‘‘We will keep at it until we are confident the job (i.e. killing inflation) is done.’’

Jerome Powell, Jackson Hole speech

Hi all, and welcome back on The Macro Compass!

Economic data continues to disappoint with some pretty impressive downside surprises in leading, interest-rate sensitive sectors like housing.

QT is about to accelerate and the friendly dynamics behind the Fed balance sheet composition which helped risk assets stage a comeback rally in July are likely to fade away in Q4.

Nevertheless, we just heard Powell deliver a very decisive speech in Jackson Hole where he stressed out that the Fed won’t be making another mistake: after underestimating inflation in 2021 and delaying the tightening cycle, they will not prematurely stop now.

On the other hand, they will keep at it until they are confident the job is done.

And getting the job done will come at a great cost for the economy and markets.

In this article, we will:

Discuss recent economic data, the impact QT is likely to have from now onwards and how the markets are responding to this very interesting set of macro and monetary policy variables;

Summarize implications for long-term and tactical portfolio allocations.

Don’t Fight The Fed

Actually, before we jump right in.

As you know I am a supporter of rule-based investing and risk management practices, as they are proven to reduce our innate bias towards emotional decision making.

Very often though this approach requires quantitative skills and complicated coding infrastructure which makes popular and successful strategies (e.g. momentum, minimum volatility, risk parity, inflation hedge etc) accessible only to sophisticated investors.

The guys at Composer are doing a very good job in democratizing this rule-based investment approach: they empower you to build and backtest your own strategy (at no cost!) and of course to also directly invest in these systematic strategies that minimize emotional decision making.

I definitely recommend checking them out - here is the link.

Now, back to it: let’s look at the latest set of economic data, the dynamics affecting the Fed balance sheet and how markets are interpreting Powell’s Jackson Hole speech.

1. Housing IS The Business Cycle, And It Doesn’t Look Good

Housing activity is slowing down very fast, and it matters.

If we also consider the second round spending/activity around the housing market, it accounts for almost 20% of GDP in many countries and its highly leveraged, interest-rate sensitive nature makes it prone to move first when financial conditions and economic cycles are changing - this is why housing is so crucial to the business cycle.

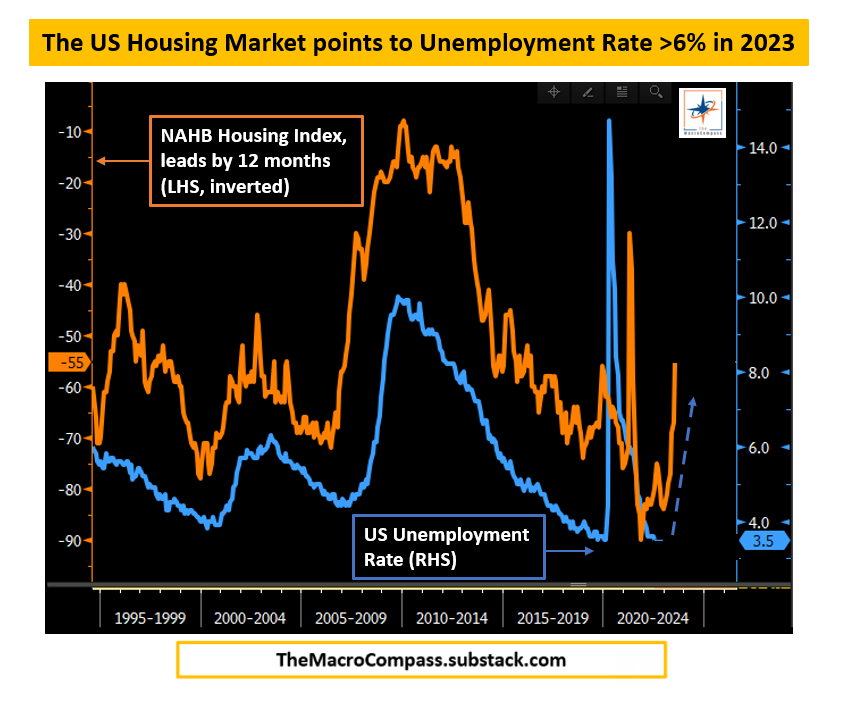

The chart below shows the US NAHB Housing Index (orange, inverted on the LHS) against the Unemployment Rate (blue, on the RHS).

