Hi all, and welcome back on The Macro Compass!

Quick reminder: from January 1st, getting access to this content (and much more!) will require a paid subscription.

As a loyal TMC reader, there is an exclusive offer for you: get in now and pay only 9 months instead of 12!

The offer is time-limited: it runs for only 4 more days, and out of the 1,000 available spots only 224 are left (78% already taken).

Last round: check out which subscription tier suits you the most and take advantage of this exclusive offer before December 10th!

King Dollar Matters

Our monetary and credit system is USD-centric: the lion share of international debt, trade invoices, asset classes and FX volume is settled or denominated in US Dollars.

Funnily enough though, direct access to $ liquidity is only available to entities located in the United States but in a credit-based system the rest of the world also has an incentive to leverage in US Dollars to boost or enhance their global business models.

That means European banks, Brazilian corporates or Japanese insurance companies which want to do global business will most likely get exposure to $-denominated assets and liabilities ($ debt) despite being domiciled outside the United States.

The required USD funding happens both on and off-balance sheet, and the FX derivatives market is an important part of the latter and the focus of the latest BIS report which is making the rounds.

In this article we will:

Discuss the BIS paper, with a deep dive into the ‘‘hidden USD debt’’ story…but in plain English, and in a 15 minutes reading-time article;

Present our conclusions and findings - spoiler: it’s much more nuanced than the clickbait-y media headlines floating around.

What’s This ‘‘Hidden Debt’’ All About?

Let’s first define some basis concepts first.

A Japanese insurance company which wants to purchase US Treasuries needs USD funding for this transaction, the same way a Brazilian corporate needs USD funding to boost their international activities.

USD bond issuance and repo funding are accounted on-balance sheet and hence transparent and easy to track: we know there is roughly $20-25 trillion of $-denominated funding sitting outside the United States. Big number.

But there are also ways to get USD funding off-balance sheet.

FX derivatives (mostly FX swaps and cross-currency swaps) account for the lion share of off-balance sheet USD funding, or what the BIS called ‘‘hidden debt’’.

It sounds complicated but it’s not.

A FX swap is an agreement in two steps:

I sell JPY to buy USD spot (leg 1: spot exchange);

I agree with the counterpart to sell back the USDs and buy back the JPYs at a pre-agreed price at a given date in the future (leg 2: forward agreement).

Notice how we exchange the full principal at maturity: in other words, this is loan secured by the FX amounts - a property not common to all derivatives, which makes this transaction also somehow similar to a funding deal.

Easy, right?

A cross-currency swap is basically the same, but it’s done for longer tenors and it requires exchanges of cash-flows throughout the life of transaction.

Now, why does the BIS tag the USD FX derivatives funding as ‘‘hidden debt’’?

Because accounting rules allow for it to be off-balance sheet.

FX swaps are reported on a net basis, while repo or bond issuance in US Dollars is reported on a gross basis and hence immediately visible on the balance sheet.

As per any derivatives, FX and cross-currency swaps require variation margin to be posted by the counterpart under water and hence their mark-to-market is continuously recorded but on average it accounts for 5-10% of the notional amount.

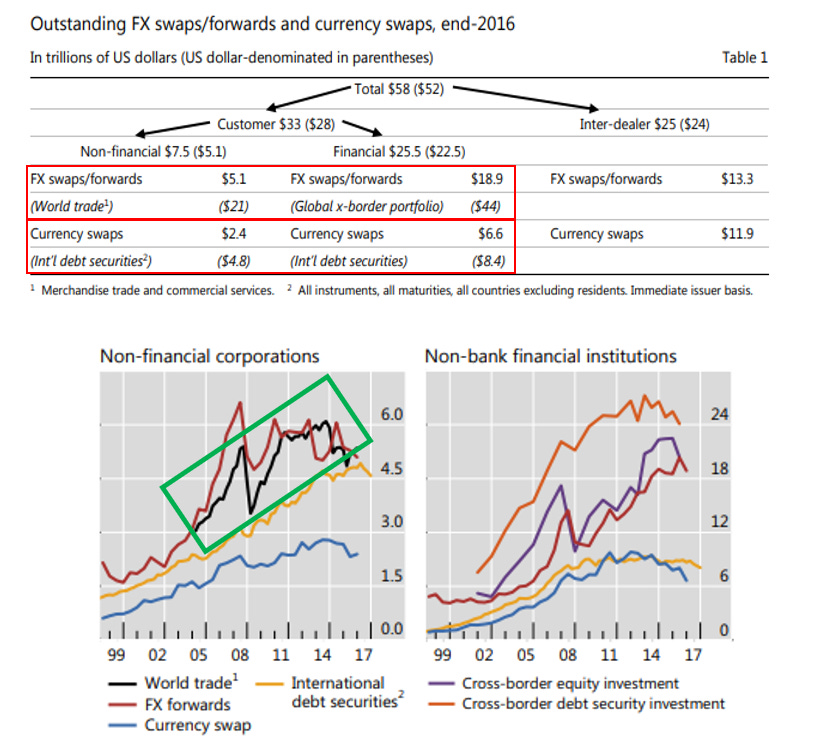

So, how big are these notionals?

