18’ reading time

Good morning everybody and welcome back to The Macro Compass!

This article will break down last week’s Central Bank meetings: why and what should you care about, and what does that mean for your portfolio.

Specifically, we are going to touch upon:

The most interesting (yet overlooked) takes from ECB/Fed meetings and what to pay attention to in 2022

The resulting overweight/underweight in my medium-term ETF portfolio

Without further ado, let’s jump right in!

The devil is in the details

Central Banks meetings last week were mildly hawkish across the board - let’s have a look at some interesting takes from Powell and Lagarde.

The Fed decided to accelerate its tapering plan to ‘‘retain optionality’’ on when to start the hiking cycle as the FOMC noticed rapid progress towards maximum employment and inflation running consistently above targets.

Powell mentioned few interesting things.

The labor market is hot, but we recognize that labor force participation rate is weak. Nevertheless, we need to make policy now and we are facing strong inflationary pressures.

We all know the Fed has a dual target: price stability and maximum employment.

In 2020, their monetary policy review exercise concluded that FAIT (flexible average inflation targeting) was the way to go: as the St. Louis Fed explained, ‘‘under this new strategy, the Fed will seek inflation that averages 2% over a time frame that is not formally defined. This means that after long periods of low inflation, the Fed will not enact tighter monetary policy to prevent rates higher than 2%. One benefit of this flexible strategy to managing the mandate of price stability is that it will impose fewer restrictions on the mandate of full employment.’’

The FOMC is watching a robust cyclical recovery in the labor market, but it’s well aware of the structural and long-lasting damage (read: lower participation rate) caused by the pandemic shock. Nevertheless, they chose to accelerate their tightening plans as inflationary pressures persist.

FAIT is basically out of the window.

Within the dual mandate, it seems now clear that price stability > > > labor market.

The other interesting thing was the updated FOMC forecast for inflation over the next 3 years.

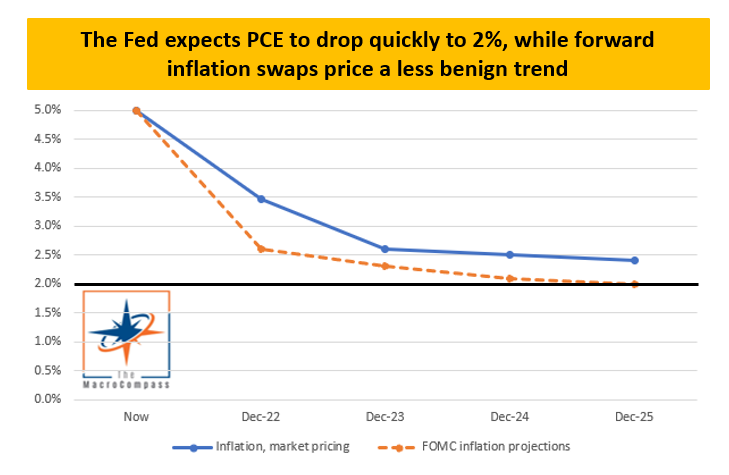

The Fed now expects their preferred measure of inflation (PCE) to drop to 2.6% in 2022, 2.3% in 2023 and then quickly converge to their long-term target of 2.0%.

The chart above shows that while both FOMC members and market participants foresee inflation converging to 2% over the next few years, the Fed inflation projections (orange line) are more benign than what’s priced in via forward inflation swaps (blue line).

As the labor market keeps healing, if realized PCE ends up being closer to what market participants price in (rather than the benign FOMC forecasts) we might be in for some additional hawkish surprises.

Interestingly though, despite being more sanguine on inflation projections traders have a hard time believing in a robust hiking cycle.

Post FOMC meeting, the OIS-implied path for Fed Funds rate over the next 5 years has diverged further from the Fed’s dot plot.

After pricing 3 hikes in 2022, market participants simply don’t believe the Fed dot plot can materialize: terminal Fed Funds rate are priced around 1.5% versus the Fed’s own long-run dot at 2.5%.

Summing up:

The Fed has turned: as maximum employment seems within reach, the focus has now turned on inflation - despite relatively benign PCE forecasts, the pressure to act is strong. FAIT has been watered down aggressively again.

Watch out for PCE, changes to the terminal Fed dot and the first announcement about quantitative tightening!

What about the ECB meeting?

The ECB meeting also delivered a mildly hawkish outcome: the 2022 net QE envelope has been effectively set in stone at approximately EUR 450 bn, hikes were foreseen possible in 2023 and no new cheap TLTRO funding for banks was announced (very relevant point, we will cover it later).

The two most interesting points from Lagarde?

She tried hard to stress ECB has flexibility to restart PEPP (mmmhhh) and that there is no end date yet to APP, so QE is still open-ended (mmmhhh)

One of the most impactful aspects of the ECB’s pandemic QE program was its flexibility to adapt to market conditions: this feature effectively served as a virtual cap for spreads and a volatility killer - I argue this feature is largely watered down now.

Restarting PEPP would require an unlikely ad-hoc ECB Governing Council approval, and the fact that the APP pace for 2022 has already been decided strongly hints that flexibility is very little.

Moreover, the declining APP pace throughout next year signals that the base case is for QE being completely phased out in 2022.

Next year, the ECB will still absorb most of net borrowing needs from governments and the European Union but the private sector will be required to step in a bit.

That’s a relatively large change from 2021, a year who saw the private sector being crowded out by the ECB who scooped up all net issuance AND bought some more bonds on top - will spreads still remain contained?

The second, very relevant point was about TLTROs, excess liquidity and tiering.

