Hi everyone, and welcome back to The Macro Compass!

Before we start: my macro hedge fund Palinuro Capital goes live next week!

If you are a professional investor and you wish to remain updated on my fund, from now onwards you can only do that if you access my private distribution list.

To remain updated on my Macro Hedge Fund, please leave your info here.

This is your last chance.

It only takes 2 minutes.

The Chinese real estate market is de-leveraging very hard.

Economists estimate Chinese households have suffered $10+ trillion of wealth losses as a result.

There is now a strong urge to stop the bleeding amongst Chinese policymakers.

Last week, China unleashed a ‘‘stimulus bazooka’’.

But what were the measures all about?

And will they be effective to fix the Chinese economy?

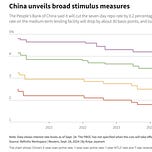

Chinese policymakers announced the following package:

A) More interest rate cuts

B) The Chinese version of the ''Fed put''

C) Vague wording about fiscal stimulus

Interest rate cuts and the ''backstop'' facility are propping the Chinese stock market to the moon.

Yet they are very unlikely to work in a balance sheet recession.

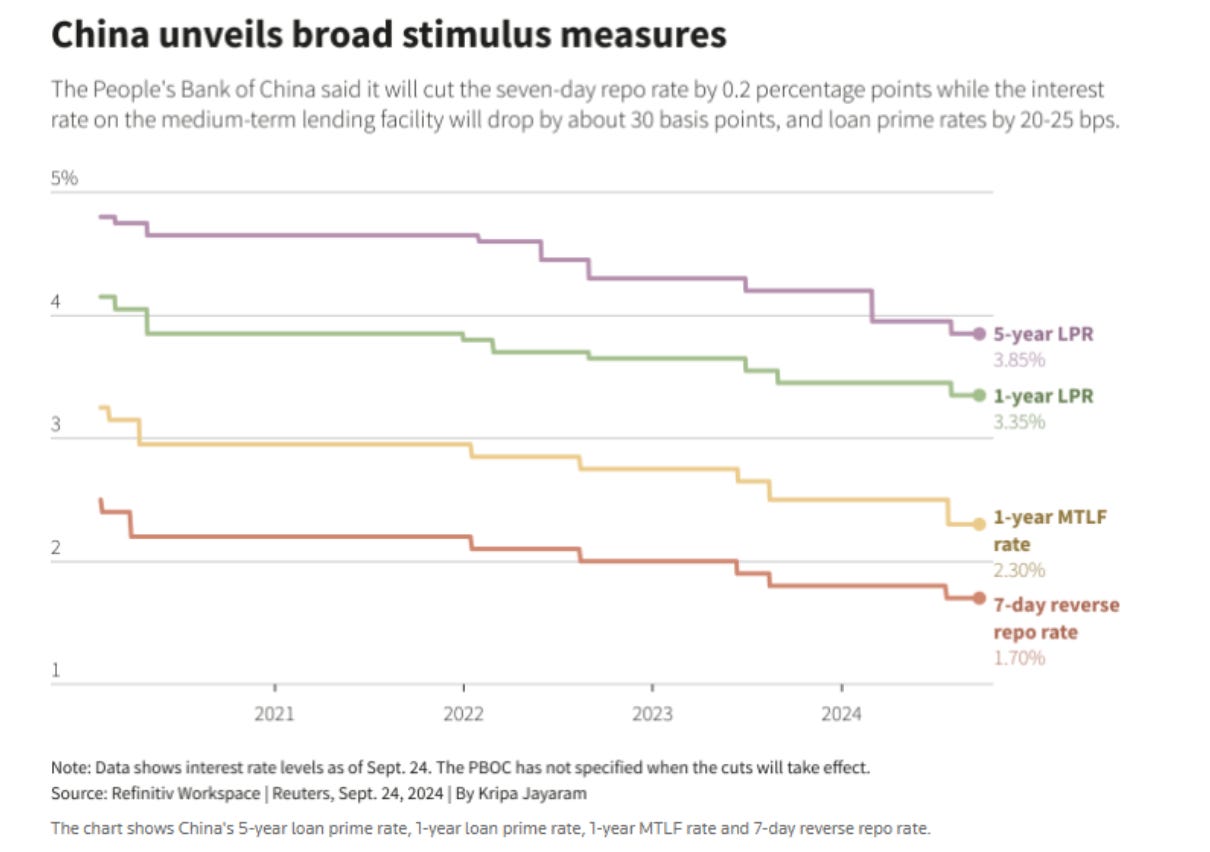

In the 90s, Japan cut rates aggressively and that wasn't the solution to the problem:

Cutting rates won’t encourage households or corporates to leverage: corporates were tapped out in 2016 already, and households have just been burnt with excess debt so we shouldn’t count on them.

Lowering interest rates in combination with the new ‘‘PBOC Put’’ can instead help reinstate animal spirits.

