Hi all, and welcome back on The Macro Compass.

Next week I am releasing my ETF portfolios and tactical trade ideas for 2023 and our flagship interactive macro tool - The Volatility Adjusted Market Dashboard.

But, be aware: from now onwards getting access to The Macro Compass reports, portfolios, courses and interactive tools will require a paid subscription.

We are 100% committed to our mission: help you become a better macro investor.

Check out which monthly or yearly subscription tier suits you the most and come join the hedge funds, family offices, and thousands of worldwide macro investors in this exciting macro journey together!

Buy-And-Hold Won’t Work As It Used To

Forget the buy-and-hold 2010s, where purchasing a 60/40 portfolio and going to sleep generated 10%+ returns per year with minimal volatility and drawdowns.

The next 5-10 years are going to be different.

Why?

Two reasons, amongst many others.

#1: The Growth and Inflation Pendumuls Will Swing Much Faster

Politicians have experimented with large-scale fiscal stimulus and witnessed its powerful impact - in 2021, the US recorded nominal GDP growth around 10% (!).

They are now also familiar with the flipside of it: inflation.

As a result of fiscal injections and removals, the growth and inflation pendulums in the 2020s are likely to swing much faster than in the 2010s.

Fertile grounds for macro volatility.

#2: The Vengeance of Geopolitics

Russia/Ukraine, China/Taiwan, the US/China semiconductor saga and many more pieces of the geopolitical strategy puzzle will be needed to design a successful macro asset allocation.

Uncertainty brings volatility, but also alpha opportunities.

Contrary to popular belief though, the key to generate consistent excess returns is not having a crystal ball.

But it’s rather following a process to:

Understand why and where is the action really happening in global markets;

Put the pieces of the macro puzzle together;

Systematically exploit macro inefficiencies.

Let’s dig into these cross-currents and see how the VAMD (my flagship interactive macro tool) can help us generate alpha.

The Macro Cross-Currents

The big picture still holds: the global printing press has come to a sudden halt in 2022, and as a result we should expect growth and inflation to markedly drop in 2023.

The magnitude of the drop?

Big - S&P500 EPS could contract by 15-20% next year.

So, just sit in bonds and chill?

Hold your horses.

China has decided to avoid widespread social unrest and embarked in a journey to fully reopen its economy.

The CCP’s biggest asset is social stability: while a full reopening is never going to be a smooth ride, it’s hard to foresee military lockdowns again.

The playbook shouldn’t look very different from the US or European reopenings: start-and-stop when strictly necessary, sure.

But bottom line: China is going for a full reopening.

A full reopening in China is definitely supportive for global nominal growth.

My prop measure for Chinese real-economy money creation has shown a mild positive sign throughout 2022, which means new spendable money has been printed by the Chinese authorities.

Yet, as people were locked home this didn’t result in higher economic activity.

Reopenings are obviously positive for cyclical growth, and the additional pent-up demand from the 2022 Chinese credit creation will compound this effect.

On top of it, the Western experiences show that full reopenings tend to be inflationary events: the rapid spread of the virus limits the ability to maintain fully functional supply chains and it hampers the supply of labor leading to overall supply bottlenecks exactly when demand is cyclically strong - higher prices being the natural outcome.

A typical example of the 2023 macro cross-currents.

The forest: a global disinflationary recession.

The trees: a cyclical growth and inflation upside shock coming from China.

So, how do we trade such an environment?

First, we systematically study and understand how global markets are reacting.

After, we look for inconsistencies to generate good risk-adjusted returns.

Let’s do that.

Piecing The Puzzle Together

The VAMD is the most comprehensive global market screening tool you can imagine.

It covers all the asset classes across global jurisdictions and most importantly it points you to where the real action is happening in global macro.

