Hi nice people, and welcome back to The Macro Compass.

This is an old-style free macro piece for everybody - enjoy!

The soft landing crew is increasingly taking over.

No, the bond market’s base case is not a recession - it’s immaculate disinflation.

Yes, getting this call right is crucial for your portfolio performance in 2023.

In this article, we will:

Look at different corners of the bond and equity markets to assess what are the market-implied probabilities of a recession or a soft landing;

Debate how to approach macro investing in such a binary environment.

The Bond Market - Immaculate Disinflation

‘‘The bond market is pricing 200 bps of cuts = the bond market says recession - 100% !’’

No, not really.

The bond market’s base case is immaculate disinflation, and let me show you why.

Most of the confusion stems from an overly simplistic approach.

In the average recession over the last 30 years, the Fed cut by 350 bps over an 18 months period.

The bond market is pricing 200 bps worth of cuts between Jun-2023 and Dec-2024, so that must mean the bond market’s base case (60%) is a recession.

This simplistic analysis is misleading because it ignores:

- The ultimate landing point for Fed Funds and real yields

- The credit market

- The tails

Let’s start with a clear chart.

Fed Funds are priced to peak at ~5% in summer, and then 200 bps of cuts are expected.

Yet, Fed Funds are never (!) priced to be below reasonable estimates of neutral rate (2.25-2.75% in nominal terms) throughout the next 2-5 years.

This would be the first time ever the US is in a recession and the Fed doesn’t cut rates below neutral - it doesn’t make sense, right?

Indeed, because the bond market’s base case is not a recession: it’s immaculate disinflation.

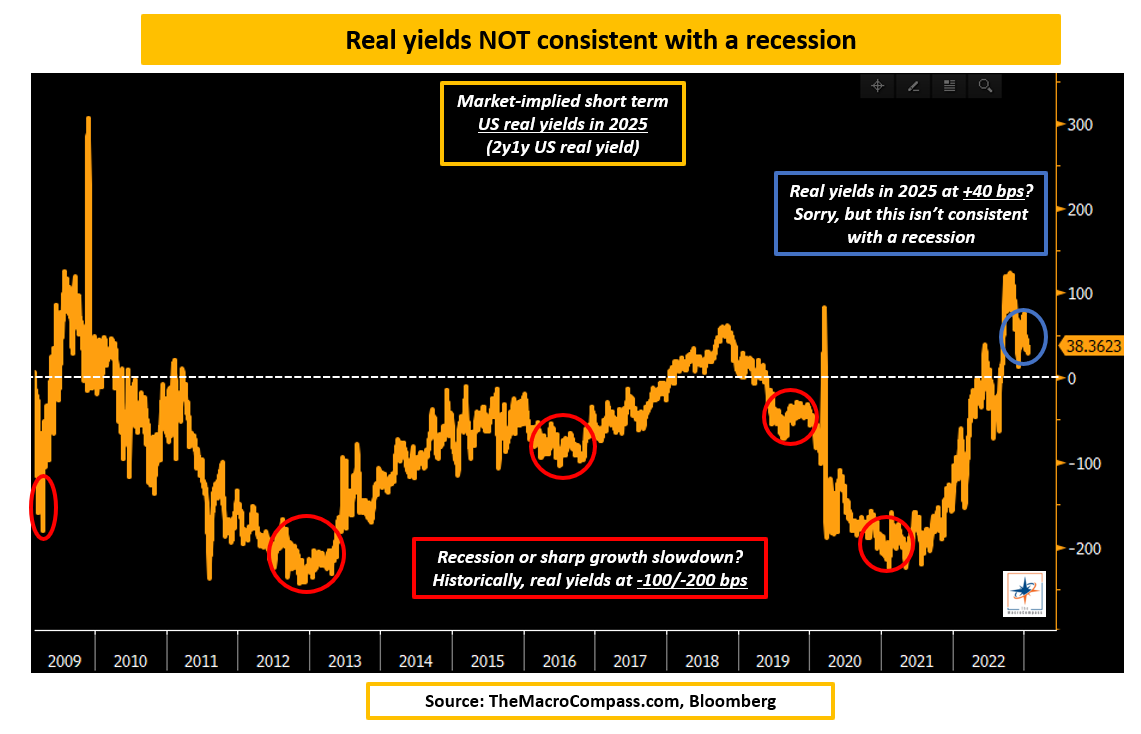

This is also evident in the expected path for real yields, which compares expectations for Fed Funds (see above) against inflation expectations.

In any recessionary or growth slowdown episode of the last 15 years, real Fed Funds 2-year ahead were priced to be between -100 and -200 bps.

That’s the bond market asking the Fed to be very accommodative given poor growth.

