‘‘The only true wisdom is in knowing that you know nothing.’’

Socrates, Greek philosopher

Hi all, and welcome back on The Macro Compass!

Global macro and markets are a gigantic puzzle that will always fascinate investors and lure most to believe that in the end we can put all the pieces in the right place and find the Holy Grail of Investing.

The reality is different: we will always miss some pieces, and we will often be wrong.

The common trait of the best investors and hedge fund managers I can call friends is not having a macro crystal ball, but embracing and living by this simple principle: maximizing the odds (and not the ephemeral feeling of infallibility) of achieving good returns while taking predictable amounts of risk.

This is generally achieved via a combination of solid macro skills and by mastering the art of portfolio/trade construction.

In this article, we will:

Discuss the foundations of how to maximize your odds of success in both strategic asset allocation and tactical trade construction;

Look at how some trades sitting in my long-term and tactical portfolios try to reflect these principles given the current macro and market backdrop.

How To Maximize The Odds

As we know we will be wrong plenty of times: so how do we structure portfolios to be able to manage risks around these inevitable bumps?

There are at least 3 things we need to care about during portfolio/trade construction to maximize our odds of success in this highly unpredictable game called investing.

1. Build unbiased & data-driven macro models (and don’t blindly trust them…)

Let’s start by postulating that global macro and markets are not a 0-1 binary environment but rather resemble a probabilistic setup with multiple potential outcomes whose odds of materializing vary across time.

Every investor has its own subjective probabilistic macro setup that must be weighted against market consensus.

My approach to generate one is to craft unbiased, data-driven macro models…and after all the hard work, to not blindly rely on them for investment decisions.

For instance, The Macro Compass models use forward-looking macro indicators (e.g. G5 Credit Impulse, and many more) and a prop gauge of the monetary policy stance against neutral (e.g. real rates vs r*, liquidity proxies and others) to grasp the subjective base case macro environment we currently sit in.

This is how it looks like today.

My model-driven assessment is that the current base case macro environment is a Quadrant 4 setup: economic growth is poised to decelerate further while Central Banks are likely to keep monetary policy and liquidity tighter than equilibrium levels.

This has historically been a very poor setup for risk-adjusted real returns across asset classes.

And yet, I am overweight long-end bonds in my structural long-term portfolio and I am not indiscriminately max short everything in my tactical book: why?

Because to maximize our odds we can’t build portfolios solely relying on our own subjective assessment - we need to consider at least 2 more things.

2. Find your opponent’s (i.e. the market’s) weak spots

Many investors forget this is a relative, not an absolute exercise.

Your aim should be to find the best risk/reward setups in the relative discrepancies in cross-asset valuations between what your assessment suggests and what markets are discounting.

For instance: if your subjective assessment suggests there is a high probability the Fed will have to cut rates to 0% and the market is already discounting the very same probabilistic setup, you wouldn’t be maximizing your odds by adding that trade to your book.

For a strategic, long-term investor this relative assessment can be performed by looking at valuations and probability distributions.

On June 23rd, I bought 10y+ European and US Treasury bonds (see here) for my structural portfolio even though The Macro Compass model would not suggest the best possible setup for this investment yet: why?

Because as the chart above shows, markets were pricing the ECB to remain in restrictive territory (above my estimate of neutral rate) for more than a decade to come although the economy is already weakening very hard: even accounting for an error band in my estimate of EUR neutral rate, this very large discrepancy was hard to ignore.

Another way to think about this is to look at probability distributions: if you are able to identify an overly distorted one and anticipate how/when markets are going to normalize it, you have an edge.

The picture above shows the premium and payoff of a CADJPY 1-year digital option.

Don’t worry, it’s really simple - bear with me.

The option requires you to pay CAD 80k upfront to get a final payoff worth CAD 1 million if CADJPY drops 20% or more and hence trades at or below 80.526 (spot = 104.77) in 1 year from now or otherwise you’ll lose your premium.

The strike has been chosen to be 20% out of the money as this roughly compares with a 2 standard deviation move in one year - a theoretical 5% probability.

Given that you pay CAD 80k upfront and your final potential payoff is worth CAD 1 million, this means markets are pricing in a 8% probability instead.

Using digital options, you can derive market-implied probability distributions for almost any asset class you want and constantly compare it with your own subjective assessment: cool, right?

P.S. We are working to develop a tool that will interactively allow you to do just that!

Now the question is: what’s your subjective probability?

Mine is in the 20% area - hence I shorted CADJPY (and AUDJPY for similar reasons).

And here is why.

The Canadian private sector is more indebted than the Japanese one at the peak of the real estate bubble in the ‘90s - when the Imperial Palace was ‘‘worth’’ more than the State of California.

At the same time, the Bank of Canada is forced to tighten monetary policy way above neutral levels to tame inflation and hence it will compound the pain for a highly leveraged economy - there are already signs of a slowdown in the housing market.

On the other hand, as global economies slow down and yield differentials decline I expect money to flow marginally towards safe-haven and stable currencies like JPY.

