‘‘Stability breeds instability because stability itself is destabilizing’’

Hyman Minsky

The main point behind the Financial Instability Hypothesis developed by Minsky was that artificial stability and low volatility generate complacency amongst economic agents and ultimately lead to suboptimal decisions: the seeds of the next crisis are sown in the good time.

Once economic agents are confident nothing can ever go wrong, borrowing happens on more and more relaxed terms until anybody qualifies for leverage without credible possibilities to produce enough cash flows to service their liabilities.

And at some point, something breaks.

Credit spreads are an incredibly important variable to monitor if one wants to grasp at which stage of the leverage cycle we’re in: very narrow credit spreads imply borrowers have easy and abundant access to leverage while widening credit spreads are generally the canary in the coal mine for things to get worse for the private sector.

In this Bond Market 101 Series article, we will:

Define credit spreads, and analyze what determines their price action;

Dig deep into the buyers of credit spreads: what are their institutional and regulatory constraints, and why they matter;

Look at the credit spread market today and discuss where to find relevant (and free) credit spread data to monitor.

Without further ado, let’s jump right in!

What are Credit Spreads, and Who’s Buying Those anyway?

Actually, before we jump right in.

If you are reading this piece, there is a good chance you like macro newsletters - the question is: where do I find them, and in particular the good ones?

The guys at Harkster have done a fantastic job creating this free app that allows you to track and find finance newsletters - super handy to use, highly recommended!

Go and check out which macro newsletters I’m reading myself - there is some great content out there!

Back to it: in this previous Bond Market 101 Series piece we discussed the below decomposition of bond yields and in particular the risk-free rate (OIS) and the meaning of various yield curve shapes.

Today, we are going to focus on credit spreads - yes, we are leaving that weird animal called ‘‘asset swaps’’ for last.

Credit spreads can be defined as the additional yield over risk-free government bonds demanded by lenders to compensate for the credit risk (default risk) of the borrower.

Let’s take the US and Europe as examples.

In the US, you can lend to the government (buy risk-free US Treasuries) or to private sector economic agents which bear a certain risk of default: you can purchase investment grade or junk corporate bonds, mortgage-backed securities etc.

For instance, US companies rated below BBB- (investment grade) have to face on average more than 400 bps additional cost vis-à-vis the US government to borrow for a 5 year period. In Europe, that’s around 450 bps.

Those are credit spreads investors demand to be rewarded for lending to risky business rather than buying risk-free government bonds.

Ok, so far so good but things get interesting now: let’s move to Germany for a second.

The German government-owned development bank Kreditanstalt für Wiederaufbau (KFW) provides funds for housing, environmental protection and to German small and medium enterprises on behalf of the government.

Germany issued a direct and unlimited statutory guarantee that covers all of KfW's liabilities - basically, KFW bears no additional credit risk compared to the German government as its liabilities are explicitly and fully guaranteed by Germany.

It’s indeed rated AAA as the German government is.

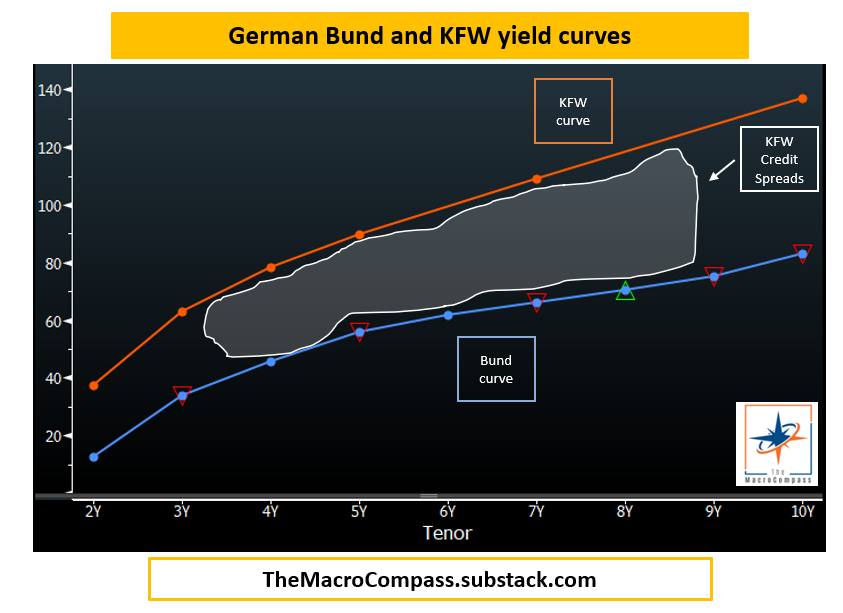

And still:

What the heck, Alf?

No real credit risk, even the same AAA rating and still KFW bonds bear a 30-40 bps credit spread over German government bonds?

That’s because credit spreads don’t necessarily reflect only credit risk, but also regulatory and institutional constraints the big-whale bond buyers have to adhere to when purchasing fixed income instruments.

Who are the big whales? Mostly bank treasuries, Central Banks’ FX reserve managers and pension funds: today, we’ll have a deep look at the first two.

After the Great Financial Crisis, regulators woke up to the fact that commercial banks weren’t owning enough liquid assets on their balance sheet.

Hence, they introduced the Liquidity Coverage Ratio (LCR): banks must always have enough High Quality Liquid Assets (HQLA) to meet deposit outflows in a stressed scenario.

This effectively means that 10-15% of banks’ balance sheet has to be invested in HQLA assets. Do you want to know how big that is?

