‘‘Trust I seek and I find in you (global macro)

Every day for us something new (right, J-Pow?)

Open mind for a different view (always)

And nothing else (except macro) matters’’

Metallica after reading The Macro Compass

Ehy guys, welcome back on The Macro Compass!

Hopefully the Metallica are fine with me borrowing one of their most famous songs, but it’s really true: nothing else except macro matters here!

There were 3 important pieces of economic data released over the last week: a leading (NFIB survey), a coincident (Jobs Report) and a lagging indicator (CPI).

The picture couldn’t be any clearer:

Inflation (lagging indicator) showing the most acceleration on the upside;

The labor market (coincident/slightly lagging) holding on okay-sh for now;

The NFIB survey (leading indicator) flashing red.

In this article, we will quickly cover those 3 reports and then analyze investment opportunities by breaking down each big macro asset class and answering the same question for each of them: is it time to go long, to go short or to go fishing?

The Lagging, The Coincident, The Leading

Actually, before we jump right in.

I’d like to take a second and thank you all.

The Macro Compass is now a community of 70,000+ macro enthusiasts and investors, and sharing this journey with you nice people has been such a blessing.

I am working on delivering even more for you: interactive tools for screening markets and sizing positions, ETF-only portfolios backed by my macro models and courses that will cover global macro, monetary mechanics and portfolio management - effectively, a Global Macro University.

Expect plenty of fireworks in Q4!

In the meantime: if you like TMC and you’re excited about what’s next…feel free to tell a friend or colleague!

Now, back to it: let’s quickly look at the latest piece of US economic data.

1. The CPI report: once again, the inflation momentum is accelerating and inflationary pressures are broadening.

While mainstream headlines would focus on the 9.1% YoY print, I’d like to highlight two more relevant statistics that would worry the Fed further here.

A) MoM headline and core inflation are the highest in 20+ years: the inflation momentum is not only failing to decelerate, but it’s even picking up!

B) Inflationary pressures are really broad now: roughly 75% of the components of the CPI basket have seen prices increase by more than 4% over the last 12 months. It’s not only used cars or energy prices anymore: it’s everywhere.

The Fed will be very uncomfortable with both developments, and we can’t discard a 100 bps hike in a few weeks now.

But they’ll be adding fuel to the recession fire by setting their monetary policy stance based on CPI which is a lagging indicator: over the last 50 years, every sharp economic slowdown has always managed to substantially reduce inflation and commodity prices are already dropping like a stone.

But the Fed won’t take a more nuanced stance anytime soon, and who are we to fight the Fed…

2. The labor market report: holding on okay, but…

A) After accounting for negative revisions to prior NFP reports, the pace of job creation over the last 3 months is much less impressive than it would seem by reading headlines;

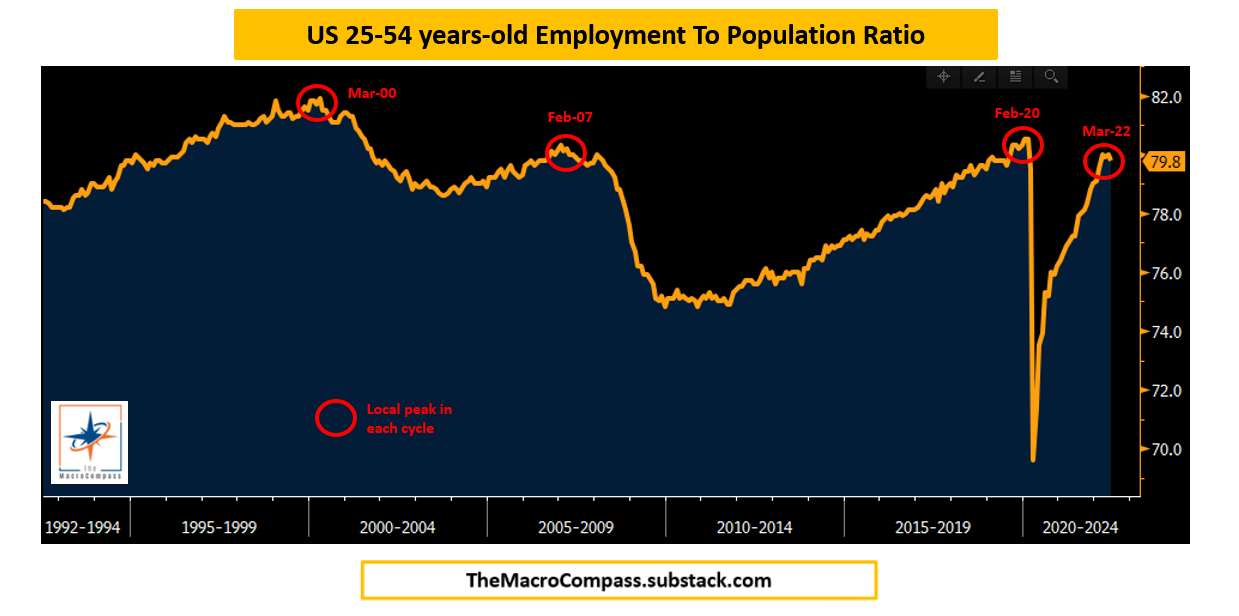

B) The labor force shrank (!) by 350,000+ people: the number of total employed people in the US divided by its total population in the 25-54y age bracket dropped below 80%.