Chinese authorities set up a BTFP-like facility which allows you to pledge collateral (cash, bonds etc) and get funding to go and buy Chinese stonks.

Yet, this is unlikely to solve the structural malaise affecting the Chinese economy.

Fiscal is the only real fix, and here is why.

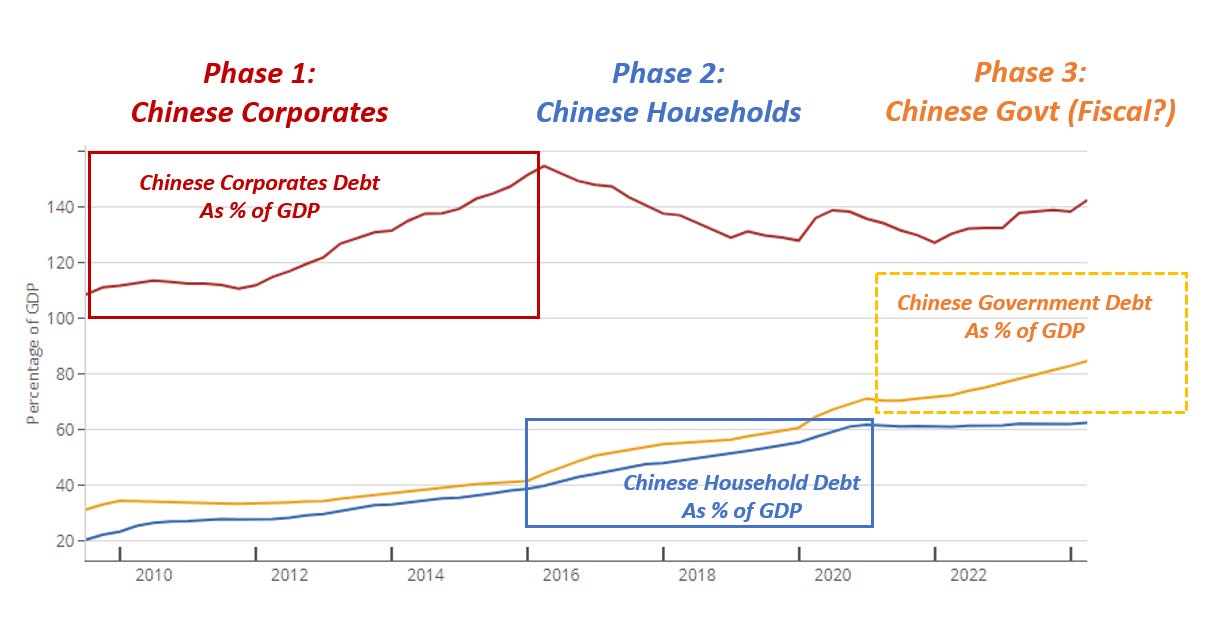

There have been 3 key phases of Chinese leverage:

1) Corporates (red)

2) Households (blue)

3) And now fiscal is the only solution (orange)

10 years after entering the WTO in 2001 and once the demographics dividends were exhausted, China embarked in massive leverage to sustain their growth targets.

Phase 1 saw Chinese corporates (red) tap up leverage aggressively (2010-2016).

Once corporates’ appetite for debt was exhausted, Xi Jinping tapped Chinese households (phase 2).

This led to the creation of a massive real estate bubble which China is trying to deflate now.

The only agent left to pick up the slack is the Chinese government – fiscal deficits are key here (phase 3?).

So while the ''bazooka'' has been excellent at restoring market confidence, there is only one real fix for the Chinese economy here.

It's a large, large fiscal stimulus package.

Will China actually implement it?

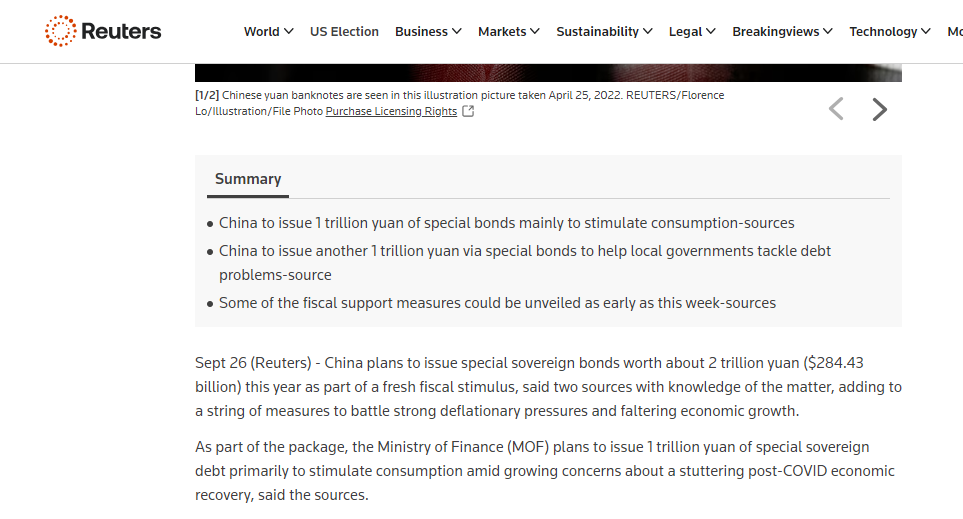

Reuters ran a piece discussing a $284 bn fiscal package.

