‘‘We have made substantial progress in removing monetary policy accommodation, and we have to recognize there are clear signs of an economic slowdown in the Eurozone.’’

Christine Lagarde - ECB October press conference

Hi all, and welcome back to The Macro Compass!

Over the last two weeks, several G10 Central Banks came across as ready-to-pivot.

Australia, Canada and now Europe are starting to weigh pros and cons of calibrating monetary policy with a single objective: bringing inflation down to 2%, as soon as possible.

Instead, they are beginning to consider a slowdown in the pace of hikes and most likely a complete pause relatively soon.

Why such a sudden change of heart?

Because all these jurisdictions have something in common: inherent fragilities.

Be it private sector debt (Canada), the domestic housing market (Australia), upcoming recession fears or a very suboptimal architecture for a ‘‘monetary/fiscal union’’ (Europe) it’s become increasingly clear that relentless monetary policy tightening will end up breaking something.

And hence, all of a sudden pros and cons need to be weighed against each others.

Today’s ECB decisions and press conference went exactly into that direction, with a lot of interesting decisions and nuances.

In this short article, we will:

Briefly discuss the ECB meeting, and focus on its most interesting nuances;

Summarize the main implications for portfolio allocations & tactical trade ideas.

A Ready-To-Pivot ECB?

Actually, before we jump right in.

Nowadays, time is our scarcest resource and sharing insights in an effective way through charts and visual infographics is a great tool to have in your arsenal.

On my social channels, I must have used Chartr visual insights countless times for this very reason - these guys are very skilled at conveying macro, business and market insights in a visual and easy-to-remember fashion.

I strongly recommend signing up for their 5-minutes read newsletter which is packed with these very useful and information dense visual insights.

It’s free - here is the link.

Back to it: let’s unpack this ECB meeting together.

#1: We Are Serious About Inflation, But…

The ECB hiked by 75 bps hence bringing the Deposit Rate to 1.50%, and acknowledged inflation is likely to stay high and hence that further interest rate increases will be necessary.

So, where is the ‘‘ready-to-pivot’’ stance?

In the language used to communicate whatever is left of the ECB’s forward guidance.

A) The press release indicates the Governing Council doesn’t expect ‘‘to raise interest rates over the next several meetings’’ but only ‘‘to raise interest rates further’’: a much less specific reference to the hike sequencing being prolonged over time;

B) The press release now reflects an ECB assessing today’s stance as reasonably tight and moving there quickly: ‘‘With this third major policy rate increase in a row, the Governing Council has made substantial progress in withdrawing monetary policy accommodation.’’

C) Lagarde being very vocal in her press conference about recession risks, and the need to weigh pros and cons when moving monetary policy much tighter from here.

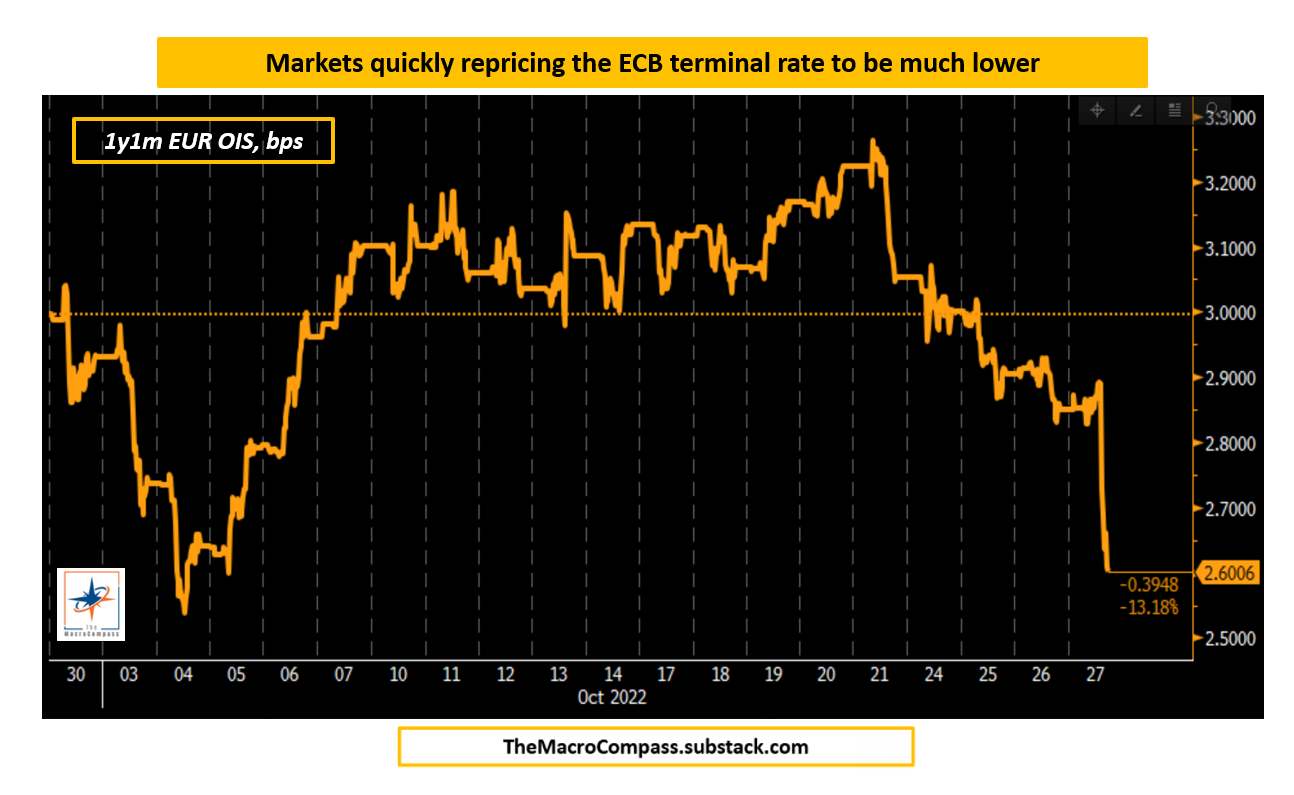

A quick snapshot of today’s market reaction - we will cover this in much more details later: investors immediately repriced the ECB terminal rate down by 30+ bps!

