The S&P500 realized volatility is below 10%.

Credit spreads are super tight, and aside from some short-lived European political drama markets keep marching higher.

Yet, I think macro volatility is coming back.

First of all: we are suppressing economic cycles, injecting an artificial equilibrium which will only make the system more fragile in the long run.

We are not allowed to have a recession anymore.

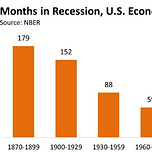

This great chart from Prof. Lee Coppock shows the number of months the US economy spent in recession in 30-year periods starting from the 1870s until today.

The message is pretty clear: our economic system has become much more stable, as we spend less and less time in recessionary conditions.

But why?

I would say there are 3 main reasons:

1️⃣ Geopolitical stability

Not rocket science here, but by having less systemically important wars you are going to have way more financial and economic stability

2️⃣ The shift from a Gold standard to a fully elastic Fiat Money system

The Gold Standard works by pegging the fiat currency to a fixed, hard asset whose supply can't be expanded - gold.

Doing that reduces the odds of rapidly expanding or devaluing fiat money over time.

But the flipside to the Gold Standard is exactly that: by not allowing for a rapid expansion of fiat money creation when needed (i.e. to stabilize the economy during recessions), you will end up with more volatile economic cycles and hence spend more time in recession.

The Gold Standard had benefits but also downsides, and after the 1970s we migrated towards a fully elastic Fiat Money system.

But this meant that...

3️⃣ Policymakers try hard to ''cancel'' the concept of recessions

Being able to expand fiat money creation in a fully elastic way is great, but politicians can abuse this system.

This leads to where we are today: policymakers are trying hard to erase the concept of a recession altogether.

But in a capitalistic system, that doesn't work!

The side-effect of suppressing natural economic cycles is that productivity levels will decline rapidly (think of zombie companies), and most importantly as Minsky once said: (Artificial) Stability is Destabilizing.

Recessions should be part of a standard economic cycle, where the system is allowed to ''cleanse'' and re-start stronger than ever.

Yet, also this time policymakers have chosen to artificially stabilize the economy.

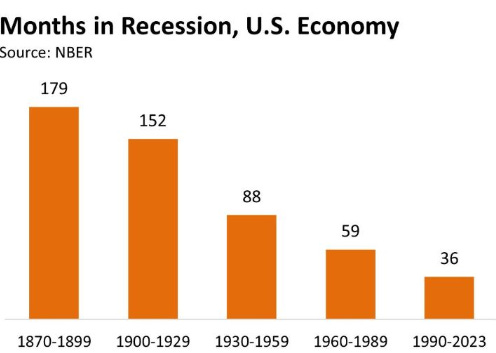

This chart explains why the Fed hiked rates above 5%, and yet the US economy doesn't break.

The last time Fed Funds were raised aggressively towards 5% and kept there with a long, hawkish pause was in 2006-2007.

And clearly something broke then: the US housing market, which broke havoc in the banking industry too and generated the biggest financial crisis in the post WWII era.

But there is a key difference between now and then.

The big money expansion in 2005-2007 was Credit-Driven.

Today, it’s Fiscal-Driven.

Economies grow above-potential if new money is getting created in large size: this can be done via the government with generous pro-cyclical fiscal stimulus (today) or via private sector credit (bank lending, etc).

And if brought to the extreme, these two sources of money creation lead to different imbalances over time.

In 2005-2007, money creation was all about private sector borrowing (blue): the US private sector leveraged up a lot to chase the housing bubble via the subprime mortgage and credit market engines.

Back then, the government wasn’t a large contributor to money creation.

In late 2007, the housing market cracked under the pressure of excessive private sector leverage.

When private sector credit as a % of GDP rises uncontrollably you often get a Credit Event – or basically: ‘’something breaks’’.

The Japanese and Spanish real estate bubble, the Asian Tigers fever, the US housing bubble, or China today.

Ok, sure - but today the story is different.

Private sector credit isn’t the source of excessive money creation and instability - the US private sector has actually de-leveraged since 2008!

Instead, it's all about government deficits!

Today, the story is different: the scale of government deficits (orange) in 2020-2021 was enormous, and that was by far the main driver of money creation which is still circulating in the economy.

We also got another fiscal shot in 2023, while private sector credit (blue) has been moderating for 2 years now.

This means the risk this time isn't necessarily that ''something breaks'', especially in the US. The risk is that the US government keeps throwing fuel on the fire, and it might end up re-accelerating inflation and make the macro cycles more volatile.

Which brings me to the real source of upcoming macro volatility: US elections.

