‘‘We are at the early stages of the U.S. economic expansion’’

James Bullard - June 24, 2022

Hey guys!

Back from my holiday, and happy to be writing a piece of The Macro Compass again.

While I was out, the Fed kept talking the US economy up but economic data showed clear signs of slowdown and we witnessed big moves in markets that seem to compound that thesis.

‘‘Global R’’ calls even are making the rounds.

That begs two questions:

Will we actually see a global recession?

And if so: when, and how bad?

Is A Global Recession Coming?

Actually, before we jump right in.

If you are reading The Macro Compass, you’ll probably be interested in other good quality newsletters.

The guys at The Daily Upside are doing a great job at sifting through the clickbait-y headlines traditional financial media poses.

Instead, their team of investment bankers, scholars, and journalists condense the latest financial stories in a clear, concise, and occasionally witty daily newsletter - it is read by over 500,000 people every day and by the way…it’s free!

I definitely recommend checking them out: here is the link.

Now, back to it: how likely is a global recession? And when is it going to hit?

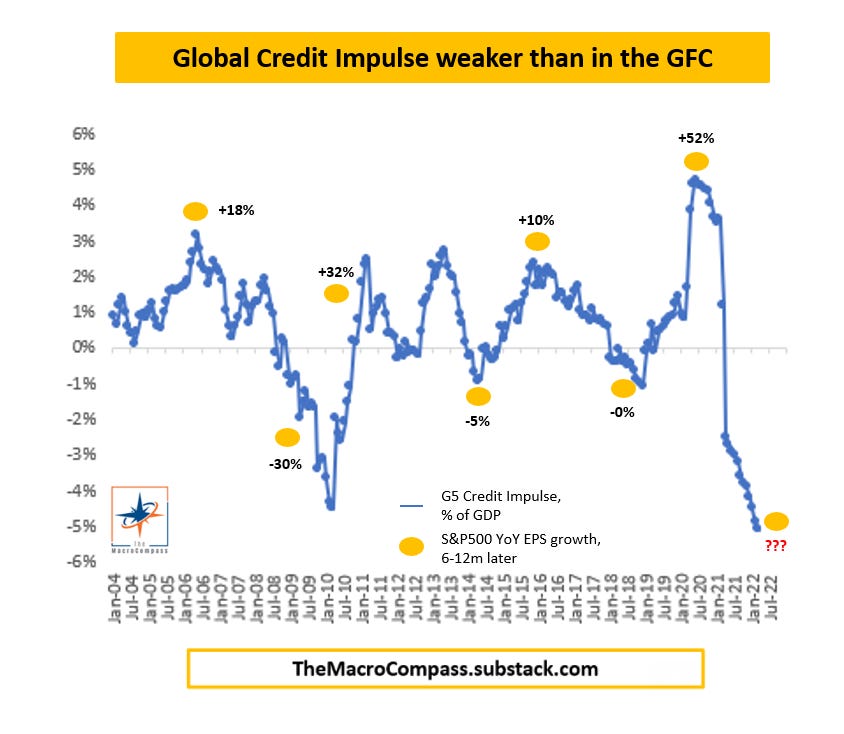

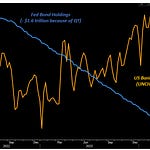

Amongst the many forward-looking economic indicators I focus on, you will know by now that one of my preferred metrics is my G5 Credit Impulse series: it measures the pace of change of credit creation in the 5 largest economies worldwide and it serves as a very reliable leading indicator (6-15 months lead time) for economic growth and the performance of several asset classes.

Why?

Because as our structural ability to deliver economic growth is impaired by weak demographics and stagnant productivity, we learnt that printing money out of thin air works as a (temporary) substitute: the more money we inject in the private sector, the more likely we’ll get a cyclical boost to economic growth.

Slow down that process, and growth will cyclically slow down too.

Notice two things:

Printing money = printing bank deposits held by the non-financial private sector (us), not bank reserves printed by Central Banks.

The former represents the ‘‘real economy’’ money printing, and the printers sit within commercial banks and governments - not Central Banks.

More about that in these pieces (here, here and here).The pace of change (acceleration or deceleration) in real-economy money creation matters more than the mere direction.

