The reflationary trade is dead in the water

TMC #12! Another week without ''regime change'': lower yields, tech > value, and the bond market ignoring a 5% CPI print. And don't miss my new, free product for you!

10’ reading time, hopefully well spent

Hi all, and welcome back to The Macro Compass! I hope you had a good weekend.

I’d like to thank all the 4k subscribers. Your support and engagement over the first 45 days of TMC has been truly amazing.

I have a couple of surprises for you. Let’s get started with the first two.

Last week, I was invited on The Contrarian Podcast (available for free on Spotify and Apple). We discussed my non-consensus disinflationary view of the world and why 10y Treasuries could touch again 0.5% yields over the next few years.

I also released my weekly video on Trading View: it covers different macro topics and asset classes via a mix of charts and slides and it lasts about 10-15 minutes.

From now onwards, I will be posting here all podcasts/video interviews/extras I will be busy with during the week so that you can shout at me when I am wrong on a view.

For my next surprise, you’ll have to read the whole 10 minutes article. Sorry!

Connecting the dots in markets last week

There are so many markets and variables to look at in global markets.

So, what caught my eye last week and why?

The bottom line is still: the reflationary trade is dead in the water.

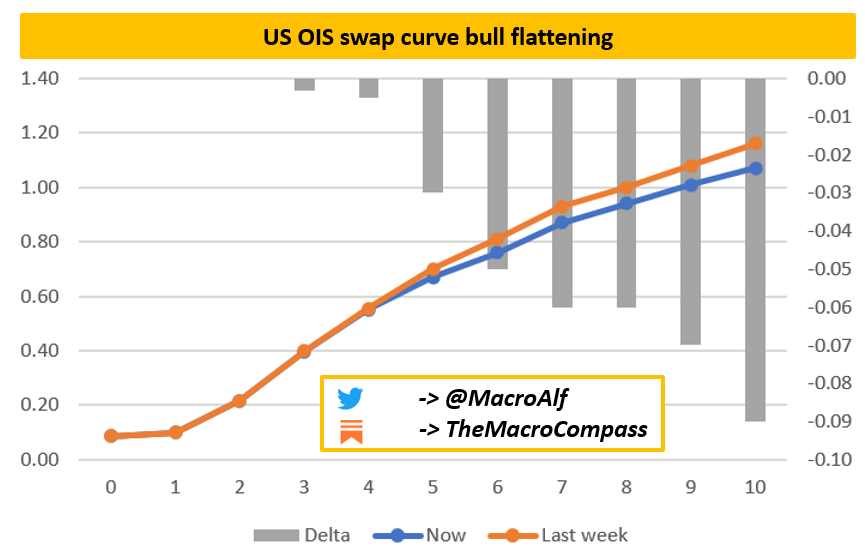

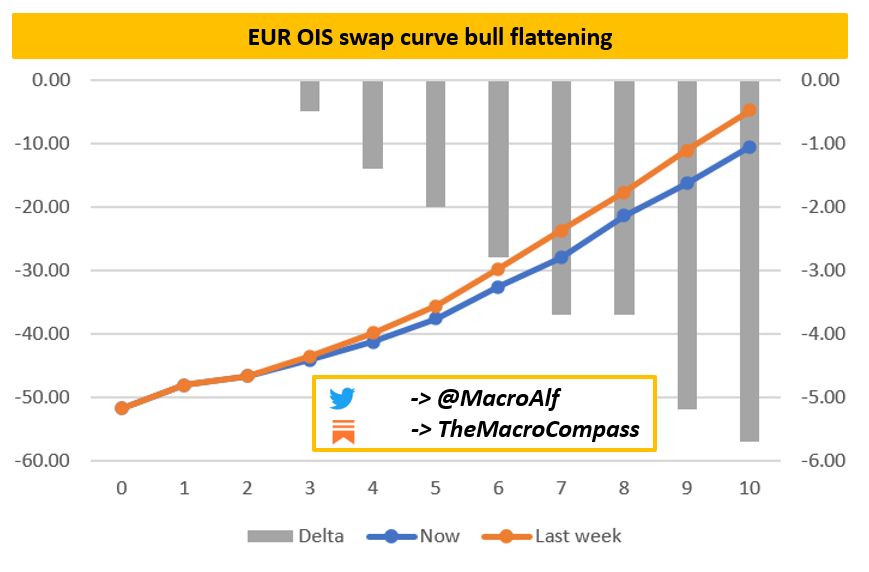

Exhibit 1: yield curves bull flattening.

Bull flattening means yields are going down + the slope of the yield curve becomes flatter as this happens: basically the whole yield curve moves down, but long-term yields display the largest drop.

As the market starts digesting a peaking global credit impulse while Central Banks can’t (or don’t want to) ease monetary policy further, the short-end of the yield curve is anchored around the effective lower bound while the drop in yields gets more reflected in the long-end.

