Brazilian President Lula recently asked the following questions:

‘’Every night I ask myself why should every country have to be tied to the US Dollar for trade?’’

‘’Why can’t we trade in our own currency?’’

‘’Why can’t a BRICS Central Bank have a currency to finance trade between BRICS countries?’’

Lula’s speech sparked yet another mediatic hype on the upcoming De-Dollarization.

So, let’s explain how today’s USD-centric system works and why it’s been impossible to replace in 50+ years.

Before we dive into it, a quick reminder: if you enjoy these educational pieces and you haven’t subscribed yet to The Macro Compass premium platform…

…well, what are you waiting for?

Come join thousands of investors receiving unique, jargon-free macro insights and actionable investment strategy for their portfolios every week!

For more information, here is the website.

Now, back to it.

In a globalized economic system you want to trade with as many partners as possible in a seamless way.

When Brazil exports its commodities to China or Japan and the trade happens in USD, Brazil accumulates Dollars – it might also use them to buy goods or services it needs from other countries.

In other words, today the US Dollar is the Global (Reserve) Currency of choice: over 80% of global FX transactions and 50%+ of global trades and payments happen in US Dollar.

More importantly, in the last 30 years competitors could not alter this massive USD dominance: why?

Well, it’s because being the US Dollar seems fun from the outside.

But it ain’t easy.

Let’s start from the asset side.

When Brazil exports commodities in USD more than spends USD to import stuff from the outside, the country accumulates USD foreign exchange reserves.

These USDs enter the domestic banking system, and ultimately the local Central Bank is responsible for managing this FX reserve buffer – that means keeping these US Dollars safe and liquid.

In our monetary system, keeping money ‘’safe and liquid’’ means avoiding credit risk and investing in deep and liquid markets that guarantee a painless turnover if necessary (either via selling or repo-ing securities).

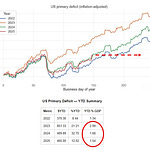

The US Treasury market stands out as the global leader in this field: as big as 20+ trillion in size, liquid and underpinned by a deep repo ecosystem it ticks all boxes.

No capital controls, democratic roots and the rule of law reinforce the case.

Most importantly, an ample supply of US Treasuries (read: deficits) provide to the rest of the world what they need: a safe and liquid asset where to recycle the USD proceeds from their global trades.

But so, what’s the potential alternative?

Japan? Its government bond market is 60%+ absorbed by the BoJ, and there have been multiple days in a row (!) where no trade happened in the JGBs – how can you store your FX reserves in such an illiquid market?

Europe? With such a fragile monetary but non-fiscal union, and the only AAA countries potentially able to provide the world with safe collateral (German Bunds) instead sticking to austerity for decades?

China? Brazil? Russia? You are facing a combination of capital controls (China), lack of democracy/rule of law (Russia), corruption and frequent episodes of double-digit inflation (Brazil) – do you want to take these risks when storing your hard-earned FX reserves accumulated from selling your goods and services abroad?

The truth is that US Treasuries don’t have a valid competitor as a global vehicle where to invest FX reserves.

And this is also true for the other side of the coin: debt.

USD-denominated foreign debt is huge, and it makes an orderly De-Dollarization not more than a fairytale.

Entities sitting outside the United States have accumulated $12 trillion of USD-denominated debt: this is because to finance global businesses that sell stuff in US Dollars…well, you need US Dollar debt.

I can’t stress how important it is to understand this concept: if you want to break this system and ‘’De-Dollarize’’, you need to deleverage a $12 trillion debt system.

Brazil walking away from USD-denominated trades would hamper its own organic inflows of US Dollars, and Brazilian corporates would be choked under USD scarcity as they need to repay and refinance their USD debt.

When you de-leverage a debt-based system, you are either bidding up the debt denominator (the USD) or you are witnessing tectonic geopolitical events (e.g. wars) where the world order is at stake.

An orderly unwind of the US Dollar is a fairytale: there is no valid alternative for a smooth transition, and de-leveraging the global USD debt based system would be a very painful process.

And this is why you keep hearing about the De-Dollarization, but it never happens.

If you have enjoyed this piece, consider joining The Macro Compass premium platform.

The best investment you can make is in your own macro education, and TMC is trusted by thousands of worldwide investors to deliver unique and actionable macro insights every week.

For more information, here is the website.