‘‘Central banks will have to plunge the economy into a deep recession if they really want to squash today’s inflation — or live with more inflation.’’

Blackrock Research Institute - August 2022

Hi all, and welcome back on The Macro Compass!

A ‘‘very strong’’ labor market report coupled with the first preliminary signs of inflation slowing down have brought back 2021-like euphoria in risk assets: junk credit spreads are tightening fast, meme stocks are going through the roof and even Turkey (!) is now priced as a much safer investment despite front-end real interest rates as low as -60%.

In the investment world, when markets are behaving as if the economy is delivering decent growth and inflation is predictably low we call that ‘‘Goldilocks’’ - as in the story of Goldilocks and The Three Bears, markets are not hot or cold but just right.

There is one problem: the Goldilocks or Soft Landing market interpretation seems very misplaced at this stage.

In this article, we will:

Discuss the latest CPI and labor market reports, and show how they do not necessarily imply high odds of a Soft Landing;

Look at the behavior of different asset classes and discuss implications for long-term and tactical portfolio allocations.

So, Goldilocks? No.

Actually, before we jump right in.

If you are reading The Macro Compass, you’ll probably be interested in other good quality newsletters.

The guys at The Daily Upside are doing a great job at sifting through the clickbait-y headlines traditional financial media poses.

Instead, their team of investment bankers, scholars, and journalists condense the latest financial stories in a clear, concise, and occasionally witty daily newsletter - it is read by over 500,000 people every day and by the way…it’s free!

I definitely recommend checking them out: here is the link.

Now, back to it: is the Fed achieving the famous Soft Landing after all?

A deep look at the latest job market and CPI reports reveals how the extent of aggregate demand weakness the Fed engineered through tight financial conditions is not consistent with a Soft Landing - it will help in slowing down inflation, but it will also come at a big cost for economic growth.

Hence, the uprising Goldilocks or Soft Landing narratives seem misplaced at this stage: let’s see why.

1. ‘‘The job market is very strong!’’ Hold your horses, cowboy…

The good news first: all jobs lost during the pandemic have now been recovered (and more on top!). Interestingly, estimates of the pace of job creation necessary to keep unemployment rate stable given US demographics sit in the 100k per month.

For comparison, the latest job report showed the US added >500k!

Great, right? Well, let’s dig deeper.

A. Compared to June, the sector which added most jobs was…the government?!

In a very strong economy where growth is robust, you would expect private (and not public) sector job creation to lead the way.

Not to say other industries didn’t deliver, but the government job creation stood out.

B. Even more interestingly, the Household Survey data was much (!) weaker than the Bureau of Labor Statistics job report (NFP).

This matters a lot because the BLS survey has two interesting (and very relevant) features: multiple jobholders are counted as if multiple jobs were created, and the statistical methodology for the net number of opened/closed businesses was changed after the pandemic and this can lead to very volatile outcomes.

The household survey instead correctly accounts for multiple jobholders, and it shows how since March we have less (!) full-time and part-time workers while the number of multiple jobholders continues to increase.

Additionally, the BLS survey reported an estimated +309k net new business openings (!) in July - a very large number that contributed to the positive NFP report, and likely the result of a new statistical methodology (here for more details) rather than underlying business openings.

C. Participation rate is not picking up at all

We are still almost 1.5pp away from the pre-pandemic participation rate and by now it seems clear that people who decided to leave the labor force…well, they left for good.

This is very negative for the Soft Landing camp: a structurally smaller labor force means less growth and potentially higher wages - the opposite of Goldilocks.

2. Good news on the inflation front! But why did CPI slow down?

Finally, inflation is showing signs of a slowdown.

And what a slowdown that was: the drop in monthly headline inflation from June's 1.3% to July's 0.0% is the biggest since the '80s - but let’s look at the details.

As we know, the Fed cares about the momentum and composition of inflationary pressures going forward: to ease their policy stance they need to see progress from both fronts.