This would be very much unlikely to sort things out.

Size matters here: consumers and corporates have been hit by a $10 trillion de-leveraging in the housing sector, and so the fiscal stimulus needs to be large and targeted to make the difference for the Chinese economy.

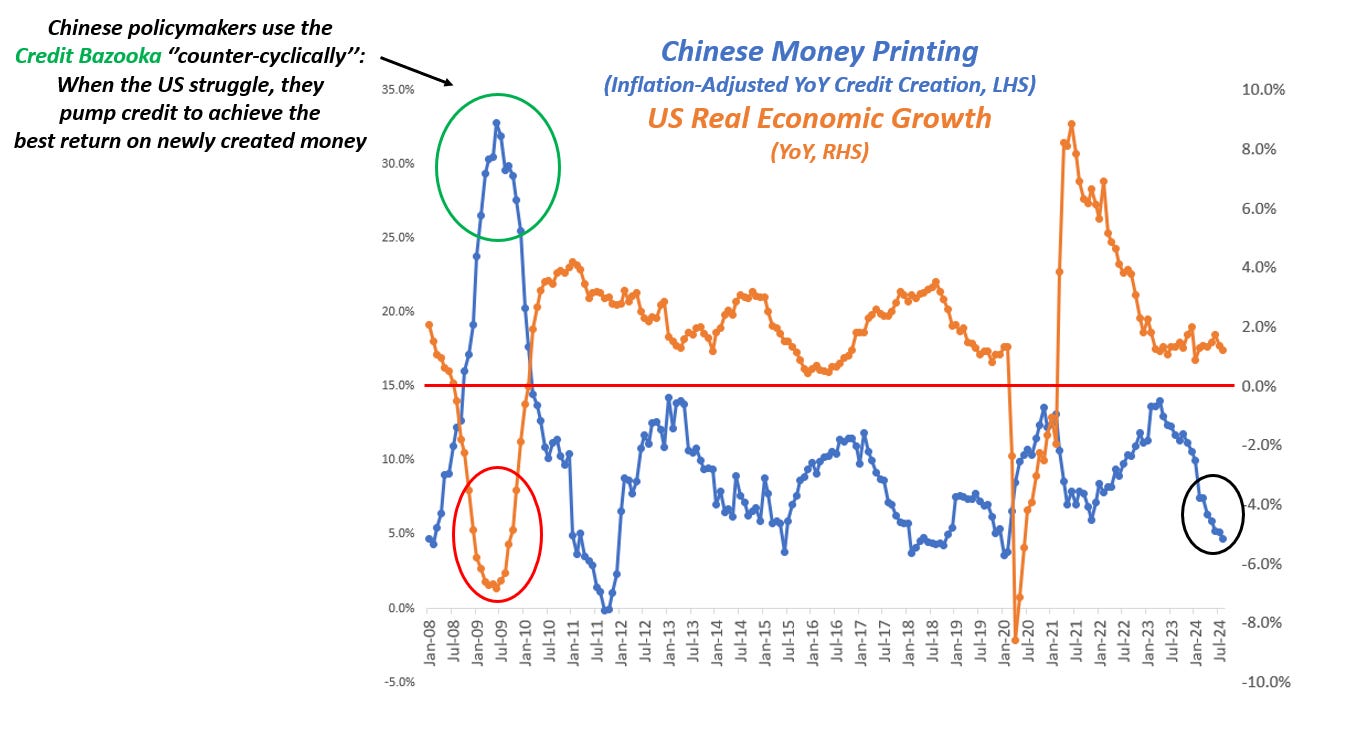

While we keep monitoring any concrete announcement on fiscal stimulus from China, it’s worth remembering how Chinese policymakers love a ‘‘counter-cyclical’’ Bazooka:

China loves to stimulate (for real) when the global economy is weak.

This way, they can get the best ROI on their money creation and go buy cheap foreign asset/strengthen their trade position/gain shares in crucial markets.

Until the global economy slows down further, China might not be interested in proper stimulus but rather in ''controlling the bleeding'' and get investors occasionally stopped out in their China shorts - a story we've seen happening for 18 months already.

China matters for the world.

China needs a large fiscal stimulus.

Large. Fiscal.

These are the two key words you should be focusing on.

If you enjoyed this piece, feel free to share it with a friend:

And remember: my macro hedge fund Palinuro Capital goes live next week!

If you are a professional investor and you wish to remain updated on my fund, from now onwards you can only do that if you access my private distribution list.

To remain updated on my Macro Hedge Fund, please leave your info here.

This is your last chance.

It only takes 2 minutes.

The Big Chinese Bazooka