‘‘Almost every financial blow up is because of excessive leverage.’’

Seth Klarman - Hedge Fund Manager

Hi all, and welcome back on The Macro Compass!

I find August to be a great month to focus on the big picture and thoroughly enjoy the never-ending learning journey in global macro - no Central Bank meetings, (often) quiet markets and perhaps a bit of well-deserved relax.

Hence it seems like the perfect time to revive our Bond Market 101 Series with an educational piece on the most important market in the world: the Repo Market.

It’s a very relevant corner of the fixed income market which is often overlooked but given its role in underpinning the smooth functioning of government bond markets and the broad range of different players involved, its importance can’t be overstated.

In this article, we will:

Unpack the repo market, including its different players and how/why they use repo and reverse repo;

Explore previous stress episodes and relate them to today’s pricing and structure of the repo market: how likely again?

The Repo Market Explained

Before we start, a big ‘‘thank you!’’ to this wonderful community which keeps growing at a very rapid pace - we are now the biggest Finance newsletter on Substack: wow!

Delivering free educational material is a key objective of The Macro Compass - and as this is an article of my Bond Market 101 Series, for those who are not familiar yet that is my best effort at demystifying the bond market and providing you with the tools to analyze such an important and yet very deceptive market.

In case you want to explore it further, here are my previous pieces of the Bond Market 101 Series:

- Helicopter View of The Bond Market

- Real Yields and Inflation Expectations

- The Yield Curve

- Credit Spreads

Now, back to it: let’s explore the Repo Market.

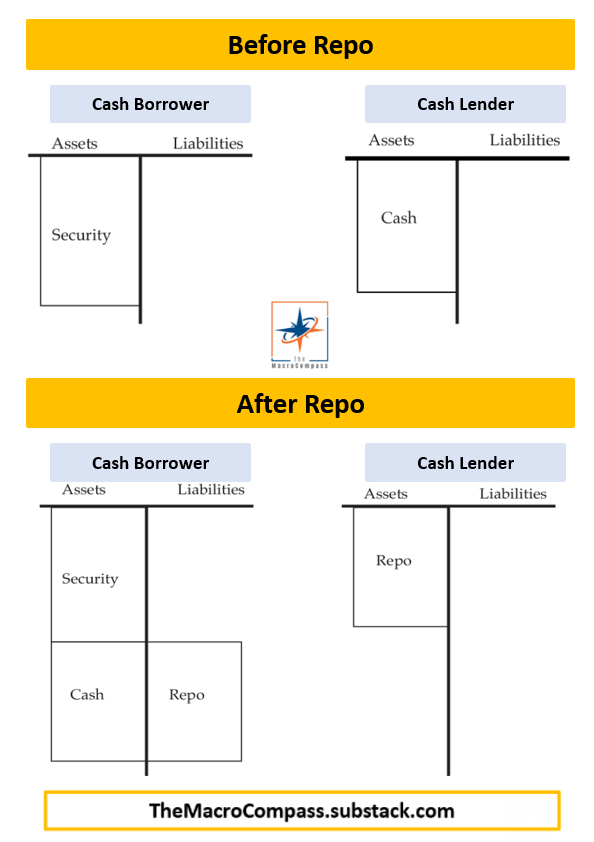

A repurchase agreement (repo) is nothing else than a form of collateralized loan, where the cash borrower posts collateral (i.e. a security, for instance a bond) against its loan but he also agrees to repurchase the security back at the end of the agreement.

The collateral “posted” by the cash borrower is basically a form of protection for the cash lender in the event that the borrower becomes insolvent - hence, repo is a secured or collateralized form of lending.

The biggest repo markets in the world use bonds as collateral.

Also worth noticing that the cash lender who receives the security as collateral can further redeploy that security in other repo transactions (!).

Essentially, we are looking at a low-risk (collateralized) financing mechanism underpinning the largest and most liquid markets in the world (bonds) with a built-in feature to enhance leverage and redeploy the same security over and over again as collateral (re-pledging).

I guess you can already understand how systematically important is the Repo Market.

Two important things to notice before we dig deeper.

The global repo market is huge, with an estimated size of $15 trillion and a turnover of $3-4 trillion worth of repo transactions per day!

Repo transactions require a cash borrower (security-rich agent) and a cash lender to interact. Notice how the balance sheet expands for the cash borrower.

