The Fed hiked rates above 5%, and yet the US economy doesn't break.

Back in 2022 already, the yield curve inverted and it has stayed inverted ever since.

The lags looked relatively short, and the US economy was going through a soft patch in 2023 when it became consensus that a recession was gonna happen.

Something even broke in markets (regional banks), and yet nothing really happened.

Here is why.

High interest rates are supposed to break something because an overly indebted economy will have to service a mountain of debt at expensive rates and it will have less money for income and spending.

The problem is that people are looking at the ''wrong'' debt.

Private sector debt levels and trends are far more important than governmment debt.

Contrary to the government, the private sector doesn't have the luxury to print money: if you get indebted to your eyeballs and you lose your ability to generate income, the pain is real.

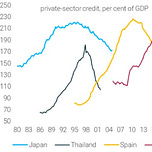

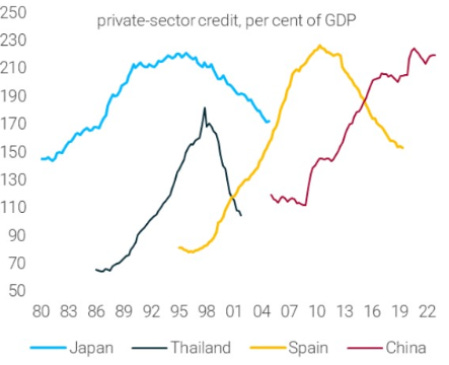

As Dario Perkins' chart shows, the biggest financial crisis happened as a result of high and growing private sector debt. The Japanese or Spanish house bubble bursting, the Asian Tigers, or China today are clear examples.

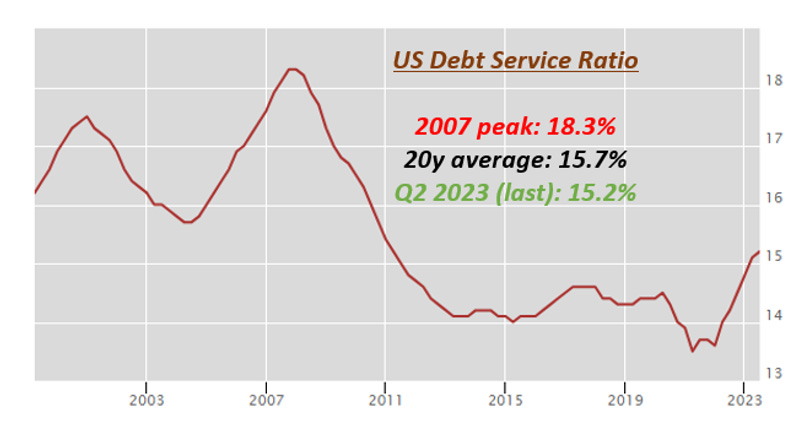

And this is why we need to look at Debt Service Ratios.

Debt service ratios measure the amount of disposable income which is used by non-financial corporations and households to service their outstanding debt payments.

This is a crucial metric because it efficiently visualizes the pass-through of monetary policy tightening on the private sector.

The US debt service ratio is going up but only slowly: it sits at 15% which equals its long-term average.

There are really four ways Debt Service Ratios can move up fast:

The economy sits on a mountain of private sector leverage;

A large share of private sector debt (mortgages and corporate bonds/loans) is based on variable rates, hence as the Central Bank hikes households and corporates are immediately faced with higher debt servicing costs;

A large share of private sector debt works with interest rate resets, so in a short period of time all these debts will have to be reset at higher rates;

A large share of private sector debt is due for notional refinancing soon (e.g. a large maturity wall)

It’s safe to say the US doesn’t face much of these 4 problems: private sector debt as a % of GDP is lower than 2007, loans and mortgages are mostly on fixed rates with no short-term resets, and maturity walls are gradual.

But what about other countries?

I looked at some of the major economies in the world and found that:

- Australia

- Canada

- Korea

- Sweden

Are all under pressure: their DSRs are high in absolute terms and higher than their 20-year average, and the trend is also negative as they keep increasing over time.

For example Sweden just cut interest rates under the pressure coming from higher debt service ratios.

The US instead sits at a more reasonable ~150% of private debt/GDP and its private sector will take longer to feel the pain from higher interes rates.

Think of the US in 2007 and how different the US economy is today.

Back then the housing market cracked under the pressure of excessive private sector leverage and the Great Financial Crisis ensued.

Today, the story is different: the scale of government deficits (orange) is enormous, but private sector credit (blue) is not roaring.

Private sector credit isn’t the source of excessive money creation and instability - the US private sector has actually de-leveraged since 2008!

Instead, it's all about government deficits today.

And in short, this is why high interest rates and an inverted yield curve haven’t broken the US economy yet.

Yet slowly but surely, a few cracks are appearing under the hood:

If you lose your job today, it’s quite hard to get one back in a short period of time: therefore, you’re likely to be classified as a permanent job loser.

The share of US permanent job losers as a % of the total labor force is increasing: companies facing 7-8% refinancing rates on their loans/bonds are reducing their spending and slowing their hiring intentions, hence cooling the job market.

The US economy hasn’t broken so far.

But if the Fed keeps rates high for a long enough period of time, they will eventually succeed.

Thanks for reading!

If you enjoyed this piece, let me know by smashing that Like button.

And feel free to share it with friends and colleagues!

Share this post