12’ reading time

Hey everybody, welcome back to The Macro Compass!

This is a special edition. We have the pleasure to welcome back a great macro strategist and friend: Andreas Steno Larsen.

I sat down with him for a fireside Q&A session on his global macro and asset allocation views - enjoy!

We are in the late ‘80s.

Ross Johnson, the CEO of the massive food and tobacco corporation RJR Nabisco, attempts to buy the company. Before long, other major players become involved, most notably Kravis and Forstmann. It all quickly turns into a ruthless bidding war.

Forstmann argues that to stop raiders like Kravis: "We need to push the barbarians back from the city gates’’.

In the end, the ‘‘barbarian’’ Kravis wins the bidding war.

You can try to push them away, but Vikings always come back at the gate.

Without further ado, let’s jump right in!

Alf: ‘‘Welcome back to the Macro World, mate! Hot topic first: what do you make of the latest C-19 pandemic developments?’’

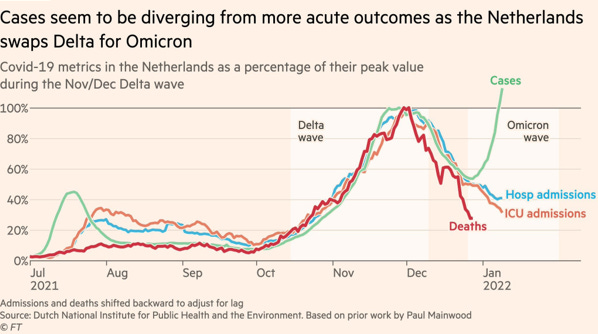

Andreas: ‘‘Thanks! Several people have already tried calling the “end of the pandemic” with limited luck, but it seems as if the data we receive on the severity of Omicron brings about an increasingly compelling case for this pandemic to be close to ending.

Right about every expert agrees that Omicron is substantially milder but also more transmissible than Delta. This is textbook virology. A virus mutates in a milder but more transmittable direction and soon lethality times transmissibility will prove benign enough for this to be treated as just yet another endemic virus.

Enough bodega-virology for now.. .’’

Alf: ‘‘I see. Well, shall we expect a crack-up boom in economic growth if you are right on the pandemic coming to an end?’’

Andreas: ‘‘Not really. The power of the rate of change of things is very important here. Look at money creation for example.

The extreme volatility in credit creation is a result of Covid-policies since the first round of lockdowns did bring about the most bizarre short-term credit expansion in history as 1) governments ran humongous unfunded deficits and 2) everyone and their mother started utilizing idle revolving credit facilities at commercial banks.

This expansion led to a massive yearly increase in actual money creation (and here we are not talking about QE, but private/public sector credit creation), but it also leads to a so-called credit cliff as soon as the pandemic dissipates.

No more public credit schemes to SMEs while larger corporates start to bring down revolving credit facilities again as liquidity improves due to the increase in economic activity. All in all, a material tightening of the so-called credit impulse.

What comes up, must ultimately come down in rate of change terms and besides the GFC in 2008/2009, such a material change of the credit environment from a rate of change perspective has not been seen in modern history.

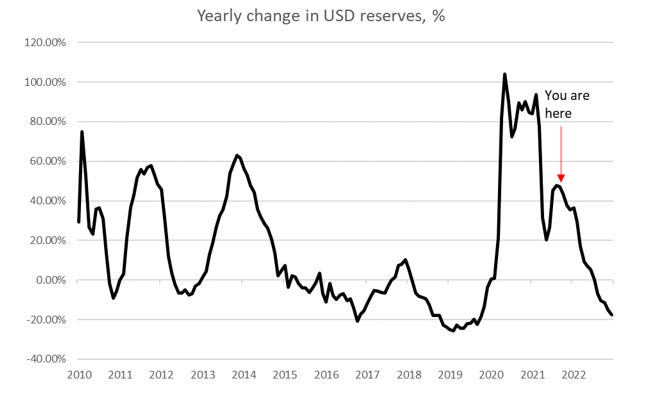

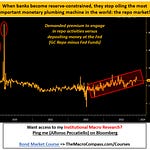

If you pair that with the Federal Reserve contemplating an outright shrinkage of the balance sheet, we may be in for a 2019-like contraction in USD reserves in the financial system already before year-end.

Alf: ‘‘So: the rate of change of both credit creation (mostly deficits and bank lending) and reserves creation (QE/QT) is moving in the wrong direction: what does this mean for bond yields?’’

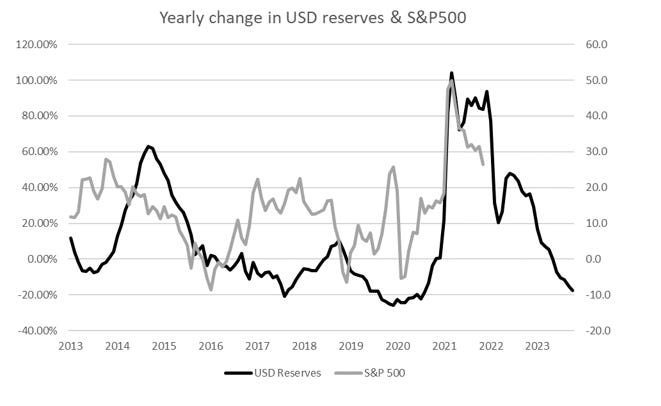

Andreas: ‘‘Interestingly, the rate of change of credit means a lot to asset allocation as a credit boost equals an activity boost with a time-lag. A massive credit expansion in 2020 hence meant booming energy and industrial commodities, higher long bond yields and a decent performance in value-stocks in 2021.

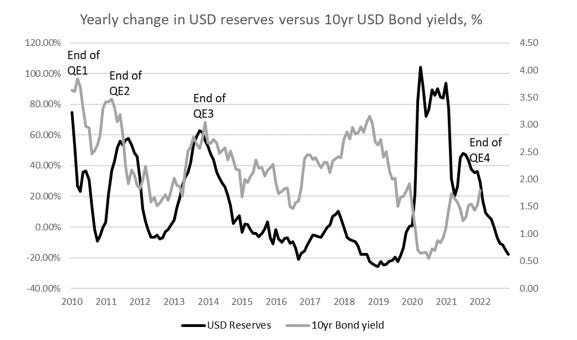

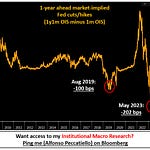

We are now standing at those exact cross-roads again, as the rate of change in credit has come down materially through 2021 and will come down much further through 2022, in particular if the recent Federal Reserve rhetoric is any guide. Interestingly, we have had a peak in long bond yields exactly when the Fed ended QE1, QE2 and QE3, which makes the current end to QE4 an exciting empirical experiment.

Right about everyone expects bond yields to skyrocket again alongside the end of asset purchases: we are not so sure even if inflation is running hot and unemployment is running low, and it has to do with both the power of rate of change and the end of the pandemic.

When the credit creation in rate of change terms has been running hot (measured by a rapid increase in dollar reserves), we have also seen a tendency towards higher long bond yields, not lower, which is in sharp contrast to the supply/demand picture through such period. As a consequence of tapering, the consensus this time around again - as it was when QE1, QE2 and QE3 ended – that fewer purchases of longer-dated bonds must lead to a higher long bond yield.

The thing is that consensus around higher bond yields and booming commodities is always extremely uniform when the rate of change in credit creation peaks, and it makes sense as actual creation of money in the real economy leads to an increase in activity.

Alf: ‘‘And what does this mean for inflation and other asset classes in 2022?’’

Andreas: ‘‘Thankfully, we can actually forecast on the credit impulse (impulse is a word invented by macro guys such as Alf, when they want to sound extra esoteric without any purpose), and furthermore the credit impulse actually often leads the market developments by quite a while.

In other words, we have seen long bond yields, commodities and inflation expectations peaking exactly when the rate of change effect is the most material, which is what we see just now again. The headwinds from a rate of change perspective will become bigger and bigger through 2022, and already in Q2 inflation will face rate of change headwinds in the used cars category and in Q4 the inflation growth will face almost every possible gust of base effects at the same time, which may lead the overall inflation into negative territory even if underlying fundamentals point in the other direction. Growth will face rate of change headwinds already now, which is before the headwinds will arrive in inflation from a momentum perspective.

If the history of rate of changes is any guide, both inflation and growth are likely to surprise negatively by the end of this year.

Positioning is once again, as per usual by the end of a QE program, very loaded towards higher bond yields and cyclical assets such as industrial metals and this also coincides with a material positive rate of change effect in credit during 2020. Now that we are faced with the opposite – a material negative rate of change momentum in credit – it ought to lead positioning in the other direction over the coming 2-4 quarters once both growth, inflation and ultimately wage growth starts surprising to the downside.

As the pandemic dissipates, we should expect the workforce to increase (as boomers return), supply chain issues due to a bizarre purchase volume of goods to fade and stimulus measures to disappear. The result is a negative impulse, which will likely lead to one of the most material negative rate of change events in recent decades – and we argue that it makes sense to start positioning accordingly already now.

Yes, the Fed is likely to hike. Yes, the Fed is likely to try and start tightening the balance sheet again. Yes, other G10 central banks ought to try and be hawkish… What happens when you tighten into a massive slowdown in the rate of change of credit, is that you flatten the curve materially... And I am even tempted to say that you should both buy the USD and duration (in most currencies) with an arm and a leg already now.. And equities overall.. Hmmm.. see below!

Happy hunting in 2022 😊

If you enjoyed this piece, please consider clicking on the like button and share the article. It costs you literally nothing, but you would be helping me a great deal!

A small present for The Macro Compass subscribers: the interview I did with David Rosenberg. It’s a really interesting one.

Real Vision has much more of this, and I’d definitely encourage you to subscribe to the platform to get access to similar valuable content!

Are you an institutional investor who likes The Macro Compass and would be interested in a bespoke, pro-to-pro coverage?

Are you looking for any other kind of partnership or collaboration?

Feel free to get in touch at themacrocompass@gmail.com.

See you again on Monday!

Vikings At The Gate