The macro framework you need to prepare your portfolio for 2022

TMC#17! In this article, I try to cut through the daily financial news noise to provide investors with the relevant info needed to enhance the risk/return profile of their portfolio in 2022.

15’ reading time

Good morning everybody and welcome back to The Macro Compass!

I am so glad to be back, and very humbled by the support I received from many of you during my absence and by the large positive response I had when I announced my comeback. A warm, heartfelt thank you!

This article will provide you with:

A panoramic macro update heading into 2022

A framework to understand what’s going on in the bond market

An intuitive way of how to approach the stock market at this stage

A glance into some of the exciting news!

The aim is to help you cut through the noise and focus on the big picture to enhance the risk/reward of your portfolio as we enter 2022.

The big picture macro outlook

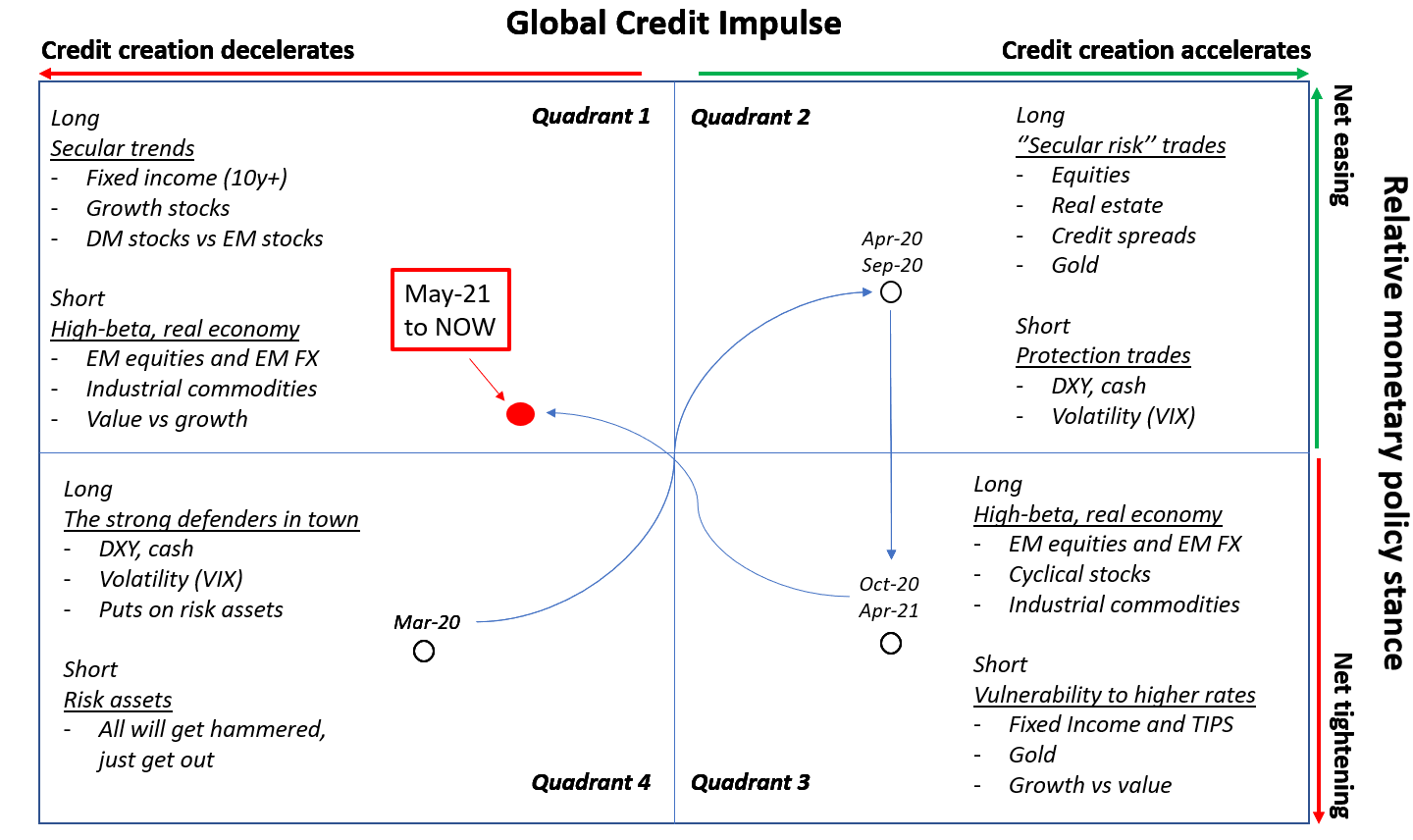

The Macro Compass has been sending a very clear message since May 2021: fade the ‘‘this time is really different’’ narrative and steer your portfolio back into assets which benefit from the secular trends.

My proprietary metric for the G5 credit impulse leads economic activity and relative performance across asset classes by 6-12 months, and it clearly peaked in Q420.

The chart below shows the relative performance of IWM vs QQQ lagged by 8 months against the G5 credit impulse - quite telling, isn’t it?

I am in the process of updating my prop credit impulse metrics, but the preliminary signs are not encouraging - the process of credit creation hasn’t picked up since June 2021. Banks are not increasing their net lending activity and the fiscal impulse has also weakened materially.

Although imperfectly calculated and only referring to China, the below Bloomberg’s Chinese credit impulse as % of GDP delivers the concept pretty well.

The weakening global credit impulse in 2021 doesn’t bode well for the ‘‘crack-up boom’’ narrative for real economic activity heading into next year…

Now, let’s look at central banks and political incentives.

The labor market is quickly healing, and Biden wants to consolidate his position as 2022 mid-term elections loom on the horizon. He is adamant for that trend to continue, with one big caveat: real wages need to go up!

