‘‘Markets are constantly in a state of uncertainty and flux, and money is made by discounting the obvious and betting on the unexpected.’’

George Soros - The Man Who Broke The Bank of England

Hi all, and welcome back to The Macro Compass!

The FX vigilantes are back - and that’s an important news.

Global FX markets are on fire, with wild moves involving several currencies around the world and mostly having one common denominator: weakness against the US Dollar.

Why such dramatic moves?

For the last 20+ years, developed markets’ economic models were based on a two-tier system of cheaply available leverage:

Low-cost economic inputs underpinned by just-in-time global supply chains (leverage used to generate non-inflationary growth);

Relentless public and private credit creation at lower and lower borrowing costs (leveraged used to feed the wealth effect).

Such an economic model can work wonders…as long as there is no exogenous shock to the system - and right now, there is no shortage of external shocks (e.g. energy inputs, supply chains, inflation, borrowing costs etc).

Once you apply stress to a complex system, the resulting pressure will look for a release valve - currencies being one of the obvious candidates.

But this scary pickup in FX volatility also brings a lot of potential opportunities, as not all countries sit in the very same boat.

All of a sudden, fundamentals matter.

In this article, we will:

Provide you with a framework to assess relative FX vulnerabilities around the world, and investigate the moves and potential developments ahead for 3 major currencies (JPY, GBP, CHF);

Assess the implications and provide portfolio allocation guidelines and trade ideas for both long-only and tactical long/short macro portfolios.

FX Fundamentals Are Back With A Vengeance

Actually, before we jump right in.

On October 17-18 I will be a speaker at the Digital Asset Summit conference in London - it’s a very well-organized event attended by large investors and companies situated at the crossroads between macro and the digital asset space.

You can listen to a large amount of good quality content and meet macro and crypto funds, family offices, banks…or even me :)

If you are interested to attend, as a reader of The Macro Compass you can get tickers with a 20% discount using the code ‘‘TMC’’ - the link is here.

Now, back to it.

An easy way to think about global FX vulnerabilities is to ask yourself: where was the two-tier leverage system applied most extensively, and are policymakers now credibly able to stop the bleeding caused by exogenous shocks?

By quantitatively and qualitatively assessing the following variables per each country, we should be able to get a good snapshot of the situation.

Vulnerabilities: debt and deficits.

If the value of your goods and services imports exceeds your exports (Current Account deficit), and if the value of your external debt is much higher than the foreign assets you own (net debtor country under the Net International Investment Position) you are not in a great position to handle external shocks - if you also plan to make a large use of Fiscal Deficits, that’s even worse - hello, UK?

Additionally, if Private Sector Debt is very high you are likely not well-equipped to sustainably tighten fiscal and monetary policy to offset this shock.

Strengths: Central Bank/policymakers’ credibility = net FX reserves & the ability and willingness to tighten policy.

Successfully overcoming exogenous shocks requires a wide array of credible policymaking (higher real rates, FX management, long-term strategic decisions): the amount of Net FX Reserves and the extent of Policymakers’ Credibility in their ability and willingness to tighten are important.

Here is a quick visual snapshot of how different currencies are ranking according to this framework:

The framework looks at quantitative measurements for each category, focusing not only on spot levels but also on trends and future base case.

But it also overlays qualitative assessments - for instance on the willingness and ability of policymakers to deliver ‘‘friendly’’ FX policies (hello, Japan?).

Finally, it color-codes variables for each country on an absolute basis: green tonalities for a healthy, FX-supportive element while orange/brown tonalities otherwise.

Let’s now cover the 3 interesting currencies in more details.

1. Japan: Is The YCC Ever Going To Stop?

Japan has been running QE forever, and few years ago the BoJ decided to focus on ‘‘quality’’ rather than quantity by shifting their focus on pinning 10y rates at 0.25% rather than on a certain amount of QE envelope - effectively kickstarting a Yield Curve Control (YCC) policy.

Japan’s current account and fiscal balances aren’t particularly healthy, and its private plus public sector leverage is very large.

Lately, as interest rate differentials between Japan and the rest of the world widened aggressively markets are loudly asking one question - when will the YCC end?

The answer is in this chart.

Japanese core inflation has averaged minus (!) 0.2% over the last 2 decades, and 5-year forward, 5-year inflation expectations have only rarely managed to trade above 1%.

Incentive schemes are important here: Kuroda’s term will end in Spring 2023, and he won’t easily give up on an easy monetary policy especially if he’s getting one last chance to declare ‘‘victory’’ and leave a ‘‘better’’ legacy behind.

