Average inflation targeting, or maybe not

TMC #5! Powell will not keep monetary policy easy until the cows come home. It's easy to commit strongly to AIT until inflation actually bites.

*POWELL: WE DON’T DISMISS CHANCE HIGHER PRICES GO ON FOR LONGER

*POWELL: IT WILL BE APPROPRIATE TO CONSIDER ANNOUNCING A PLAN FOR REDUCING OUR ASSET PURCHASES AT A FUTURE MEETING; MAY SAY MORE ON TAPER TIMING AS WE SEE MORE DATA

I did not fall asleep half-way through the Fed meeting yesterday: that’s already something nowadays.

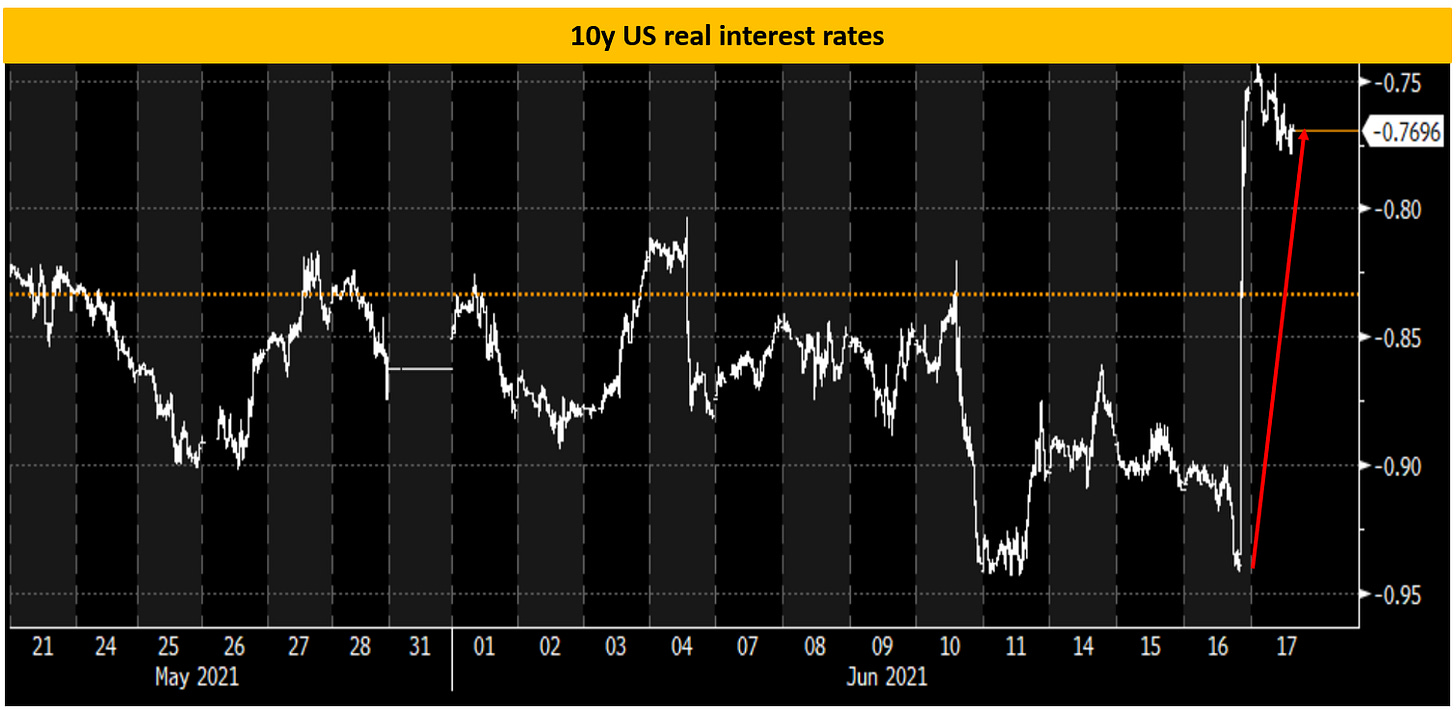

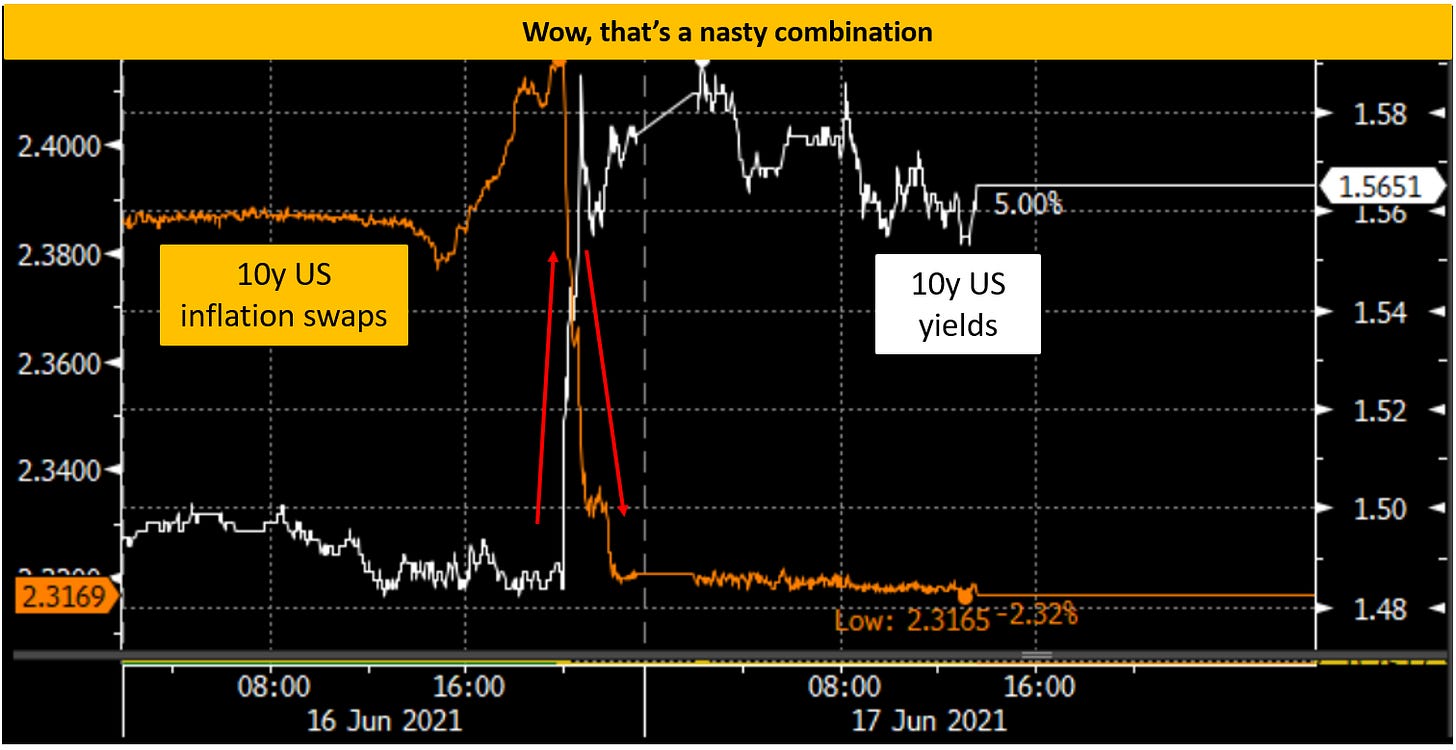

The most relevant market move out of the meeting was the +18 bps move in 10y real interest rate as a result of the trickiest possible combination of inflation expectations dropping 9 bps and nominal yields increasing by 9 bps.

So, why is that relevant? Well, for a number of reasons.

1) The AIT approach is somewhat watered down, and this implies less commitment towards accepting inflation overshoots and hence less pressure on real interest rates to keep trading lower and lower.

2) Any move up in yields from here has to be driven mostly by real rates rather than inflation expectations => the economy needs to be strong enough to handle higher real rates without collapsing under debt burdens and servicing costs.