The BIS estimates off-balance sheet USD funding from entities outside the United States roughly in the $60 trillion ballpark, or ~3x the one recorded on balance sheet.

Massive number: is it all going to collapse?

Hold your horses - it’s all much more nuanced than it seems.

Notional amount in derivatives generally matter very little: these contracts are often used to offset existing positions, and being mostly centrally cleared the Clearing House takes care that the continuous mark-to-market and margin posting exercise.

The main question is: who are the players involved, and are they really offsetting existing positions?

The BIS shows they are.

The FX derivatives notionals (chart: red) sitting on corporates and banks’ balance sheet outside the United States show a positive relationship with the amount of world trade (chart: black).

A $1 billion increase in quarterly global trade over a 6-month period is associated with a $660 million increase in corporates’ FX derivatives positions.

In other words, if a Brazilian corporate gets continuous access to $ cash flows because of its flourishing trade business, using FX swaps will actually be a risk-mitigating exercise as it will allow them to smoothen the USD/BRL FX risks ahead.

So, nothing to worry about at all?

Again, it’s nuanced - which means there are material downsides too.

Where Is The Problem?

In short, there are two main problems:

Plenty of USD funding needs for entities sitting outside the US means a continuous flow of fresh $ is necessary for this system to stay in equilibrium;

There is a clear maturity mismatch between USD funding and assets, and hence rollover risk during stressed times: what if the lenders step away exactly when you need to rollover your USD funding as an entity outside the US?

The chart below depicts the problem 1. very well.

It shows the YoY trend in Korean exports (blue, LHS) against the YoY performance of the DXY lagged by 9 months (orange, RHS, inverted).

As long as exports are growing, US Dollars are organically flowing to Korea and the USD doesn’t appreciate against other currencies - it actually often depreciates when global trade growth is strong.

But if the trade growth music stops (blue line down), the USD often rapidly appreciates (orange line down, it’s inverted) a few quarters later.

Why does this happen?

Because a Korean exporter that has leveraged its balance sheet in US Dollars to enhance its business won’t have a problem in periods of strong growth, as $$$ organically flow and he can easily service its $-denominated liabilities.

But when these USD cash flows dry up as the economy is weakening, all of a sudden servicing $ debt becomes hard.

In a snowball mechanism, all foreign entities leveraged in US Dollars try to de-leverage…which means they bid up the spot USD itself, which in turn hits other foreign USD borrowers in a self-fulfilling prophecy.

The US Dollar wrecking ball in action.

The other problem with this sytem is that off-balance sheet USD funding in FX derivatives is often very short-dated: FX swaps generally mature within 1 year….

..but assets are longer dated than that, and hence this funding must be renewed year after year.

Rollover risk is important.

