Before we start, a quick announcement: starting this week, I’ll be kicking off The Macro Education series!

I will publish short and educational pieces covering the bond market, monetary mechanics, portfolio construction, risk management and much more.

It will be and it will forever remain FREE.

Looking forward to share some educational macro insights with this nice community!

When the yield curve flattens and eventually inverts, you worry.

But it’s when a recession hits, the Fed cuts rates and the curve steepens that you become s**t scared.

Yield curve dynamics represent a crucial macro variable, as they inform us on today’s borrowing conditions and on the market future expectations for growth and inflation.

An inverted yield curve often leads towards a recession because it chokes real-economy agents off with tight credit conditions (high front-end yields) which are reflected in weak future growth and inflation expectations (lower long-dated yields).

A steep yield curve instead signals accessible borrowing costs (low front-end yields) feeding into expectations for solid growth and inflation down the road (high long-dated yields).

Rapid changes in the shape of the yield curve at different stages of the cycle are a key macro variable to understand and incorporate in your portfolio allocation process.

Hence, in this piece we will:

Quickly walk you through the different yield curve regimes (i.e. bull steepening, bear flattening etc);

Analyze 50+ years of asset classes returns through these different regimes;

Assess where we stand today, and what the labor market is telling us about the macro cycle;

Conclude with our actionable investment strategy.

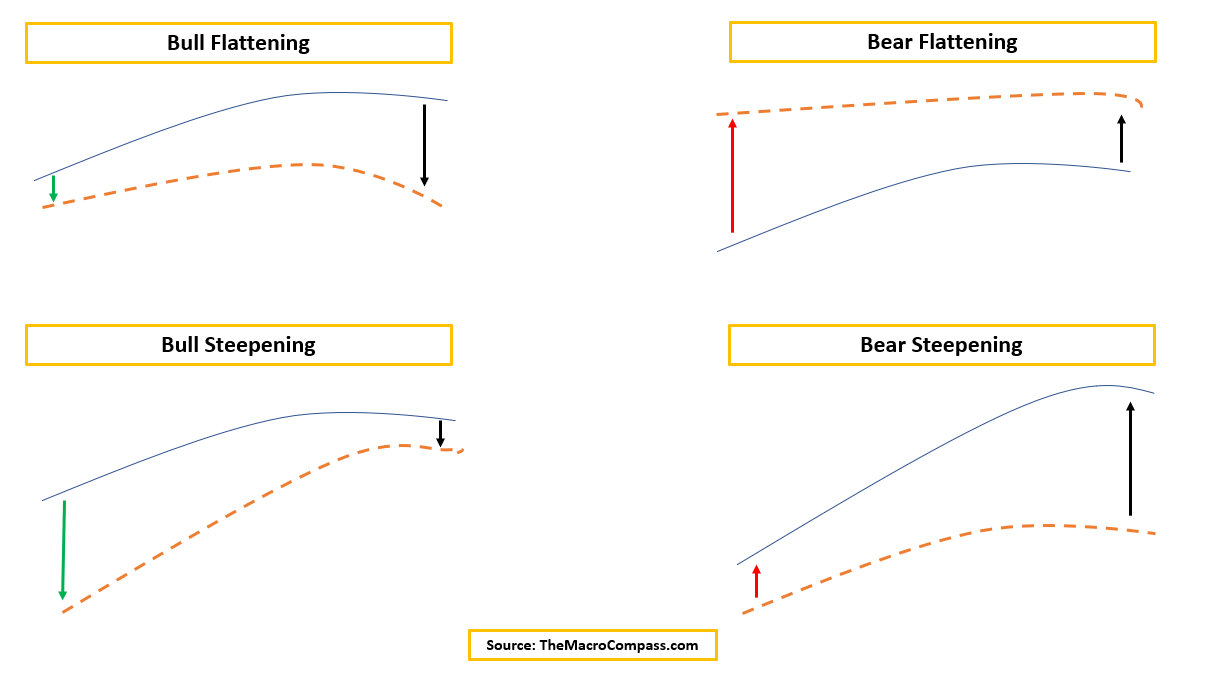

Bull Flattening = lower front-end yields, flatter curves.

Think of 2016: Fed Funds already basically at 0% and weak global growth. Yields stay put at the front-end and could meaningfully move lower only at the long-end, hence bull-flattening the curve.

Bull Steepening = lower front-end yields, steeper curves.

Late 2020, early 2021: the Fed was keeping rates pinned at 0% and stimulating via QE but the economy was flooded with fiscal stimulus and ready for reopening. The friendly borrowing conditions and the massive upcoming growth boost could mostly be reflected through higher long-end yields, while 2-year interest rates were pinned at 0% by the Fed. Bull-steepening of the curve.

Bear Flattening = higher front-end yields, flatter curves.

2022 was the bear flattening year: Powell raised rates aggressively to fight inflation, but he ended up choking the economy off. This was reflected in lower future growth and inflation expectations at the long-end of the curve. Front-end rates went higher, but the curve bear-flattened.

Bear Steepening = higher front-end yields, steeper curves.

Do you remember 2009? The worst of the GFC was behind us and (monetary-mechanics-illiterate) investors were afraid that QE would lead to runaway inflation and the Fed would be forced to start acting on it. Front-end yields moved a bit higher, but long-end yields took most of the hit as investors (mistakenly) bumped the inflation risk premium up = the curve bear-steepened.

Rapid changes in the shape of the yield curve when growth is at turning points are a key variable to consider for a successful asset allocation process.

We looked at 50+ years of cross-asset returns through different growth and yield curve regimes, and here is what we found:

The implications from this table are crucial for your portfolio allocations.

Let’s dig in…

Eager to read the remaining part of this macro report?

Come join The Macro Compass premium platform to get access to Alf’s full-length timely pieces, actionable investment strategy and much more!

Check out which subscription tier suits you the most using the link below.

For more information, here is the website.