Over the last 30 years, at the peak of each economic cycle this ratio was over 80%.

Once we got there and some weakness started to emerge (Mar 2000, Feb 2007 and Feb 2020) the next 12-18 months weren’t particularly pretty for the global economy.

This time around we failed to even get there and we might be receiving some preliminary signals of unease in the labor market.

Also, Google announced they are going to materially slow down hiring over the next 6 months - kind of a polite way to progress towards a hiring freeze?

The labor market is a coincident/slightly lagging indicator, and hence it would make sense to see some material weakness emerge over the next few months already.

3. The National Federation of Independent Businesses (NFIB) survey: bad, really bad.

The NFIB survey is a comprehensive set of questions addressed to roughly 800 US small companies across the country.

A) Small companies hold their worst future outlook on the expected volume of sales since 2009: in a high-inflation environment, it’s good to look at volumes and real numbers to avoid distorting the picture with nominal figures.

B) The diffusion index built with answers to a question addressing the outlook companies have for general business conditions ahead looks like this:

The NFIB survey is a very decent leading indicator for both economic activity and employment with a lead time of a few quarters.

Ain’t looking pretty…

But now: what does this mean for each of the big macro asset class out there?

An Overview of Macro Asset Classes

Four big macro asset classes, and for each:

Three main points

One chart to rule them all

A Long/Short/Fishing call with investable ideas through ETFs and futures.

Ready?

Bonds (Long 10y+)

- ETF: US = TLT; Europe = MTH

- Tactical/Pro: US 2s10s flattener, Schatz/BOBL flattener

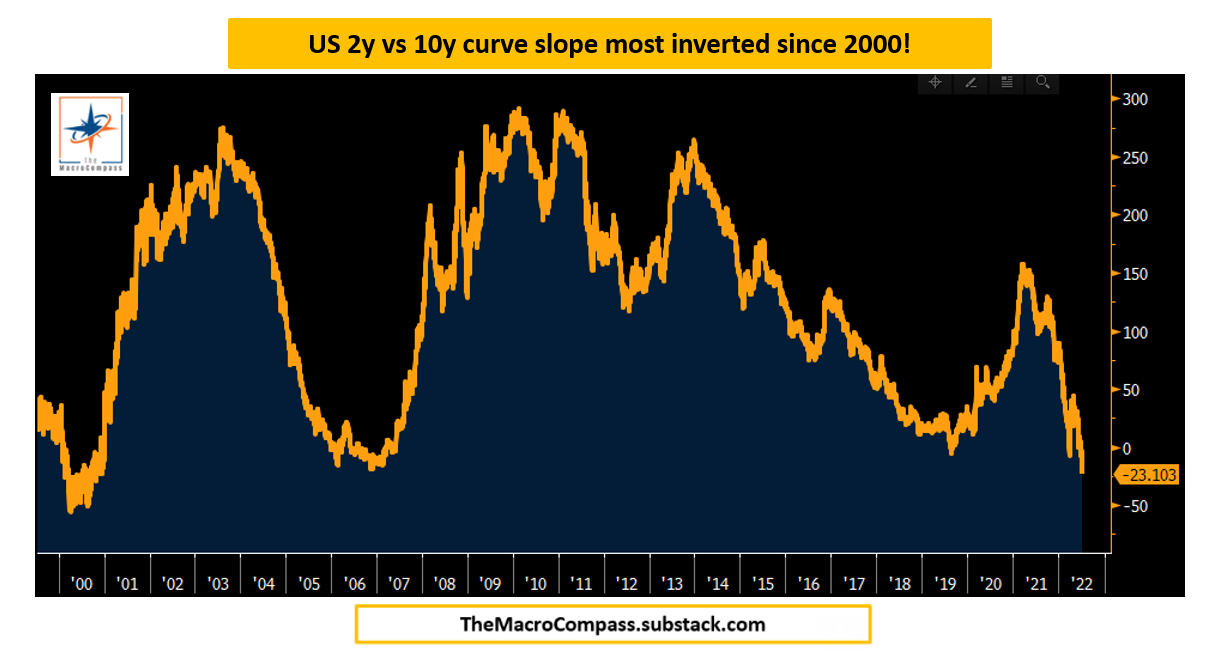

Long-end bond yields reflect expectations for future growth, inflation and a term premium to compensate owners for the interest rate risk they’re running.

As it focuses on a lagging indicator (inflation), the Fed will be keeping a very tight stance and extend the duration and magnitude of the economic slowdown.

This will compound expectations that future growth and inflation will remain low for a while, and increase the probability that such an outcome realizes.While short-term bond yields will be pinned close to where the Fed ‘‘commands’’ with their forward guidance, long-end bond yields will reflect what mentioned above (= yield curves to invert further).

