Good morning, this is Alf - welcome back to The Macro Compass!

I wish you a fantastic year ahead: follow your passions, keep learning, and don’t drink cappuccino after 11am.

In this macro piece, we will cover the biggest market mover for H1 2025: tariffs.

We will also investigate what’s the most attractive asset class today.

But before we start, here is a present for you to kickstart this new year.

Early next week, I’ll publish my top 3 macro trade ideas for 2025.

If you want to:

Read my macro research multiple times per week;

Have access to my long-term macro ETF portfolio;

Receive all my tactical trade ideas (including next week’s)

You can now sign up to the premium TMC tier for 30% OFF.

For the first 30 users, 30% OFF. First come, first serve.

Discount Code ‘‘HNY’’.

Use the link below:

Now, to the piece.

What if tariffs end up being non-inflationary and negative for growth?

And what if Trump focuses on short-term painful policies first in H1, to then deliver tax cuts in H2?

Consensus isn’t ready for this.

Let’s disentangle the thought process behind the concept of ‘’disinflationary tariffs’’.

This paper from the new Council of Economic Advisor (CEA) Chair Steve Miran covers it – I’ll summarize.

The main idea is very simple.

In his previous term, the Trump administration increased the effective tariff rate on Chinese imports by 18%.

During the same time span, the US Dollar appreciated by 14% against the Chinese currency.

It basically means the after-tariff price in USD to import Chinese goods was almost unchanged.

As long as the USD appreciates, US consumers aren’t going to feel much inflationary pain from tariffs:

Yet we also know that tariffs are negative for business sentiment, investment, and growth.

Even if tariffs are phased in gradually as a negotiation tactic, the message will be clear: if you want to export your stuff in the US, you need to re-think your business model or cut your profits.

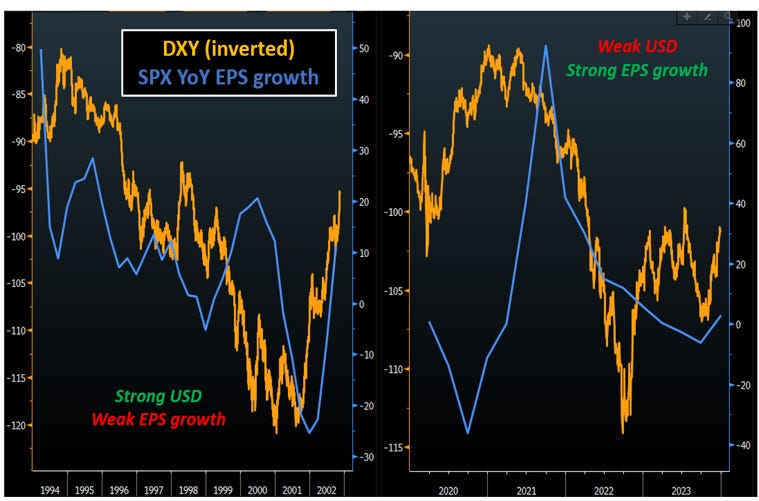

Additionally, it’s well documented that a super strong US Dollar acts as a drag for earnings growth in the US:

US companies generate about 60% of their revenues outside the US, and a strong USD doesn’t help there.

The charts above prove that was indeed the case in 1996-2001 and 2021-2023: a relentless USD appreciation (orange line down) slowly but surely weakened earnings growth (blue) for US companies.

Under the assumption that countries hit by US tariffs will accept a currency devaluation without a fight, there are reasons to believe that tariffs can be non-inflationary and negative for growth.

But can we safely assume China isn’t going to push back?

Why would China not try to stabilize their currency and export some inflation and pain in the US?

Let’s try to think this out as if we were Chinese policymakers.

We have three options:

1) Accept the hit: let the CNY weaken

2) Fight back: protect the CNY by selling down USD FX reserves, and hit back the US

3) Play the long game

I believe China will opt for 3: play the long game. And here is what I mean.

Chinese policymakers don’t face elections, but the Trump administration does – US midterms in 2026.

Rather than going for the extremes (1 or 2), China could decide to apply a long-term strategy that relies on two pillars.

A) Allow a steady CNY deval, and plug the hole with fiscal stimulus where needed

As China can afford to play the long-game from a political standpoint, they could opt for a middle ground between a full CNY devaluation and a strenuous defense of their currency by selling USD reserves.