If economic conditions start to deteriorate a bit and monetary policy authorities can’t ease accordingly, the fixed income market will price in weaker nominal growth long-term with more certainty. A less uncertain distribution of potential outcomes for nominal growth long-term leads to a compression of term premium required to own long-term bonds = forward, long-end nominal yields drop.

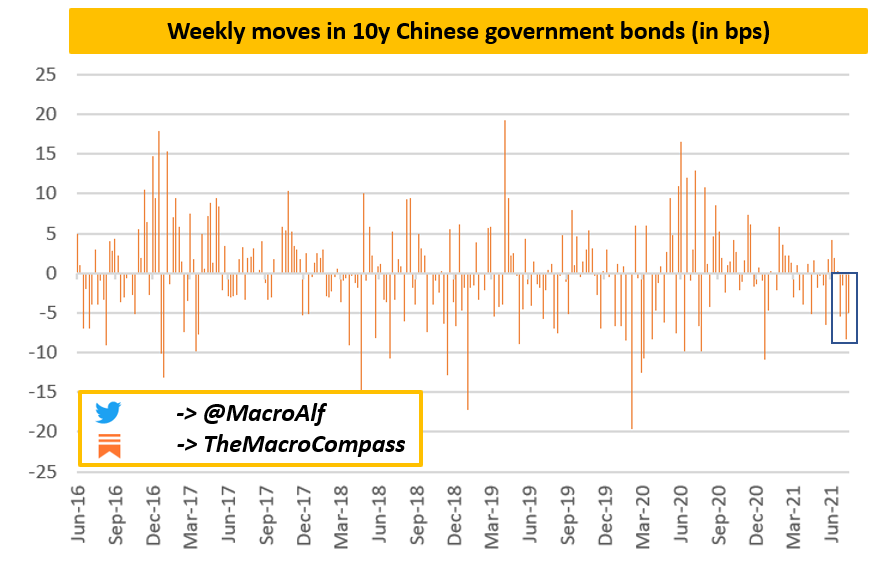

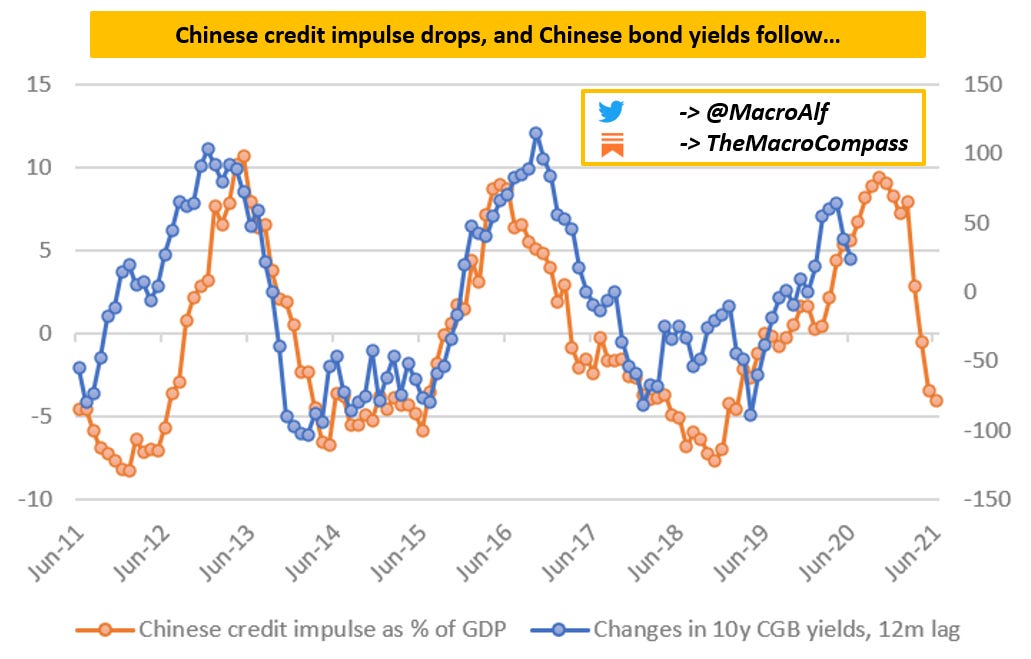

Exhibit 2: Chinese bond yields dropping.

10-year Chinese bond yields dropped below 3% last week.

Barring the pandemic, the last time this happened was in 2016 - do you remember the ‘‘Chinese economy hard landing’’ scare?

The chart above shows the weekly moves (in bps) for the 10y CGB over the last 5 years.

While the absolute size of the weekly moves is not incredibly large yet, the Chinese bond market has consistently rallied over the last 4-5 weeks. In a row.

