Gold: to have or not to have?

TMC#15! A measured approach to assess the pros and cons of gold and whether you need it in your portfolio. Spoiler: yes, you need it.

10’ reading time

Good morning everybody and welcome to The Macro Compass!

If you are not subscribed yet, here you go!

Today we are going to talk about gold.

I am not a maximalist: neither a gold bug nor a gold basher, so you’re going to get both the pros and cons of owning gold in a long-term investment portfolio.

Bottom line: you should own 5-10% gold in your portfolio.

Before we dive in, a short update on my tactical global macro portfolio.

Reminder: this is NOT an investment recommendation but rather my own investment journal. These ideas might be reflected in my personal savings portfolio. Treat this as a public record of a (potentially fictitious) tactical portfolio.

In general, I always represent myself and not my employer.

I stopped out of my relative value trade: long Nasdaq, short EUR banks last week.

While the long side of the trade (plus the EUR/USD short overlay) is working well, the short European banks leg suffered a lot.

This was the typical example of “proxy” trade gone sour. The short leg (EU banks) was based on the assumption European rates would remain depressed and therefore financials would suffer as they can’t make margins. Bund yields are much lower but financials are rallying…ouch. Note to myself (again): do not proxy trade.

Still in US 5s30s flatteners (entered @129 with first target @100, now @116).

The global credit impulse marked slowdown starts to be reflected in few surveys here and there (e.g. UMich last week, Chinese PMIs) while the Fed is about to embark in an attempt to tighten monetary policy => I expect the US yield curve to flatten.

Every trade is sized as such my P&L suffers a 2% drawdown when I stop out.

YTD P&L now at +4.5% with annualized volatility around 5.5%.

Now let’s dive into gold as an investment vehicle!

A bit of context first

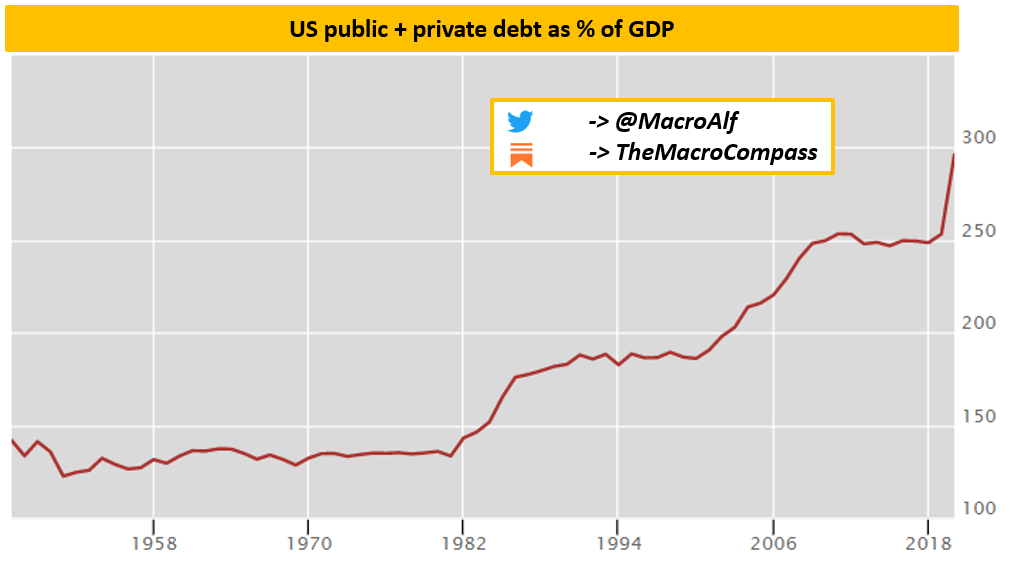

After 1971, our monetary system embraces a fully elastic process when it comes to credit creation.

Governments and banks can expand/contract credit whenever they deem appropriate. The amount and pace of credit creation is not inherently tied to any hard asset which is considered valuable and whose supply is limited by definition (e.g. gold standard).

Credit creation is the process of printing ‘‘real economy’’ money ex-nihilo: our system literally allows to inject resources in the private sector hands with few keystrokes (bank lending) or a couple of deficit-friendly politicians (government deficit spending).

This allows us to expand credit and generate cyclical growth to overlay on the (declining) potential growth rate of the economy.

Now, take Germany for example.

Germany is estimated to have a potential YoY real GDP growth of about 0.5% over the next decade. I'd think it’s even less as my estimates for total factor productivity (including capital) are lower. Say very close to 0%.

Now, is it socially/political acceptable to have such a low real GDP growth? Not much.

‘‘We want all, and now’’ is a deeply rooted feature of human nature and it finds a perfect breeding ground in such a monetary system: if your structural growth is poor, we can always create credit to overlay some cyclical growth on top.