That’s because our system is based on the continuous expansion of credit and leverage, and hence while the direction is generally set in stone (up, apart from rare global de-leveraging episodes) the pace of change is more relevant.

So, how is the G5 Credit Impulse looking like today?

I am in the process of updating the series, but these are the preliminary indications.

Sharp changes of direction in the Credit Impulse series have historically predicted aggressive acceleration or deceleration in the S&P 500 YoY earnings per share by a few quarters.

Courtesy of the massive fiscal drags and tepid refinancing activity in the private sector, we are now witnessing a contraction in credit creation which is even faster than the one we experienced during the Great Financial Crisis.

As a result, we shouldn’t discard an earnings recession in late 2022/early 2023 already - for reference, analysts are still expecting earnings to grow by almost 10% this year and next year.

But what actually defines a recession?

While I discussed above a potential earnings recession, the historical NBER definition implies two consecutive quarters of negative real GDP growth.

The truth is a proper recession involves the labor market: after all, US consumer spending accounts for almost 70% of GDP and as long as the labor market holds consumers might hold too.

The labor market is a coincident indicator: when it materially weakens above certain threshold, you are already in a recession.

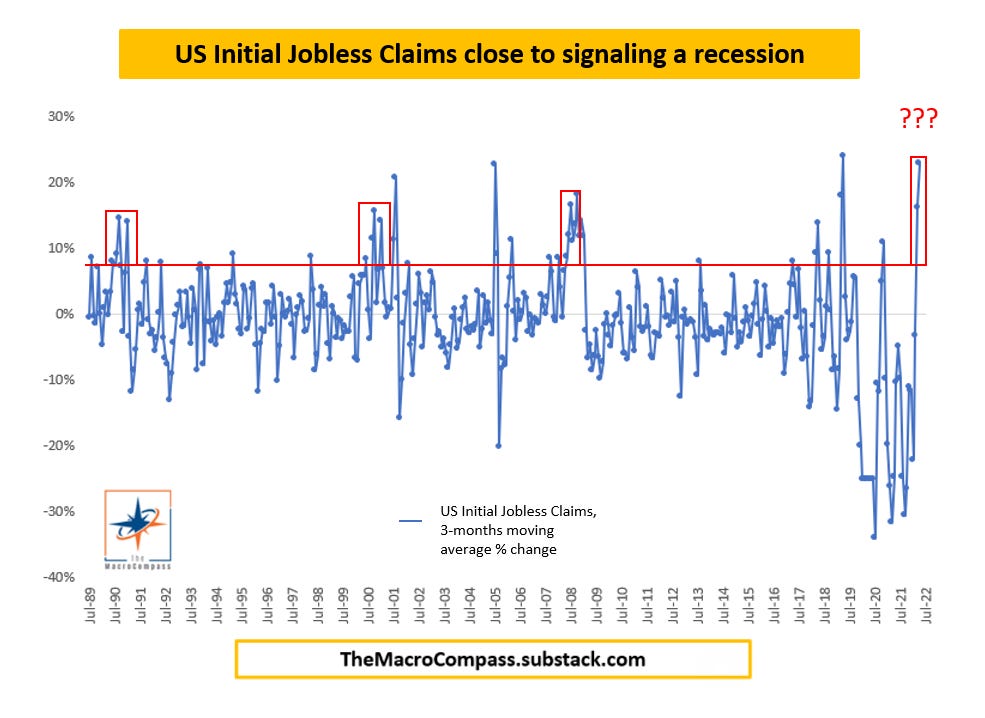

Keeping that in mind, let’s have a look at one of the most forward looking labor market indicator out there - US Initial Jobless Claims.

The 1990, 2001 and 2008 recessions all happened when the % change in the 3-months moving average in US Initial Jobless Claims exceeded 7% for at least 3 of the last 4 observations.

The last two prints for the 4th week of May and June 2022 were +18% and +14%.

A print in the 220k area at the end of July would add fuel to the fire, confirming the US labor market is indeed weakening and contributing further to the recessionary narrative.

Markets are beginning to validate this narrative, too.

