Hi everybody, and welcome back to The Macro Compass!

The Fed intends to drain ‘’liquidity’’ at a rapid pace in 2023.

And while the pace might be more friendly for the next months, don’t get distracted.

Banks, the repo market and Wall Street will soon start feeling the heat.

In this piece, we will:

Explain what ‘‘liquidity’’ really is in plain English;

Go over the drivers of US liquidity in 2023;

Assess how they will interact with each others and drive markets;

Conclude by refreshing our market views and our actionable ETF Portfolio

Let’s start with the basics: ‘’liquidity’’ = bank reserves.

It’s one line item you can easily track on the Fed balance sheet (liabilities), and you don’t need any fancy formula to calculate it.

Bank reserves are money for banks.

Banks use reserves to transact with each other and with the Fed: to settle transactions, buy bonds (!) from each other, and lubricate the biggest funding mechanism in the world – the repo market.

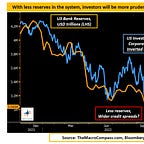

A regime of ample reserves helps banks in providing liquidity to financial markets.

In that regime, banks will facilitate a smooth functioning of the repo market and have appetite for absorbing high-quality bonds (Treasuries, high-rated corporate bonds and mortgage-backed securities etc).

As repo markets work smoothly and banks bid high-quality bonds, investors tend to take more risks.

Instead, tighten ‘’liquidity’’ rapidly and over time investors’ risk appetite could fade.

No, I will not draw a line chart of ‘’liquidity’’ versus the S&P500 and tell you that is the magic formula.

Because that’s macro gaslighting, or aka bull…. :)

Banks don’t use reserves to buy stocks because equities are not a regulatory well-treated asset (HQLA).

Monetary plumbing is not so easy.

But yes, the amount and the rate of change of bank reserves matter for repo markets and risk appetite.

And in 2023, a lot will be going on with bank reserves.

Let’s start with the elephant in the room: Quantitative Tightening.

In its simplest form, QT shrinks the balance sheet of the Fed on the asset side (bonds not reinvested) and on the liability side – here, the standard is that bank reserves are destroyed.

As the government keeps issuing bonds over time, it’s up to the private sector to absorb bond issuance.

Reserves are destroyed, and private investors have less room to allocate towards riskier assets.

The Fed will be running QT at a yearly pace of > $1 trillion.

So, does this mean reserves are going to linearly shrink by $95 billion per month?

And most importantly: how will other factors like the Treasury General Account (TGA) or the Reverse Repo Facility (RRP) impact US liquidity?

Understanding ‘‘liquidity’’ is crucial to navigate markets.

Let’s dig in, and assess how we position for these dynamics at The Macro Compass…

From January 2023, getting access to the premium The Macro Compass content will require a paid subscription.

Not only deep and unique macro insights but also ETF Portfolios, tactical trade ideas, interactive tools, courses and much more are available on the TMC platform.

Come join this vibrant community of macro investors - check out which subscription tier suits you the most using the link below.

For more information, here is the website.