Hi everybody, and welcome back to The Macro Compass!

There is a time to be long, a time to be short and a time to go fishing.

As inflation skyrocketed and the Fed turned hawkish, bonds were kryptonite for investors for most of 2022: it was time to be short.

Between October 2022 and today we have instead seen inflationary pressures somehow moderate but the economy hanging in there, with 10y Treasuries stuck between 3.50% and 4.00%: time to go fishing.

With long-dated Treasury yields once again approaching 4%, might this be the time to go long?

In this piece, we will:

Look at history and identify what were the ideal conditions to buy bonds (you’ll be surprised);

Focus on the present, and assess whether these conditions are met today;

Answer the big question: is it time to buy bonds?

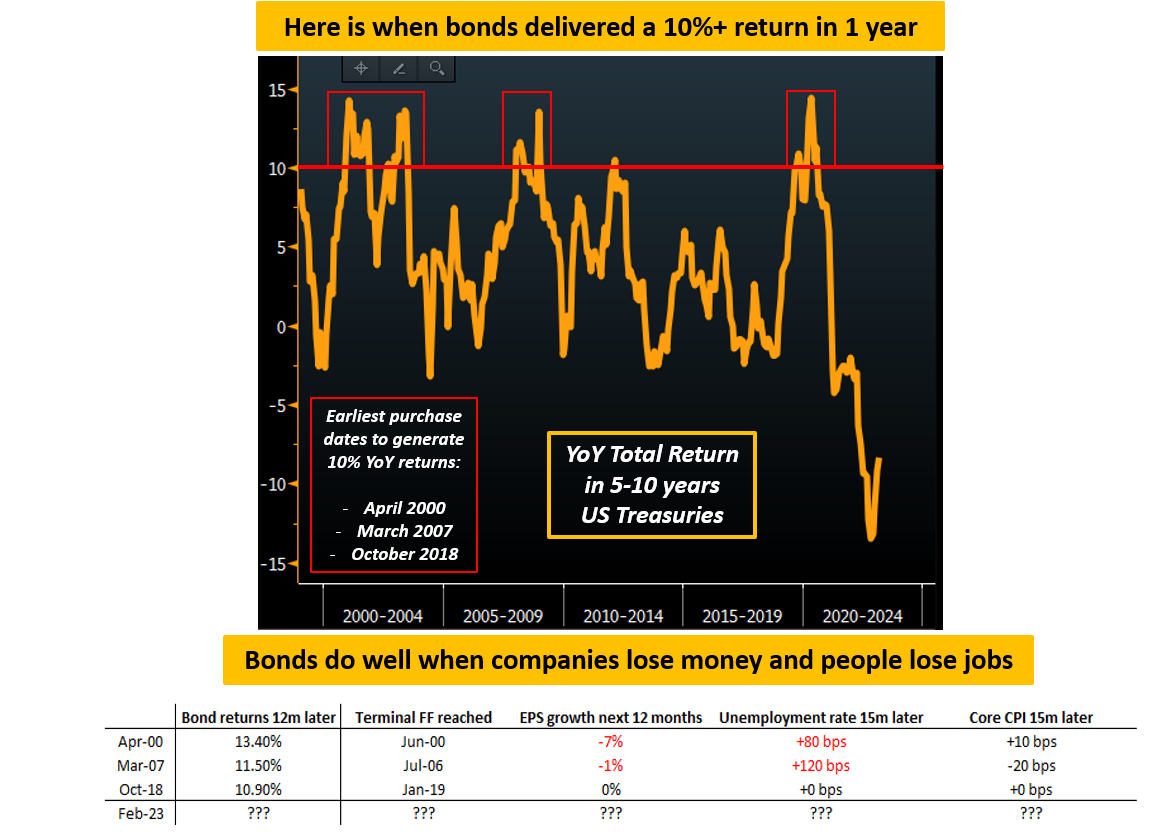

Let’s say you were looking for a 10%+ return by buying bonds and holding them for 12 months.

Your objective is to capture that initial, vicious 100+ bps move down in 10-year Treasury yields.

Now imagine somebody asked you this question.

In hindsight, what were the prevailing conditions in that very perfect moment when to go long bonds and harvest a 10%+ return in the subsequent 12 months looking at the past 3 decades?

Don’t cheat.

You probably said ‘’when the Fed announced QE’’ or ‘’right at the beginning of the 2001 or 2008 recession’’.

And while these periods were good for bonds, they didn’t deliver that banger return you’re looking for.

The best periods to buy bonds were when:

Nobody wanted or thought he needed bonds at all;

A few quarters before companies started losing money and people started losing their jobs.

Let’s talk about the chart and the table above.

Buying 5-10 years US Treasuries in April 2000, March 2007 and October 2018 delivered a subsequent 12-month return north of 10% - in medium term bonds, that’s quite a banger return.

Notice: no QE was announced in the immediate aftermath, and neither we were in a recession already.

Instead, the first common feature across these periods is that everybody hated bonds.

In April 2000 the Fed was still hiking rates as core inflation had upside momentum, animal spirits were still running wild in the Dot-Com space and the economy was holding on okay – nobody needed bonds.

In March 2007 we were in the midst of the US real estate miracle (read: bubble) with unemployment rate at cycle lows and the S&P500 in an unstoppable march higher – who needed bonds, again?

And do you remember October 2018? Ongoing QT, Powell talking about a higher neutral rate, and a strong labor market – nobody wanted bonds.

The second common feature is that the odds of negative EPS growth and higher unemployment rate were rising rapidly.

Basically, nobody wanted bonds but everybody would soon need them.

For all these period in the subsequent 4-5 quarters earnings growth didn’t look good, the labor market cooled off and core inflation stalled.

Macro data was unequivocally showing a nominal growth slowdown, which in 2 out of 3 cases morphed into an outright recession (2001, 2008).

History shows the best moment to buy bonds is right at the intersection when nobody wants them, but macro data will soon remind investors they do instead need bonds.

So, with 10-year Treasury yields fast approaching 4% again…

…is it now time buy a truckload of bonds?

Let’s dig in together…

Enjoyed it so far and eager to read the remaining part of this macro report?

Come join The Macro Compass premium platform to get access to Alf’s full-length timely pieces, actionable investment strategy and much more!

Check out which subscription tier suits you the most using the link below.

For more information, here is the website.

Share this post