Ok, but now: who are the players involved and what’s their incentive scheme?

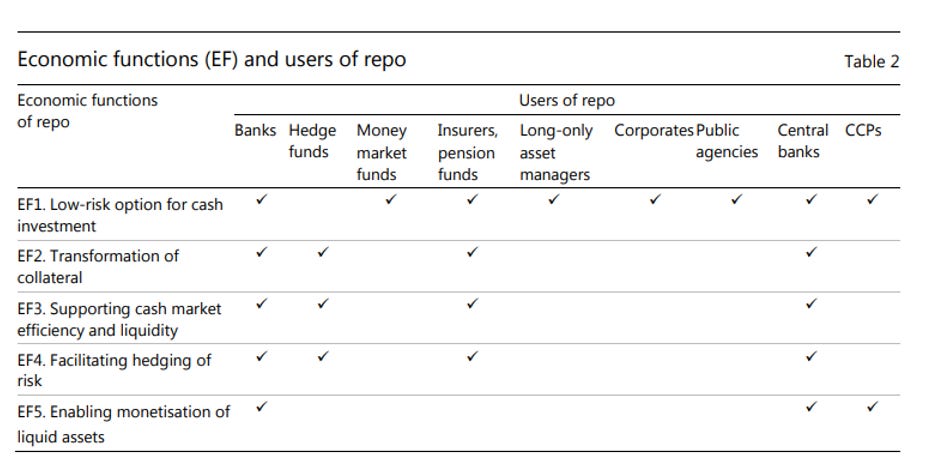

A) Commercial banks: low-risk solution to monetize their liquid assets.

Since after the Great Financial Crisis, regulators have forced commercial banks to own very large amount of liquid assets (e.g. HQLA = mostly bonds).

As natural buyers of these securities, commercial banks often engage in the repo market as a cash borrower (lends securities, receives cash) to monetize some of their liquid assets.

B) Insurers, pension funds, MMF and corporates: deploying cash in a safer way.

These large institutional investors do not have accounts at their domestic Central Bank. This means their ‘‘cash’’ is nothing else than an unsecured bank deposit at a commercial bank - very little reward, quite some risk.

Participating in the repo market as cash lenders (reverse repo: lends cash, receives securities) allows them to deploy cash in a secured, collateralized way.

C) Hedge funds and dealers: exploit market opportunities via leverage and provide liquidity through financing large inventories.

Due to their high-quality and low-volatility, using bonds as collateral in repo transactions requires small haircuts and initial margins: a convenient way for hedge funds to amplify leverage when arbitraging away small pricing inconsistencies in bond markets (little capital required to magnify the size of your trade).

For dealers, repos are important to finance large bond inventories required to accommodate flows and provide secondary market liquidity for their clients.

Given their tactical and opportunistic nature, hedge funds and dealers are often both cash lenders and borrowers in the repo market.

In short: the repo market is a gigantic machine underpinning the most liquid asset class in the world, and able to unlock leverage and investment opportunities for a bunch of crucial players in the bond market arena.

How should you think of repo rates and episode of repo market stress, then?

Let’s have a look at it together.

P.S. I know this is a relatively complex topic; feel free to leave a comment and/or ask questions below - I’ll try to answer them all!

