Hi all, and welcome back on The Macro Compass.

Quick reminder: The TMC Bond Market Course is out, and the heavily discounted spots are running off fast!

As a loyal TMC reader, there is an exclusive offer for you: using the coupon ‘‘BOND500’’ at checkout you can claim a chunky 25% off!

The offer though is spot-limited: out of the 500 available spots only 223 are left (55% already taken in 3 days).

So: be quick and take advantage of this exclusive offer before it sells out!

For more information, you can visit this dedicated page.

Over the last few weeks bond markets have been on the move: 30-year Treasury yields have rapidly surged from below 4% to almost 4.50% catching many by surprise.

Yet understanding why and what drives bond market action is a crucial skill for macro investors, so let’s explore together an approach that will help us make sense of the recent bond market developments.

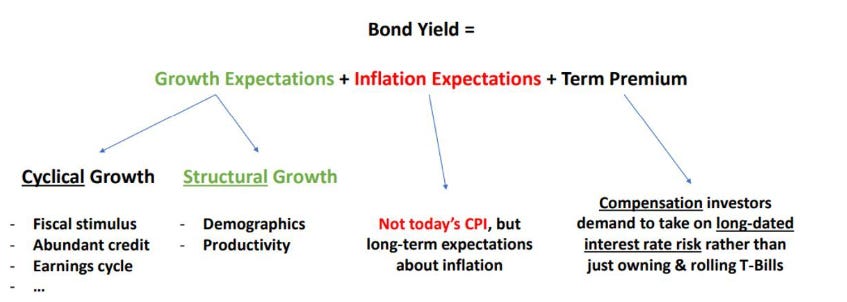

Nominal bond yields can be thought of as the interaction between:

1️⃣ Growth expectations

2️⃣ Inflation expectations

3️⃣ Term premium

1. Growth expectations

When it comes to economic growth we must consider two angles: structural and cyclical growth.

Structural economic growth can be generated through more people joining the labor force (good demographics) and/or through a more productive use of labor and capital (strong productivity trends).

The ability of an economy to generate structural growth is an important driver behind long-dated bond yields (strong structural growth = structurally higher long-dated yields and vice versa).

Short-term economic cycles also matter for bond yields - particularly at the short-end.

Cyclical growth trends are driven by the credit cycle, the fiscal stance, earnings growth, labor market trends and more - the healthier they are, the higher short-end bond yields can be pushed also as a result of a likely tightening from Central Banks that might grow worried about economic over-heating and inflationary pressures in such an environment.

What happened to growth expectations recently?

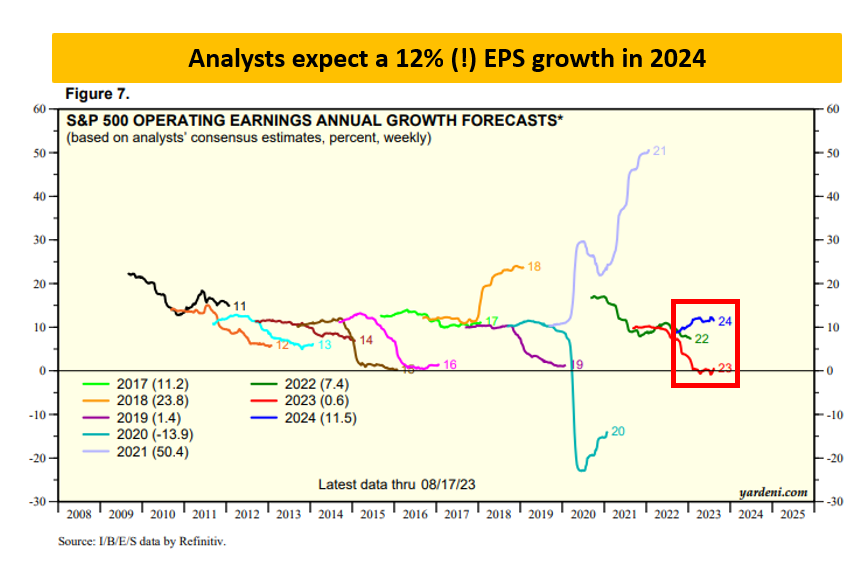

Analysts stopped revising down their 2023 earnings per share (EPS) expectations and started revising them higher for 2024 - they are now looking for a healthy 12% EPS growth for next year!

