The Fed has been running QT for a while and yet there is still abundant liquidity in the financial system.

Fed’s bond holdings are down $1.3 trillion from their peak (due to QT), yet only half of this supposed tightening has actually impacted bank reserves (aka ‘’liquidity’’) which are down a meagre $0.7 trillion.

This ongoing ‘’money mystery’’ has caught many off-guard, and it has helped fuel several bullish narratives: the most famous one being that higher ‘’liquidity’’ has supported stock markets in 2023.

2024 is shaping to be another year where monetary plumbing will matter a great deal.

To understand the mechanics behind this money mystery, let’s start from QT.

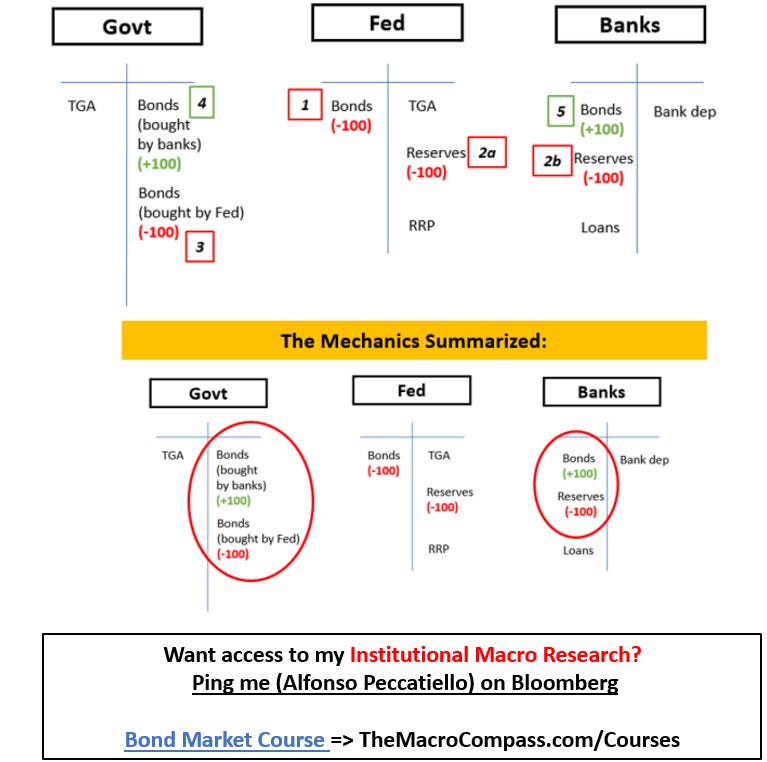

Here are 5 simple steps to understand how Quantitative Tightening works:

Step 1-2: the Fed doesn’t reinvest maturing bonds (1) from its QE portfolio (= performs passive QT) and therefore destroys reserves (2) - also known as ‘‘liquidity’’’;

Step 3-5: the government needs to roll-over its funding, but the Fed isn’t rolling over its bond holdings (3).

Banks now needs to step up and absorb more of the newly issued securities (4-5).

The resulting balance sheet changes are summarized in the bottom tables: the Fed reduces its balance sheet by 100 which sees a 1:1 reduction in reserves (aka ‘’liquidity’’) as banks must step up to absorb bond issuance.

This is how QT normally works.

Yet something different is happening this time.

Back in 2021 the Fed had an issue: rates were at 0%, and there was too much money in the system.

Money Market Funds (MMF) were bidding up T-Bills so much that yields were testing negative levels (!), and so to stabilize money market rates the Fed proposed a friendly alternative: the Reverse Repo Facility (RRP).

This encouraged MMF to park money at the Fed, and they did in huge size: the RRP reached $2.5 trillion.

You can think of this like pent-up ‘’liquidity’’ stored in a corner of our financial system.

Here is the thing.

In 2023 MMF have unleashed this pent-up force: the RRP usage has dropped materially, and this wave of supportive ‘’liquidity’’ has been thrown at markets.

And this is likely to continue in 2024.

How does this work?

