The Fed understands that banking stress is ultimately disinflationary as the flow of credit to the real economy slows down and so does economic activity, and inflation with it.

Markets are now busy interpreting what it all means, and this is why in this timely piece we will:

Discuss the 2 most important takeaways from the Fed meeting;

Assess market reactions across asset classes, with a particular focus on the bond market;

Disclose the resulting tactical trade ideas

Wait: Have We Broken Something Here?

“Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”

With inflation sticky and still trending above 5%, for the Fed to come out of the gate with a forward-looking statement like this is quite something.

Powell & Co deeply understand the disinflationary nature of banking stress.

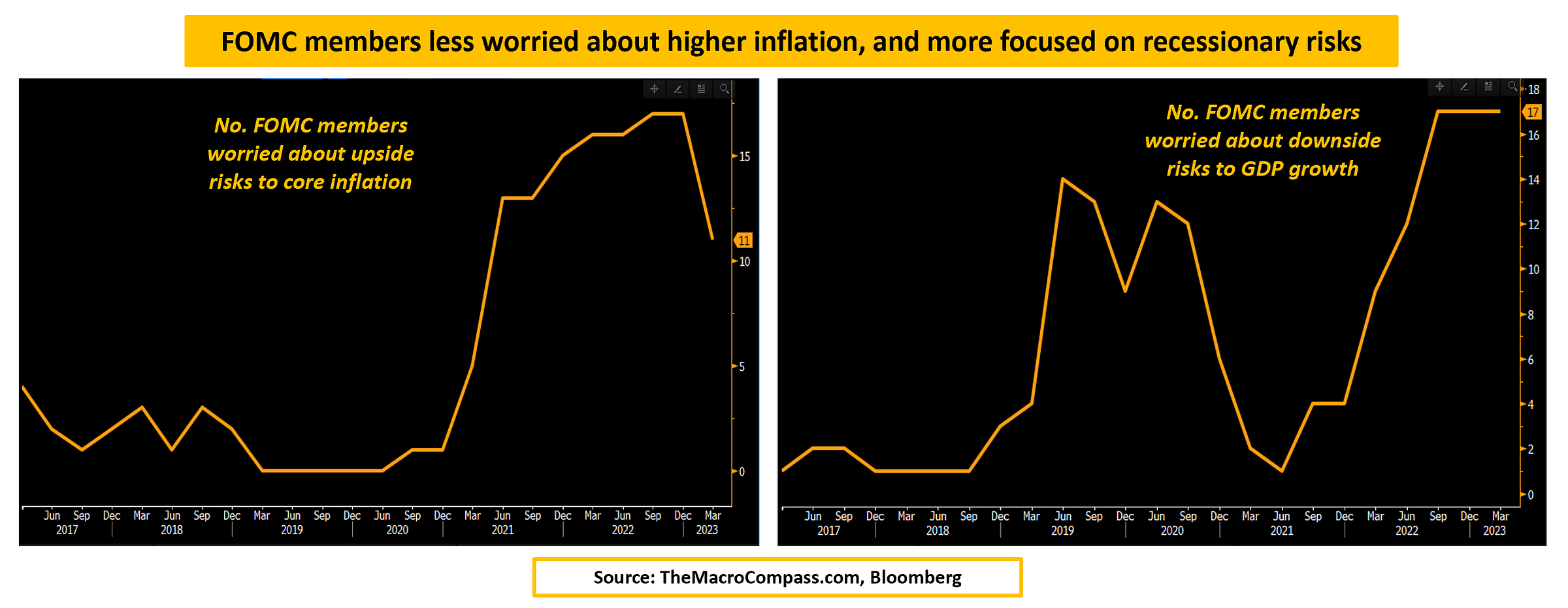

This was also reflected in the economic forecasts, and particularly in the uncertainty surrounding them.

Due to the banking stress, a large number of FOMC participants is worried about downside risks to GDP growth while less and less participants expect upside surprise on inflation.