It’s All About Demand And Supply

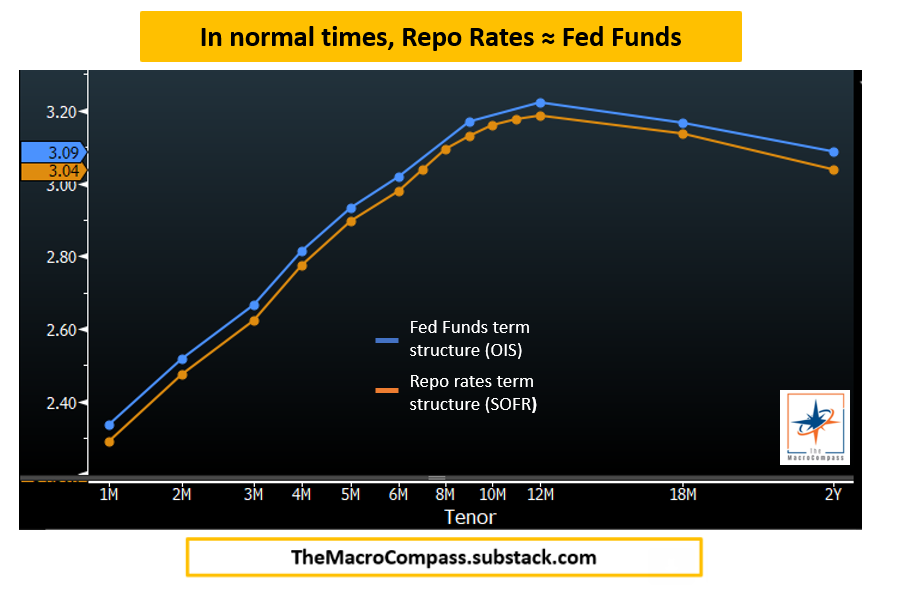

Postulate: repo rates on Treasuries should be very close to the most risk-free rate available in the market.

Why?

Because absent large balance sheet constraints or liquidity shocks, a Treasury repo is nothing else than a short-term fully securitized loan using the most risk-free and liquid asset in the world as collateral.

And indeed, here is a chart showing how in normal times (e.g. today) repo rates (orange) trade very close to Fed Funds rates (blue).

This implies the repo market is functioning smoothly: the demand and supply of cash and securities in the market results in reasonable and realistic repo rates.

Curious to see an example of ‘‘distorted’’ repo rates?

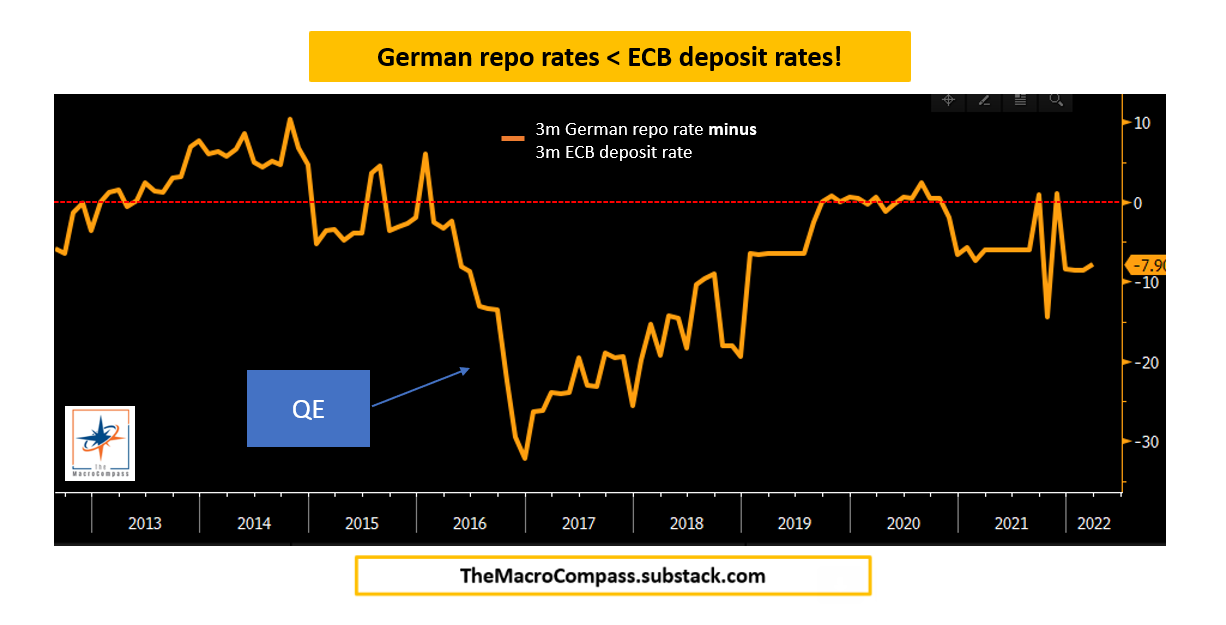

Look no further than Europe (in particular: Germany).

As a result of a long-lasting imbalance between supply (very limited) of good, AAA-rated and liquid collateral issued by the German government and the demand (big) for it, here is how the situation looks like today:

German repo rates are still below the ECB deposit rate, and in 2016/2017 we reached quite some impressive levels - the chart above shows repo rates for an average German bond, but certain ‘‘special’’ bonds traded 70/100 bps through the ECB depo!