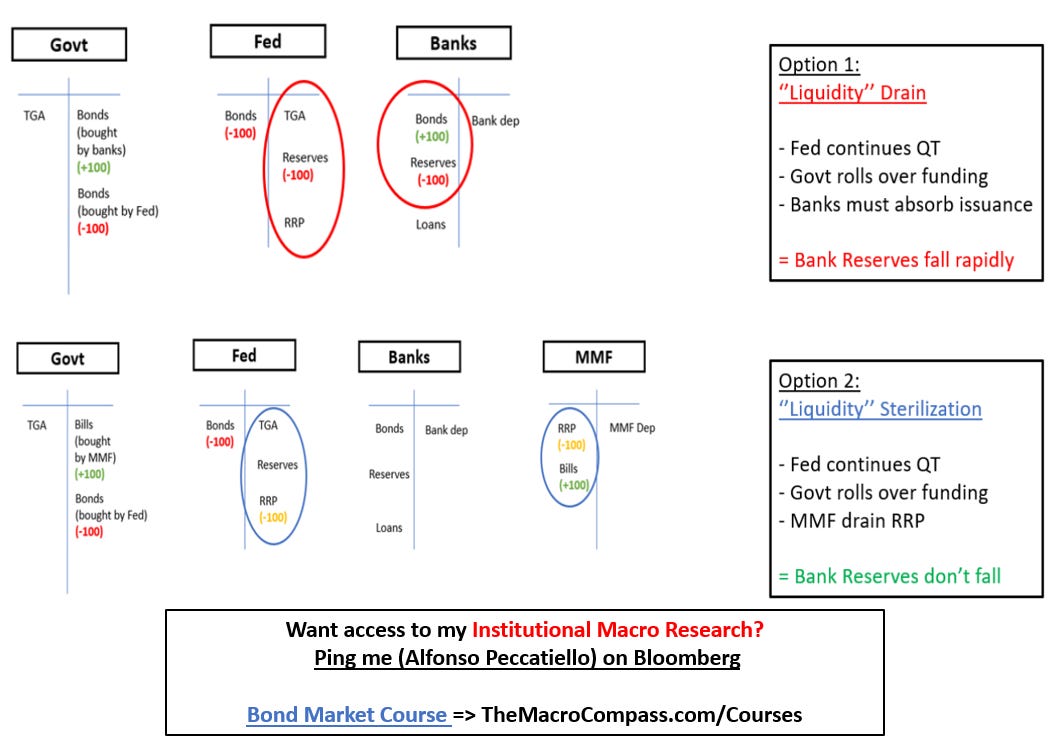

As always, let’s check our stylized balance sheets to find the answers:

MMFs drain down their huge RRP balances (orange) and they buy T-Bills (green).

The government has to roll-over debt while the Fed does QT (red), but this time the slack is picked up by money market funds and not by banks.

The result is that QT doesn’t drain ‘’liquidity’’ but the RRP takes the hit (blue circle).

Effectively, we are running a sterilized version of QT:

In other words, the Fed is actually reducing its balance sheet but not draining the ‘‘excess liquidity’’ (bank reserves) from the system.

A liquidity conundrum.

So, what happens next?

The RRP facility is down from $2+ trillion to $600 billion, so this ‘‘sterilization’’ mechanism can work for a bit longer in 2024 but it will ultimately come to an end.

And dwindling liquidity can cause a lot of trouble in the biggest monetary plumbing machine in the world.

The repo market.

Claiming that the amount of reserves (‘‘liquidity’’) in the banking system somehow affects asset prices is outright wrong: banks don’t use reserves to buy stocks, and that’s why the supposedly direct relationship between changes in liquidity and stock market returns doesn’t exist.

But banks do use reserves to engage in repo market activities with each others.

And that matters!

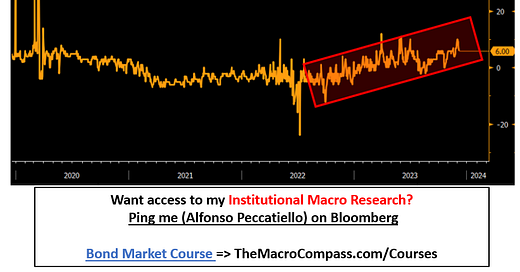

As the chart above shows, the requested premium to lend money in repo markets against simply depositing at the Fed is slowly increasing - levels aren’t worrying yet, but there seems to be a trend in place.

The red circles in the chart show how unhinged repo markets became in 2019.

Here are the 7 steps to the real monetary plumbing risk ahead for 2024:

The Fed continues QT but MMF stop immunizing the negative effect on liquidity;

Bank reserves take a serious hit, and banks’ appetite to engage in repo markets declines;

The US Treasury continues to issue large amounts of bonds;

The imbalance between collateral (bonds) to absorb and available liquidity (reserves) grows;

Repo rates steadily increase signaling more strains in the monetary plumbing arena;

Leveraged players relying on steady repo rates blow up;

Deleveraging occurs.

In short: the money trick which made QT look like a walk in the park in 2023 might as well disappear later in 2024.

And this is a very underestimated risk which almost nobody has on its radar.

Share this post