(Audio file now fixed)

Hi all, and welcome back on The Macro Compass.

In this piece we are going to cover the Fed meeting and its implications for markets.

For free. One last time.

So, a kind reminder: if you find value in the timely macro analysis and portfolio strategy The Macro Compass provides, this (and much more) will very soon require a paid subscription.

On the TMC platform we will step up the game: unique market insights, courses, ETF portfolios, tactical trade ideas, top notch interactive macro tools and much more.

Gates are closing soon: check out which subscription tier suits you the most - I’ll be waiting for you to come onboard!

The Fed Meeting Explained

To explain what happened today with the FOMC meeting, we need a short step back.

The latest US CPI release materially surprised on the downside: both headline and core inflation rose way below the expectations of 65 out of the 67 (!) economists surveyed by Bloomberg.

Powell recently divided inflationary pressures in 3 main categories:

- Core goods: supply bottlenecks combined with the pandemic-related binge spending led to hefty core goods inflation, but the Fed understands this category will suffer from disinflationary pressures ahead and it’s not where its focus lies;

- Housing-related: Powell knows negotiated rents are cooling down, but he also understands housing-related CPI will take a while to reflect these trends; the Fed likes shelter inflation lower, but it can only wait and see;

- Ex-housing core services: the stickiest inflationary components that the Fed can directly influence via a weaker labor market and lower wages = this is what must go convincingly down.

The latest CPI print showed ex-housing core services pricing cooling further: its annualized 3-month rate of change is now rapidly dropping towards 2%.

Markets interpreted this as the ultimate dovish signal, and sent bond yields sharply lower and equity prices higher in a typical ‘‘Fed pivot’’ move.

After all, if the stickiest components of the CPI baskets are showing signs of cooling this must be a green light for the Fed to be more confident they’ll achieve their objectives and hence loosen up?

Instead, today the Fed comes with their updated economic projections showing Fed Funds at 5.125% (!) by December 2023 (!)…and core PCE still at 3.5% (!) by that time.

An incredibly restrictive Fed Funds rate for a very long period of time will only be able to slow core PCE down to…almost double (?!) the Fed mandate?

Let’s look at 3 important points from today’s Fed meeting.

#1: The Fed Believes The Labor Market Is Still Red Hot

I must stress out two concepts here.

A) The Fed is really opinionated about this, as much as forecasting the first time in history when the Sahm rule won’t apply: in their projections the 3-month moving average of unemployment rate would move way more than 50 bps above its last 12 month low, and yet this time ‘‘it will be different’’ and we won’t have a recession.

B) I disagree: this time is never different, and we will have a serious recession.

Powell believes the only way to convincingly bring ex-housing core services inflation is via weakening the labor market, which he believes to be ‘‘super strong, and incredibly out of balance’’.

My estimates are that he spent at least 7-8 minutes of the press conference endlessly repeating how hot the labor market is.

But it’s not.

Forward-looking labor market indicators show US Non-Farm Payrolls are likely to slow to 0 (yes, zero) by March next year and turn negative (!) after that.

Financial conditions and banks lending standards have tightened very aggressively in 2022, and they lead hiring patterns by 9 months.

Powell is setting policy looking in the rearview mirror, and he will lead the US into a recession with Fed Funds above 5%.

Don’t fight the Fed.

#2: The Bond Market Is Calling The Bluff

Bond investors have made up their mind: the Fed can change the Dot Plot all they want, but at this point in the cycle there is no chance they’ll be able to keep rates above 5% for the entire 2023.

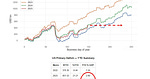

The left chart shows market-implied Fed Funds (blue) for 2023 implying net interest rate cuts towards the 4% area while the Fed Dot Plot (orange) points to further hikes above 5% and a long pause.

But the most interesting nuance in fixed income markets is how inflation swap traders are pricing YoY CPI to develop in the months ahead (right chart): from today’s 7%+ to basically 2.5% in only 8 months.

That’s a much more aggressive disinflationary trend than even the optimistic Fed expects, but there is a catch.

The bond market understands that if you tighten financial conditions like hell, and keep doing so by ignoring all forward-looking indicators you will definitely succeed in slowing down inflation.

But that’s because you’ll be causing a serious recession.

History shows us how a recession always succeeded in slowing down inflation very rapidly, and this time won’t be different.

Don’t fight the Fed.

#3: Changing The 2% Inflation Mandate? Forget About It

'''Changing the inflation target is not something we are thinking about.

And it's not something we are going to think about thinking about under any circumstances. Our inflation target is 2%. Full stop.''

It’s not about what the Fed should do, but about what they will do.

And while we may discuss whether raising the inflation target to 3-4% is a sensible policy choice, there is no way Powell will even entertain a discussion about it now.

Credibility is seriously at stake, and the only way to get it back is getting the job done.

Not moving the goalpost and calling victory.

Conclusions & Portfolio Implications

Powell won’t even consider risking a premature loosening of financial conditions, as the experience from the ‘70s strongly cautions against that.

That literally means he’ll be watching the US walk into a recession and stubbornly keep monetary policy very tight hence further exacerbating the problem.

What’s the right portfolio strategy for such a macro environment?

The golden rule is you don’t want to fight the Fed.

But you want to challenge it where it makes sense.

Medium term (6-12 months)

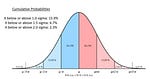

In an average recession, the Fed cuts by 300-400 bps in the 12-24 months immediately after the recession starts - the bond market is pricing a 20-30% probability of that happening, and my subjective probability for that oucome is higher.

Also, in an average recession earnings drop by 30% and that’s not nearly priced in.

Hence, I find value in:

2-5y Treasuries (and mid-2024 Eurodollar or SOFR call spreads)

Long Utilities or Staples (Defensive) against Financials or Industrials (Cyclical)

Short term (1-2 months)

Don’t underestimate markets’ muscle memory.

For 10 years, any remote hint of a ‘‘Fed pivot’’ meant buy the dip hand over fist.

The initial equity market reaction might well be similar, as we saw post the CPI release: bonds, gold, stocks, everything rallies in the short-term.

As inflation further slows down and the labor market cools off, unexperienced traders will be trying to put up ‘‘Fed pivot’’ trades by buying equities.

I’ll be patiently waiting for them to set up tactical SPX shorts.

Don’t fight the Fed.

And this was it for today, thanks for reading!

If you enjoyed the piece, please click on the like button and share it with friends :)

Finally, an important reminder.

From January 1st getting access to this content (and much more!) will require a paid subscription.

On the TMC platform we will step up the game: unique market insights, courses, ETF portfolios, tactical trade ideas, top notch interactive macro tools and much more.

Subscribers to The Long Term Investor tier will get weekly macro insights backed by an ETF portfolio.

On top of that, subscribers to the All-Round and Pro Investor tiers will get timely market reports like this one, interactive macro tools and much more.

Gates are closing soon: check out which subscription tier suits you the most - I’ll be waiting for you to come onboard!

For more information, here is the website.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.