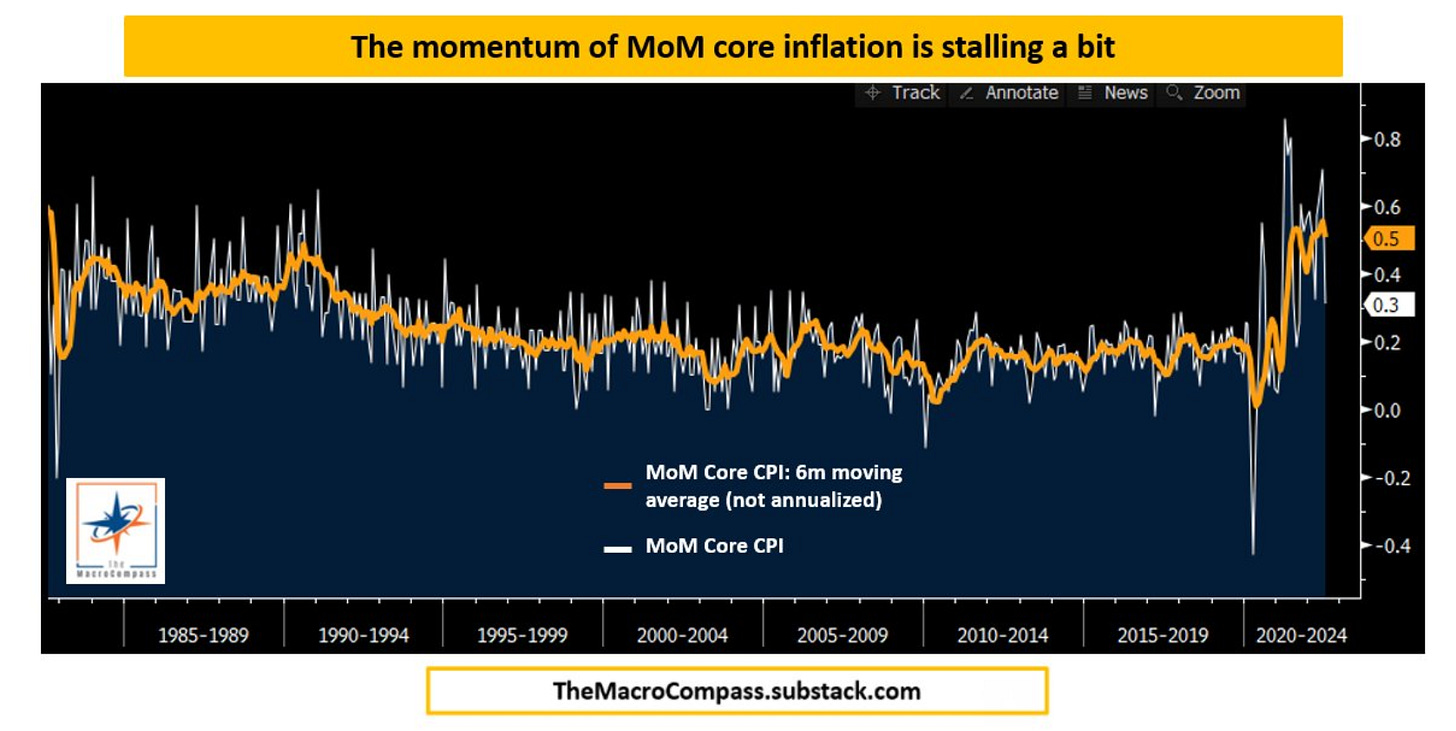

The 0.3% MoM Core CPI print stabilized the momentum a bit, but the 6m moving average of monthly core inflation remains historically high at 0.5% - a good step, but obviously more is needed.