But given the Japanese vulnerabilities to exogenous shocks highlighted in the table above, if markets can’t use bonds as a release valve…they’ll be testing the JPY.

So, is the Ministry of Finance ammunition and credibility enough to (temporarily) defend the JPY?

Yes.

Japan owns $1.3 trillion in gross foreign exchange reserves, with the net amount (e.g. accounting for foreign currency liabilities like repo or FX derivatives) in the $1 trillion area - that’s 20% of GDP and it would cover for >1.5 years (!) worth of imports.

Does this mean Japan will sell US Treasuries and European bonds?

Not immediately, at least - the first step is to deploy the 135+ billion sitting in deposits at foreign Central Banks.

Bottom line: Japan is definitely vulnerable to external shocks, but its policymakers’ incentive schemes and its large amount of FX reserves could frustrate JPY and JGB shorts for quite some time.

2. Switzerland: Strong and Orthodox

Switzerland scores pretty well on the FX framework dashboard due to its healthy current account and fiscal position, but most importantly due to the very large amounts of FX reserves accumulated since 2008: a whopping 120% (!) of GDP.

The idea was to ‘‘import inflationary pressures’’ by weakening the CHF - sell CHF to buy foreign currency (assets, actually) mostly denominated in EUR and USD.

The Swiss National Bank ended up with almost $1 trillion (!) in reserves, with a very interesting portfolio composition - yes, they own 25% in equities.

The SNB doesn’t embark in much repo or FX derivatives operations, so gross basically = net reserves and also they mostly own securities rather than cash at foreign Central Banks - keep the last point in mind.

Now, inflation has been picking up in Switzerland too and the SNB is a very coherent Central Bank: as their orthodox approach led them to accumulate a gigantic amount of FX reserves and even invest them in equities, the same orthodox approach will now lead them to be very credible in mechanically hiking rates until CPI falls back in line.

Most importantly, they now wish for a stronger CHF and they have all the ammunition in the world: policymakers’ credibility in tightening conditions and a gargantuan amount of FX reserves to use - and if/when they do use them, German/French/US bonds and also equities could feel the heat of these large flows.

Bottom line: the Swiss Franc is a very palatable currency to use as long leg in FX trades given its unique position - policymakers willingness and credibility in hiking rates to fight inflation coupled with very large amount of FX reserves to use to strengthen the CHF.

3. The UK: Oh Dear…

In brief: the UK has a big problem here.

They are experiencing a serious exogenous/inflationary shock and they have:

A poor (and worsening) current account balance and a large net debtor position to the world when it comes to financial account balances;

Some non-negligible private sector debt vulnerabilities - especially in the mortgage market;

One of the lowest amount of net FX reserves as % of GDP and imports across developed markets;

A new government pursuing fiscal largesse (!) and a Central Bank forced to backstop the domestic pension fund system and hence struggling with credibility.

With such a setup, the market is going after both the release valves: GBP and UK government bonds are tanking at the same time.

In other words, the market is giving very clear signals that it won't be happy to fund the UK’s external deficit positions at today's levels of real yields and FX - investors will be demanding a cheap GBP or much higher real yields to support UK assets.

Also, please allow me one word on the UK mortgage and real estate market.

Interestingly, the UK mortgage market has been historically skewed towards pretty short-term fixed interest rate mortgages: until 2017, roughly 70% (!) of the market was concentrated in < 5 years fixed mortgages.

Even if the share of 5y+ fixed rate mortgages has increased since, I estimate that there are ~1.5-2.0 million (!) UK mortgages that need to be refinanced in 2023.

What’s interesting about that?

Well, those mortgages were locked-in at an average rate around 2%.

Refinancing activities are going to happen in the 6%+ area.

Good luck with that.

Bottom line: unless the expansionary fiscal stance is somehow watered down, the UK sits in a very, very precarious position. The latest BoE intervention in the long-end of the bond market (I am going to cover that soon) might further motivate Mr. Market to go after the release valve policymakers can’t address: the GBP.

So, what about portfolio allocations and tactical trades?

Portfolio Update

The comeback of FX volatility can act as an additional headwind for long-only portfolios, as some countries (e.g. China, Japan, Switzerland) might opt for defending their domestic currencies through selling the sizeable FX reserves accumulated over the last decade - while they will start from deposits at foreign Central Banks and not from securities, the potential selling pressure on 5-10y government bonds and the subsequent potential widening in risk premia should not be underestimated.

