The US Dollar is not going to zero

TMC #8! Let's debunk some myths about the USD and explore why the US Dollar is such a crucial macro variable.

Reading time: 7’, hopefully well spent

Hi everybody, and welcome back to The Macro Compass!

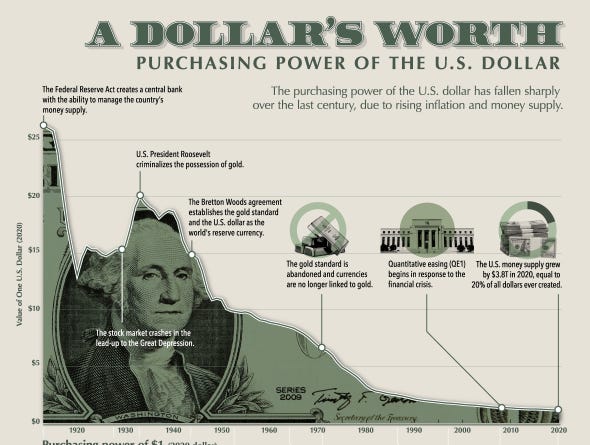

I guess you’ve heard about the US Dollar a gazillion times, and you’re probably familiar with pictures like this one below.

Well, that picture is missing a big point about the USD purchasing power.

In this short article, I am going to walk you through some USD myth debunking but also show you why watching and understanding the US Dollar is paramount important to get a good understanding of global macro. So, let’s start!

The USD is losing value…value against what?

As always, let’s not miss the forest for the trees.

You must have heard very often that the US Dollar is losing purchasing power, and that sentence is often accompanied by the picture above that shows how little you can buy with 1 USD today compared to 50 years ago. It looks very scary, doesn’t it?

The issue with this approach is that it doesn’t show whether real wages have gone up or down. For example, if your dollars buy you half as many tomatoes today as they did 50 years ago (due to price inflation), but your salary adjusted for inflation has doubled …well, you get it!

Ok, so how do we get a better understanding of whether the American people are losing purchasing power or not by being paid in and holding US Dollar?

You look at the whole picture: salaries adjusted for inflation and risk-free real yields.

YoY change in real wages tells you whether your salary is going up or down adjusted for the change in prices of the items you want to buy (inflation).

Risk-free real yields tell you how much you are charged or you earn adjusted for inflation by depositing your USD savings on a bank account or buying short-term US government bonds.

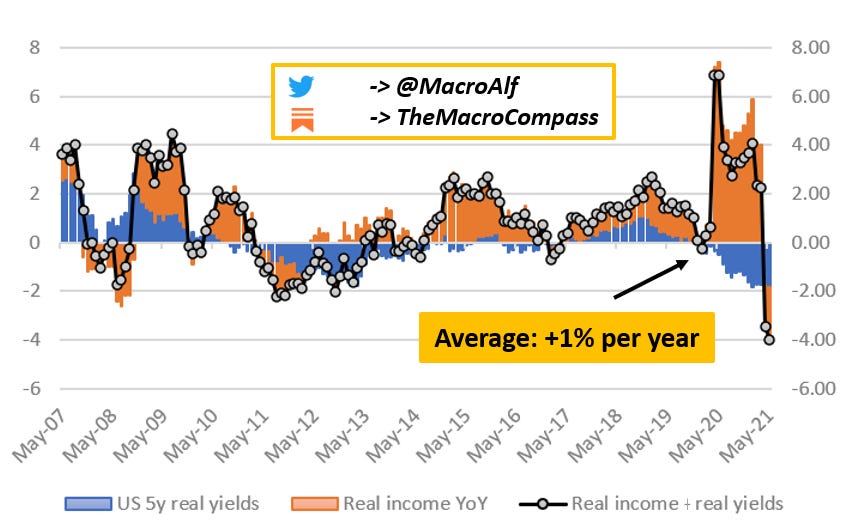

The chart below shows real income YoY changes in orange, risk-free real yields in blue and the sum being the black line.

Over the last 14 years, the average American has received a +1% salary increase above the prevailing inflation rate. By deploying savings in a short-term risk-free USD instrument, she has earned (a whopping…) 0% inflation-adjusted yield.

That leaves her with a rolling +1% real purchasing power increase on average over the last 14 years. Every year.