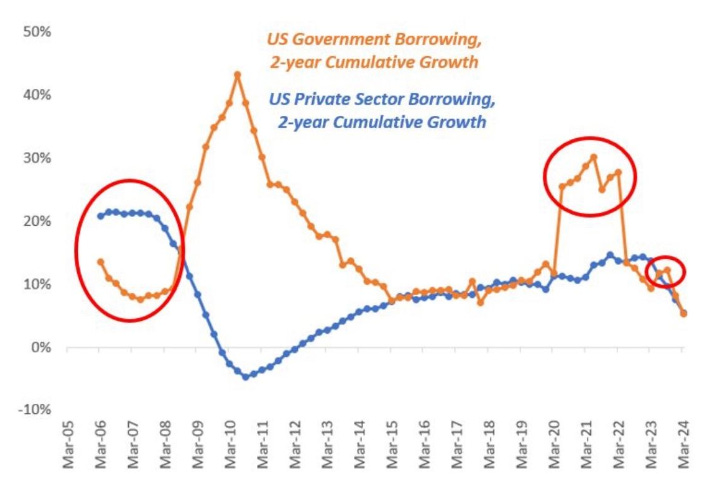

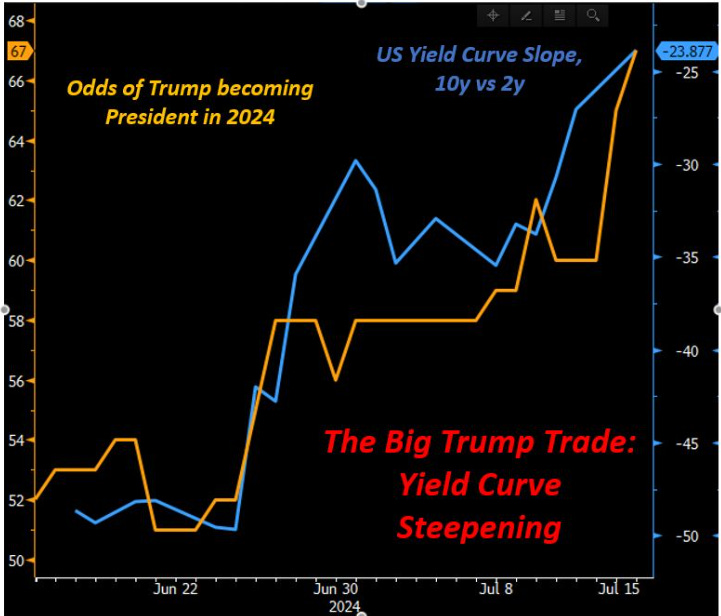

Since the Presidential debate, the Bond Market has been sending an interesting signal.

As the debate ended, Biden's underperformance led to a sharpe increase in the odds that Trump might be the next President.

These odds have now further increased after the terrible events of the weekend.

The bond market didn't take long to respond.

The yield curve has been steepening pretty strongly since the debate, and the steepening pressure could continue.

The chart above shows the market-implied path ahead for Fed Funds (today in blue, two weeks ago in orange). The panel below shows the difference in yields per each point in the curve.

The steepening is very evident.

But why is it happening?

So far, we know that Trump's economic agenda involves:

1️⃣ A tough stance on immigration

That's inflationary.

One of the reasons why the disinflationary path has been so friendly so far while the labor market holds in the US is because there is a been a large addition in labor supply - mostly due to net immigration in the US.

Hampering that would flow of labor supply would reduce growth while at the same time increase inflationary and wage pressures.

2️⃣ Heavy tariffs on China

That's inflationary.

Import prices would rise aggressively, and volume of imports/exports around the world might suffer as a result of increased protectionism.

3️⃣ Pressure on the Fed to cut rates

Despite the US economy holding fine and his inflationary policies, Trump wants the Fed to cut rates.

The risk is that the economy would overheat, potentially generating further inflationary pressures.

As Trump's odds of winning the race increase, so do the risks of inflationary (or stagflationary) policies while the Fed is pressured to cut rates.

This leads bond market investors to inject term premium: as the uncertainty around future bouts of inflation increases, the curve has to steepen to guarantee a wider buffer (term premium) for bond investors to get involved.

And if volatility comes back in bond markets, you better watch out.

We are watching the proverbial calm before the storm.

Before leaving, a word of support for two friends writing interesting pieces - I know you are always on the lookout for good (free) newsletters, so here they are:

Semafor

With Semafor’s business and finance newsletter, you’ll get exclusive insight on the movers and shakers on Wall Street from Liz Hoffman, who’s covered those movers – and the gargantuan sums they move – for decades. She’s one of the best sourced reporters in the biz, and over 50k senior executives already swear by her dispatches. Sign up for exclusive Wall Street scoops right here.

Alts

My friends at Alts study exotic alternative investment markets and show you what’s interesting: anything from artwork, to farmland, to precious wine and whisky.

In a world where bonds and stocks could be often highly correlated, alternative investments are an interesting asset class to monitor.

Sign up for their free newsletter right here.

And this was it for today!

Feel free to share the article around with friends and colleagues.

And today, remember to tell someone you appreciate them.

Macro Volatility Is Coming