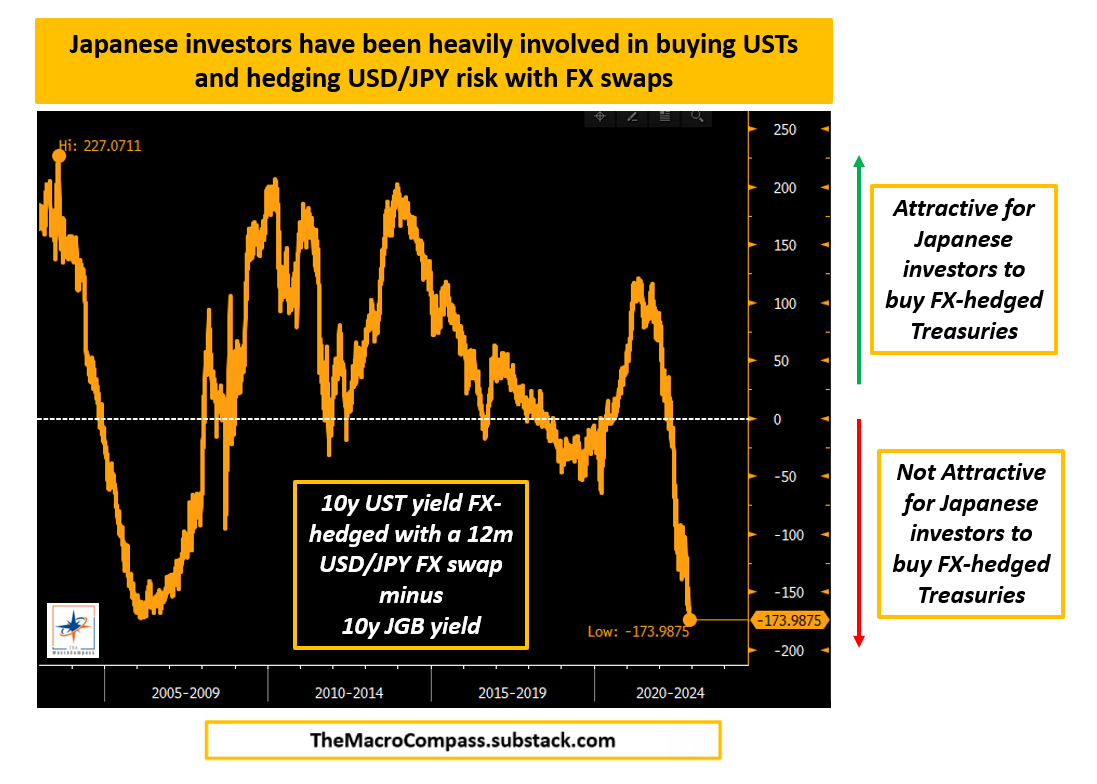

Let’s take a Japanese insurance company - these guys were heavily involved in purchasing 10y+ US Treasuries and funding their need for $ in the FX swap market: they would sell JPY to buy USD spot, purchase the US Treasuries with it and agree to pay back USD for JPY in 1 year.

For long periods of time between 2010 and 2020 this was a very lucrative exercise.

The chart below shows the additional yield the Japanese insurer would get from purchasing 10y Treasuries and hedging the USD/JPY risk with a 1-year FX swap instead of just buying Japanese government bonds - this yield pickup was often in the 100+ bps area.

Today the FX hedging costs are so high that this yield pickup has disappeared, similar to the 2005-2007 period.

Notice how the asset (US Treasury) tenor is 10 years while the funding (FX swap) tenor is 1 year - the Japanese insurance companies would need to roll-over their FX swap every year.

It works fine if there is little volatility and lenders of USDs in the FX swap market (e.g. US banks) are there - but what if they are not when you need them?

In September 2008 the FX swaps market froze: 1-year USD/xxx FX swaps suddendly became 100 bps more expensive, and foreign investors were left to scramble for US Dollars.

Conclusions

Tens of trillions of off-balance sheet US Dollar funding exposure sounds very scary.

Yet, a deeper assessment points to a more nuanced take.

First, ‘‘off-balance sheet’’ doesn’t mean it’s going to blow up: these FX derivatives require variation margins and their mark-to-market is constantly taken into account.

Second, a good portion of this USD funding offsets existing $ positions: a Brazilian corporate selling commodities in US Dollar actually mitigates its risk profile by hedging future $ cash flows in the FX swap market.

In any case, the current $-centric model which incentivizes foreign entities to borrow in USDs is definitely prone to strains.

Plenty of USD funding needs for entities sitting outside the US means a continuous flow of fresh $ is necessary for this system to stay in equilibrium; as soon as this oiling mechanism stops, the scramble for USD begins

There is a clear maturity mismatch between USD funding and assets, and hence rollover risk during stressed times: what if the lenders step away exactly when you need to rollover your USD funding as an entity outside the US? (e.g. 2008)

Monitoring global trade growth and signals coming from the derivatives markets is vital to keep the pulse of this very fragile system.

Luckily, at The Macro Compass we’ll be in a perfect position to do that by relying on our data-driven macro approach and interactive tools monitoring market signals across asset classes and including derivatives.

Timely updates like this will be available to subscribers of the All-Round Investor tier.

And this was it for today, thanks for reading!

If you enjoyed the piece, please click on the like button and share it with friends :)

Finally, a quick reminder: from January 1st, getting access to this content (and much more!) will require a paid subscription.

As a loyal TMC reader, there is an exclusive offer for you: get in now and pay only 9 months instead of 12!

The offer is time-limited: it runs for only 4 more days, and out of the 1,000 available spots only 224 are left (78% already taken).

Last round: check out which subscription tier suits you the most and take advantage of this exclusive offer before December 10th!

Subscribing to any of the tiers above now will guarantee you lock-in early bird prices and your subscription will cover the entire 2023 calendar year.

For more information, here is the website.

I hope to see you onboard!

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.