The giant Swiss bank Credit Suisse is no more.

Central Bankers have announced several facilities during weekends to calm markets down.

The 2008 vibes are very strong – what now?

In this piece, we will provide you with a level-headed analysis of:

The Credit Suisse deal, including its repercussions on the broader European bank and credit markets;

The scope and effectiveness of the Fed’s BTFP facility and the reactivation of global $ swap lines;

How are we managing our portfolio, and what lies ahead for markets.

Credit Suisse has been acquired by UBS for $3.3 billion in a deal brokered by the Swiss government over the weekend – the deal also includes about $10 billion the Swiss government will cover for potential CS losses hitting UBS and around $108 bn of liquidity facilities the Swiss National Bank will make available to UBS.

This is a decent deal for UBS, and yet markets were unhappy because of one important detail.

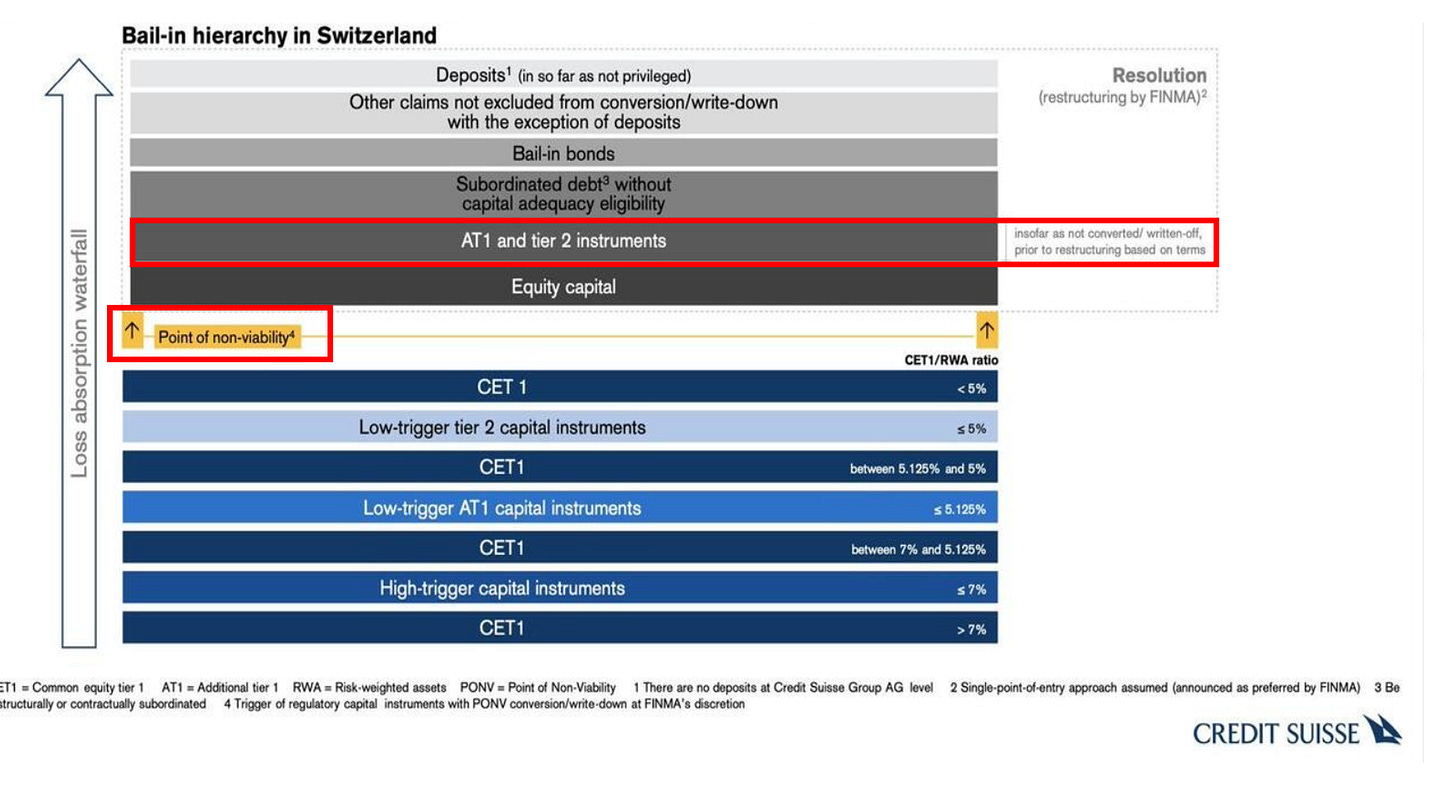

While CS equity investors got (some small) residual value out of the deal, $17 billion of CS’ Additional Tier 1 bonds (a “hybrid” instrument between bonds and equities) were completely written down to zero.