And why?

Well, our friend credit impulse peaked a while ago in China and guess what? It leads about everything with a lag, including Chinese bond yields.

See for yourself in the chart below.

Chinese bond yields are very relevant in the global macro landscape.

Nominal (and real) yields dropping on a relative basis against EUR or USD yields have a significant impact on CNY/EUR and CNY/USD over the medium term.

Stronger/weaker CNY impacts exports and the ability to import/export inflationary pressures from China towards the rest of the world, and/or vice versa.

Also, depending on the appetite Chinese authorities might have for a weaker/stronger Yuan, their policy reaction function in contracting or expanding credit flows is paramount important for the global credit impulse…which leads about everything.

Watch this space!

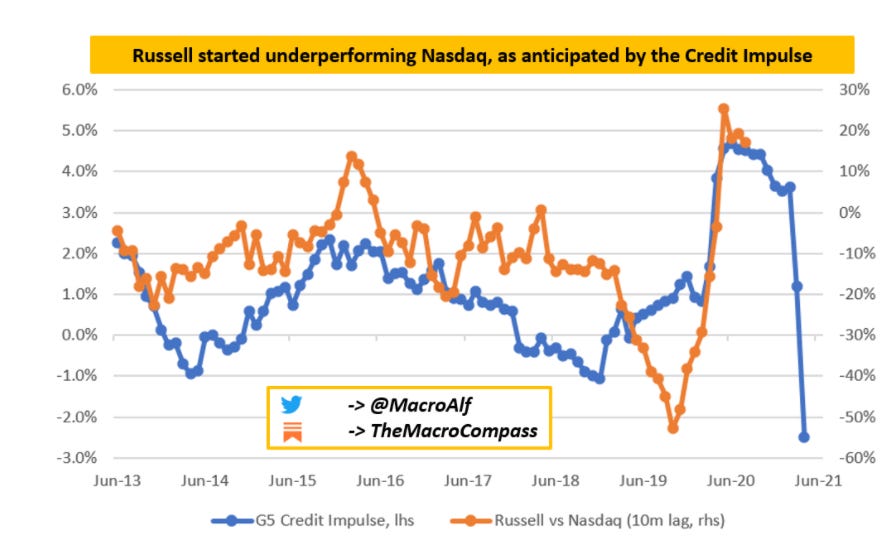

Exhibit 3: Russell versus Nasdaq

Russell underperformed Nasdaq by 5% last week.

The G5 credit impulse would suggest this is just the start of a medium-term trend.

The small-cap, value driven Russell index needs the real economy to produce meaningful nominal growth down the road such that earnings can gather steam.

The mega-cap, tech driven Nasdaq index instead does very well in a secular disinflationary trend.

Trade updates

Long Nasdaq / short Euro Stoxx Banks (with embedded short EUR/USD):

Initiated Jul 15 (link here)

Hard stop loss: -10%

First profit target: +15%

Current P&L: +3.4%

5s30s US flatteners (link here and here):

Initiated Jun 17 (entry: 129 bps)

Hard stop: 145 bps

First profit target: 100 bps

Current P&L (incl. carry and roll): +14 bps

Keeping both trades, no changes.

Reminder: this is NOT an investment or trade recommendation.

In general, I always represent myself and not my employer.

Almost no juice in Eurozone bonds: return-free risk bonds

Assume you’re a European investor and you have appetite for fixed income instruments. Perhaps you are a pension fund or an insurance company that has to hedge the duration risk of your liabilities, a corporate that has to invest a liquidity buffer or the treasury department of a bank.

At the moment, buying Eurozone bonds delivers almost zero compensation for any risk you take.

Let’s assume you are buying one of the most liquid, decently rated government bonds out there: the 10y French government bond. They yield 0%.

Let’s look at the risks you are taking and the compensation you get:

Inflation risk / real returns: likely negative compensation!

Nobody likes to see their real, inflation-adjusted purchasing power going down. Back in the days, purchasing medium-term bonds would deliver positive or flat real coupons. Not the case anymore. You now need the average CPI print over the next 10 years to be around 0% (!) to preserve your real purchasing power by buying 10y French government bonds. The bad news is that overnight cash yields -0.50% (or less, if you don’t have access to a Central Bank deposit account): even worse.