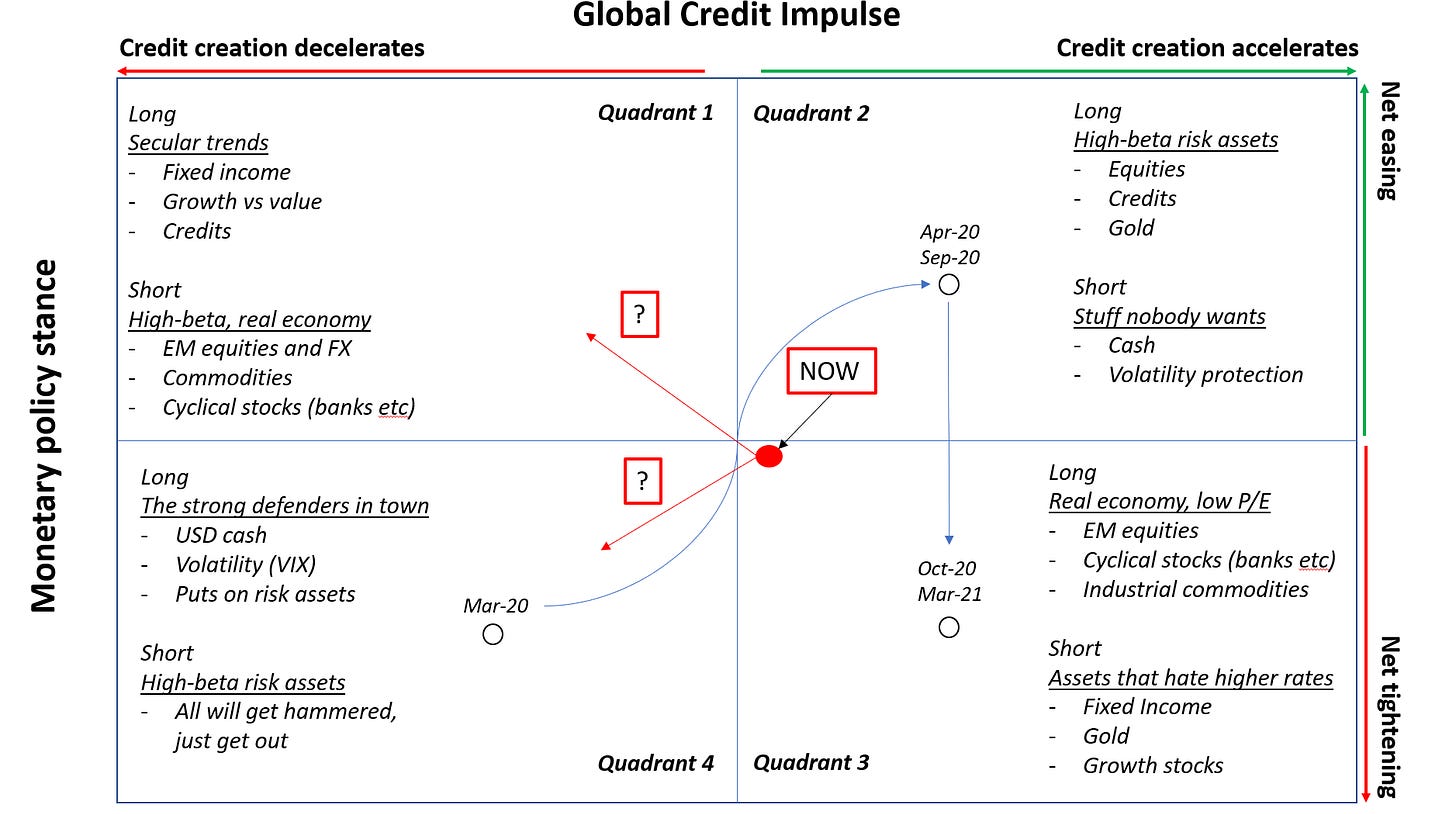

3) We are definitely moving away from Quadrant 3 (long cyclical, commodities etc) into Quadrant 1 or 4. As a result, I took profits on Oil, Brazilian and Russian equities I entered on May 14 (+12% on those trades). I had already taken profit on S&P and Gold as indicated here.

Question: would you be interested if I’d publish my long/short recommendations with entry, stop loss, profit targets and live P&L tracking in a more structured format?