This reinforces the big picture: stay as defensive as you can.

And no, the BoE didn’t ‘‘pivot’’ - they just acted as the lender of last resort for the domestic pension fund system but there is nothing bullish about that.

Accordingly, my Long-Term ETF portfolio (constructed to deliver better risk-adjusted return vs a 60-40 benchmark portfolio) remains positioned as follows:

Long (USD) Cash

Large Underweight in Equities and all other risk assets

Patiently waiting to accumulate 10y+ Bonds

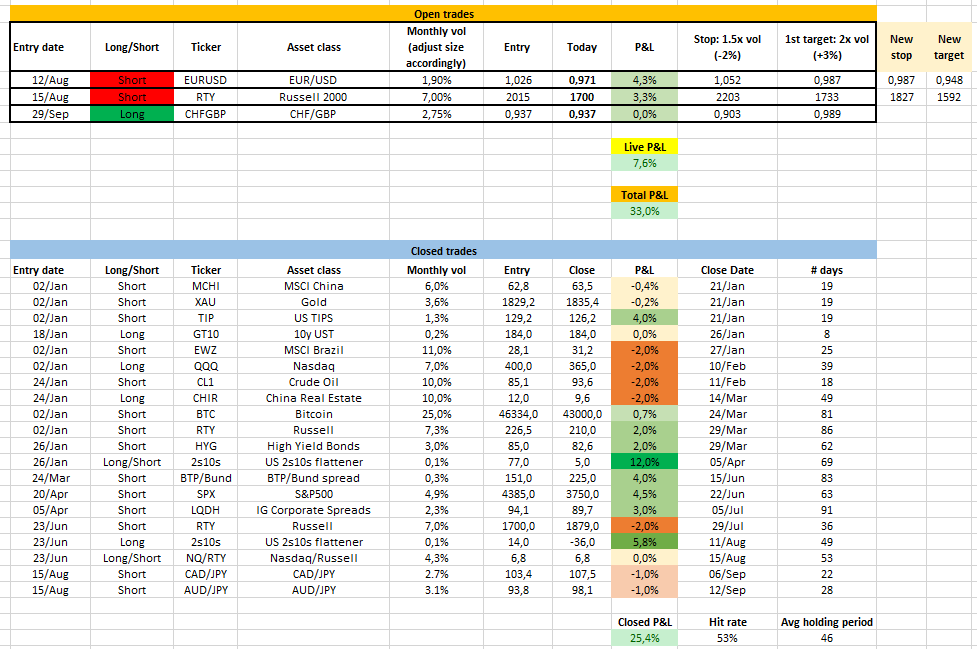

My Tactical portfolio is instead designed to generate a double-digit yearly total return (with Sharpe ratio >1x) via long/short trades across asset classes with a horizon of roughly 1-3 months.

I have been stopped out from my JPY longs against AUD and CAD.

On the back of today’s piece, I just added a tactical trade there: long CHFGBP.

One way to implement it away from spot FX would be via FX options, and specifically a digital call option on CHFGBP constructed as follows:

3m expiry

Strike at 1.04 (~10% OTMF = 2x standard deviation of 3m rolling returns using a 10y window; annualized implied vol sits in the 18-19% camp)

Pay upfront 17% → potential payoff ~6x your initial cash outlay.

The skew isn’t cheap, but for good reasons.

And given the elevated levels of realized volatility I expect and the underlying macro drivers we just discussed, a 6x payoff here sounds like a reasonable risk/reward expression.

As I am already short EURUSD, I refrained from adding a short BTP/Bund spread position but that seems to me as one of the most asymmetric trades out there: I expect some fiscal largesse from new PM Meloni, and you have seen how markets react to that kind of news lately - 300+ bps is a distinct possibility, while the downside (tighter spreads) is limited and the negative carry hurts less when volatility and hence potential P&L opportunities are so large.

To sum it all up: buckle up - FX vol is back, and it matters.

That was all for today!

If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within the TMC family - they might appreciate it and after all…it’s free!

P.S. Over the next few weeks there will be a lot (!) of exciting news: stay tuned!

See you soon here for another article of The Macro Compass, a community of more than 98,000+ worldwide investors and macro enthusiasts!

If you are interested in any kind of partnership, sponsorship, conferences or media appearances feel free to reach out at TheMacroCompass@gmail.com.

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Every week, I also interview the best macro strategists and risk takers around the world and ask them what’s their top trade idea on my podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks YouTube channel.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post