B) Keep using ‘’middlemen’’ to dodge tariffs

We had some fun testing this hypothesis: can we show that China used ‘’friendly neighbors’’ to re-route their goods into the US as a way to circumvent tariffs?

Since the first round of Trump tariffs went live in 2018, China (and Hong Kong) now import a volume of goods in the US which is 5% lower than the pre-tariff era.

But at the same time, Vietnam + Korea + Thailand + Malaysia have all increased their trade flow with the US.

Coincidence?

Or China trying to dodge some tariffs by re-routing their goods exports to the US through ‘’middlemen’’?

Consensus is strongly positioned for tariffs to be:

A big macro event

Negative only for the rest of the world (US growth exceptionalism to continue)

Adding to inflation uncertainty in the US

I think there is space for consensus to be caught offside on all the above.

I could foresee a world where Trump phases in tariffs, China dodges most of them through middlemen countries, the anticipated inflation volatility doesn’t realize, but growth slows down because business investments are hit by uncertainty.

Given today’s pricing, the most attractive asset class in this scenario would be bonds.

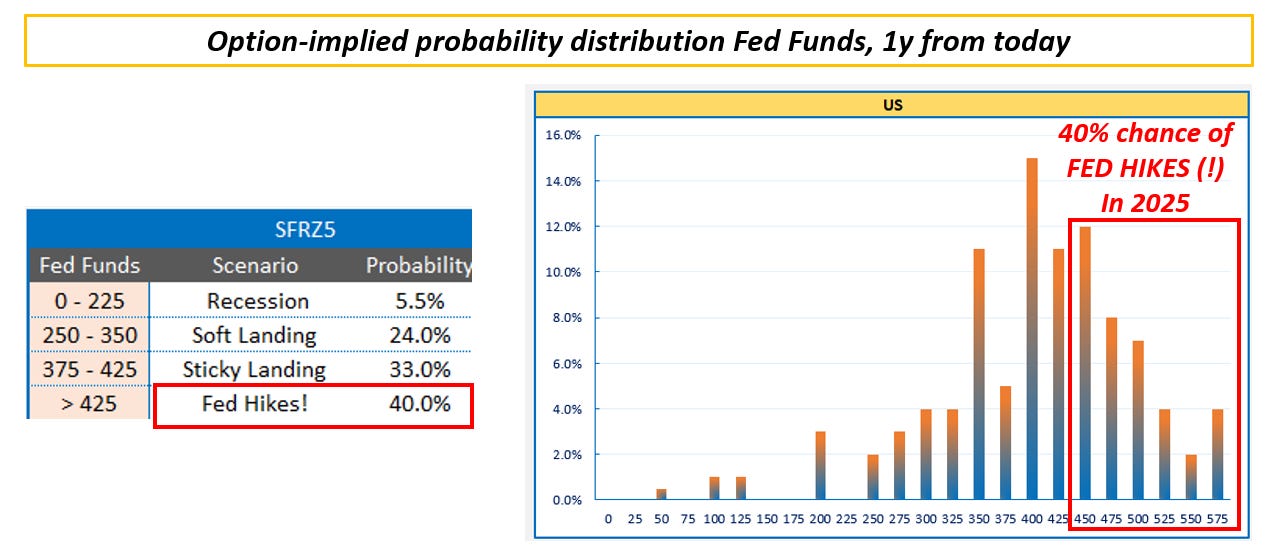

Our models show that the option-implied probability for the Fed to hike (!) over the next 12 months is priced at 40%. That’s quite high, and it show the extent of hawkish pricing people pushed into the front-end of bond markets.

And not only that: the curve has bear steepened, and term premium has been injected in the long end too.

With Fed Funds at 4.25%, the bar being very high for the Fed to hike rather than cut, and 10-year yields at 4.60% (= positive carry) bonds look interesting here.

Especially if you think a strong USD will slow down corporate earnings, and that the hype about the macro impact of tariffs might be exaggerated.

This was it for today.

If you enjoyed it, please share this piece with a friend:

Finally: don’t miss the 30% discount on the premium TMC tier!

Early next week, I’ll publish my top 3 macro trade ideas for 2025.

If you want to:

Read my macro research multiple times per week;

Have access to my long-term macro ETF portfolio;

Receive all my tactical trade ideas (including next week’s)

You can now sign up to the premium TMC tier for 30% OFF.

For the first 30 users, 30% OFF. First come, first serve.

Discount Code ‘‘HNY’’.

Use the link below: