Hi everybody, and welcome back to The Macro Compass!

Our base case remains negative EPS growth and higher unemployment rate from May/June 2023.

In other words: a recession.

But what if we are wrong?

In this piece, we will:

Refresh some of our key indicators to assess where are we in this macro cycle;

Update the probability and timing of a US recession;

Unveil our main tactical trade idea.

Labor Hoarding

During the pandemic, companies experienced serious staff shortages and faced major challenges when trying to hire new qualified staff.

These memories might still be very fresh – look at this chart, for instance.

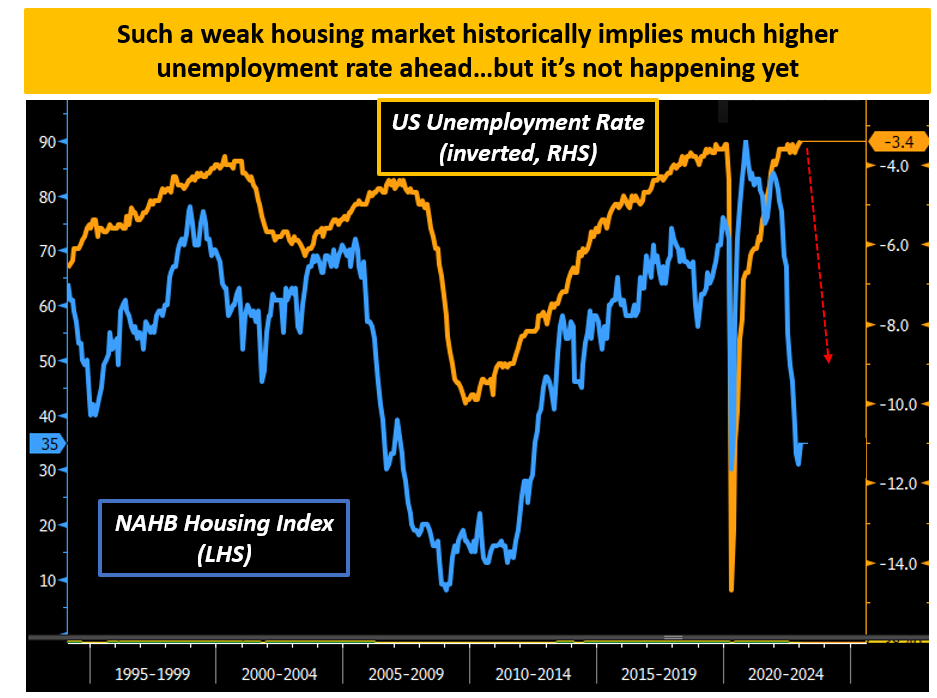

The rapid deterioration in the US housing market (blue) would historically suggest big layoffs in the construction sector which would significantly move the needle for unemployment rate (orange).

Some back-of-the-envelope calculations suggest such a frozen housing market should involve roughly 1.5 million job losses in all sectors related to real estate (construction, financials, brokers, ancillary activities). These job cuts alone would put the US in recessionary territory.

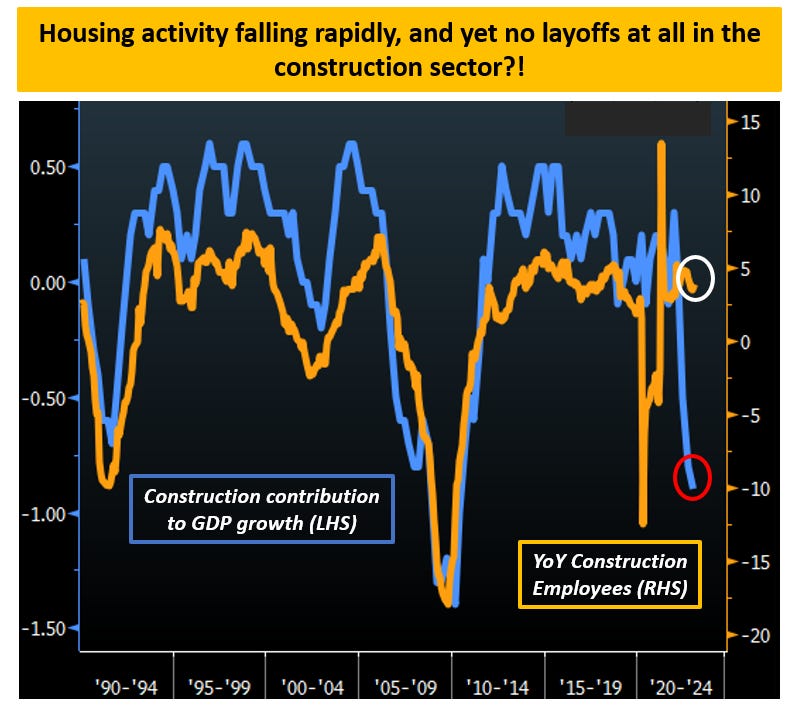

And instead, the construction sector has been net hiring (?!) over the last 12 months.

The only reasonable explanation here is labor hoarding.

As companies experienced serious difficulties in hiring qualified staff during the pandemic and perhaps expect this housing market freeze to be short-lived, they are not actively laying off people as they fear it might be hard to get them back.

Two confirming factors: wage growth isn’t accelerating and the average workweek hours keep declining. If companies want to hoard labor even if activity slows down, to save costs they will decrease their employees’ working hours and be more mindful about bumping up wages.

Labor hoarding seems real, and it might well delay the start of a recession.

Ultimately though, it’s a kick-the-can-down-the-road exercise.

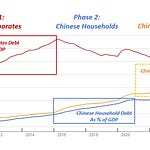

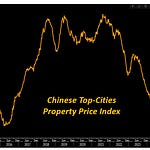

2. Just Too Much Money? (TMC’s Global Credit Impulse)

Let’s now have a critical look at our flagship TMC Global Credit Impulse indicator, and how the Chinese reopening and stimulus interplay with it.

And after that, let’s discuss our tactical trade ideas…

Getting access to The Macro Compass full-length pieces requires a paid subscription.

This article is reserved to All-Round Investor subscribers, which get:

A long-form Macro Report (1x/week);

Timely Tactical Market Reports (additional 2x/week);

Tactical Trade Ideas and the TMC Long-Term ETF Portfolio;

Access to our flagship Interactive Tools to step up your macro investing game;

A Monthly Q&A Zoom call with fellow TMC subscribers and myself;

50% (!) off any Macro Courses we will ever release.

Thousands of macro investors have joined the TMC community already.

What are you waiting for?

Share this post