‘‘If you can’t stand the heat, get out of the kitchen’’

US President Harry Truman, 1942

Hi all, and welcome back on The Macro Compass!

Global markets are at important crossroads.

Central Bankers around the world are showing an ever increasing commitment to fight inflation: Powell’s speech at Jackson Hole is being fully digested by bond markets, and the upside surprise in European core inflation has sparked a debate about a 75 bps hike by the ECB (!) and resulted in inverted European yield curves too.

At the same time, we are getting more evidence of cooling economic activity and geopolitical developments keep complicating the picture - China has just locked Chengdu (21 million people) down, hence further pressuring supply chains and hitting global demand.

The heat in the kitchen is increasing fast: can markets stand it?

In this article, we will:

Deep dive into the important European and US fixed income markets reaction to the latest macro developments;

Summarize implications for the bond and the stock market, and reflect on portfolio allocations going forward.

Bond Markets at Important Crossroads

Understanding what the bond market is pricing across its many dimensions is not useful because it tells us what’s going to happen - actually, its predictive abilities aren’t always great.

Exactly one year ago, fixed income markets were expecting the Fed to hike by 25 bps in 2022 - instead, only 8 months in the Fed has already delivered 225 bps worth of hikes and another 100+ bps are highly likely.

It’s instead a very useful exercise because the bond market is the biggest and most liquid building block of the ‘‘global markets pyramid’’, and as such fully grasping its multi-dimensional signals is crucial to understand where consensus lies.

What matters for portfolio returns is not our absolute macro and market views, but how and why those differ relative to market-implied consensus.

So, let’s dive into the European and US fixed income markets: 7 charts in total, and market implications for the bond and stock market after.

1. Will The ECB Really Dare To Hammer Inflation Down?

The drivers behind the European and US inflationary pressures are not exactly the same - several recent studies (one example here) attribute only 15-20% of the pickup in European inflation to pressures coming from aggregate demand.

Energy and supply bottlenecks are responsible for most of the EU CPI increases.

So, should the ECB follow the ‘‘hammer inflation down, wherever it comes from’’ strategy and aggressively hike rates?

The key word here is should.

With the momentum of European core services CPI at the highest level in 25+ years, the time for nuances at the ECB is over - regaining credibility is all that matters.

Yes: the drivers behind the strong inflationary pressures have been mostly supply and energy driven so far. But as inflation is broadening towards core services and the momentum isn’t slowing down, it’s not about what the ECB should do.

It’s about what the ECB has to do.

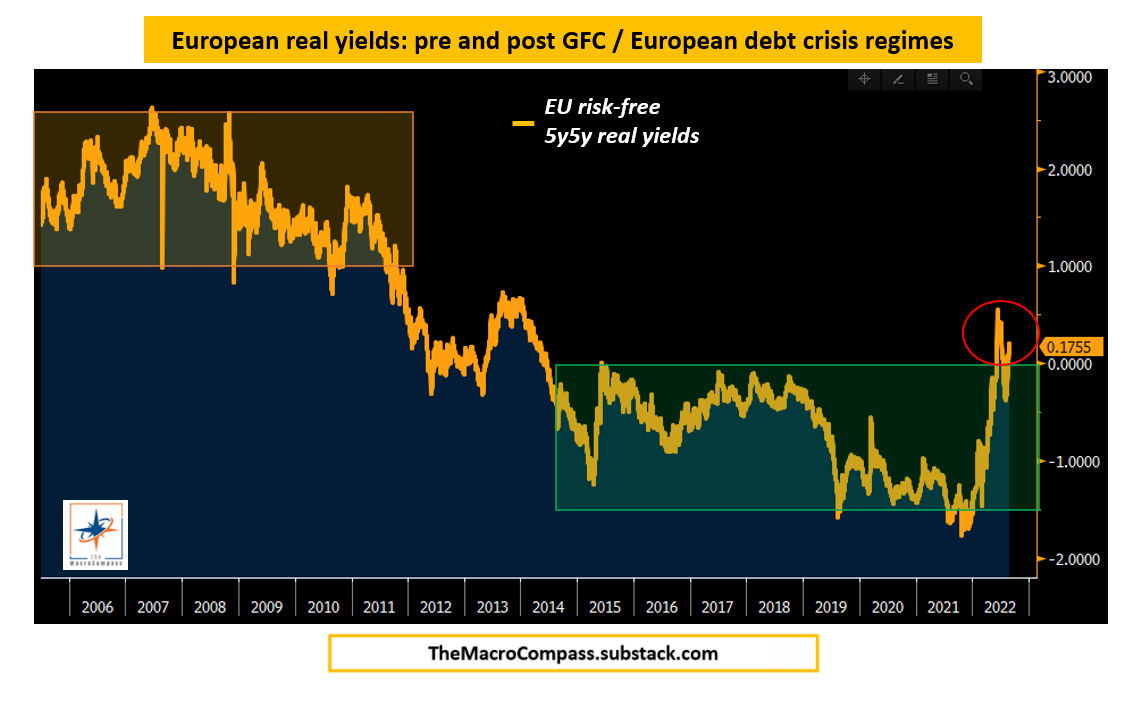

European fixed income markets are getting the memo, and real yields offer undisputable evidence that’s the case.

Before the Great Financial Crisis (orange box), risk-free European real yields consistently traded in positive territory - low levels of debt, decent demographics, no evident signs (yet) of capital misallocation etc.