On top of this, consider that:

The AI-mania led to speculations over big productivity gains, and therefore boosted the ‘‘higher structural growth’’ narrative';

The stubbornness of the US economy spurred discussions on whether we can handle higher rates for longer due to stronger structural growth;

In short, long-term growth expectations were revised higher: the first item of the equation above contribute to pushing 30-year Treasury yields higher.

2. Inflation expectations

The second component driving nominal bond yields is inflation: but NOT TODAY'S inflation - instead we are referring to long-term inflation expectations.

Central Banks might temporarily react to concentrated bursts of inflationary pressures by raising short-term interest rates but when it comes to long-dated bond yields investors will always pay close attention to inflation expectations.

That's because consumers and borrowers will tend to make important decisions based on these rather than on volatile short-term trends in inflation.

What happened to the inflation component?

Contrary to popular belief, investors are generally not scared of sticky persistent inflation: the US 5y5y inflation break-even has traded in a 2.45-2.75% range for the last 12 months - that means investors expect US CPI inflation to float around these levels between 2028 and 2033.

In short, investors have pushed 30-year Treasury yields higher NOT because of fear over sticky persistent inflation but because of:

Positive re-rating of cyclical growth (EPS expectations pushed higher);

(Some) Positive re-rating of structural growth (narrative driven: AI, higher r*);

Wait for it…

3. Term Premium

An investor looking to get fixed income exposure can do that via buying 3-month T-Bills and rolling them each time they mature for the next 10 years.

Alternatively, it can decide to purchase 10-year Treasuries today.

What's the difference?

Interest rate risk!

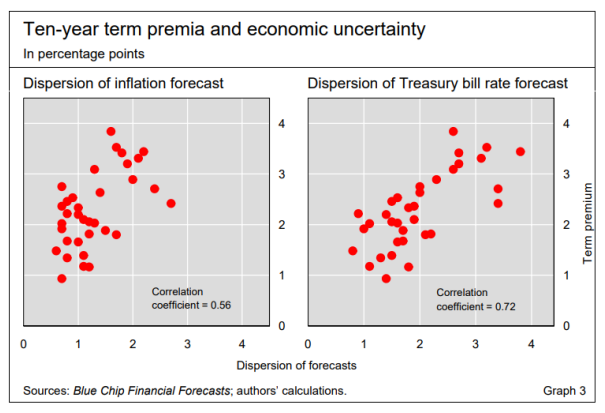

Buying a 10-year bond today rather than rolling T-Bills for the next 10 years exposes investors to risks – term premium compensates for this risk.

The lower the uncertainty about growth and inflation down the road, the lower the term premium and vice versa.

The chart above proves the point: the higher the uncertainty (x-axis moving to the right) about future growth and inflation, the higher the term premium (y-axis moving upwards).

Per our simple equation shown earlier, a higher term premium pushes long-dated nominal bond yields higher.

So, what happened to term premium?

Estimates of the US Term Premium have moved higher and they are now testing the upper side of recent ranges: in other words, there is some more uncertainty being priced in about the path ahead for growth and inflation.

Investors are less confident about a future of predictably contained inflation and growth, and they expect some more volatility and uncertainty down the road.

Taking a step back though, term premium remains still very depressed by historical standards: 10 years ago we were north of 1%, and today we are barely back to 0%.

Conclusions

The recent aggressive move higher in 30-year Treasury yields is NOT driven by fears of persistently higher inflation but instead by:

A positive re-rating of cyclical growth (2024 EPS estimates pushed higher) and some narrative-driven speculation for higher structural growth (e.g. AI effect on productivity);

Slightly higher term premium, reflecting investors’ expectation for more unpredictable boom and bust of growth and inflation down the road.

Thanks for reading, and a quick reminder.

The TMC Bond Market Course is out, and the heavily discounted spots are running off fast!

As a loyal TMC reader, there is an exclusive offer for you: using the coupon ‘‘BOND500’’ at checkout you can claim a chunky 25% off!

The offer though is spot-limited: out of the 500 available spots only 223 are left (55% already taken in 3 days).

So: be quick and take advantage of this exclusive offer before it sells out!

For more information, you can visit this dedicated page.

Share this post