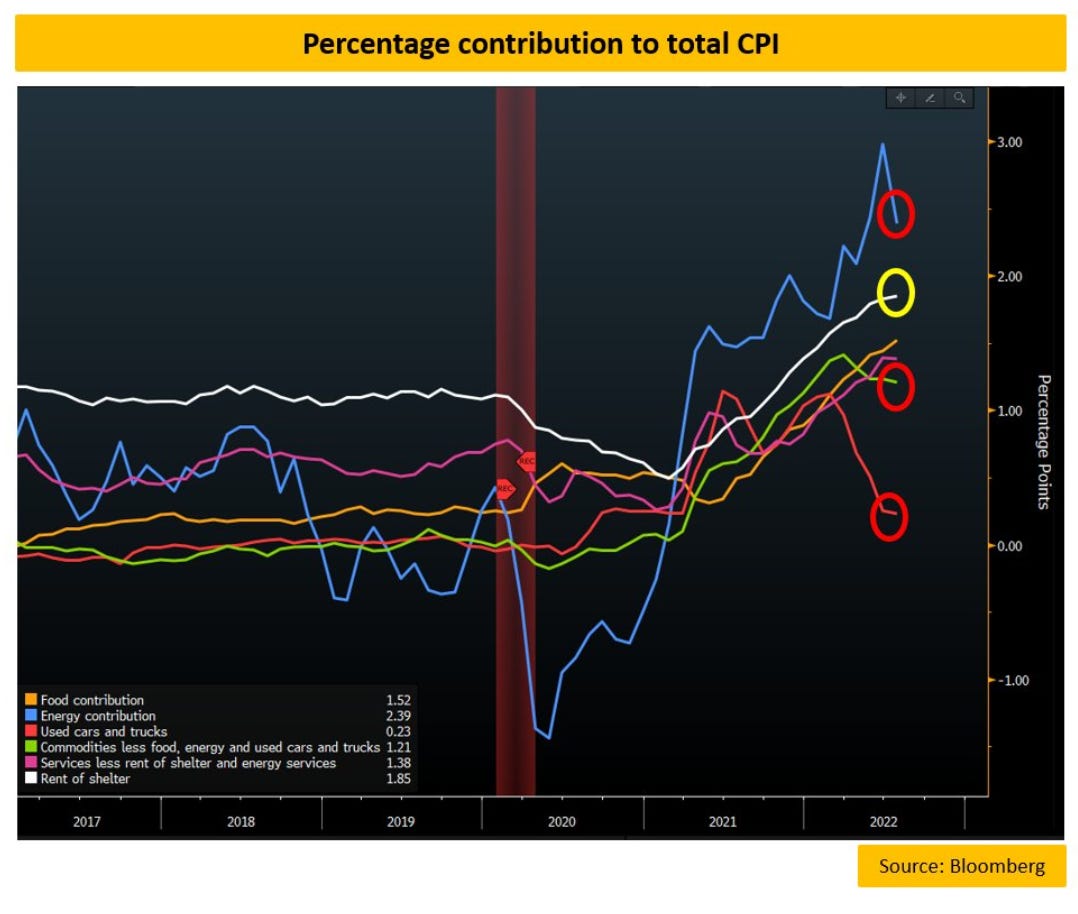

When it comes to the composition, the big drivers behind the move down in CPI where energy and other commodities (blue and green) together with the most cyclical components of the CPI basket like used cars & trucks (red).

Broadly speaking, the supply chain of these items (particularly energy and other commodities) hasn’t improved much and hence the deceleration in prices there could simply be the byproduct of a weaker aggregate demand.

The weaker demand theory is also backed by another evidence: while the cyclical components of the CPI basket are experiencing drawdowns, the stickier and more lagging core services price (e.g. shelter) remain stubbornly high for now.

In Short: The Soft Landing Narrative Seems Misplaced.

A Soft Landing implies a marked slowdown in inflation while growth remains robust.

While the direction of travel seems right (lower inflation, growth cooling towards trend), the evidence points towards a rather steep drop in economic activity and not a measured and controlled slowdown consistent with the Goldilocks narrative.

Grim forward-looking economic indicators, negative real wage growth for 1.5 years and the reach for credit card debt to bridge the purchasing power gap, multiple jobholders accounting for most ‘‘job creation’’ since March and our G5 Credit Impulse metric all suggest this is not going to be a Soft Landing.

So, how do we react to this big market repricing?

What about asset allocation?

Markets & Portfolio Implications

As previously argued, some of this rally makes tactical sense: if inflationary pressures are abating the Fed can take the foot off the gas pedal a bit = lower real yields = the not overly cyclical, high quality growth sectors can take a breather.

What seems more unreasonable is to price in a Soft Landing with the subsequent upgrade for future economic growth and hence a (dubious) rally in small-cap cyclicals, emerging markets, junk credit spreads etc.

Over the next few quarters, fixed income should emerge as one of the best risk-adjusted asset classes amidst this disinflationary/lower economic growth cycle - whether the front-end or the back-end performs better will mostly depend on Central Banks’ reaction functions but the big picture takeaway remains the same.

Prefer safer assets to risk assets.

Accordingly, my long-term ETF portfolio remains positioned as follows:

A good chunk of (USD) Cash

Low exposure to risk-assets (preference for high-quality growth names and non-cyclical, low-beta industries: good tech, utilities, healthcare)

Higher than usual exposure to 10y+ Government Bonds

My tactical portfolio has been stopped out from the Short Russell trade on July 29th (notice: would have lost a lot more money not honoring the stop) and now sits with:

2s10s flatteners

Long Nasdaq / Short Russell

The ‘‘Markets & Portfolio Implications’’ paragraph will be enhanced in future editions of The Macro Compass and my next article is going to cover at length portfolio allocation, tactical trades and the risk/reward of several asset classes across geographies.

If you have asset allocation or tactical trade ideas, or broad topics you’d like me to address in the next market/portfolio oriented article…shoot a comment below! :)

And this was all for today, thanks for reading!

If you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

See you soon here for another article of The Macro Compass, a community of more than 84,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.