Looking back at the 2015-2021 period when I traded bond markets at a large bank, it was quite boring.

Rates were mostly stuck around 0% at the front-end, and to make money you had to find small dislocations and monetize them with leverage hoping volatility would remain low forever.

Today, the story is different: bond markets are truly exciting.

So let’s have a fresh look at them.

Before we do that though - an important announcement.

My macro hedge fund Palinuro Capital is going live in January.

This is a dream coming true for me.

Do you want to be updated about the performance and progress of my hedge fund?

Fill in the form below and I will include you in the distribution list:

I expect the Fed to cut rates again in December.

Why?

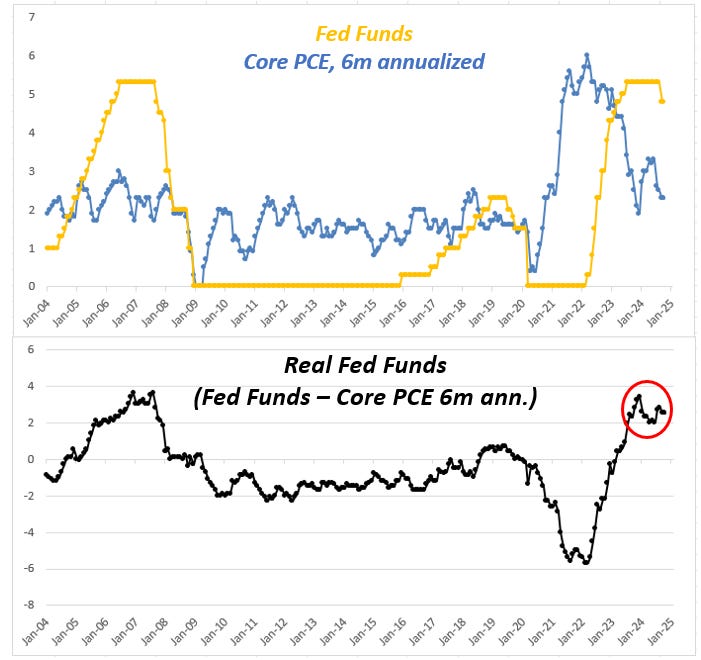

See the chart below:

Even after the recent Fed cuts, today’s Fed Funds (orange) are still markedly above the underlying trend of core PCE inflation (blue).

The Fed is a simple animal: their dream is to have a stable labor market with predictable inflation.

And today, the main risk they see isn’t an inflation pick-up.

Instead, risk management forces them to protect the US economy against a deterioration in the job market.

Running a real Fed Fund rate (bottom chart, black) at +2% for several quarters on end is an exercise which was last performed in 2007.

I don’t think the Fed sees major benefits in running such a tight policy.

Hence, I believe they will cut rates by 25 bps in December.

But here is an argument for them to feel confident the US doesn’t need a major cutting cycle in 2025:

This chart looks at the US private sector (orange) and government (blue) debt to GDP since the 1990s.

It’s an incredibly important chart to approach US bond markets today.

The US went through two clear macro phases before today.

In phase 1 (before GFC), the US government refused to lever up: government debt as a % of GDP was at or below 60% and deficits were seen as a bad thing.

As the private sector didn’t receive any stimulus from government deficits and it grappled with declining demographics and productivity, it used leverage to achieve higher growth.

In phase 1, the US private sector was forced to lever up aggressively.

Until in 2008 excessive private debt and loose credit standards led to the Great Financial Crisis.

This kickstarted phase 2 of the long US macro cycle – the post GFC period.

Between 2009 and 2012 the US government printed money (read: deficits) to stabilize the US economy.

This allowed the US private sector to de-leverage: private sector debt as a % of GDP fell below 150%.

But this fiscal profligacy didn’t last for long: between 2014 and 2019 the US primary deficit as a % of GDP was less than -2% on average – mildly supportive for the private sector, but nothing special.

So we sat there in this limbo of acceptable GDP growth, but as neither the US government nor the private sector levered up aggressively we lived through a ‘’meh’’ US growth cycle.

Finally, C-19 hit and the game might have changed for good (phase 3).

Since 2020, US deficits have exploded and this has allowed the US private sector to de-leverage.

US private debt as a % of GDP is now the lowest since 2003 (!).

So: why does this matter for bond markets?

Because in a world with less private sector leverage, ceteris paribus interest rates can be a bit higher.

When there are less mortgages and corporate loans to refinance vis-à-vis higher nominal wages and earnings, the equilibrium interest rates at which the economy can function should be higher.

The flipside is obviously that an increasing load of government debt will have to be refinanced at higher rates.

In the US case though, that’s more manageable than for other countries due to the reserve currency status.

This is why the market feels quite strongly about terminal rates being well above 3% this time.

As per today, markets expect Fed Funds to still be at 3.50% in 3 years from now.

The most important implication for investors is this.

If the Fed embraces this new narrative, we are looking at few (if any) cuts left in 2025.

This is because if neutral rates are considered to be higher, the Fed doesn’t need to cut rates much more to achieve a neutral policy stance.

With euphoric expectations about earnings growth, nosebleed valuations and a less friendly Fed overly bullish investors might be disappointed in early 2025.

This was it for today. I hope you enjoyed this macro piece.

Please share it with a friend:

And also, don’t forget.

Do you want to be updated about the performance and progress of my hedge fund?

Fill in the form below and I will include you in the distribution list:

Have a fantastic day ahead,

Alf

Share this post