So we can keep track of how much I suck :) and nowhere to hide then!

Reminder: these are personal views and opinions. I am not speaking on behalf of my employer and those trades reflect solely my own personal investment activities. This is not financial advice, always perform your due diligence.

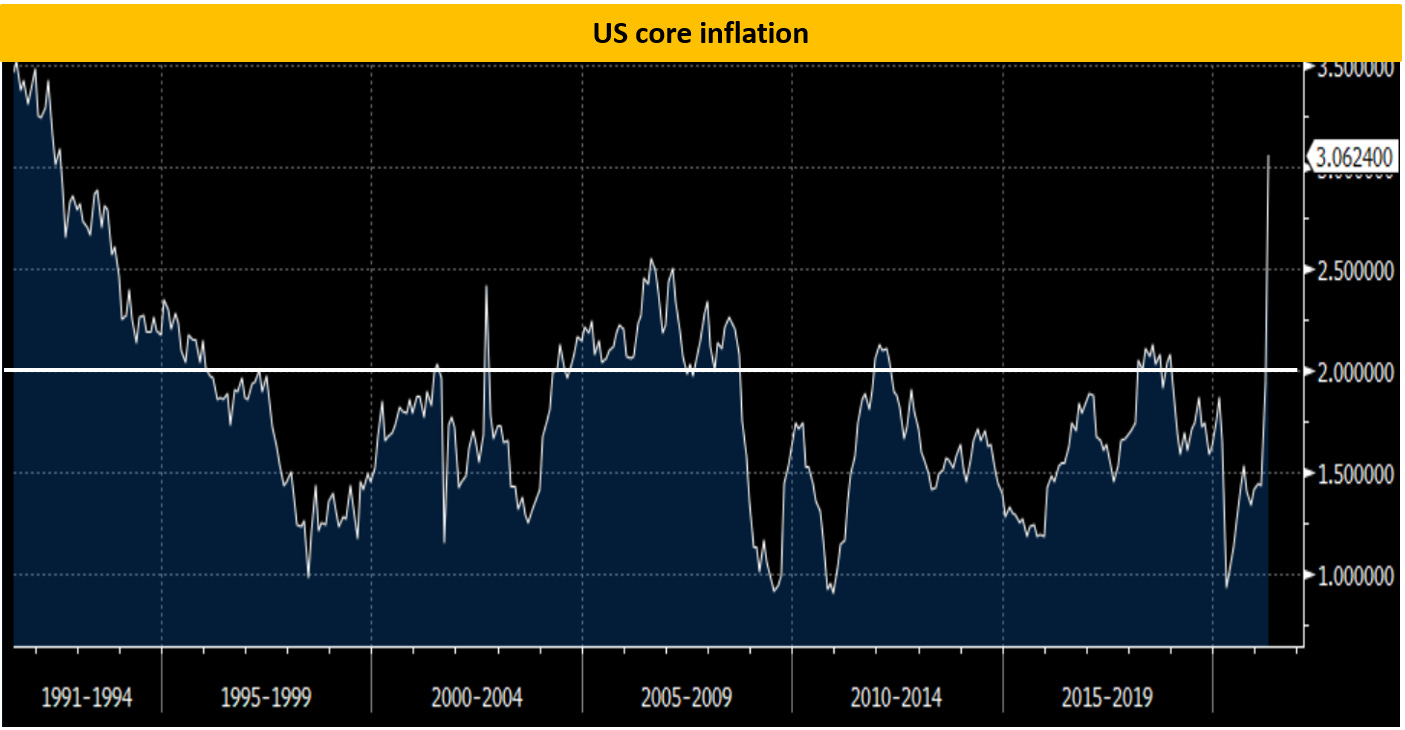

The Fed moved to AIT (average inflation targeting) in 2020 in order to try and make up for inflation undershoots below their 2% target that occurred in the past. They were neither clear about what time horizon they were using to capture the undershooting, nor if there were limits to how much inflation overshoot they would tolerate under this regime. I mean, have a look by yourself at core PCE.

It could mean them not tightening monetary policy for decades, or for few years only depending on the interpretation.

