Hey everybody! Before we start, a quick announcement.

I just launched The Macro Compass YouTube channel!

Every week I will release a 10-minute video that breaks down the most important macroeconomic and market developments - no jargon, in plain English and with the use of plenty of charts!

It’s of course free, so what’s your excuse for not subscribing? :)

This is the link to the channel.

The FX market is one of the biggest and most liquid in the world.

Fluctuations in currency valuations also greatly affect investors’ portfolios: for instance, a US investor buying Japanese equities will be inherently exposed to the Japanese Yen too.

So, how to make sense of FX moves and valuations?

Let’s get into this edition of the TMC Macro Education series where we are going to cover the most important fundamentals and drivers of currency valuations.

Now, picture we are walking into an energy crisis with a tight Fed policy and a roaring USD like in 2022 and you want to rank global currencies (using the USD as denominator).

The table above did just that based on current account, fiscal balance, net international investment position (NIIP), an index that measures debt vulnerabilities, net foreign exchange reserves and a measure of policymakers’ credibility.

Let’s see why these indicators matter for the value of currencies.

The current account balance measures whether the value of goods and services exported by a country exceeds (surplus) or is lower (deficit) than the value of its imports.

Due to higher energy prices, dysfunctional supply chains and a de-globalization push currencies that heavily relied on cheap imported energy and strong exports suffered the most: EUR, GBP, JPY for instance.

Countries with a stable current account surplus (e.g. Switzerland) export more than they import, and that means they accumulate more FX reserves they can use to stabilize their own currency.

A good indicator to keep track of these developments is Terms of Trade (TOT), which is the ratio between the price of exports and the price of imports (higher = better for the currency).

You can find current account balance and terms of trade data here and here.

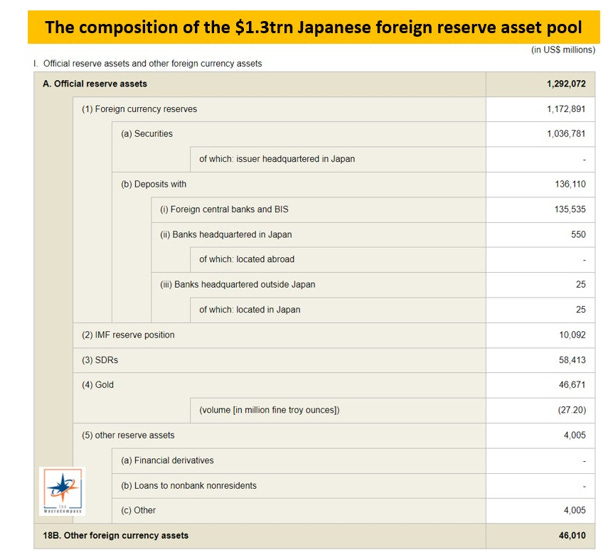

Net foreign exchange reserves represent the country’s war chest to stabilize their domestic currency against sharp devaluations – the larger the war chest, the easier to stop the bleeding.

When the Japanese Yen was under pressure and trying to breach 150 versus the US Dollar, it was aggressive sales of USD from the Japanese net FX reserves war chest that discouraged sellers to proceed further.

If Japan exports more than it imports, the country accumulates FX reserves which it invests in safe and liquid securities like US Treasuries – so far, so good.

When running this analysis, watch out for the ‘’net’’ though: Japan can also borrow (!) US Dollars through the FX derivatives or the repo market and these borrowed USD offset the available FX reserves.

In general, the bigger the net FX reserves war chest the more positive for the domestic currency.

The best way to tally up foreign exchange reserves is by comparing them to months’ worth of imports: back in September when speculators were attacking the JPY, Japan could cover 1.5 years (!) worth of imports by selling its net FX reserves down.

Data on FX reserves can be found here. For the net numbers, you have to dig into each Central Bank website.

So far we talked about goods and services, imports and exports.

But our world is highly financialized, and so the flow of financial assets and liabilities matters a lot: that’s what the Net International Investment Position (NIIP) tracks.

Can you find the outlier? :-)

Be careful extrapolating too much from this metric alone: as the provider of the reserve currency of the world, the US will always have foreign countries investing in US assets (Treasuries, US equities etc) to a larger extent than US investors export capital abroad.

As ~70% of global trades are denominated in USD, these hard-earned Dollars are then recycled back into US asset markets contributing to a negative NIIP.

Nevertheless, it’s important to remember that countries with a negative NIIP are net financial debtors towards the rest of the world and hence their domestic currencies are more vulnerable to financial shocks.

You can find NIIP data here.

What about domestic fiscal policy and external debt?

When it comes to currency fundamentals, a key concept to understand is that despite getting a lot of mediatic attention government debt denominated in domestic currency is much less of an issue than private debt or foreign currency denominated debt.

It’s much easier for a sovereign country to service a big amount of its own government debt denominated in local currency (Japan has been doing that for decades) than servicing foreign-currency denominated debt (China can’t print US Dollars) or for households to handle mortgage debt during a housing crisis.

Therefore, look for external debt vulnerabilities and trends in private sector debt: guess where the most indebted households are?

You can find data on external debt and private sector debt here.

Policymakers’ credibility is another important driver of FX valuations.

If politicians and Central Bankers do not set credible policy objectives and show commitment to reach them, investors are going to be reluctant to invest in their countries.

This is why the Fed isn’t going to change the inflation target from 2% to 3% anytime soon.

Before actually achieving 2% inflation and retaining credibility, that’s not an option.

Credibility is the biggest asset of a policymaker, so best to invest in FX whose policymakers are highly credible.

The reason why I didn’t mention interest rate differentials so far is that they tend to matter more for short-term FX moves than as a structural fundamental of currency valuations.

But yes: rapid changes in rate differentials can have a relevant impact on short-term FX fluctuations.

This was it for today’s TMC Macro Education Series!

And remember the best trade out there: stay long macro education.

If you enjoyed this piece, I have to warn you are missing out on a lot more! :)

Come join The Macro Compass premium platform and get access to all of my timely pieces, actionable investment strategy and much more!

Check which subscription tier suits you the most using this link or the button below:

For more information, here is the website.

Share this post