Next week will be crucial for markets as Trump is set to announce (or disappointingly not announce) tariffs.

In this piece I will highlight the rationale behind my base case scenario and its impact on markets.

Before we do that, I want to share something with you.

I am offering a FREE trial to my institutional macro research service!

The service includes:

Multiple macro research pieces per week;

Timely coverage of important events and market implications;

Direct access to me

If you are a HNW private investor, a family office or an institutional investor feel free to request a free trial using the link below:

FREE Trial to Alf's Institutional Macro Research

And now, back to the article.

1. Recent economic data provides Trump with cover to go big on tariffs

The biggest risk Trump runs with tariffs is a bond market insurrection: if investors perceive inflation as too high, tariffs can generate an injection of risk premium that launches bond yields to the moon.

In turn this would tighten financial conditions, slow down the economy, hamper Trump’s plans to reduce borrowing costs for the US, and just make him quite unpopular (people hate inflation spikes).

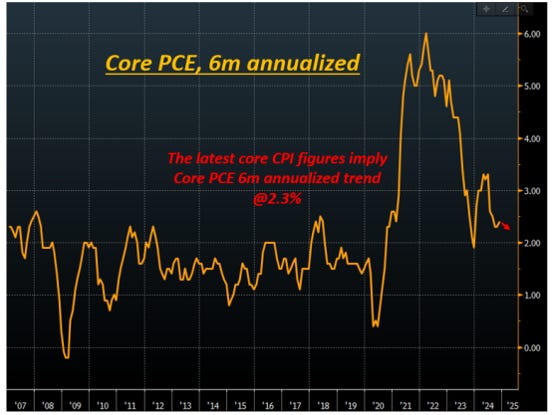

Luckily for him, the recently released inflation report suggests core PCE is trending at 2.3% - not bad:

Additionally, the latest job market report was encouraging and the control group of retail sales is running at 5.4% - around 2018 levels, when the pre-pandemic economy was considered strong. The economic momentum and a 2.3% trend in core PCE inflation provide Trump cover to go big on tariffs.

2. To increase his negotiating power, Trump can target vulnerable economies

As the Fed hiked rates, all other Central Banks around the world merely followed the same strategy. The big issue here is that not all economies were equipped to handle such an abrupt increase in rates.

After the GFC, the US economy has deleveraged its private sector – private debt to GDP is down in the US. The US private sector also borrows mostly on fixed rate for long tenors (think about 30-year mortgages). The US also issues bonds in the global reserve currency, so bond vigilantes are unlikely to go after the US.

But what if another economy had high private sector debt, or upcoming refinancings, or floating rate mortgages and corporate borrowing which makes the passthrough of rate hikes fast and furious?

In that case, the economy will prove quite vulnerable to a prolonged hiking cycle.

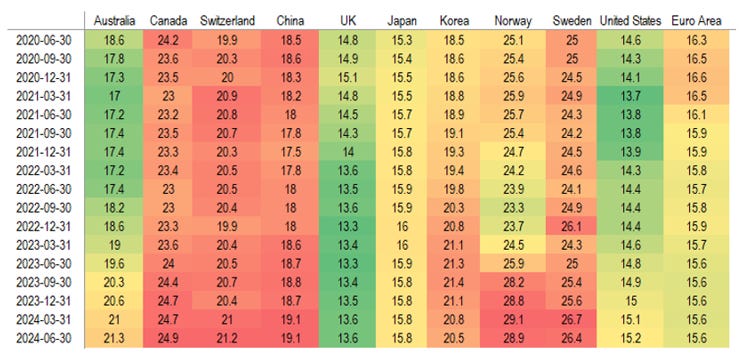

The BIS just updated their private sector Debt Service Ratio (DSR) for H2 2024 – this snapshot allows us to verify in which countries households and corporates are under pressure from a prolonged hiking cycle.

Red or green colors refer to how much the DSR is above or below its long-term average in that country:

Notice how Canada and China are under increasing pressure.

And it would make sense for Trump to go after them – negotiating with a weak counterpart is always better. But identifying vulnerable economies is not only about the Debt Service Ratio – politics also matters.

For example, Germany is very unlevered as an economy: the German DNA prevents (for now) any proper deficit spending, and the private sector is also relatively conservative on how much it leverages.

As a consequence, the DSR doesn’t really pick up – yet the German economy is vulnerable.

Its business model of cheap energy imports and outsourcing production and manufacturing has been challenged by the pandemic, and China has made huge progress as a competitor for car exports. The German economy has taken a major hit, and people aren’t happy.

New elections are planned for February, and negotiating with a country in political turmoil is always better. From a game theory perspective Trump could decide to focus on China, Canada and Germany.

3. A tariff strategy to raise the most amount of money, and take the smallest amount of risks

Even if Trump wants to target the most vulnerable economies, he must be careful.

Let’s take a look at the countries the US imports the most from, and in which categories of imports:

The car, pharma, oil and household/tech goods industries are by far the largest import sectors for the US. And Mexico, China, Canada and Germany the top 4 countries that exports the most volume to the US.

If Trump’s intention is to raise the most amount of money through tariffs on the most vulnerable economies, basic logic imposes equally heavy tariffs on all these 4 countries above.

But there is a risk in going huge against China from the get-go. While it’s very unlikely that Canada and Europe will protect their currencies, China could decide to do it.

And if we get 25%+ tariffs on China from the get-go but the CNY doesn’t weaken, US consumers will feel it. Higher import prices on Chinese goods without an offsetting move up in USDCNY = US consumers will take the hit out of Chinese tariffs, and not China.

Here, game theory would hence suggest Canada and Europe are the prime candidates for heavy tariffs.

Conclusions and market implications

Given that:

1) Soft inflation and solid growth provide cover for Trump to go aggressive on tariffs

2) To increase his negotiating power, Trump might focus on the most vulnerable economies

3) China, Canada and Europe are 3 vulnerable economies and the all export a ton to the US

4) But China can hit back via supporting the CNY = US consumers would pay for tariffs

5) Canada and Europe are not in a position to defend their FX, and they face political jitters

My base case for tariffs sees:

A global tariff rate of 10%

Additional targeted tariffs on China (phased-in monthly increase of 2.5% with no end in sight)

Additional targeted tariffs on Europe and Canada for a total of 25% to start (+ monthly increases)

If this unfolds, the market is not prepared.

Over the following 2-4 weeks, I would expect:

A) EURUSD to breach parity, and USDCAD to march towards 1.50

B) Bonds to rally at first, and stabilize after

C) An initial knee-jerk negative reaction in stock markets

If you liked this article, please share it with a friend.

And remember: I am offering a FREE trial to my institutional macro research service!

The service includes:

Multiple macro research pieces per week;

Timely coverage of important events and market implications;

Direct access to me

If you are a HNW private investor, a family office or an institutional investor feel free to request a free trial using the link below:

FREE Trial to Alf's Institutional Macro Research

Speak soon and have a wonderful day,

Alf

Share this post