All they told you about printing money is wrong - and here is why

TMC #6! Commercial banks and governments print ''real economy'' money, not central banks

If I could choose one macroeconomic misconception I’d want to eradicate from the average financial actor’s mind is that Central Banks print money (via QE).

Jeez, it drives me nuts. This 10 minutes article is a very ambitious attempt at convincing you that’s false. I will try to explain how money printing really works.

Before we get there, if you ever wondered how bad my Italian accent is you can listen to this Market Narratives podcast episode (Apple or Spotify) where I discussed the issues with a European monetary union without a proper fiscal union, the role of Italy in the EU, and why the deflationary forces and policy decisions are pushing markets towards non-linear price action.

Ok, let’s see how money printing works.

Central Banks print money, right? No.

Financial media is full of headlines like ‘‘Central Banks go brrrr (sound of a printer), QE money printing leading to runaway inflation’’ and similar click-baiting titles.

Let’s actually picture the whole process here. Reading the chart from the left to the right helps. Let’s start at the top.

The pension fund owning bonds (purple) before QE now owns cash in the form of an overnight deposit (red) at a commercial bank.

The central bank created new reserves out of thin air (green stack increasing) to purchase government bonds from the pension fund.

The commercial bank now owns more deposit (red stack higher) as the result of the pension fund depositing more money on their bank account. On the asset side, the commercial bank now owns more reserves parked at the central bank account (green stack higher).

No ‘‘real economy’’ or inflationary form of money was created during QE.

A simple swap between bonds owned by a pension fund and central bank reserves has been made, and the commercial bank acted as an intermediary.

Neither the pension fund nor the commercial bank own more ‘‘real economy’’ or inflationary form money than before.

They just own more deposits/reserves and less bonds than before.

Ok, I know what you are thinking.

As banks own more reserves, they can lend those out and hence create ‘‘real economy’’ form of money leading to higher economic activity and inflation.

Money multiplier, money velocity and the likes. Nope, that’s not correct.

Let’s see how money is really created.

Commercial banks and governments print money

Commercial banks create money by making new loans. When a bank makes a loan, for instance to somebody interested in taking a loan to buy a new car, it credits their bank account with a bank deposit of the size of the value of the new car.

This new amount sitting on the car buyer’s bank account (and later on the car seller’s bank account) is literally new money created out of thin air.

The commercial bank extended a new loan (increased white stack) and credited the consumer’s account with a new deposit (increased red stack).

This is literally new ‘‘real economy’’ money created out of thin air.

Commercial banks didn’t take existing reserves (green stack) and lent them out. They created new money ex nihilo by making a new loan. The car’s buyer took this newly created money to purchase the car from the seller, who now owns more ‘‘real economy’’ money and can contribute to aggregate demand and inflationary pressures.

I like using Japan as an example.

Between 2001 and 2006, Japan’s base money almost doubled as QE was introduced. The BoJ printed bank reserves and purchased government bonds from the private sector. The newly created bank reserves went up almost 2x as a result.

According to the misleading money multiplier/fractional reserve banking system theory, Japanese banks were now sitting on a huge amount of reserves they could lend out. Lending out a small portion of this would generate economic activity and inflationary pressures.

Well, it didn’t happen because that’s not how it works.

Bank loans actually shrank by 20% in this period.

This happened because banks cannot directly lend out reserves, and their decisions about lending more/less has nothing to do with them.

Banks lend more/less based on the risk-reward they see in loan yields versus borrowers’ creditworthiness, return on equity they can generate and regulatory constraints they have to adhere to.

So, what can we do with these bank reserves?

Reserves are simply an IOU (promissory note) from the central bank to commercial banks. Commercial banks can use them to settle payments to each other, service withdrawals from the public, use them as collateral, meet regulatory requirements (if any: BoE and Fed have 0% minimum reserve requirements today) and perform other ‘‘inside’’ activities.

Nothing to do with ‘‘real economy money’’.

Banks are not reserves-constrained when they decide to (or not to) make loans.

Their decision depends on the factors described above.

Reserves are not an incentive to lend => 1 zillion bank reserves might still result in loan books not expanding, or even shrinking!

Ok, QE creates bank reserves and those have nothing to do with ‘‘real economy’’ money creation which is driven by bank lending and government deficits.

Let’s talk about governments printing money for a second.

If you are the US government, you can create new ‘‘real economy’’ form of money by spending more money than the taxes you intend to collect: budget deficits.

When you want to balance your budgets, you will do the opposite: you will increase taxes by draining money from the private sector and run budget surpluses.

Think of the massive 2020-2021 US stimulus checks.

The US government ran large budget deficits and literally created new ‘‘real economy’’ money by transferring checks directly to Americans.

The private sector had more money all of a sudden.

So, that must be hugely inflationary right? More money, same basket of goods.

Well, in principle yes, but don’t forget to look at what the private sector is doing.

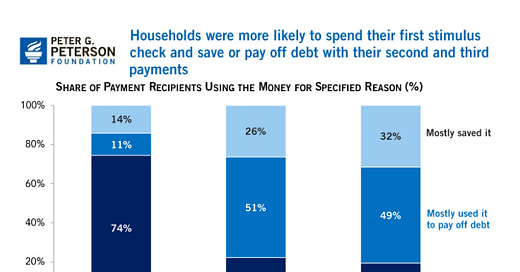

Apart from the CARES Act, only 20% of the stimulus was actually spent.

50% of it was used to pay off debt.

Paying off debt literally means destroying money which was previously created when the loan was taken.

This is also why despite Japan has been running 6%+ deficits for the last 7 years and the BoJ has been buying all the new bonds out there facilitating the process, there is no sustainable inflation.

The private sector and the banking system are destroying money via deleveraging while the government is trying to create new money via budget deficits.

I hope you enjoyed this article on money printing.

If you did, I’d really love if you could share it on your social media. At the end of the day it’s free (and hopefully valuable) content and it would really help me to grow my audience and keep me motivated!

Alfonso.. While American QE is not dollar printing, I believe it is part of dollar debasement, to the extent that contributes to the funding of fiscal spending. (I am assuming here that the QE is never unwound.) Do you agree or disagree with that? Also, I would love to hear your thoughts on Lyn Alden's piece at <www.lynalden.com/quantitative-easing-mmt-inflation>. Here's an excerpt:

Quote from Lyn Alden >> Some analysts suggest that QE isn’t really printing money. It’s just a matter of creating bank reserves that get locked into a “box” of reserves and never put into the economy. The QE money never really gets to Main Street in their view, in other words. And if it doesn’t get to Main Street, it can’t cause consumer price inflation that critics of QE fear. Although there is some truth to it, the problem with that analysis is that proponents of that view are only looking at one side of the ledger, rather than both sides of the ledger. The other side of the ledger is that the government was able to spend money on the domestic economy via the fiscal spending side that it never extracted from any existing base of money; it instead extracted that funding from a newly-created pile of dollars from the Fed, and those Treasury securities are locked away on the Federal Reserve’s balance sheet from which it drew the new dollars from. The Treasury Department is the mechanism for the Federal Reserve’s QE to get to the public. <<

Thanks. It's one of the more clear explainers of QE. Amazed at how many financial analysts don't understand how it works.