Big changes in the National Association of Home Builders Index lead turns in unemployment rate by roughly 12 months - with the notable exception being the 2020 pandemic where the global economy was shut down so fast that the housing market couldn't lead the process.

With the momentum of US home sales slowing faster than in 2007 (!) due to the terrible affordability of real estate at the moment, the NAHB index just lost 30+ points.

Historically, such a drop precedes a 3% jump in Unemployment Rate.

If the correlation would hold, that implies US Unemployment Rate above 6% in 2023.

Soft landing, you said? :)

Aside from housing, also other leading economic indicators keep deteriorating.

The US Conference Board ranks the top 10 economic leading indicators and wraps them in a very convenient diffusion index depicted in the chart below.

Every time the index prints two or more times below 0, we are already in a full recession - you know, not only a technical one but one that also leads to protracted weakness in the labor market.

Once this criteria was met, the index correctly forecasted 5/5 recessions since the ‘80s.

The recent trend is clear and the last print was 0: let’s monitor what happens next.

In short: tighter monetary and financial conditions take a few months to be fully reflect in leading indicators, and a few quarters to affect hard coincident indicators like the labor market and real consumer spending.

It seems we are getting there, and the path after that doesn’t look great either.

2. Central Banks’ Balance Sheets DO Matter For Markets

Have we forgotten about QT?

As I explained in this primer, QT matters for markets as it generally reduces the amount of interbank liquidity (bank reserves) while adding net collateral (bonds) the private sector needs to absorb at the same time - this has major implication for repo rates and risk taking, more in the article above.

But over the past few weeks a very interesting phenomenon occurred: despite ongoing QT, bank reserves actually grew (!).

What the heck?

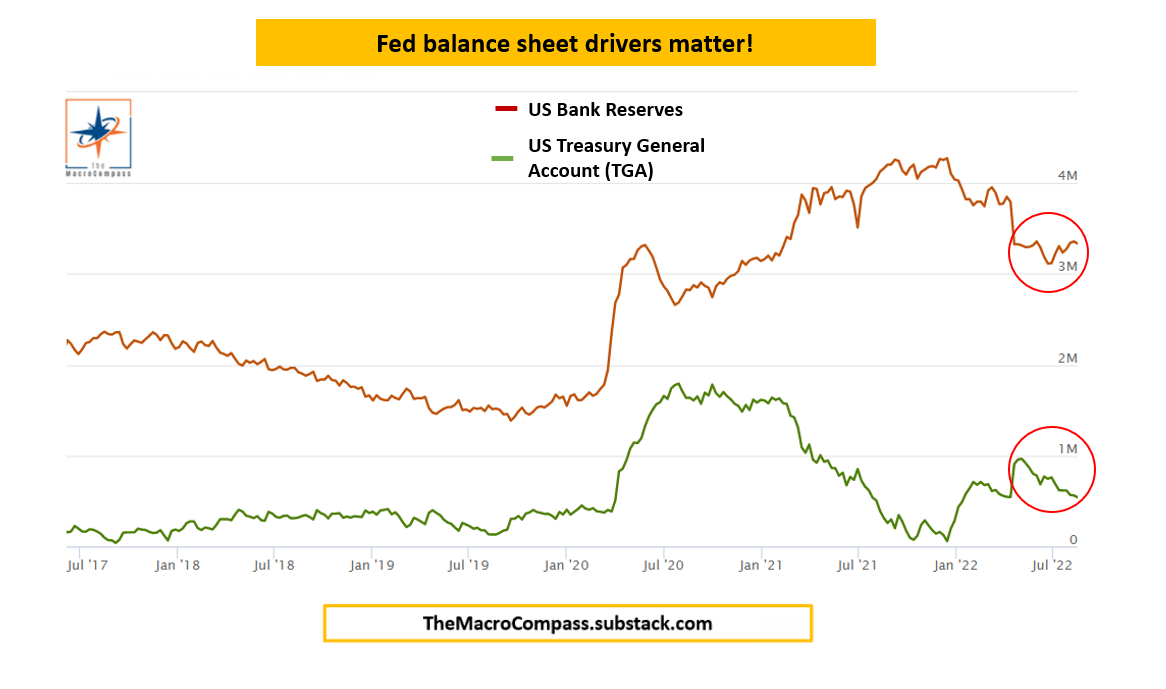

When the asset side of the Fed balance sheet shrinks (QT), liabilities must shrink too: but bank reserves aren’t the only liability there - the Treasury General Account (TGA) and Reverse Repos (RRP) are also Fed liabilities.

