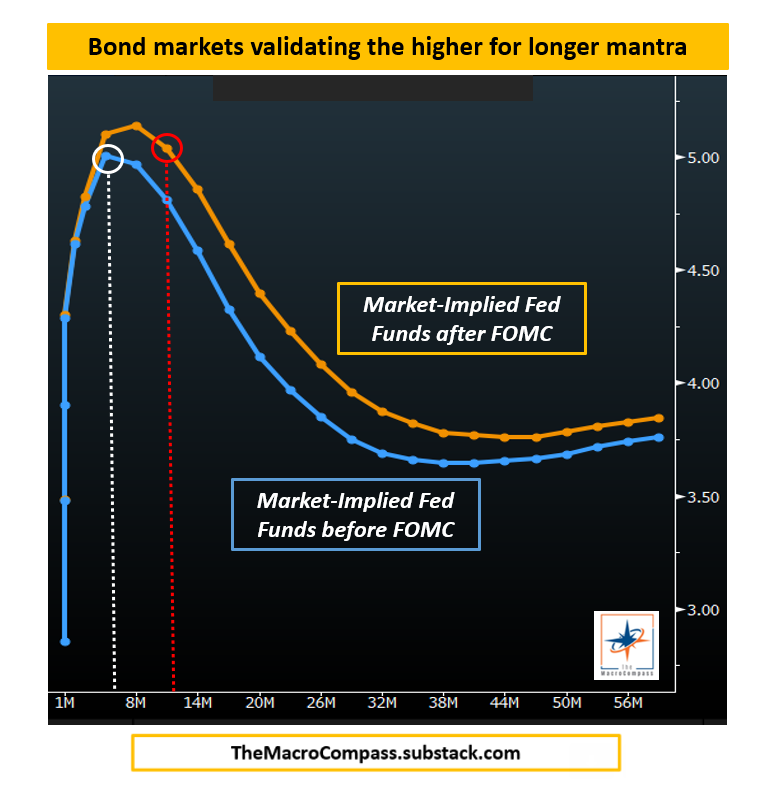

The chart below shows how the bond market digested this message: the Fed was not only repriced to hike rates above 5%, but to keep them at least around that level for 6 more months all the way until the end of 2023.

Try to picture this: Fed Funds ≥ 5% for the entirety of 2023.

The higher for longer mantra is important to Powell because it reduces the possibility of financial conditions preemptively easing well ahead of time, potentially spurring an uptake in economic activity which is undesirable given the Fed’s willingness to bring inflation down to 2% as soon as possible.

When a journalist asked about markets rallying (although they weren’t…) during his press conference, Powell’s reaction was unambiguously along the same lines: strong pushback against easing of financial conditions.

Higher for longer: got it?

#3: Risk Management = Over-Tightening > Doing Too Little

''Prudent risk management suggests the risks of doing too little are much higher than doing too much. If we were to over-tighten, we could use our tools later on to support the economy. Instead, if we did too little we would risk inflation getting entrenched and that’s a much greater risk for our mandate’’.

This was the most nuanced and yet the most relevant punchline, in my opinion.

Again inspired by his ‘‘hero’’ Volcker, Powell understands that doing too little is way more risky than doing too much when fighting inflation.

In the 70s, Volcker made that mistake and was then forced to tighten even more aggressively to bring inflation down once and for all.

Powell wants to go down as somebody who successfully slayed the inflation dragon, and in order to do that he must regain credibility with markets in the first place.