Ok, so we don’t know exactly what it means but we know Powell is a bit less willing to tolerate major inflation overshoots and he can’t dismiss the chance of this happening.

This implies the Fed will be slightly more reactive and less ‘‘AIT committed’’ than market expectations were implying. This leads mechanically to higher real rates, especially at the front-end of the curve.

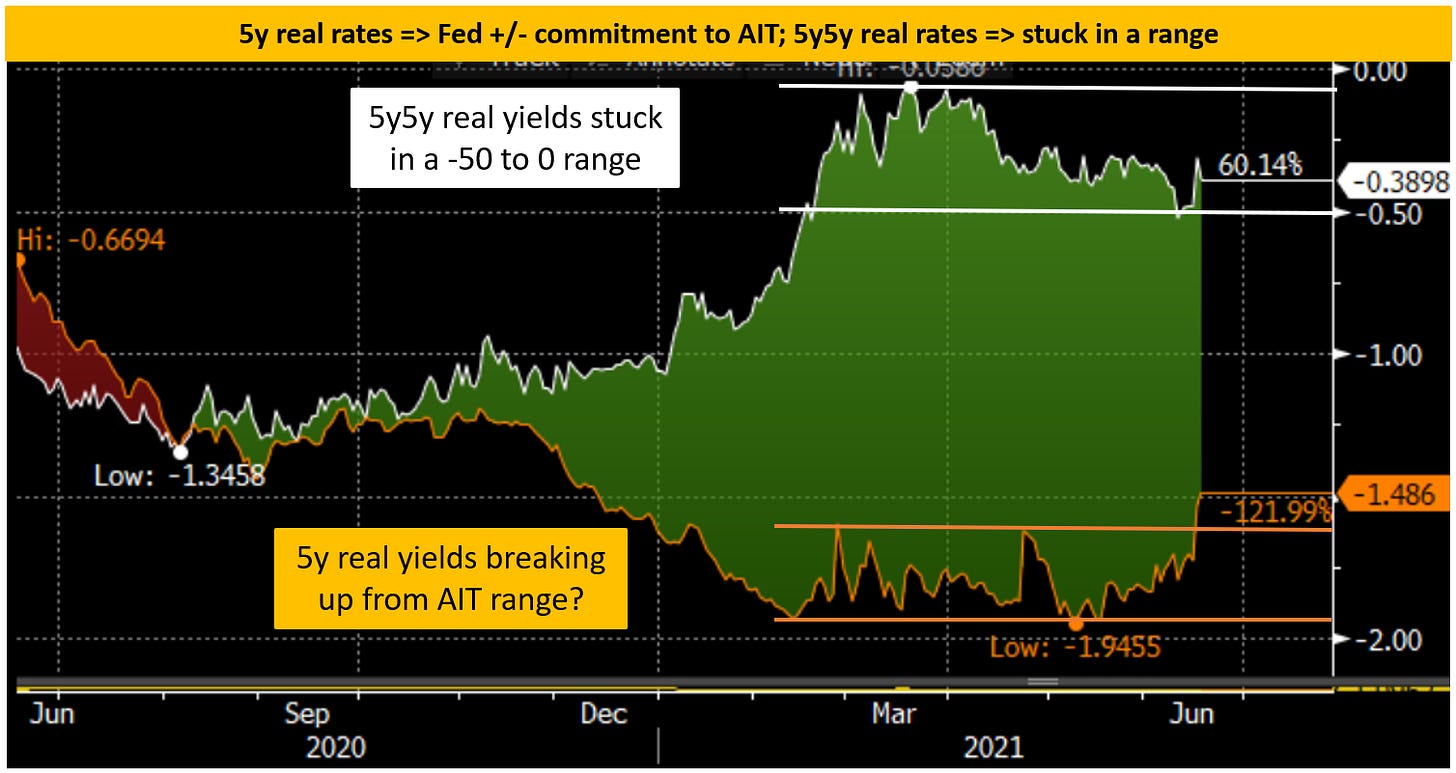

If you break 10y real interest rates down in 5y real rates and 5y forward 5y real rates, you find out some interesting stuff.

As the market interprets the Fed AIT commitment to be less strong, front-end real interest rates tried to break upwards of a 6 months range.