It does not seem to me the average American has lost any purchasing power over the last 14 years. Looking at today though, risk-free real yields are negative and the YoY real income path does not look very healthy as most of the large increases in 2020-early 2021 were driven by government stimulus checks which are unlikely to be renewed at the same pace.

The other thing you often hear is that the USD is being devalued.

When I hear this, the first thing that comes to my mind is: devalued against what?

If your view is that the US government is going to push risk-free real interest rates into negative territory (i.e. financial repression) to inflate away the real debt burdens at the expense of the savers/investors, welcome onboard! I agree with you.

But the right way to express that view is not to sell USD against other fiat currencies.

It’s a relative game: what do you think other governments are doing? The same.

The chart above shows EUR/USD in blue versus 10y real yield differentials (10y EUR real yields - 10y USD real yields) in orange.

Nice visual correlation, right?

So, if European governments are trying to push EUR real yields down more aggressively than US is doing, EUR/USD falls. And vice versa.

It’s all a relative game.

Of course, this is not the only explanatory variable for FX moves over the medium term. For instance, simply looking at real yields differentials in 2012 would have suggested EUR/USD at 1.50. But the sovereign debt crisis was strongly denting the credibility of the EUR, and hence we only traded at 1.30.

If you believe financial repression is the way, there are better ways to short the USD: in general, you should do that against real assets.

Precious metals, real estate, collectibles etc.

Always consider both legs of your trade and try not to miss the forest for the trees.

But why is the US Dollar such a relevant macro variable?

The graph below from the Bank of International Settlement is rather telling.

The USD dollar share of official FX reserves, cross-border loans and international debt securities is somewhere between 40-60%. The USD alone (!) represent about half of foreign currency denominated loans, bonds and reserves across the globe. Wow.

This is against the USD representing approximately 20% of global GDP.

So, the world is highly dependent on continuous USD supply to facilitate trades, payments, repay loans etc.

During a sharp economic slowdown, the pro-cyclical nature of this system shows all of its weaknesses at once.

Economic downturn = less activity and trades = companies anticipate less revenues in USD to service their USD payments/loans = scramble to get US dollars.

Emerging market sovereigns, banks and corporates face a proper issue. The graph below from BIS shows how the amount of USD foreign debt doubled from 6 trn to 12 trn over the last 10 years. A good portion of this USD foreign debt was issued by emerging markets sovereigns, banks and corporates.

Emerging markets heavily exposed to USD denominated debt also face a situation where commodity prices drop, global trades slow down and investors switch back into safe assets.

But who can supply these USDs?

Commercial banks and US authorities.

Commercial banks could immediately provide USD access, but the perceived increase in risk and decline in borrowers’ creditworthiness leads them to do the opposite: they don’t provide USDs anymore but rather hoard cash and risk-free securities.

It’s a vicious circle.

The US government is able to supply USD to American people via fiscal deficits, but it generally takes a while until these USDs flow abroad.

The US Federal Reserve can supply USD liquidity to US counterparts immediately, and can provide certain foreign central banks with USD swap lines. But again, it takes some time to arrange this and let USD supply flow again through the system.

The pro-cyclical nature of our monetary system and the disproportionately big role played by the USD as the global reserve currency lead to non-linear US Dollar squeezes during crisis. For a non-US resident, the USD can serve as a hedge during such periods. It should be noticed though that negative real yields (imho here to stay) imply a hefty premium to hold short-term USD as a hedge.

To conclude, I’d like to mention the great job my friends at The Two Quants are doing. If you are into quantitative investment process, give their website a quick look. It’s full of amazing content!

I hope you enjoyed this article on the US Dollar.

If you did, I’d really love if you could share it on your social media. At the end of the day it’s free (and hopefully valuable) content and it would really help me to grow my audience and keep me motivated!

What is your belief about trading price of EUR/USD in the following months? Given the enormous stimulus that the FED induced in the economy respectively to the ECB one, considering the current inflation rate at 5% in US and 2 something % in EU, my immediate conclusions is that we should expect an ulterior devaluation of US dollar. However, in your article you mentioned that this is a relative game and many countries or institutions are doing the same.

Thank you very much, your articles are very interesting and thoughtful.

Matteo Ticli

By measuring USD purchasing power against metals - e.g. gold - aren't we assuming that gold purchasing power - so not price - is constant over time?