Yesterday’s rally in TLT after a 9.1% CPI tells you everything you need to know.

Equities (Short)

- ETF: US = RWM, EU = BSX

- Tactical/Pro: Short 2x Russell 2000, Long 1x Nasdaq

Total returns in equities are mostly explained by changes in valuations and in earnings. As monetary policy became tighter and tighter while the economy started rolling over, valuations have taken quite a hit.

Earnings instead are nowhere near pricing the economic slowdown predicted by my forward-looking models: way too much optimism still out there.

Hence, I remain short cyclical indexes (Russell, EuroStoxx) that are highly dependent on strong earnings while also implementing a relative value trade (long Nasdaq, short Russell) to capture some relative tailwinds tech stocks might get from lower long-end real yields.

Commodities (leaning Short, but mostly Time to Go Fishing)

Gold is finally experiencing a sustained drawdown as its negative correlation with moves higher in real yields would have implied; tough call from here as front-end real yields are likely going up, but long-end not really so?

Time to go fishing.Supply-impaired commodities (Crude Oil, NatGas, some Agriculturals) have also been hit hard by the demand slowdown narrative being priced in, but geopolitical developments will be responsible for the bulk of the moves going forward - not much visibility there.

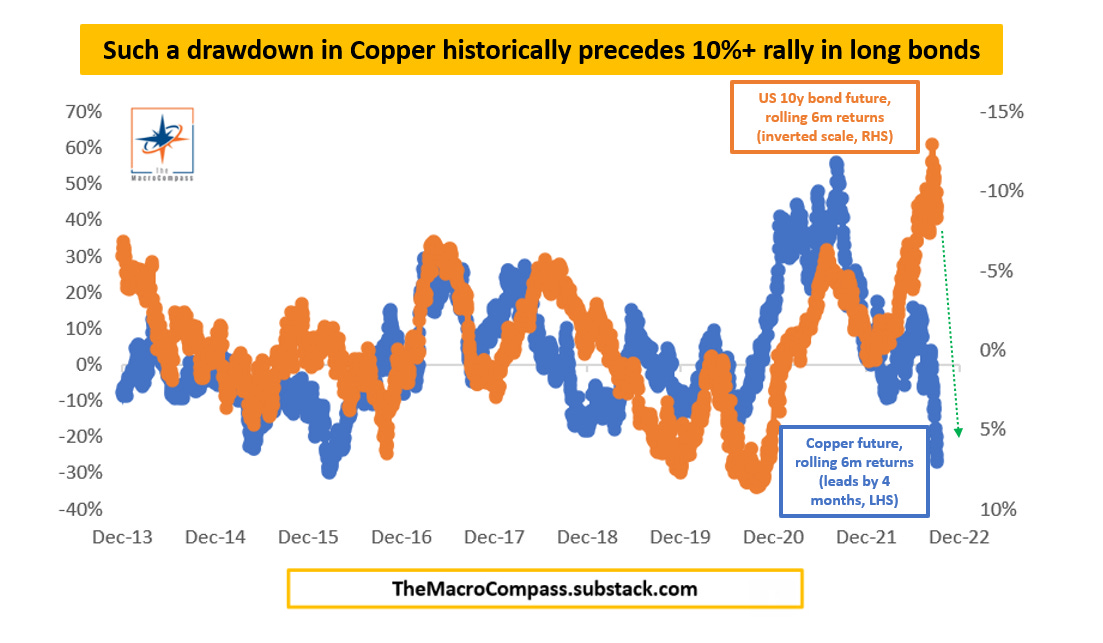

Time to go fishing.Industrial commodities (Base Metals, Copper) are the cleanest expression of global demand destruction as their short-term supply chain is more functional and geopolitics plays a smaller role.

One could consider shorting them but it’s basically another derivative of a long bond trade with the presence of other undesired risk factors.

The 27% drawdown in Copper observed over the last 6 months (blue) generally precedes total returns over +10% for long bonds in the following quarters.

Just buy those?

FX (Keep Leaning Long USD & Short Commodity Exporters: BRL, AUD, COP)

Energy importers have been highly penalized so far even if their Central Bank has attempted to tighten policy in order to support their currency (EUR); a typical Emerging Market external shock situation where Terms of Trades worsen materially and policymakers can’t do much about it.

Once again, geopolitics at the forefront: time to go fishing there.Commodity exporters with positive carry (BRL, COP) have had a brilliant H1 but what happens when commodity prices drop while global trades slow down too? Your currency weakens, especially if you have to service your liabilities in strong currencies which brings me to…

The US Dollar wrecking ball: when there are >12 trillion of USD denominated liabilities issued by foreign entities without direct access to USD liquidity if not from trades and activity, guess what happens when the party stops…

And this was all for today, thanks for reading!

Stay tuned for more articles with deep dives on each single asset class, portfolio and risk management techniques for both structural ETF-only and tactical portfolios and educational pieces on the functioning of our monetary system and the bond market!

Last but not least: if you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

May I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

See you soon here for another article of The Macro Compass, a community of more than 70,000+ worldwide investors and macro enthusiasts!

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post