But after the GFC and the European debt crisis (green box), EU real yields found a new equilibrium in negative territory and traded between 0% and -2%.

Now, for the first time in almost a decade EU long-term risk-free real yields are back in positive territory: markets understand the ECB has to set tighter monetary policy.

That’s a massive change of scenery for over-indebted, low-quality balance sheet European borrowers which have enjoyed very friendly real borrowing costs for years.

The party is over.

Another striking evidence of bond markets appreciating the forced ECB reaction function lies in the slope of the EUR OIS swap curve.

As a reminder, the Overnight Index Swap (OIS) solely reflects market-implied expectations for the future path of the overnight Central Bank rate.

Well, the 5s30s EUR OIS swap curve just inverted for the first time since 2008.

As the ECB hikes to the priced-in terminal rate of 2%, markets expect this will somehow compound downside pressures on economic growth and hence start reflecting that via an inverted yield curve.

I believe this trend will intensify.

Finally, a word on Italy.

Elections are looming and BTP/Bund spreads are trading in the 230 bps area.

As the right-wing coalition could secure the majority in Parliament, a niche corner of the fixed income market (CDS spreads) is getting a bit more concerned about Italian Lira redenomination risks.

The chart below shows the delta between the old and new Italy CDS contracts: they both hedge against an Italian government default, but only the 2014 version also protects against redenomination risk while the 2003 doesn’t as that risk wasn’t considered material when the Euro was introduced.

A 85 bps delta between the 2014 and 2003 Italian CDS contracts is not negligible, and for good reasons: the potential new PM Giorgia Meloni has taken a loud anti-European stance throughout her political career, and the recent ‘‘softening’’ of this stance seems more like a temporary political maneuver than anything else.

Let’s have a look at the US bond markets now.

2. Ok JPOW, We Kinda Get It Now

Powell will be pleased with the US bond market behavior we have observed since his Jackson Hole speech, and let’s see why.

First of all: US real yields now trade in positive territory across the curve, which is something Fed members have clearly expressed preference for in recent months.

This is important because it means markets are understanding and transmitting a tighter Fed stance to real economy borrowers: getting credit and leverage is not cheap anymore in real terms, regardless of the tenor.

If you can’t stand the heat, get out of the kitchen.

Something else the Fed was very keen on is conveying the message that the hurdle to cut rates in 2023 is very, very high.

But here, markets are much more reluctant to fully price this in as a base case: 5 quarters (to December 2023) of challenging economic conditions are quite a long time to go, and while the Fed’s control on the very short end of the yield curve is significant…5 quarters isn’t a very short time in this macro cycle.

The market-implied probability of 4% (or higher) Fed Funds by December 2023 moved back to 32% but it’s not yet the market's base case.

But the most important macro question to answer right now remains this.

Let’s assume bond markets are right: over the next 18 months, US inflation will move down to 3% (orange) and Fed Funds will be in the 3.5% area (blue).

Will the Fed be ok with a new regime of inflation in the 3%+ area?

I really don’t think so: the first step to regain credibility is to achieve your targets, not to move the goalpost at your convenience.

In Short

European bond markets understand the ECB has no room for nuances anymore: they have to intervene and regain credibility on their price stability mandate.

This will increase real yields and widen credit spreads much beyond what over-indebted European borrowers can afford, especially as the economy keeps weakening.

US bond markets have gotten the Jackson Hole memo, and they are now almost fully pricing in the Fed’s preferred monetary policy transmission mechanism: positive real yields across the curve, and (almost) no cuts throughout 2023.

From here onwards, as the Fed basically pins front-end bond yields economic data will drive the long-end and the shape of the curve.

Let’s now quickly sum up what this means for portfolios and asset allocations.

Markets & Portfolio Implications

Forward-looking macro indicators and global credit impulse sinking while Central Banks are forced to aggressively tighten monetary policy and send real yields higher to regain credibility on the price stability mandate.

This is the most challenging environment for investors across all asset classes.

Risk assets are obviously the most exposed.

With real yields rapidly increasing in the absence of strong economic growth (orange), equity valuations (blue) have to be accordingly downgraded.

Actually, I would argue at this point in the macro cycle equity risk premia (white) should at least expand to the 5.75-6% area seen in the 2015-2016 and Q42018 sell-offs.

The math is simple: even assuming forward earnings are correct (I expect them to undershoot analysts’ expectations by 10%+), assuming unchanged real yields the S&P 500 should trade at a 15-16x forward P/E.

That’s roughly 3600-3700 in the S&P500.

Both our Long-Term ETF and Macro Tactical portfolios have shown resilient performance this year due to the broad defensive/short stance, and my main macro theme remains that while the first 8 months of 2022 were about ‘‘short everything, long (USD) cash’’, over the next 7-8 months the stance might have to change to ‘‘very short risk assets, slowly accumulating some bonds and gold, long (USD) cash’’.

My Long-Term ETF portfolio (1y+ horizon) remains positioned as follows:

Long (USD) Cash

Big Underweight in Equities

Accumulating 10y+ Bonds (next TLT target to add: 107)

My Tactical portfolio (1-3m horizon) remains positioned as follows:

And this was all for today, thanks for reading!

If you are interested in any kind of partnership, sponsorship, conferences or media appearances feel free to reach out at TheMacroCompass@gmail.com.

Finally: may I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

See you soon here for another article of The Macro Compass, a community of more than 90,000+ worldwide investors and macro enthusiasts!

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post