Macro investing without deeply understanding bond markets is like eating soup with a fork.

You can still somehow make it, but it’s cumbersome and unproductive.

We are at a crucial juncture for macro and monetary policy, which means getting a grip on bond markets is even more important.

This piece will help you with that, and most importantly provide you with the right framework to use.

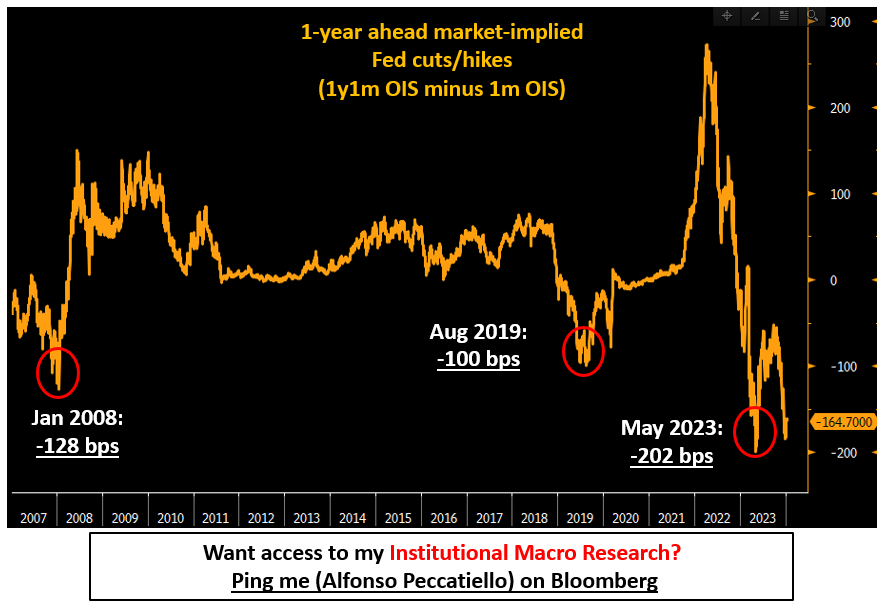

Everyone is talking about this chart all the time:

It shows the market-implied Fed cuts (in bps) over the next 12 months, and it says -165 bps.

165 bps of cuts in 12 months is quite aggressive by historical standards.

Even in early 2008 with Fed Funds at 4.50% and the US economy on the verge of a huge recession, markets were pricing only 128 bps of cuts for the consecutive 12 months.

Why would bond markets be so aggressive now?

In a nutshell, there are two main reasons:

The first reason has to do with the Fed’s mandate – one could argue the job is done.

The labor market is back in balance (glass half full) and judging from the trend in private job creation at only 115k/month and steadily declining one could argue there are risks it’s weakening too much (glass half empty).

The labor market isn’t remotely hot anymore: job done?

Core PCE (the preferred Fed’s inflation measure) is already annualizing at 1.9% which is below Fed targets.

Further disinflationary tailwinds from the delayed pass-through of weaker rent inflation and a softer job market should corroborate the trend in H1 2024.

The underlying trend of core inflation is already consistent with 2%: job done?

The second argument for so many cuts priced in is tightly connected to the first.

If the Fed’s job is done, what’s the appropriate level of Fed Funds?

Back to neutral over the next 12-18 months.

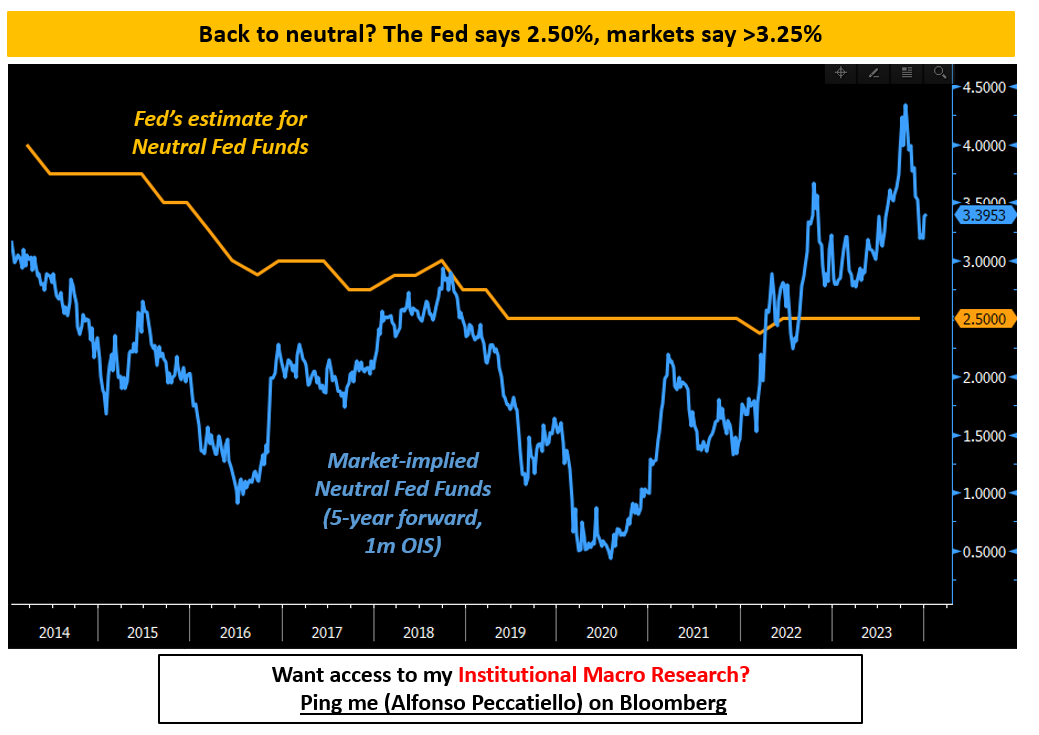

And if anything markets are more sanguine on where neutral Fed Funds are than the Fed is:

The pandemic hasn’t changed the Fed’s mind on what’s a neutral stance: 2.50% nominal Fed Funds (orange) are still considered the rate which doesn’t overly stimulate or cool down the US economy.

Markets have a different and more sanguine opinion right now.

Prior to the pandemic, bond markets (blue) were always more pessimistic than the Fed about the neutral rate and they were proven right: the US couldn’t generate meaningful growth and inflation with Fed Funds often below 2%, let alone higher.

The Fed was saying neutral was ~3%, and facts were showing this wasn’t the case.

Today, bond markets disagree again but for the opposite reasons: neutral Fed Funds are seen >3.25% hence quite a bit higher than the 2.50% the Fed is stuck on.

Let’s pause here for a second and recap.

Markets are pricing 165 bps of cuts over the next 12 months which is aggressive by historical standards, yet this might be partially justified as judging from labor and inflation data the Fed’s job seems done.

If the Fed’s job is done, policy should return to neutral over time – but here markets are more hawkish.

They see neutral Fed Funds at 3.25% while the Fed thinks neutral is 2.50%.

Ok, this is interesting: but here comes the real banger.

Once you understand this, the bond market will make a lot more sense to you…

Eager to read the remaining part of this macro report?

Come join The Macro Compass premium platform to get access to Alf’s full-length timely pieces, actionable investment strategy and much more!

Check which subscription tier suits you the most using this link or the button below:

Share this post