This time, market-implied US real yields in 2025 are priced to be…positive?!

Again, that doesn’t square with the ‘‘bond market is pricing in a recession’’ mantra.

Inflation slowing down to 2.5% quickly, and the Fed cutting rates to neutral (and never below) is not recessionary pricing.

It’s immaculate disinflation pricing.

The credit market wholeheartedly agrees: a recession is not the base case.

US high-yield credit spreads are trading barely above 400 bps, below the 20-year average and far away from median recessionary episodes (1000 bps).

Additionally, the default cycle is priced in to be very mild and downside protection in the broad credit market is not as expensive as it would be if a recession was base case.

Finally, the tails.

Insurance is very expensive when the house is already on fire.

So, what tail risks are markets trying to insure against by December 2024?

A recession with Fed cutting rates below neutral (say, to 1.5% - orange line) or higher-for-longer (say, Fed Funds above 4% - blue line)?

Using a 2-year horizon and option-implied probabilities, insurance on the Fed keeping rates higher-for-longer is more expensive than insurance on Fed cutting rates in a magnitude consistent with a recession.

The bond market’s base case is immaculate disinflation, not a recession.

A relaxed credit market, inflation rapidly declining to 2% and the Fed cutting rates back to neutral, forward real rates still expected in positive territory and the lack of aggressive insurance bid for recessionary cuts all point in that direction.

Recession: 20-25% probability

Immaculate disinflation: 45-50% probability

Growth regime/higher-for-longer: 30% probability

The Equity Market - Soft Landing

The equity market’s base case has rapidly shifted towards soft landing.

There are three main angles to cover:

- Earnings expectations

- The internals of the stock markets

- The tails

First, the more recessionary vibes.

Analysts are realizing their 2023 EPS estimates might have been too optimistic.

The pace and breadth of negative revisions is in line with other recessionary episodes.

Also, highly cyclical sectors like semiconductors are experiencing EPS slashes in the 30% area which are almost consistent with a recession.

Yet, 2023 EPS consensus at $225 implies roughly a 4% earnings growth this year.

In recessionary episodes, the average EPS decline is instead -30%.

The Chinese reopening is obviously playing a role in boosting cyclical growth expectations around the world.

Countries with tight Chinese trade relationships like Germany or Australia have outperformed in a risk-adjusted way.

Within sectors, US semiconductors and high-beta have been the market’s darling while defensive sectors like staples and utilities are lagging.

Soft landing vibes getting stronger, helped by the Chinese reopening.

What about tails?

If markets were truly worried about an earnings recession and a stubbornly higher-for-longer Fed, you’d expect some bid for deep out-of-the-money put options.

But given the absence of jump risks in 2022, the strong ‘‘Fed put’’ muscle memory and expectations for earnings to be weak but not in recessionary territory downside protection in the S&P 500 is at the cheapest levels in 2 years.

The implied volatility in 20% out-of-the-money SPX puts with a 3-month expiry are trading in the lowest 15th percentile on a 2-year history (chart below) and in the lowest 40th percentile on a 5-year history.

The stock market’s base case is that a broad recession will be avoided as the growth downturn is bottoming (also thanks to China) and that we are past peak Fed tightness.

Downside earnings revisions are happening, but EPS is expected to still grow which is not consistent with a recession.

A cyclical growth boost is getting increasingly priced in, and cyclical sectors and countries are outperforming defensive.

Finally, the option market shows investors have little to no appetite for buying heavy downside protection.

Recession: 15-20% probability

Soft Landing: 60-70% probability

Growth regime: 15-20% probability

Conclusions

Neither the bond nor the equity markets are pricing a recession as a very high probability scenario.

Instead, the base case is an immaculate disinflationary episode leading to a period of below-trend growth.

How do investors navigate this rather binary macro outlook, with a gravitational pull force (nominal growth slowdown) opposed by a cyclical push force (Chinese reopening boosting growth expectations)?

The three best practices are:

Rely on a data-driven macro process, and don’t get stuck in a narrative if data is not validating it;

Use episodes of extreme market conviction in the prevalence of the pull or push dynamic to take advantage of macro opportunities;

Look for allocations towards investments that have a positive expected value in both outcomes, or for exposure to idiosyncratic asset classes whose return profile is not solely dependent on calling this binary macro outcome right.

Finally, an important reminder.

From January 2023, getting access to the premium The Macro Compass content requires a paid subscription.

If I haven’t convinced you to join with this piece, what else will? :)

Maybe telling you that you’ll find not only deep and unique macro insights but also actionable ETF Portfolios, tactical trades, interactive tools, courses and much more.

Come join this vibrant community of macro investors - check out which subscription tier suits you the most using the link below.

For more information, here is the website.

Share this post