As incentive schemes are tilted towards short-term for both politicians and current generations, it matters little if that credit creation results in unproductive debt.

Does it help achieving the ‘‘all, and now’’? Yes!

Well, here you go.

I am not saying this monetary system is wrong and that a gold standard system would be any better for society and long-term growth. But before talking about gold, it’s important to keep in mind how our monetary system is structured today.

Gold, pros and cons

I own 10% of my savings in gold. Why?

The pros outweigh the cons, hence I can’t afford not owning it

It’s a one of the few instruments which would thrive in a monetary system reset

Why not 25%+?

Gold is not tied to earnings and GDP growth, and my base case can’t be earnings and GDP growth will stop growing and the world will fall apart

I am not a maximalist, but I rather try to assess risk/reward of different asset classes based on my probabilistic view of the world: the probability of a historically relevant event like a monetary reset is credibly not large enough to warrant >25% allocation

So, let’s zoom into the pros and cons.

The pros

As we keep on extending credit to overlay cyclical growth on the poor structural GDP growth rate, we also need nominal interest rates to drop quickly and possibly faster than inflation rates. Why?

If I have 100$ of debt, I’d rather pay 1% than 5% interest rate to service it. Clear.

But I could afford paying 5% interest rate if the yearly inflation rate would be 6%, as inflation reduces the real value of my outstanding debt pretty quickly.

The higher the debt load, the lower inflation-adjusted interest rates we need to afford servicing those obligations. This is true unless structural GDP and earnings capacity pick up, such that debtors (especially the private sector) can service higher debt loads with their cash flow generating abilities.

Everybody knows how gold thrives when real yields drop, so I won’t bother you with charts you have seen a zillion times.

But calling ‘‘causation’’ when two lines visually correlate on a chart is not enough: I always ask myself whether there is a compelling macro story behind it, too.

And here there is one.

As a byproduct of large credit expansions while structural growth remains poor, (risk-free) real yields drop. Investors will therefore be more inclined to look through the no-carry feature of gold and the precious metal might attract marginal flows.

So, gold benefits from the structural drop in real yields which are a byproduct of poor structural growth and the monetary system framework. Great!

In my head, gold is also the best asset to hedge against the (very low) probability of a monetary system reset.

If you want to peg fiat currencies to a hard asset, gold pretty much stands out as it’s already being used for this purpose and it’s already owned by authorities on their balance sheet.

So far, so good! So, why not more than 10%?

The cons

Gold benefits from real yields dropping, but it’s not tied to earnings or GDP growth.

By denominating a larger portion of your portfolio in gold, you are missing out on the global earnings generation capacity.

Do you know which asset benefits from dropping real yields AND earnings growth?

Equities, indeed.

Equity total return is driven by dividend yield at inception, earnings growth and the development in valuations (P/E). As earnings grow, stocks would go up ceteris paribus.

What about valuations?

Well, how much would you pay upfront for a valuable stream of cash flows (earnings) in the future if the risk-free real yields are likely to stay very low for a while?

In a nutshell, that’s why equities benefit from both dropping real yields and growing earnings over time.

Yes, but gold is an inflation hedge!

Although not perfect, one might argue that’s the case over the very long term.

But again, it would be a suboptimal instrument to protect your purchasing power in such an inflationary environment as shown in the tables below.

You’d be better off owning (especially EM) equities, commodities or real estate if you think inflation is on the rise (JPM AM defined that as CPI overshooting 2.5% for a decent period of time).

Again, gold would do well in a rising inflationary environment.

But the risk/reward of owning a large % of gold in your portfolio is not great as:

It’s not tied to earnings/GDP growth, hence it might underperform other assets (especially equities in total return) more often than not

It’s not standing out either as a major outperformer during inflationary regimes.

Here is a 13y asset class performance table.

Conclusion

I believe a 5-10% allocation to gold for your long-term investment portfolio is a sound decision, as you’ll benefit from the structural trend of dropping real yields while owning an asset that inherently benefits from a tail scenario such as a complete reset of our current monetary system.

I don’t believe owning a large % of your wealth in gold is the best risk/reward strategy, and I also don’t see the immediate upside of not having any exposure to gold.

We are now a 6.000+ community here on The Macro Compass. Thank you all!

If you liked this article, why not share it with your (social) network?

If you are not subscribed yet and you’d like to receive updates directly in your inbox, you can subscribe clicking on the button below.

I generally publish 1-2x a week (Monday + sometimes Thursday) covering weekly market developments, posting trade ideas and digging deep into broad macro topics.

For free, without ads.

See you at the next update!

gold is a zero coupon perpetual bond issued by god

How about crypto instead of gold?