As Germany wasn’t keen in issuing large amount of bonds but a huge QE program was ongoing, the financial sector was starved of good German collateral while flushed with bank reserves (cash for banks) at the same time.

As banks had already abundant reserves and engaging in repo would further lengthen their balance sheet while all other participants were looking to lend cash and get good collateral in exchange (reverse repo), the marginal repo rate at which this transaction could occur had to dramatically change - it’s all about supply and demand, after all.

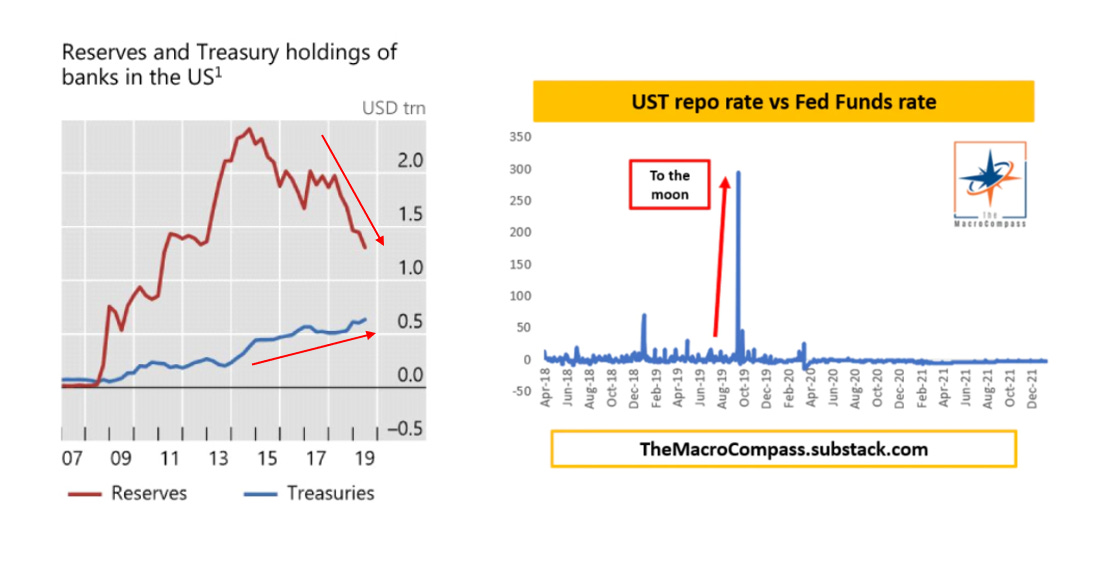

A similar (but opposite) dynamic was also one of the reasons behind the famous 2019 US repo market stress episode: as QT was forcing banks to absorb more collateral while draining their bank reserves (liquidity for banks) away, their willingness to engage in repo market transactions rapidly dwindled exactly at the point when hedge funds’ leverage had dramatically increased and required more - not less - repo funding.

Mayhem in repo markets.

Regulation plays an important role, too: as you probably noted before, engaging in a repo transactions extends your balance sheet.

Balance sheet constraints can impact the incentives to undertake repo intermediation, which is typically a low-risk but also a low-margin activity and this means a greater balance sheet capacity is needed to generate a decent level of returns.

For instance, leverage ratios force banks to hold a certain amount of capital against the size of their balance sheet - if a bank is close to its leverage ratio boundaries, it is much less likely to engage in high balance sheet capacity activities like repo.

Are we going to see another repo market crisis soon?

QT will reach its maximum pace soon in the US, and reserves have already fallen by over $1 trillion (!) in a few months - more to come.

On the other hand, policymakers have become smarter in putting backstops in place to ensure a smooth functioning of the repo market (e.g. Standing Repo Facility in the US or the newly announced Repo facility in the UK).

While chances are lower, the structural importance of the repo market can never be overstated: so, where do you find the data to track this market?

Here, here and here.

I know, I know: what about a breakdown and timely explanation of ongoing repo market dynamics though?

Well: for that, you can always count on The Macro Compass!

And this was all for today, thanks for reading!

If you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

See you soon here for another article of The Macro Compass, a community of more than 80,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

The World's Most Important Market