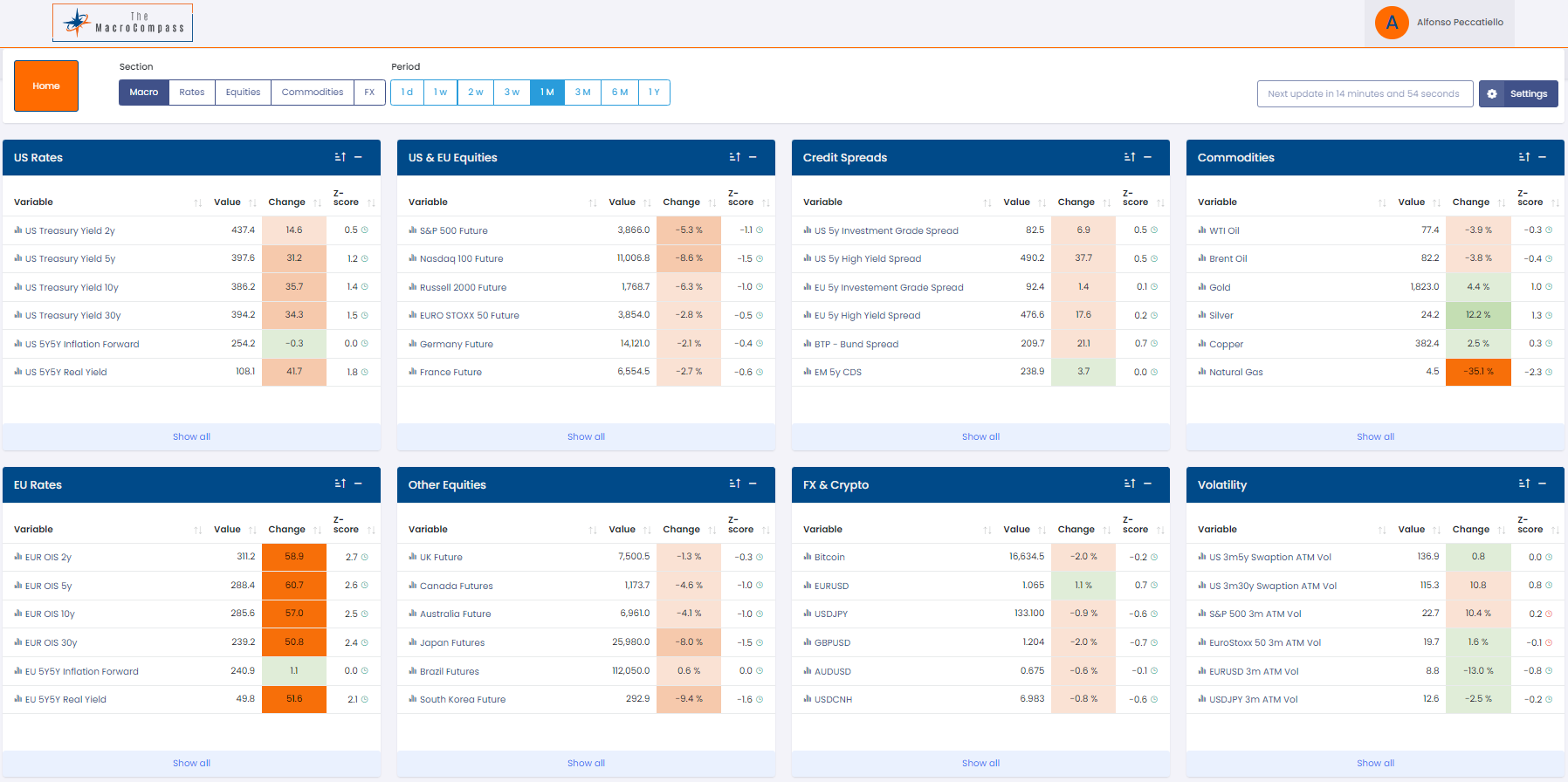

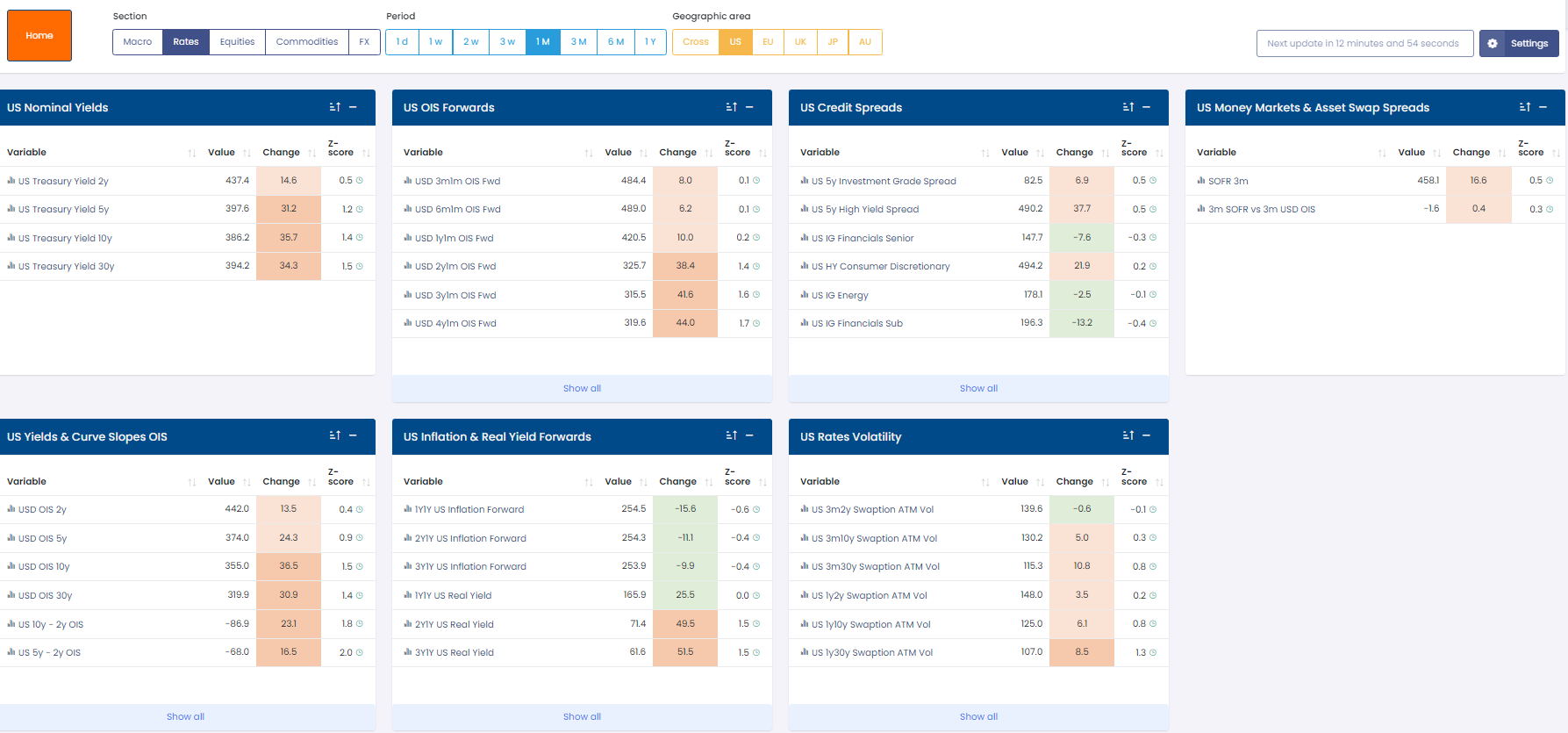

The VAMD tracks real-time moves in fixed income, derivatives, credits, equities, commodities, crypto, and FX across the world and it ranks market movers based on their magnitude.

The ranking is achieved through a visually appealing color-coding mechanism: the bigger the move, the stronger the tonality of red or green so that you immediately know where to focus your attention – where the global macro action is happening.

The magnitude is measured through a Z-Score approach: in simple terms, the latest market move in a certain time horizon is compared against the ‘’typical’’ move that particular asset has exhibited in the same time frame over the last 10 years.

The bigger the Z-Score, the larger the volatility-adjusted move was.

And the brighter the red or green color tonality.