After a very strong tax season in April, the TGA (green) almost hit $1 trillion.

The US government just took some of that TGA money from the Fed accounts and spent it in the real economy - as they did that and the RRP outstanding was virtually unchanged, it was the drop in TGA which took the hit for QT rather than bank reserves (red).

This supported risk assets on the margin, but this trend isn’t likely to continue in Q4.

As the TGA is almost down to standard levels and money stuck in the Reverse Repo facility likely struggles to get out given the absence of T-Bills issuance, bank reserves are going to bear the brunt - and when they do, risk assets tend to suffer and the yield curve flattens further.

That's because while Central Banks can greatly affect front-end yields, long-end yields are mostly driven by expectations about future growth and inflation.

QE helps boosting those expectations, while QT kills them and hence flatter curves.

In short: Central Bank balance sheet dynamics matter for markets, and as QT accelerates and bank reserves bear the brunt of it in Q4 => ceteris paribus risk assets tend to suffer and yield curves flatten further.

3. Markets Are Taking Powell’s Jackson Hole Speech Seriously

Powell’s Jackson Hole speech was unambiguous: short, direct, crystal clear.

The Fed won’t make the mistake of stopping too early or allowing financial conditions to unnecessarily ease before the job is done.

In other words: Fed pivot my a*s.

In the past, the Fed never stopped hiking before real Fed Funds (nominal Fed Funds minus YoY PCE) turned positive and this time won’t be different - actually they might want to tighten the screws further given the dangerous inflationary pressures.

Hence, the real battlefield for markets lies in pricing the path of Fed Funds and inflation in 2023 and 2024 - this is how it looks like today.

Bond markets smell a sharp economic slowdown and hence have a strong opinion inflation will quickly decelerate to 3%.

Given the Fed’s clear message they will ‘‘keep at it until the job is done’’, they are pricing Fed Funds in the 3.4% area by Q423 - Q124.

The medium term important implication of Powell’s Jackson Hole speech lies in its unambiguous commitment to kill inflation even if it means a ‘‘sustained period of below-trend growth and softness in the labor market as these are the unfortunate costs of reducing inflation’’.

He is telling you to prepare for sluggish long-term growth and inflation expectations while financial conditions will have to remain tight despite that.

This is relevant for long-term and tactical asset allocation.

Markets & Portfolio Implications

It’s time to be defensive: over the next 6-12 months, long-end bonds should deliver a much better performance than (especially cyclical) equities.

My main tilts in the Long-Term ETF Portfolio are unchanged: underweight equities, overweight cash, and accumulating long-end EUR and USD bonds.

After the crazy ‘‘Fed will pivot hence let’s leverage up again and buy stonks’’ rally we witnessed in July, I expect equity markets to remain soft as the Fed is keen in keeping financial conditions tight and real yields high while earnings could soon start to seriously disappoint. Cyclicals (and Europe) should suffer more.

My long-term bond positions are roughly back to entry levels, and the plan remains to build up exposure if 10y Treasuries trade in the 3.25-3.50% area again: the more and the longer the Fed pushes on the accelerator, the worse the economic slowdown is going to be - hence improving the attractiveness of 10y+ bonds for a medium/long-term investor.

I also expect plenty of interesting opportunities to allocate capital towards gold and high quality stocks as the next market volatility phase could indiscriminately and disproportionately hit also these asset classes which would instead be the first ones to positively react to a (true) Fed pivot.

In my Tactical Portfolio, the macro tilt towards weaker economic growth and stronger safe haven currencies remains unchanged: short EUR/USD and Russell 2000, long JPY / short CAD and AUD.

The first 7-8 months of 2022 = short (almost) everything, long cash.

The next 7-8 months might offer some good opportunities, starting from bonds.

As always, we will jump into the next macro learning journey together on The Macro Compass.

And this was all for today, thanks for reading!

If you are interested in any kind of partnership, sponsorship, conferences or media appearances feel free to reach out at TheMacroCompass@gmail.com.

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

See you soon here for another article of The Macro Compass, a community of more than 88,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.