5y5y real interest rate are instead stuck between -50 bps and 0 bps as they are more impacted by long-term economic drivers: as the equilibrium real interest rate r* remains stubbornly low, 5y5y real yields have a hard time crossing the 0% line.

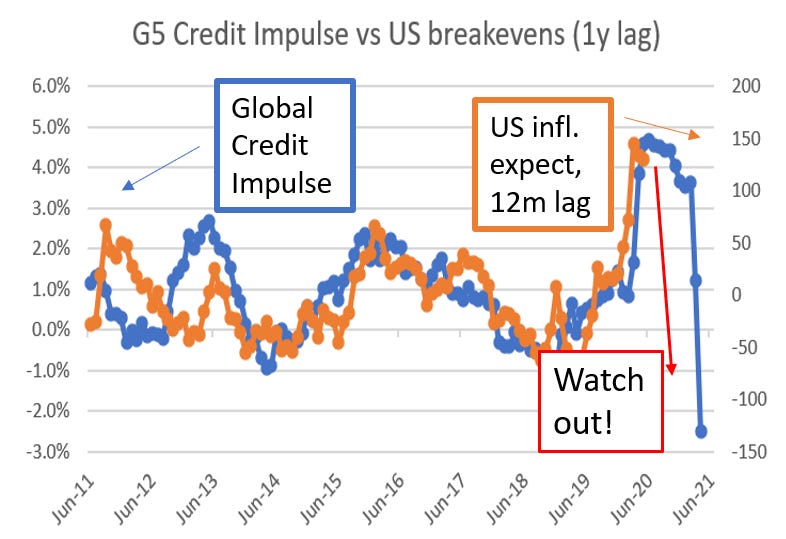

We also discussed how 10y inflation expectations actually dropped 9 bps yesterday. Industrial commodities seem to have peaked perfectly matching the 8 months average lag time with the G5 Global Credit Impulse as shown before.

Now, if yields move up from here, it probably won’t be because of higher long-term inflation expectations but rather because of higher short-term real yields as seen yesterday. This is a tricky setup for risk assets, see below.