In other words, the FOMC is more worried about a disinflationary recession than anything else.

“The Committee anticipates that some additional policy firming may be appropriate to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

From “ongoing rate increases” to “some” and “may”.

Again, this shows that the Fed will be on the lookout for signs that they might have done enough damage through this banking stress.

This is something deeply new, as until now the Fed was effectively on autopilot: keep monetary policy incrementally tight until you get people unemployed and inflation comes down.

Don’t make any assumptions, just get the job done.

Here, we are looking at a different Fed.

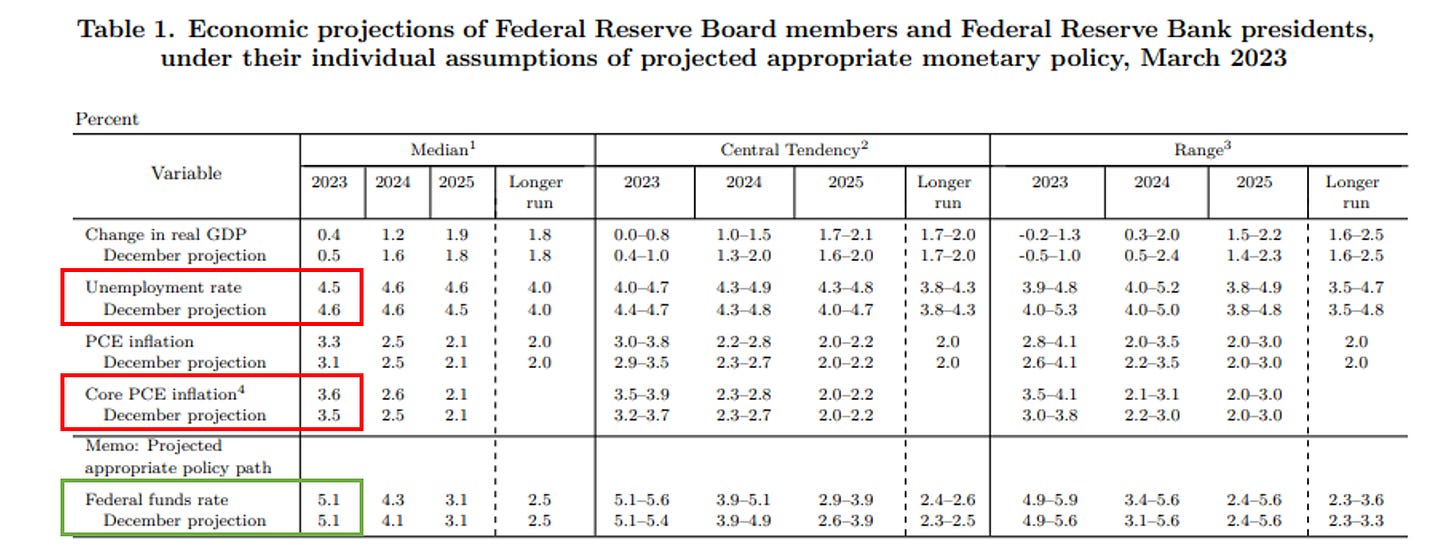

And the Summary of Economic Projections (SEP) clearly shows it.

Despite predictions for lower unemployment rate and higher core inflation in 2023, most likely to account for the banking stress uncertainty the median Fed Dot for December 2023 wasn’t revised higher.

This is a proactively cautious Fed looking to assess the damage despite inflation still running hot.

But the second point was even more important, as it led to crucial market moves and therefore opened the door to some interesting market opportunities.

Let’s dig in…

Enjoyed it so far and eager to read the remaining part of this macro report?

Come join The Macro Compass premium platform to get access to Alf’s full-length timely pieces, actionable investment strategy and much more!

This article is available to the All-Round subscribers - get in that premium TMC tier using the link below.

Powell Strikes Again