Regulators decided to sweeten the deal for UBS by sacrificing AT1 investors denying the standard waterfall.

Investors were busy extrapolating that AT1 are now a no-go if regulators can subordinate these bonds to equity capital in events of stress – returns don’t warrant the risk in these bonds, and the AT1 market in Europe is pretty big at $275 billion.

That’s an incorrect extrapolation, in my opinion.

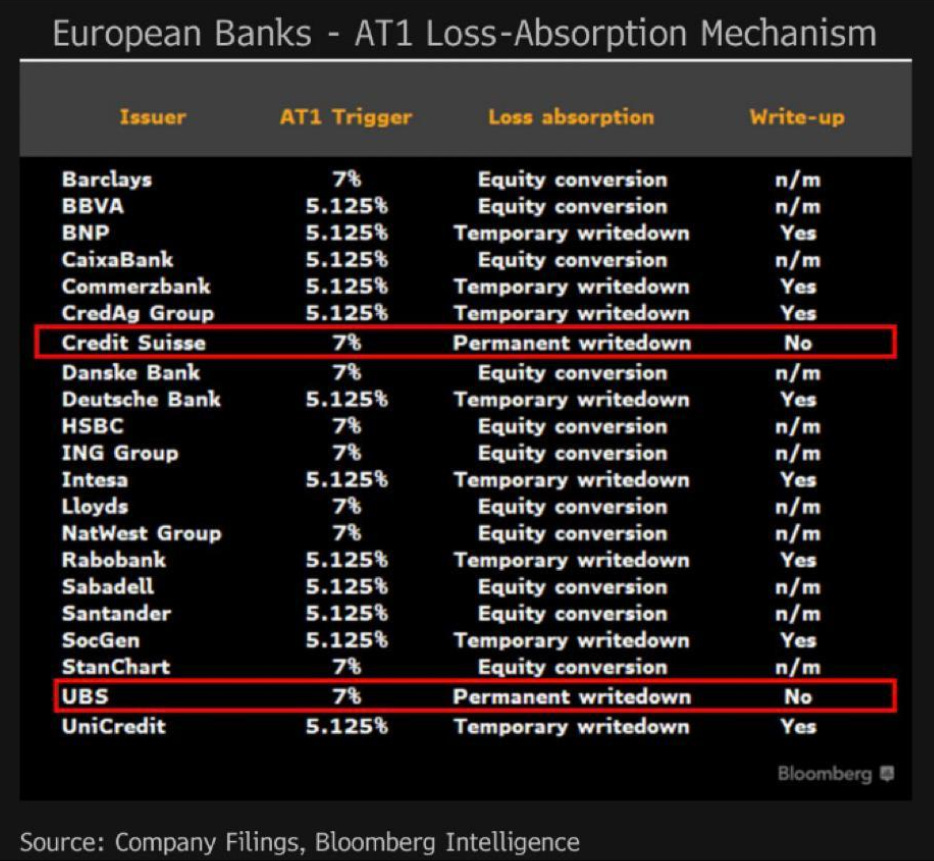

If they did their homework (I doubt…), CS AT1 investors knew already the risks they were running: the absence of “write-up” mechanism is very clear for these bonds, which means the risk of getting marked down to zero if a Viability Event/AT1 Trigger (read: bank about to go belly up) occurs is high.

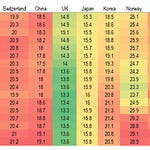

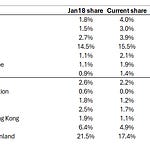

Such a permanent write-down in AT1s is NOT the standard in Europe, as you can see below:

So, yes: CS AT1 investors have been penalized but they knew they were running permanent write-down risks.

And no: the AT1 market in Europe is not dead and the spill-over risks in the banking sector are low.

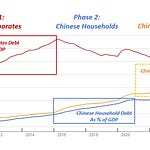

After the GFC, the bilateral unsecured exposure between banks has been massively reduced: unsecured interbank loans through the Euribor/Libor markets are mostly a thing of the past, and regulators ensured banks are highly penalized for holding uncollateralized bonds issued by other banks (like AT1s).

In other words, that means the direct contagion from the CS debacle within the banking system will be low.

Central Banks have announced plenty of facilities during recent weekends.

After the SVB debacle, no other US banks have capitulated yet and the Credit Suisse saga has been solved.

So why are markets still so stressed?

Is the bond market smelling something bad?

Let’s dig in…

Enjoyed it so far and eager to read the remaining part of this macro report?

Come join The Macro Compass premium platform to get access to Alf’s full-length timely pieces, actionable investment strategy and much more!

Check out which subscription tier suits you the most using the link below.

For more information, here is the website.

Share this post