While I don’t know whether CADJPY will trade 20% lower in one year, I expect markets to adjust their probability distribution my way going forward.

3. Remember: correlations aren’t stable and internals matter

The true Holy Grail of Investing is return-additive, yet poorly correlated assets to add to your portfolio - but there is one problem: correlations aren’t always stable.

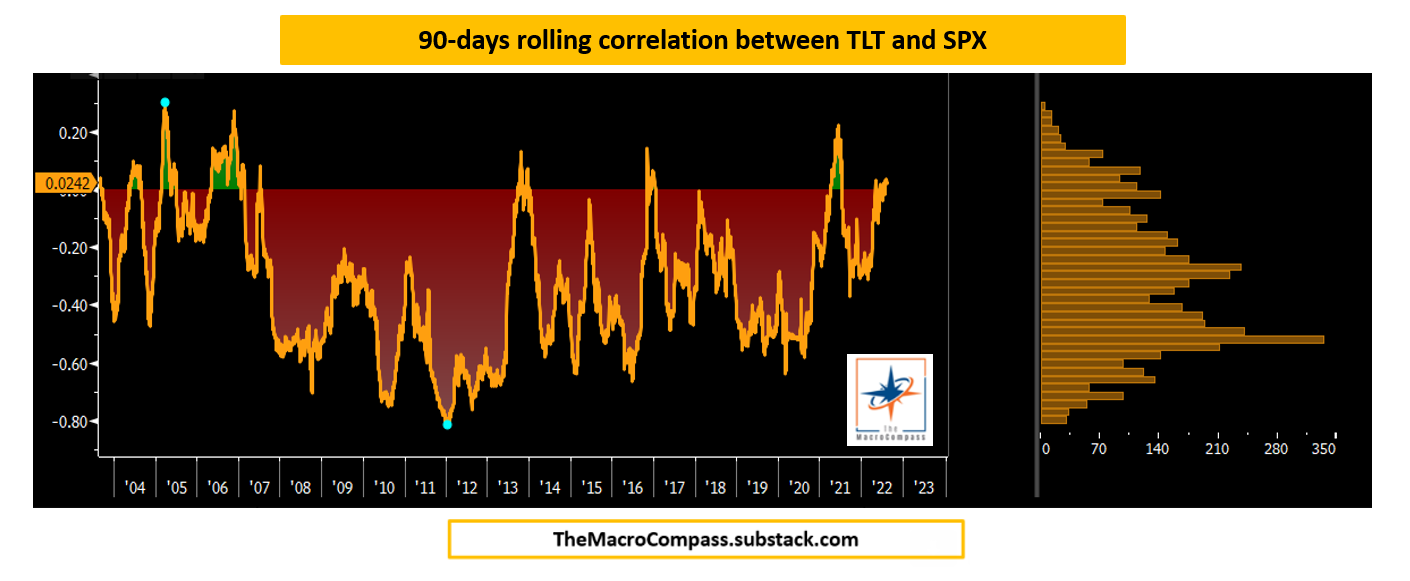

The chart above proves the point: the 90-days rolling correlation of SPX and TLT returns over the last 20 years was mostly negative, with the most observed correlation being a healthy -0.52.

Nevertheless, this correlation can quickly become unstable: recently it has turned positive in two instances already as Central Banks won’t be able to ease policy during market drawdowns because of high and persistent inflation.

Studying how cross-asset correlations behave during different market regimes is very important to limit drawdowns - and also here, we are working on interactive tools for you to be able to do just that!

Finally, if you are running a more tactical portfolio you have a keen interest in comparing the recent volatility-adjusted moves across asset class against their theoretical expected behavior in the macro regime you have identified.

Last month, the sectors of the stock market which delivered solid volatility-adjusted returns were US Industrials and Retail stocks and certain EM countries like Turkey.

Against that, the laggards were Staples and Healthcare.

Does this fit in your macro picture?

If not, why? And is there a good risk/reward tactical opportunity?

Observing the recent vol-adjusted behavior of stock market internals and asset classes in general can be a very helpful tool for portfolio/trade construction.

Conclusions

Mastering the Art of Macro Portfolio Construction requires you to live by the principle for which the true wisdom is knowing that you don’t know - global macro investing is a giant puzzle filled with uncertainty.

To maximize the odds of success, there are at least three things you can do:

Build unbiased & data-driven macro models (and don’t blindly trust them…)

Find your opponent’s (the market’s) weak spots

Remember that correlations aren’t stable and internals/cross-asset moves matter

Embracing our data-driven models and trying to reflect the principles above, this is how our Long-Term ETF Portfolio remains positioned today:

A good chunk of (USD) Cash

Low exposure to risk-assets (preference for high-quality growth names and non-cyclical, low-beta industries: good tech, utilities, healthcare)

Higher than usual exposure to 10y+ Government Bonds

And this is how Tactical Portfolio is positioned (updates posted here and here: as always, maximum transparency).

And this was all for today, thanks for reading!

If you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

See you soon here for another article of The Macro Compass, a community of more than 86,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post