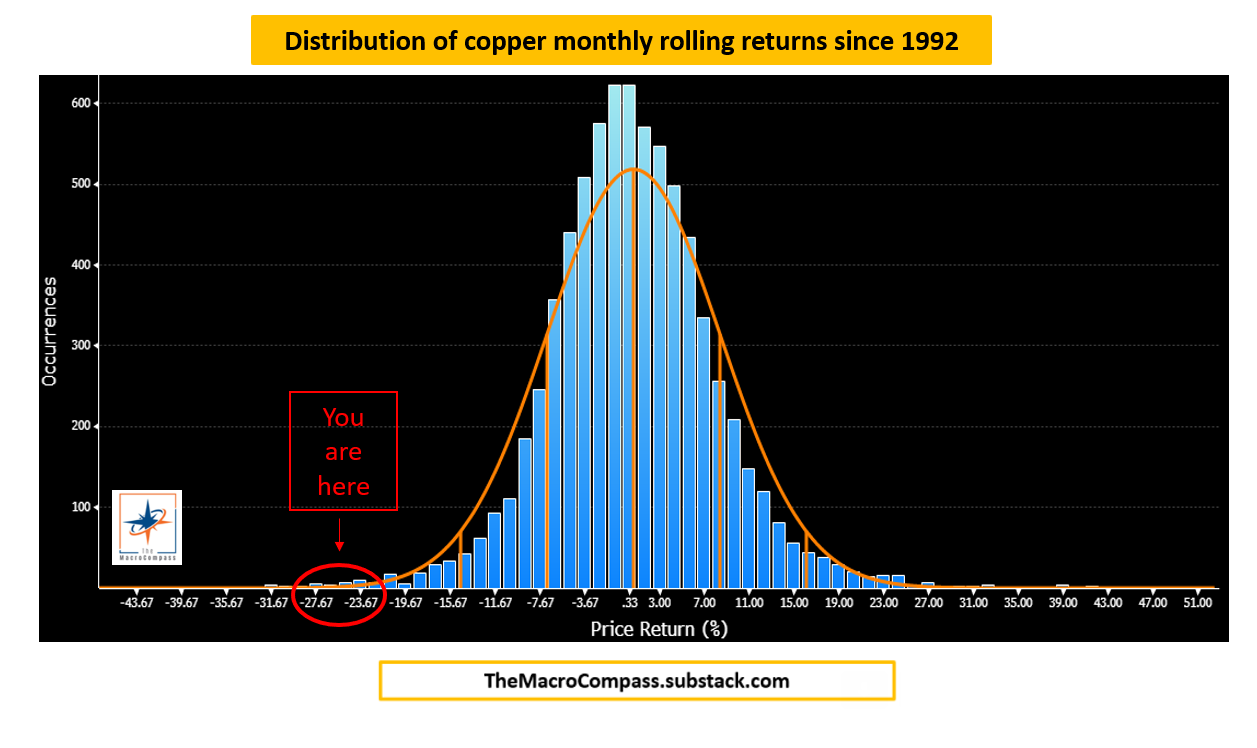

Copper is considered the bellwether for global industrial activity due to its multiple end-uses and applications in the real economy.

Its recent -25% monthly drawdown only occurred 0.45% of the times since 1992 (32 times in over 7500 rolling monthly return observations).

If you exclude the idiosyncratic Sumitomo Copper affair (cool story, read here) such a magnitude of Copper drawdowns was only experienced around the GFC period.

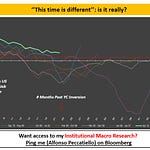

Additionally, Mr. Bond Market is now pricing the Fed to convincingly cut rates immediately after the terminal rate has been reached in its brief but intense hiking cycle - almost 100 bps cuts are priced between Jan23 and Dec24.

Over the last 15 years, the Fed was never ever priced to cut rates so aggressively in the 6-32 months period immediately following a hiking cycle.

The bond market has a strong opinion here.

As you have read here on The Macro Compass since December 2021, I have long been expecting a sharp economic slowdown as signaled by my models.

And while more people seem to be in that camp by now, I believe the analysts’ consensus doesn’t entirely appreciate the speed and magnitude of such slowdown.

In other words: the chances of an imminent and non-negligible recession keep increasing month after month.

