Hi everybody, and welcome back to The Macro Compass!

Last week, FOMO (Fear Of Missing Out) became the prevalent market narrative.

As data seemed to further validate the soft landing narrative and Central Bankers became ‘’data dependent’’, markets are FOMO-ing like it’s 2019 again.

But 2023 isn’t 2019 – for many macro reasons we are going to touch upon.

In this article, we will:

Reflect on last week’s important macro data and Central Bank meetings;

Dig deep into how markets reacted, what’s the new consensus macro regime being priced in and whether macro data will validate it or not;

Assess how to best position portfolios in this environment.

Can You Smell The FOMO?

In 2019, the Fed pivoted hard and the economy managed a proverbial soft landing.

The 2018 hiking cycle which Powell abruptly reversed with his early 2019 pivot slowed the economy down, but not nearly enough to result in a hard landing.

The S&P500 earnings growth was only +0.6% (but not negative), core inflation was stable around 2% and the US added 160k new jobs per month: low nominal growth, but not a recession – in other words, a soft landing.

But 2023 isn’t 2019 – for many macro reasons we are going to touch upon.

First, let’s picture the current market regime.

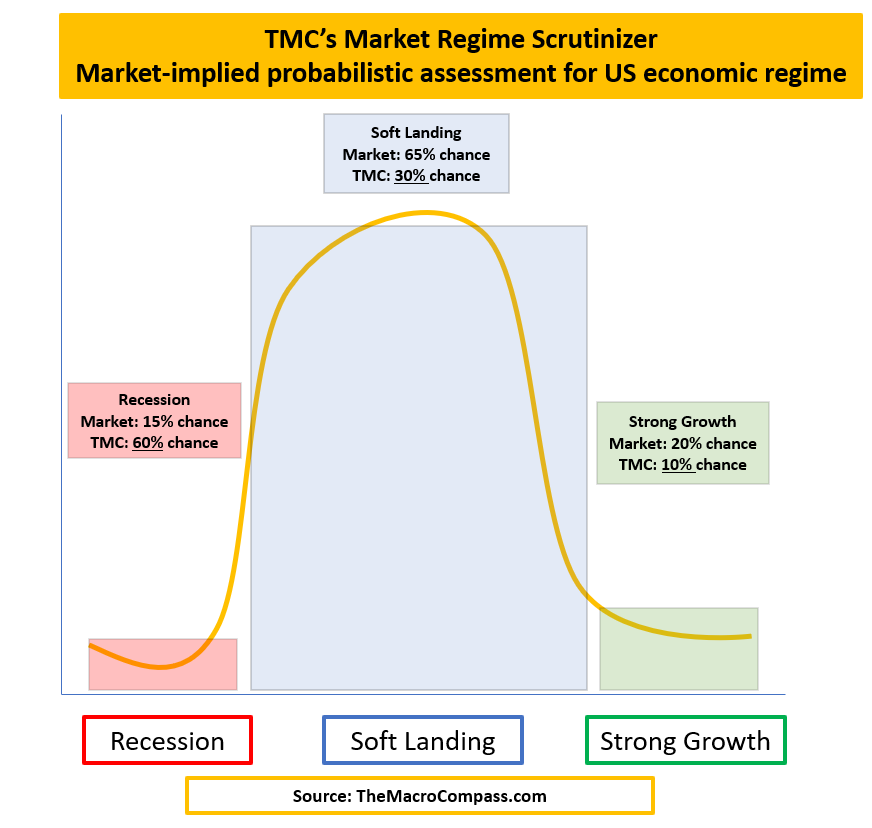

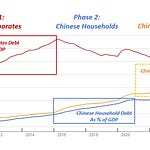

The chart above shows the TMC’s Market Regime Scrutinizer.

It measures the market-implied odds assigned to a US recession, soft landing or strong growth regime ahead.

It is derived by scrutinizing option markets in fixed income, equity, and currencies and blending the resulting market-implied probabilities in this flagship TMC indicator.

Markets are currently pricing a US soft landing as the dominant probabilistic regime (~65% probability), and in recent weeks the left recessionary tail has been aggressively priced out (now ~15%) while the chance of a strong growth regime ahead has been bumped up to ~20%.

Even after the apparently very hot labor market data and ISM services, the bond market keeps screaming immaculate disinflation/soft landing as the main regime ahead.

Inflation is priced to drop to 2.5% by year-end, and stay close to 2% in the long run;

Fed ‘’soft landing’’ cuts are priced in: as inflation slows down but without a recession, the Fed can gently cut rates to neutral levels (2.50-2.75%) without resorting to recessionary cuts or being forced to keep rates higher for longer.

Bond markets assign only a ~15% probability to recessionary cuts, and a ~30% chance to Higher-For-Longer Fed Funds amidst strong growth and sticky inflation.

As a result, the option-implied market points to a ~55% probability of a disinflationary soft landing.

When a disinflationary, immaculate soft landing becomes the dominant market regime it’s all about selling insurance and getting paid while…well, not much happens and the Fed is on a very predictable path.

And indeed, as the Fed is assumed to be on a more predictable path ahead bond volatility is getting crushed.

Lower bond volatility is leading to a much better risk sentiment in equity markets.

Now, to the key questions.

Are macro data really validating the soft landing base case priced in by markets?

Are Central Banks really on a predictable path ahead?

And finally: is 2023 going to look like 2019, a year when the S&P rallied 30%+ with minimal volatility?

Let’s find out…

Getting access to The Macro Compass full-length pieces requires a paid subscription.

On the new TMC platform, you’ll find not only deep and unique macro insights but also ETF Portfolios, tactical trade ideas, interactive tools, and much more.

Come join this vibrant community of macro investors - check out which subscription tier suits you the most using the link below.

For more information, here is the website.

Share this post