In order to achieve that, central banks need to calibrate a gentle tightening exercise: as the labor market heals thus providing some modest tailwind to the cyclical economic recovery, financial and monetary conditions can be gradually and gently tightened in an effort to reduce inflationary pressures.

A tight labor market + reduced inflationary pressures = higher real wages.

Or at least that’s the plan.

In summer 2017, ECB president Draghi tried to convey a similar message in his famous Sintra speech by saying:

‘‘As the economy continues to recover, a constant policy stance will become more accommodative, and the central bank can accompany the recovery by adjusting the parameters of its policy instruments – not in order to tighten the policy stance, but to keep it broadly unchanged’’.

Few days after this speech, Bunds sold off 35 bps leading to a quick tightening in financial conditions as real rates abruptly rose.

Good luck with your task in 2022, central bankers.

What’s going on in the bond market?

Before we zoom into the nitty gritty details of Mr. Bond Market, please have a look at the chart below.

It shows the 10-year moving average of the growth in the US labor force plotted against the market-implied pricing for the Fed Funds terminal rate (i.e. the final Fed Fund rate at the end of the projected hiking cycle).

Basically, the chart points to one simple, but powerful concept: you can’t fight demographics in the long-term.

The US labor force used to grow at 15-20% (!) on a 10y moving average basis in the 80s-90s, while in the last decade this pace has shrunk to the low single-digit area and it’s projected to slightly slow down even further over the next decade.

As the labor force shrinks, the amount of people actively contributing to long-term economic growth reduces and the amount of retirees/inactive people increases: long-term equilibrium interest rates must head down for the system to survive.

Now, back to the outlook for the next few quarters.

As the tailwind for the cyclical economic recovery solely comes from a healing labor market as credit impulse struggles to pick up, central bankers are looking to embark in a ‘‘gentle tightening’’ exercise. Quite an interesting combination.

The obvious result is flatter yield curves: why?

The front-end of the yield curve needs to price an incoming potential hiking cycle from central banks, and it needs to incorporate some risk premium for this hiking cycle to happen sooner and be more intense than previously anticipated.

But this hiking cycle is supposed to happen while the cyclical growth impulse has already weakened, hence leading to a less uncertain outcome for long-term nominal growth: it’s indeed very likely that this central bank tightening will consolidate an already weak long-term nominal growth trend.

Therefore, investors in long-term government bonds can demand less term and risk premium to own this asset as the probability distribution of future outcomes for long-term nominal growth is now even less uncertain: it’s going to be poor.

The less obvious and very important result of this exercise is higher real yields.

As central banks tighten on the back of a poor credit/growth impulse, industrial commodities start to consolidate gains and base effects kick in, inflation expectations are unlikely to continue to rise from here.

Actually, were they to continue their uptrend, I would expect central bankers to start reacting to potential de-anchoring of inflation expectations on the upside and compound their hawkish stance.

In an environment where front-end nominal yields price an incoming hiking cycle and inflation expectations seem to have peaked, real yields move up.

This is very relevant for other asset classes, including the stock market.

Stock market expected returns in 2022: mmhh…

So, you own some equity exposure in your portfolio and you are looking at the S&P500 expected returns in 2022 to get an idea about what to expect.

We all know that the stock market total return is mostly influenced by your dividend yield at inception, your EPS growth and your delta in valuations (say, P/E).

The chart below shows the 2022-2023 analyst consensus forecast for EPS growth.

I’ll save you the math: +8% in 2022 and +10% in 2023.

Now, the realized earnings per share in years subsequent to a weakening credit impulse cycle have been on average between -2% and +3%.

2022 is the subsequent year to 2021, a weak credit impulse year…

What about valuations, say P/E?

Valuations are highly affected from absolute levels and trends in risk-free real yields.

If real yields were to rise, there is a decent likelihood valuations could reprice (lower) as a result: see chart above.

Notice as the absolute level of real yields is as important as the direction of travel.

All in all, as consensus estimates for earnings growth remain relatively optimistic and forward valuations will struggle to increase the 2022 total return outlook for the broad stock market looks less buoyant than usual.

Investment ideas

This section of the The Macro Compass letter will contain actionable investment ideas to enhance the risk/reward of your portfolio.

I am in the process of creating:

A medium-long term, ETF model portfolio which is going to help the average investor navigate their asset allocation decisions;

A short-medium term trade tracker which will reflect more cyclical investment ideas and elaborate on entry levels, profit target, stop losses, size etc.

The name of the game will be full transparency and accountability.

I don’t have a crystal ball, and a big ego is the worst enemy of a good investor.

I will be wrong at times, and there is nothing wrong about that.

For now, I can only hope you are still running profits on the US 5s30s flattener initiated in summer.

Entered at 129 bps, it’s now at 54 bps.

We are now a 9.000+ community here on The Macro Compass. Thank you all!

If you liked this article, why not share it with your (social) network?

If you are not subscribed yet and you’d like to receive updates directly in your inbox, you can subscribe clicking on the button below.

I generally publish 1-2x a week (Monday + Thursday) covering market developments across asset classes, providing investment ideas and digging deep into broad macro topics. From the desk of a former Head of a $20 bn Investment Portfolio straight into your inbox.

And the best part of it: for free!

See you at the next update!

Hi Alfonso,

Congratulations for this post. It is great to have you back. Maybe I am doing something wrong, but I think the links to the flatteners at the bottom don't work.

I wish a Merry Christmas.

Thank you

what do you think of the "cash" that sits on consumer b/s? this coupled with high inflation /bad delivery times during summer/fall could, at least in my mind, be a tailwind for -22 spending even with fiscal drag! Thoughts?