Conclusions

Summing up:

The global credit impulse keeps plummeting, and its latest readings are consistent with an earnings recession in 2022 already;

Even the labor market is showing preliminary signs of weakness, with changes in the 3m moving average in US Jobless Claims accelerating rapidly;

Cyclical industrial commodities experienced a very severe drawdown consistent with sharply lower economic growth, and the bond market is pricing the Fed to aggressively cut rates immediately after completing its hiking cycle in early 2023.

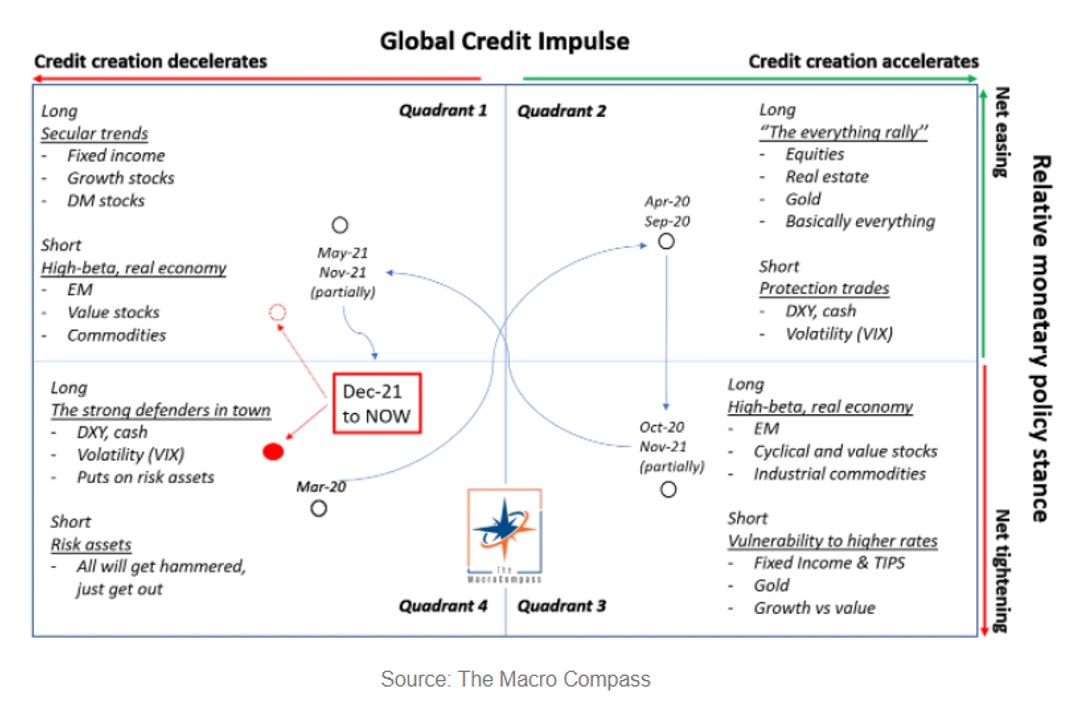

When it comes to the broader asset allocation choices, The Macro Compass remains in Quadrant 4 but the transition towards Quadrant 1 is slowly ongoing.

As Central Banks remain focused on the month-on-month changes in inflation, their relative monetary policy stance is likely to be too tight to allow for a full transition towards Quadrant 1, but the bond market will be doing some early heavy-lifting by flattening curves and lowering long-end real rates to facilitate the transition.

Broadly speaking that means long-term portfolios should continue to stay away from highly speculative assets, own USD cash and start allocating towards 5-10y+ government bonds (as suggested already 2 weeks ago: see here).

My tactical portfolio (1-3 months horizon) instead remains net short equities and credit spreads while holding some opportunistic early Quadrant 1 trades (bond flatteners and long 1x QQQ vs short 1x IWM):

2s10s flatteners

Long 1x QQQ, Short 1x IWM

Short IWM

Short LQDH

And I will be soon adding long JPY/AUD and Euribor flatteners.

YTD P&L: +21%; maximum drawdown: -7%.

If you want to know more about how I’m thinking about portfolio construction and my view on each asset class, don’t worry: next week’s article will focus just on that!

What would you like me to specifically cover in that piece?

And this was all for today, thanks for reading!

Last but not least: if you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

May I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

See you soon here for another article of The Macro Compass, a community of more than 65.000 worldwide investors and macro enthusiasts!

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

So, Recession?