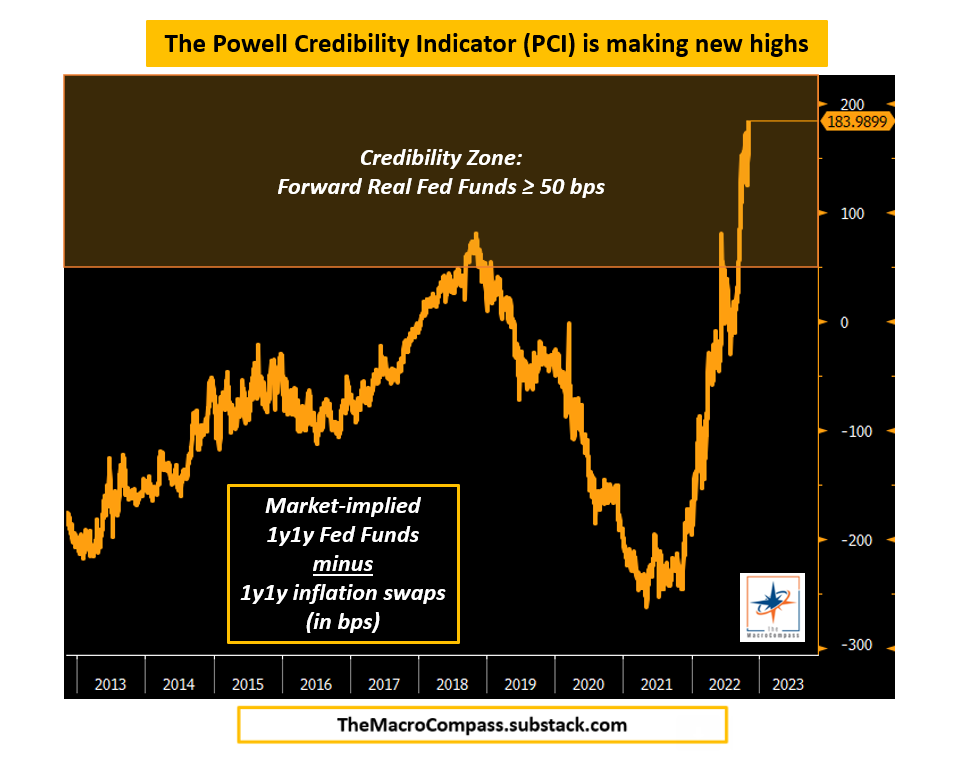

The Powell Credibility Indicator (PCI) looks at market-implied 1-year forward, 1y nominal Fed Funds minus inflation expectations: if forward real Fed Funds are priced to be comfortably in positive territory, it means the market believes Powell will keep policy tight enough for long enough to bring inflation down.

And the Powell Credibility Indicator made new highs today.

Another way to look at it is through the lens of the US Real Yield curve.

If real yields are markedly positive across tenors, borrowers will experience tight financing conditions across the board and hence be more reluctant to access credit and leverage - resulting in a more likely economic slowdown.

While 6 months ago the US real yield curve was still in negative territory until the 7y point, today US real yields are in the +2% (!) area across the entire curve.

Powell likes this.

Don’t fight the Fed.

Time to look at market implications now, also taking into account the important developments ahead in the US monetary plumbing world.

Conclusions & Portfolio Implications

Yes, there was a pivot: from hawkish to…more hawkish.

Powell is ‘‘keeping at it’’ as his hero Volcker would do, and he doesn’t want to hear it - he’ll keep driving the car looking in the rearview mirror and he is well aware of the risks of overtightening.

Yet, he will stay the course.

On this monetary policy backdrop, there is something very interesting going on in the monetary plumbing arena too.

Investors can now get 4%+ returns parking money in short-term Treasuries or money-market funds (MMFs) against getting rewarded almost nothing for keeping money at US commercial banks.

While short-term Treasuries or allocations in MMF are slightly more illiquid than a bank deposit, the pros are very compelling:

A) 4%+ additional returns

B) Less (!) risk, especially if savings exceed $250,000 (FDIC insurance threshold): over that amount, bank deposits are effectively an unsecured liability of a commercial bank while allocations in short-term Treasuries or highly regulated MMFs are effectively a liability of the US government and hence a less risky form of money.

Why is this relevant?

Because if investors allocate a portion of their bank deposits into short-term Treasuries or MMFs, they also take bank reserves away from the system.

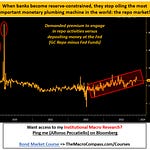

Bank reserves are money for banks, and you should think of them as the lubricant of the financial system: banks use them to settle transaction, engage in repo/reverse repo with each others and hence provide balance sheet and liquidity to markets.