For now, the most important question I want to answer is: with inflation running at around 10% (!) in Europe, why would the ECB deliver such a sudden change of heart?

Because of its inherent fragilities.

An overleveraged and unproductive private sector, weak potential growth due to poor demographics and a very suboptimal monetary/fiscal union architecture chronically expose Europe to systemic risks.

Sum up a brand-new and not necessarily Europe-friendly Italian government and geopolitical risks, and you see where I am going.

With such a backdrop, once you tightened by 200 bps in a few months the pros and cons of further aggressive tightening become more ‘‘balanced’’.

The Bank of Canada is delivering the exact same message - notice any similarities in the presence of inherent fragilities and the sudden change of heart?

In other words, the ECB is ‘‘hoping’’ that markets are right about inflation falling off a cliff (spot European CPI at 10%, and 1y1y inflation swaps are pricing in 2.7%) and most importantly that a mild tightening of their monetary policy stance above neutral rates will be enough to engineer such a sharp drop in inflation.

While this ideal outcome might unfold, history suggests baby steps are not enough to slay the inflation dragon.

Given my estimate of today’s EUR nominal neutral rate at around 1.5% (exactly where ECB depo is today), the market-implied terminal rate of 2.6% imply an ECB monetary policy stance ~100 bps above neutral.

In the 1990s, in order to restore price stability France had to go 300+ bps above neutral for over two years.

Will 100 bps be enough?

Maybe, but the ECB (& Co) are taking quite the leap of faith here.

#2: Dear Banks, The Free-Carry Party Is Over

The ECB also drastically changed the remuneration mechanism for TLTROs, the cheap funding mechanism that allowed European banks to borrow roughly EUR 2 trillion at very advantageous rates during the pandemic.

The idea there is simple: incentivize banks to repay these TLTRO loans as soon as possible, hence shrinking the ECB balance sheet and at the same time easing some of the collateral scarcity in Europe.

As the ECB balance sheet has ballooned to over EUR 4.5 trillion and this gigantic amount of excess reserves is at odds with a tightening monetary policy stance, the ECB is looking for ways to shrink its size.

The two obvious candidates are QT and a sharp reduction in outstanding TLTROs.

The ECB is well aware of the dangers of QT in the Eurozone (Italy, Greece…?), and hence incentivizing banks to repay TLTRO loans early seems like a more viable option - the hope is also that correcting the imbalance between a very abundant level of excess reserves and a scarce amount of good quality collateral (AAA German bonds) will ease the collateral scarcity in Europe.

The chart below shows how 2-year German govies are trading 80 bps through 2-year Euribor swap rates (and roughly 50 bps through 2y ESTR swap rates, which track ECB deposit rates).

Will they succeed in getting European banks to repay early?

Yes, I think so.

But less excess reserves and more bond issuance to fund energy subsidies and other fiscal maneuvers might also end up requiring wider risk premia in Europe.

So, how did markets respond to the ECB meeting and what about implications for portfolio allocations and trade ideas?

Conclusions & Portfolio Implications

The best way to grasp (the bond) market reaction to the ECB meeting is through a visual snapshot of the Rates & Credits section of my Volatility-Adjusted Market Dashboard (VAMD).

Daily changes are color-coded to reflect the magnitude of the move: the darker the color, the bigger the volatility-adjusted move in that particular instrument.

EUR OIS rates dropped materially, and front-end volatility (3-month expiries for 2-year yields) also came down pretty materially.

But the biggest volatility-adjusted movers were curve steepeners and real yields dropping: and it makes a lot of sense.

If you are telling me you will be more reluctant to tighten monetary policy further even if inflation is still running at 10%, I have to:

A) Price that in via lower short-end bond yields, but assign a bigger risk (term) premia to inflation persisting over time = steeper curves;

B) Assume forward real yields will be lower, as your commitment to have a tighter monetary stance prolonged over time has materially dropped.

Now, what does this mean for portfolio allocations - especially if other Central Banks (Fed?!) experience a similar change of heart?

Using the Macro Compass quadrant framework, that would materially increase the probability of a move from Quadrant 4 to Quadrant 1 - at least on the margin.

A flatlining rate of change of the monetary policy stance (i.e. the next step being less aggressively hawkish at every iteration) which crystalizes into the ‘‘tight but not extreme tight’’ territory would move us North in the Macro Compass.

In this particular iteration of Quadrant 1 transition, bonds and gold could do particularly well.

But given the data-driven and systematic approach behind portfolio allocations and trade ideas generated here on The Macro Compass, before we change our mind we need more evidence of this Central Banks’ change of heart - and therefore the Fed next week is a crucial event.

For now, the Long-Term ETF Portfolio remains defensive with a heavy allocation to USD cash, low exposure to risk assets and some exposure to long-term bonds.

The Tactical Portfolio has taken profits on the short Russell 2000 trade and remains very lightly positioned awaiting for further opportunities.

The YTD performance and portfolio statistics are below.

And this was all for today, thanks for reading!

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

If you are interested in any kind of partnership, sponsorship, conferences or media appearances feel free to reach out at TheMacroCompass@gmail.com.

See you soon here for another article of The Macro Compass, a community of more than 105,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Every week, I also interview the best macro strategists and risk takers around the world and ask them what’s their top trade idea on my podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks YouTube channel.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post