After years of zero interest rates such an abrupt tightening is bound to break something.

The main questions are: what, when and where does something break?

When rates are low credit is cheap and so financial actors tend to lever up more aggressively. Debt levels increase and so does the coverage of government debt.

''The US government will go broke''

''This is not sustainable'' etc

Yet the reality is that governments are the issuers of fiat money and therefore they can always nominally (!) meet their obligations by issuing more debt.

That obviously has limits too: over time they depreciate the real value of the currency and relentless fiscal deficits might lead to inflation overshoots.

But my point is that governments can kick the can down the road for a long time, but you know who can't?

You, I, and in general the private sector.

If our mortgage costs as a share of disposable income move higher we can't print money to service our debt.

If corporate borrowing costs soar and earnings growth doesn’t dramatically improve, companies will be quickly forced to deleverage or cut costs.

So while in general it’s a good practice to keep an eye on both government and private sector debt levels (as the chart below shows the higher total economic debt, the lower rates must be to keep the system afloat)…

…during macro shocks countries with high & rising private debt levels are more vulnerable than countries with high public debt levels!

And history shows that’s indeed the case: look at this great chart from Dario Perkins.

Japan's real estate crisis 1990s

Asian tiger's crisis late 1990s

Spain's housing crisis early 2010s

China now (?)

All these episodes had one thing in common: private sector debt was too high and it was rising too rapidly!

Funnily enough the obsession with government debt levels skews the vulnerability assessment towards the ''wrong'' countries.

Countries that keep deficits super contained starve the private sector from fresh resources and so households and corporates go and lever up privately.

Take China: their official government debt levels are very contained but behind the curtain they have been aggressively leveraging up their private sector.

And if you do that too fast in an unproductive way, problems tend to occur...

Or take Canada which has made a large usage of real estate debt to spur a domestic wealth effect.

Today Canada is running a higher private sector debt/GDP than Japan did just before the implosion of their own real estate market in the 90s.

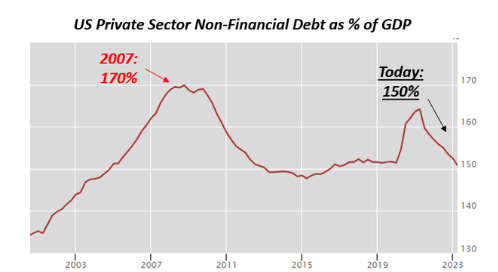

Instead if you have a look at the US you'll find that their private sector non-financial debt as % of GDP today is 20 percentage points lower than in 2007.

While mainstream media commentators obsess about US government debt despite the United States enjoying the privilege of issuing the reserve currency of the world (USD), private sector leverage trends in the US show a relatively benign picture if compared to other countries around the world.

What countries score the worst by this metric, you ask?

This table can help you quickly assess in which countries private sector debt is too high and it's been rising too fast over the last 10 years.

Now, obviously levels and rate of change in private sector debt are not the only variables to consider when assessing when/where/what will break in macro.

We also need to consider other fundamentals, the nature of the private sector debt market (floating or fixed rate, short-term or long-term), refinancing cliffs and many other variables.

Hence this was just the appetizer of my investigation into ‘‘what will break in macro’’.

The good news though is that I will be serving you the entire menu soon :)

Now, before you leave two important points:

Learn to master bond markets!

Even if a country is particularly vulnerable to macro shocks it doesn’t mean something will break there: it’s the combination of these vulnerabilities and these crucial but sometimes hidden messages the bond market is sending that will put you on the right path!

Where do you get pro-level knowledge of the intricate and technical bond market?

I unpacked it all for you: take a look here.

The TMC Bond Market Course has added a lot of value for customers - this is the kind of feedback I can proudly say I am receiving so far :)

If you enjoyed this piece, please smash the Like and Share buttons!

Hopefully you find these posts valuable.

If you do please let your macro-friends and colleagues know, and let me know by clicking on that Like button :)

Enjoy your weekend, and always stay hungry for macro!

Share this post