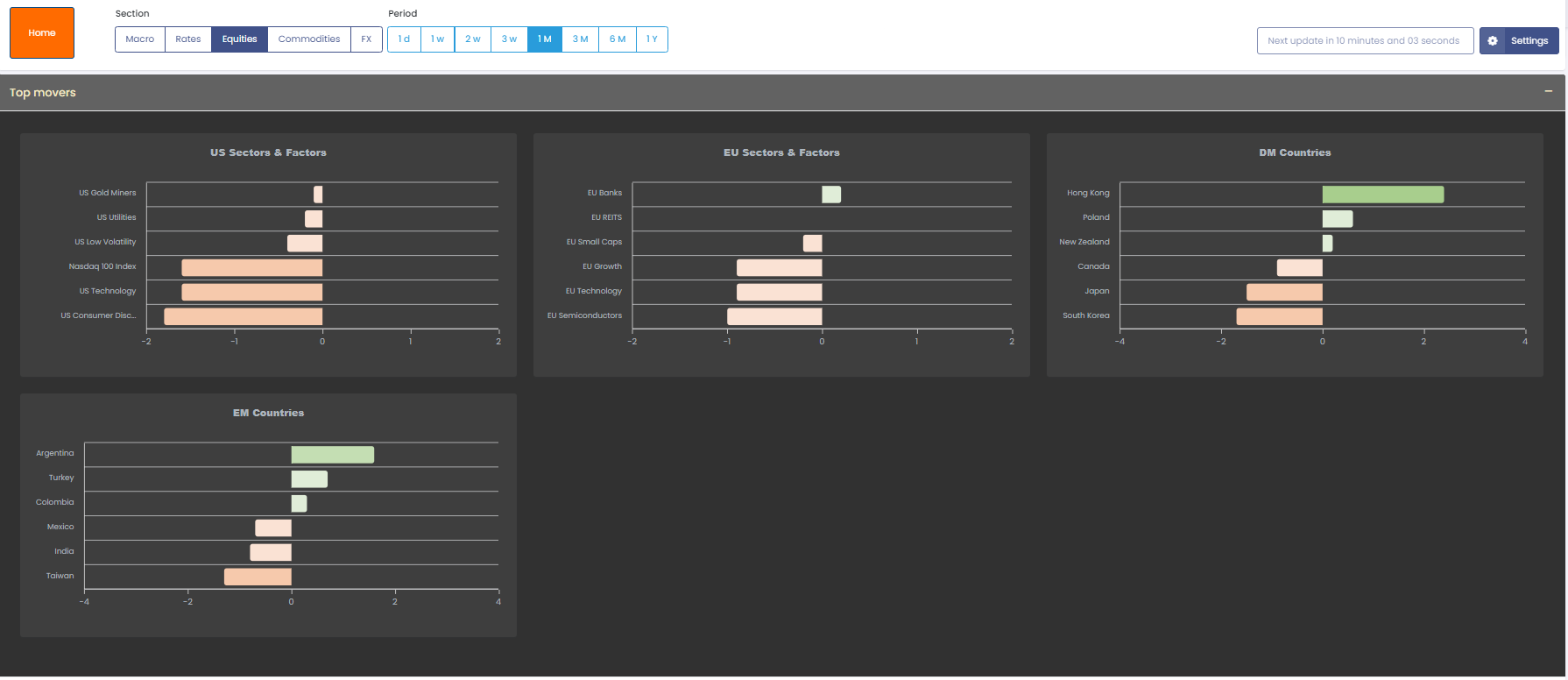

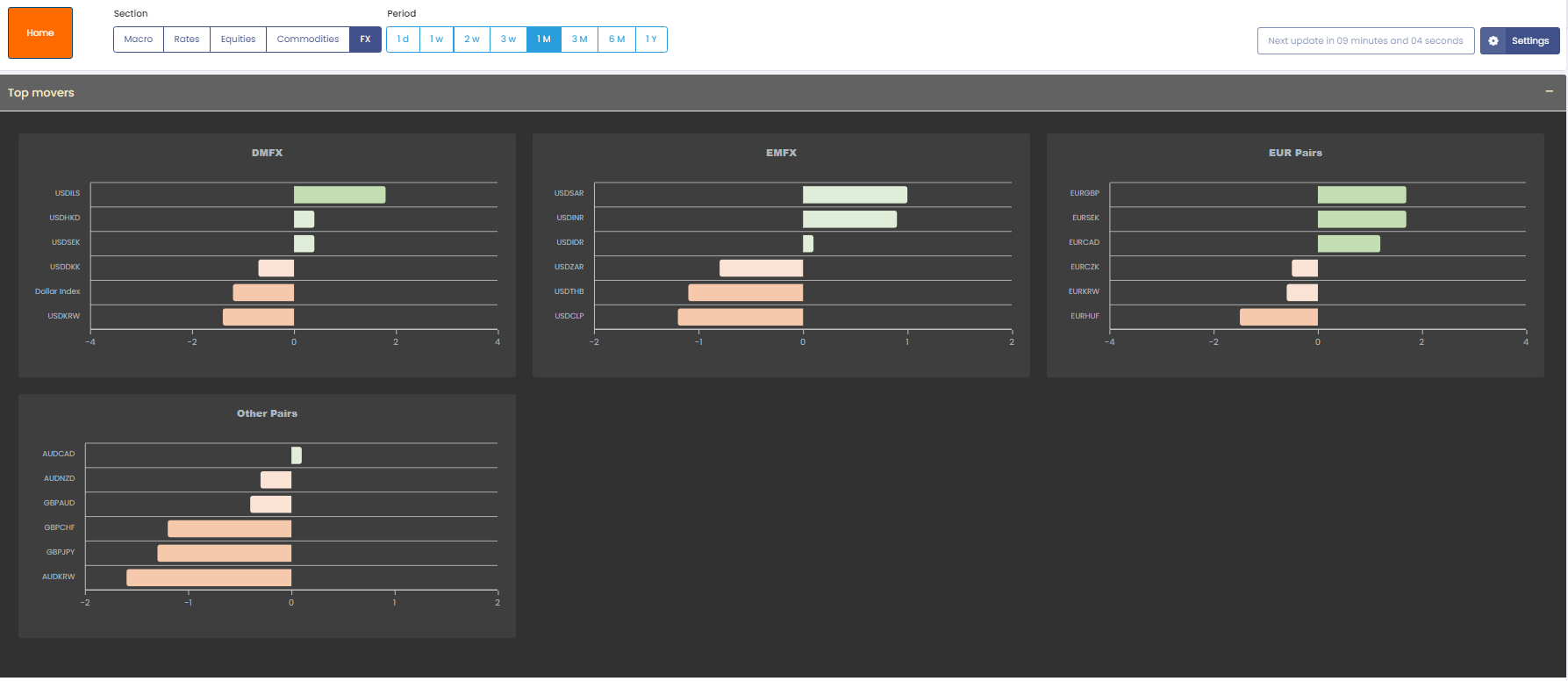

In the screens below, I showed some VAMD sections looking at vol-adjusted global market moves on a 1-month time horizon.

What catches your attention the most?

As I explained in the video above in much more details, the VAMD points to several inconsistencies in global markets.

If the Chinese reopening is being fully repriced, why are US and European inflation swaps basically unchanged and why are cyclical equity sectors underperforming defensives?

If a global recession is at play and absent new hawkish Fed surprises, why are US real yields moving viciously higher and curves steepening?

BTP/Bunds are widening again, yet the EUR is overperforming most other currencies: can it last?

Credit spreads are incredibly resilient while equities and cyclical sectors in particular have been hammered in December - are you sure a recession is fully priced in?

The VAMD is a very powerful tool to piece the global market puzzle together and find inconsistencies to potentially exploit.

A quantitative, data-driven macro process and proper risk management are the additional skills required to generate solid risk-adjusted returns.

From next week, The Macro Compass subscribers will be covered from all fronts.

Come and join the hedge funds, family offices, and thousands of worldwide macro investors in this exciting macro journey together - what are you waiting for?

Ah, almost forgot: Happy New Year, TMC Community!

For more information, here is the website.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Push & Pull