It was announced that ‘‘The Governing Council expects the special conditions applicable under TLTRO III to end in June 2022’’ and Lagarde discussed adjusting the two-tier system to remunerate excess reserves parked at the Central Bank

As a reminder, European banks can borrow (TLTRO) from the ECB posting collateral and they can do so at very favorable rates (up to -1%!) as long as their net lending activity reaches a whopping >0% level - effectively, the ECB pays European banks NOT to shrink their loan books.

These very cheap TLTROs will end in June 2022, and that’s very relevant: why?

Because as a result, the ECB balance sheet will start shrinking in 2022 already.

Yes, you read correctly.

ECB. Balance. Sheet. Shrinking.

European Banks have borrowed EUR 2.2 trillion (!) using these TLTRO windows over the last few years, and they are now likely to repay a chunky amount next year already.

Conditions will become much less palatable: the incentive to diversify funding away from Central Banks, to avoid funding cliffs in 2023 when most of TLTRO loans mature, the leverage ratio exemption for bank reserves expiring in 2022 making balance sheets more expensive and the increasing difficulties in sourcing cheap collateral to post for TLTRO will all contribute to European banks repaying some of their outstanding loans in 2022.

As TLTRO loans are repaid, my forecasts point to the ECB balance sheet shrinking in 2022 already despite the 400+bn offsetting from net QE.

In 2022, net QE will add approx. EUR 450 bn in new excess reserves but as I expect around EUR 1 trn net TLTRO repayments the amount of excess liquidity in the European system is set to drop by EUR 500bn+.

Nevertheless, the stock of bank reserves will remain very large at EUR 4 trillion.

What’s very relevant is also how will these reserves be remunerated?

Currently, excess bank reserves in the Eurozone are subject to a two-tier system: reserves up to 7x the minimum reserve requirement (approx. EUR 1 trn) are remunerated at 0% yield, while all reserves exceeding this threshold are subject to the punitive -0.50% ECB overnight deposit rate.

Lagarde hinted at upcoming adjustments for the tiering multiplier, as to ‘‘allow banks to perform their lending activity amidst an environment of abundant excess reserves’’.

Now, I hope the ECB knows that banks lending decisions are not affected by the amount of reserves in the system: they actually lend more if they are well capitalized and profitable, and the -0.50% charge on excess reserves penalizes them.

Increasing the tiering multiplier above the current 7x would be pretty relevant for several fixed income markets: exempting additional reserves from the -0.50% ECB deposit rate would make the alternative outlet for these reserves look less appealing - that’s mostly government bonds (+ reverse repo).

Summing up:

The Fed has turned: as maximum employment seems within reach, the focus has now turned on inflation - despite relatively benign PCE forecasts, the pressure to act is strong.

Watch out for PCE, changes to the terminal Fed dot and the first announcement about quantitative tightening in 2022!

The ECB has already set in stone their QE envelope for 2022, and as TLTRO loans will be prematurely repaid this will lead to a shrinking balance sheet.

Pay attention to TLTRO repayment figures and announcement on the tiering multiplier in 2022!

Some investment ideas!

I am very excited to kick-off this section of the Macro Compass newsletter!

The investment ideas section will contain:

Medium/long term investment ideas: I will use a model ETF portfolio as a benchmark and signal my under-weights and over-weights for each (sub) asset class. The holding period of these OW/UWs is intended to be few months - or longer, as we will let profits run and cut losses as always.

Short/medium term investment ideas: this will reflect my unconstrained global macro total return portfolio. The holding period for these investment ideas will be slightly shorter and targeted for the more sophisticated part of the audience. I will occasionally post some of these ideas here, but if institutional investors are interested to a deeper collaboration they can reach me at themacrocompass@gmail.com.

My model ETF portfolio is not intended to generate positive total returns every year, but just to serve as a yardstick for a long-term asset allocation benchmark and to be used to calibrate my OW/UW investment ideas.

Said that, how does my model ETF portfolio look like and what are my OW/UW?

As you can see, the model portfolio is composed as follows:

55.0% equities, of which 40% DM stocks and 15% EM stocks

27.5% bonds, of which 20% long-end Treasuries, 5% high-yield and 2.5% TIPS

10.0% commodities, of which 5% oil and 5% gold

2.5% Bitcoin

5.0% USD cash

I am underweight in:

Earnings growth sensitive sectors of the equity market: value and EM equities

Assets that suffer from higher real yields: TIPS and gold

Bitcoin, due to its turbocharged beta to risk assets at this stage

I am instead overweight in:

USD cash: as the Fed increases rates and inflation moderates, the real cost of owning optionality to stay on the sidelines (USD cash) decreases. Also, if you’re not based in the US and have this alternative, you’ll be long USD/xxx.

Nasdaq: if you really have to be exposed to equity beta here, I’d still prefer US growth stocks over value and non-US. While short-term real rates might move higher, long-term yields adjusted for inflation should remain more anchored (supporting valuations) and winter lockdowns should benefit tech stocks.

As this section of the newsletter is work in progress, I truly welcome any feedbacks on how to improve the format/content and make it more enjoyable for you!

We are now an 11.500+ community here on The Macro Compass. Thank you all!

If you liked this article, why not share it with your (social) network?

If you are not subscribed yet and you’d like to receive updates directly in your inbox, you can subscribe clicking on the button below.

Are you looking for a partnership or a collaboration?

Feel free to get in touch at themacrocompass@gmail.com.

I generally publish 1-2x a week (Monday + Thursday) covering market developments across asset classes, providing investment ideas and digging deep into broad macro topics. From the desk of a former Head of a $20 bn Investment Portfolio straight into your inbox.

And the best part of it: for free!

See you at the next update, which will be on Jan 3rd.

Happy holidays!