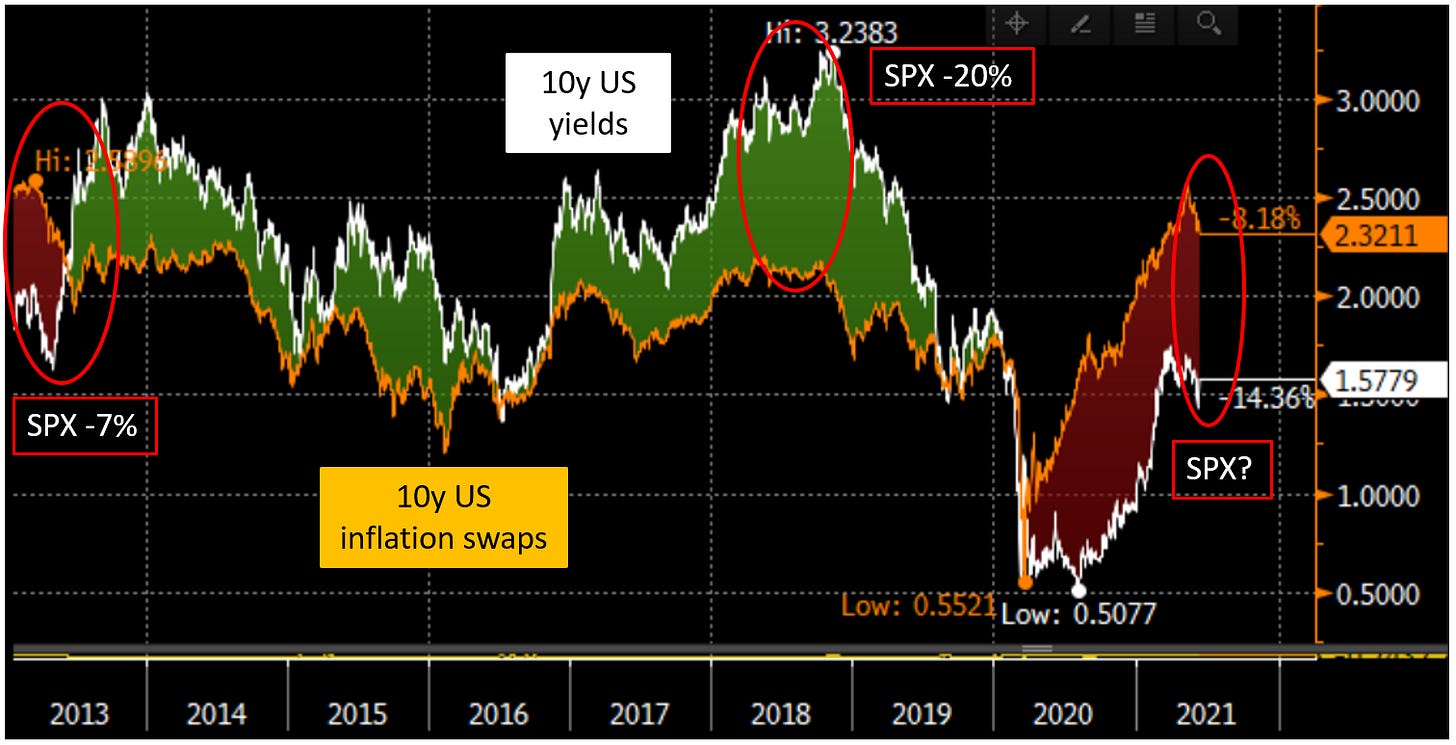

The red circles show 2 previous episodes when 10y US yields (white) moved up while 10y inflation expectations (orange) moved sideways or lower. 2013 taper tantrum with associated 7%+ S&P drawdown and the Q418 ‘‘Fed on autopilot QT’’ that led to a 20% S&P drawdown. Notice both episodes were followed by the Fed being forced to pivot back to a more dovish stance to calm markets down.

Same setup we are observing over the last few weeks.

When real yields go up for the ‘‘wrong reasons’’, i.e. inflation expectations dropping while nominal yields are going up, risk assets generally have a hard time. The S&P500 had two relevant drawdowns in the -10/-20% area in both instances.

To put things in context though, the absolute level of 10y real yields (-0.75%) is still way below my own calculations for r* (+0.2%). From an absolute perspective, we’re still pretty accommodative but the direction of travel matters a lot.

So, where does this leave us on the Macro Compass?

We are now clearly transitioning away from Quadrant 3.

That’s why I took profit on Brazilian + Russian equities and Oil.

Are we heading to Quadrant 1 or 4? Well, heck of a difference.

Tough to say at this stage, as it mostly depends on the pace and magnitude of monetary policy tightening against market expectations.

I can only observe that the global credit impulse has peaked and realized growth after Q4 might well disappoint expectations while authorities embark in some sort of a tightening path. This is not the environment where you want to own high-beta risk assets.

There is a moment to be long, a moment to be short and a moment to go fishing: for me, now it’s definitely time to go fishing. Will sit on my hands for a bit before a decent risk/reward chance happens as this tricky transition from Quadrant 3 to Quadrant 1 or 4 is undergoing.

If you liked this article, you can also follow me on Twitter.

And of course feel free to share it with friends!

Thanks, just started following yesterday. I appreciate your framework and perspective,. I say yes to " publishing long/short recommendations with entry, stop loss, profit targets and live P&L tracking in a more structured format?"

Very useful, I didn't know you had a blog too. I'm in a learning process (I'm a MD...) and the way you put the stuff out is understandable and allows me to think and learn.

Absolutely could be interesting to add some inputs about specific long/short positioning, only thing (if you decide to go for it), keep it relaxed.

I already follow a couple of blogs with same structure (macro outlook + specific inputs about equities etc...) and I've tried some others (all paid for, btw...). The dynamic IMO is that they end up trying to hide their wrong calls (of course they make wrong calls... probably they fear that if they admit a mistake you will be going to stop paying them), at the expense of the reasoning process (learning from mistakes is critically useful).

In a nutshell, keep it relaxed, regardless as to whether you add a paywall in the future.

In any case, great stuff! Thanks for sharing this :)