Now, over the next quarters reserves will be falling not only as the result of this potential allocation shift from investors but also due to:

The planned increase in the TGA (~ +75 bn)

The scheduled QT (~ 95 bn/month)

Both operations drain bank reserves from the system, unless another Federal Reserve liability takes the hit - the Reverse Repo facility.

The whispered US Treasury Buyback Plan would greatly facilitate that process, as a major issuance in T-Bills to fund bond buybacks would allow MMFs to take money away from the Reverse Repo facility and invest it in newly issued T-bills at attractive levels - but the Buyback Plan has been postponed by at least 3-6 months.

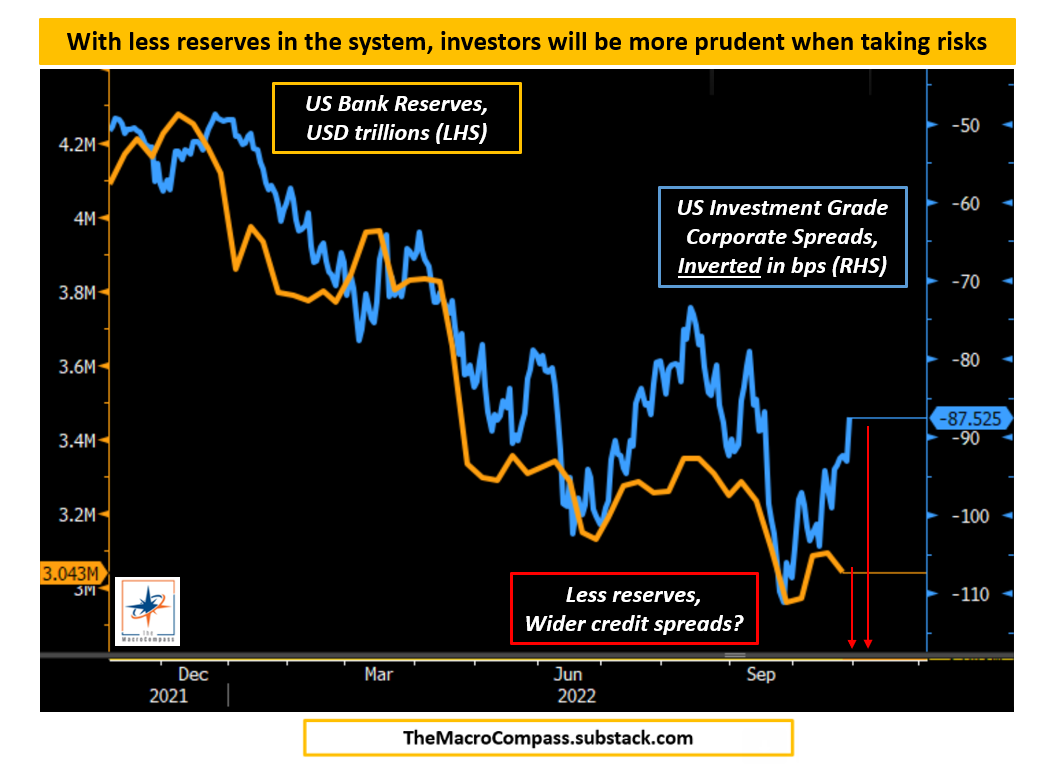

That means bank reserves will keep falling hard.

And the lower amount of reserves in the system, the more prudent banks will be when taking risks and facilitating a smooth functioning of the bond market.

The chart below shows how falling bank reserves imply wider credit spreads.

A reiterated hawkish stance plus net liquidity drains move us even more South in The Macro Compass Quadrant asset allocation model.

The economic growth impulse isn’t accelerating either, which keeps us deep into Quadrant 4.

‘‘There is a time to be long, a time to be short, and a time to go fishing (i.e. be patient)’’.

Long USD cash, Long patience.

Short almost any (risk) assets.

And this was all for today, thanks for reading!

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

If you are interested in any kind of partnership, sponsorship, conferences or media appearances feel free to reach out at TheMacroCompass@gmail.com.

See you soon here for another article of The Macro Compass, a community of more than 110,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Every week, I also interview the best macro strategists and risk takers around the world and ask them what’s their top trade idea on my podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks YouTube channel.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

A Pivot From Hawkish To...More Hawkish