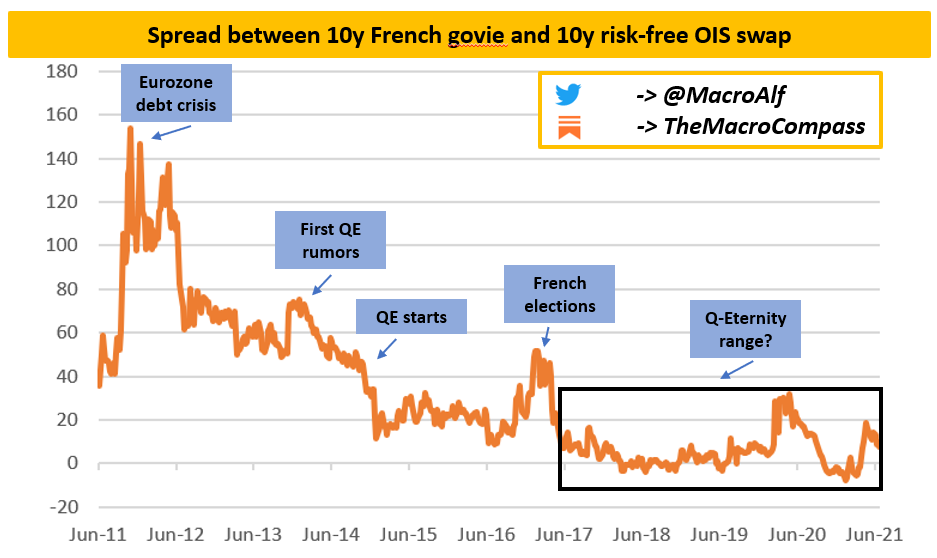

Credit risk / credit spread: zero compensation!

If you have appetite for fixed income and duration, you can achieve that by buying bonds or receiving the fixed leg of a risk-free, collateralized OIS swap. If you purchase a 10y French government bond, you’re trusting the French government to pay you back at par, in EUR: in other words, you are taking some credit risk. So, how much are you compensated for this 10y credit risk today?

You now get a whopping 0.05% compensation for buying a 10y French government bond rather than receive the fixed leg of a 10y OIS swap.

QE plays obviously a big role in this credit spread compression: the ECB forcefully changes the composition of private sector’s fixed income portfolios by taking bonds away and swapping it with excess reserves and it bids bond prices up in the process. The private sector fixed income portfolios are now less skewed towards fixed income instruments and hence portfolio managers try to re-balance them by purchasing bonds: basically a loop.

The removal of French govi collateral from the system and the presence of excess reserves creates a supply/demand imbalance that pushes credit spreads tighter and tighter over time.

Carry and roll / interest rate risk: very little compensation

If you take the risk of owning a 10y bond rather than overnight cash, you are generally rewarded with carry (bond coupons - funding costs) and rolldown (a downward sloping yield curve).

The carry and rolldown for owning a 10y French government bond for the next 12 months is a whopping 13 bps as we speak.

Rephrasing it: if in July 2022 the bond you bought moved from 0% yield to +0.13% yield, your entire carry and rolldown compensation over the last 12 months is completely wiped out.

That’s not much of a buffer, I’d argue.

The bottom line is that European bond investors have realized the uncertainty around the future path of interest rates in Europe is very very little. Rates have to stay low for a very long time.

This requires less compensation in owning long-term bonds.

At the moment though, the compensation is basically zero across the spectrum of risks you run by owning long-term bonds in EUR.

As always, you deserve a medal as you endured 10 minutes of my macro stuff. Wow.

You truly deserved your surprise too!

I am going to be hosting a weekly live Zoom Q&A session starting this week.

It’s free, of course.

But seats are limited to 100 people, first come first serve!

How can you attend? Make sure to follow all the below steps to be eligible:

If you haven’t done it yet, you subscribe to this newsletter

You share this article on one (or more) social media

If you are an old subscriber, you simply reply bilaterally to this email with a ‘‘yes’’ and one question you’d like to ask. If you just subscribed, send me an email at alfonso.pecca@gmail.com with ‘‘Yes’’ and one question you’d like to ask. You will receive a Zoom invite if you were amongst the first 100 respondents, and otherwise you will be put in the reserve list and have priority for our next weekly live Q&A session.

Clearly, I can’t answer 100 different questions at once but I’ll make sure to select the most asked questions and address them in the Zoom session.

At the end of the Zoom call, there will also be a 10 minutes live Q&A session where I’ll answer questions as they pop in the chat - it does not get much more interactive than that!

Remember: 100 seats, first come first serve!

Date and time will be released once we reach 100 attendants.

Talk soon!

One possibility for lower short term rates - neg interest rates in US. (i.e) unforeseen jump back into deflation / stagnation required drastic measures !

Hi Alfonso, Could you please consider leaving a note as to what quadrant you believe we are currently in at the end of your trades or analysis? I was a transitional 70/30 equity/bonds investor most of my life until recently. As I get ready to retire I am trying to figure out why I would start "investing" more in bonds as they don't pay real interest at this point. Therefore I have been buying gold. The way I look at bonds currently is that they are only needed for collateral for commercial banks so they can have banks reserves to me LIBOR. I will keep reading your post. I am sure I am missing something...