Summing Europe and the US, that’s roughly $10 trillion chasing HQLA assets.

And guess what?

Not only risk-free government bonds, but also some credit risk bearing fixed income instruments are considered as High Quality Liquid Asset: here is how it works.

If you purchase a government bond or keep bank reserves at your domestic Central Bank, you face no liquidity haircut: $100 million US Treasuries = $100 million HQLA in your LCR calculation.

If instead you want to purchase some nicely AA-AAA rated corporate bonds, your liquidity haircut will be 15%: for every $100 million you purchase, you’ll get $85 million counted for HQLA purposes.

If you move down the rating ladder, the liquidity haircut will grow to 50%.

Go to junk bonds, and they just won’t count for the regulatory-binding LCR ratio.

Can you see the point?

A simple downgrade from AA- to A+ increases the liquidity haircut for banks from 15% to 50%, and hence affects the decision making of this big group of marginal buyer of credit spreads way beyond the mere credit risk considerations.

Ok, but KFW bonds still face no liquidity haircuts: those are issued by a government guaranteed development bank, so how come they offer 35-40 bps credit spreads?

In this case, the institutional constraint is not regulation but liquidity.

Which brings us to the next group of big-whale buyers.

When an oil producing nation exports oil to Europe or the US, they get paid in EUR or USD. As this process continues, the country accumulates foreign currency that is very often invested in foreign reserve assets to generate returns.

As you can imagine, these investments have to be very liquid such that the oil-exporting nation can sell FX reserves to support the domestic currency or meet external foreign currency obligations at any point in time.

Wondering how big is the global pool of FX reserves: about $13 trillion.

Very often, Central Banks set their investment risk policy for FX reserves pretty tight: for instance, both the Bank of Israel (here, page 34) and the Swiss National Bank (here) do not allow any purchases of bonds whose issuer is rated below BBB-.

More importantly, they will also set maximum investment thresholds for bonds considered to be less liquid than government bonds - very often, this is determined looking at bid/ask spreads, the size of the bond market and the liquidity of the underlying repo market.

That helps explaining why a AAA-rated, fully government guaranteed entity like KFW bears 35-40 bps credit spreads: the sizes of its repo and bond markets are much smaller and less liquid than Bunds, which means big whales demand a premium (credit spread) that has nothing to do with the inherent credit risk.

Credit spreads are obviously affected by the degree of borrower’s creditworthiness, but as you can see the regulatory and institutional constraints affecting the decision making progress of huge fixed income buyers play an important role too.

Conclusions and market data

The main takeaway here is that while often credit spreads reflect underlying credit risks, regulatory and liquidity constraints affecting the big-whale marginal buyers play an important role.

A bond issued by a government-guaranteed institution can trade at a significant credit spread even if it inherently bears no additional credit risk vis-à-vis the government: a smaller bond market with wider bid/ask spreads and a less liquid repo market constrain the big whale’s ability to fully exploit this arbitrage.

A downgrade from BBB- to BB+ excludes the bond issuer from a gigantic pool of HQLA and FX reserves’ manager capital and therefore disproportionally affects credit spreads way beyond the deterioration in creditworthiness that caused the downgrade in the first place - by the way, the US BBB market is $3 trillion big and it represents a large portion of the Investment Grade market.

Worth paying attention to - here is the $LQD ETF breakdown by exposure.

When it comes to markets, credit spreads are essentially a short volatility trade: when things are getting better and monetary policy is supportive, lenders are happy to take additional risks to generate returns and money flows towards riskier businesses.

Everybody wants to be long credit spreads.

As credit spreads tighten, as long as volatility remains subdued more investors will want to jump on the opportunity to lend funds to riskier businesses despite a lower and lower compensation for credit risk: this is when stability breeds instability, and economic resources get misallocated until something breaks.

So, where do you find freely accessible data for credit spreads so that you can monitor if cracks are appearing under the surface?

$HYGH ETF: The iShares Interest Rate Hedged High Yield Bond ETF tracks the investment results of an index designed to mitigate the interest rate risk of a portfolio composed of U.S. dollar-denominated, high yield corporate bonds. It’s basically the $HYG ETF but hedged for interest rate risk, hence delivering a live look at high-yield credit spreads only: really cool!

$LQDH delivers the same result for US Investment Grade credit spreads.FRED database: You can subtract 30y US Treasury yields from the DBAA (Moody’s index for 30-year BBB rated US bond yields) to get a very close picture for long-term BBB corporate credit spreads. Here is how it looks like:

And this is (almost) it for today!

Last but not least, a new episode of The Macro Trading Floor podcast is out!

This week, Andreas Steno and I interviewed the renowned independent macro strategist Lyn Alden and asked her to unpack her thesis and to deliver an actionable investment idea for our listeners.

Links here: Apple, Spotify, Google, YouTube.

Thank you for making it all the way through! :)

If you appreciate my efforts to deliver free financial education and macro insights, would you be so kind and share this piece in your (social media) network?

It would really mean the world to me!

If you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

For more macro insights, you can also follow me on Twitter and Linkedin.

My new podcast The Macro Trading Floor is also live, and the first two episodes got more than 40.000 downloads each already!

Every week, Andreas Steno and I host worldwide macro superstars that will unpack their thesis and deliver one actionable investment idea: you can listen to new episodes on the Blockworks Macro YouTube channel and every podcast platforms out there.

See you soon here for another article of The Macro Compass, a community of more than 40.000+ worldwide investors and macro enthusiasts!

Share this post