We won’t declare victory until we see a series of consecutive, sharp declines in the monthly rate of inflation.

Jerome Powell - FOMC press conference, June 15th 2022

Heading into yesterday’s Fed meeting, the bond market asked a tough question to Powell: do you mean business?

Powell took a ‘’Bad Cop, Good Cop’’ stance: he answered with a firm ‘’Yes’’ at first, and then tried to soften the message during the press conference.

This spurred a relief rally in risk assets, but it won’t last.

Bond markets hate half-hearted stances, and they will keep testing the Fed and risk assets until they get what they want: clarity.

In this article, we will:

Unpack the Fed meeting by looking beyond the mainstream media headlines, and instead focusing on the nuances that really matter;

Analyze the market reaction across asset classes, and assess the likely path ahead;

Recap what does that all mean for your portfolios.

Bad Cop, Good Cop

Actually, before we jump right in.

We are now 58,000+ strong here on The Macro Compass!

Being very grateful for this beautiful community of macro enthusiasts and investors, I am wondering how can I help you further? What’s that very thing you’d really want me to deliver, so that you can enjoy The Macro Compass even more?

All topics, tools, formats, ideas: anything is fair game.

Let me know in the comments!

Now, back to it: Powell played Bad Cop, Good Cop yesterday.

Let’s start from the Bad Cop part - an opera in three acts.

1. The ‘‘growth is strong’’ mantra is unchanged, and that reinforces the Fed’s commitment to take aggressive steps to tame inflation.

Despite forward-looking growth indicators showing rapid signs of deterioration, the actual Q1 real GDP growth print in negative (!) territory and the Atlanta’s Fed GDP Nowcast pointing to 0% real GDP growth in Q2…

…Powell told us there are no signs of economic growth slowdown.

The economic growth mantra is unchanged.

But if the Fed’s assessment is that the economy can take it, they will feel more confident about delivering a more aggressive hiking cycle.

And indeed this was reflected in the updated Summary of Economic Projections (SEP), which also contained some more interesting piece of information.

Let’s have a look.

A) The FOMC’s estimate of ‘‘longer run’’ (i.e. neutral) rate moved slightly up to 2.5%, and they intend to hike rates all the way to 3.8%. That’s 130 bps above neutral.

A pretty decent amount of tightening!

B) In 2022, unemployment rate is going to be 3.7%. In 2023, it is going to inch up to 3.9%. Nevertheless, in 2023 the Fed will keep hiking 40 bps according to their projections: a bit of collateral damage doesn’t seem to scare them at all.

This was also reflected in the introductory statement where ‘‘The Committee expects inflation to return to its 2 percent objective and the labor market to remain strong’’ has been replaced by ‘‘The FOMC is strongly committed to returning inflation to its 2 percent objective’’.

No mention of a persistently strong labor market anymore.

C) Even with all this tightening and some collateral damage to the real economy, core PCE is expected to revert back to only 2.7% in 2023 and 2.3% in 2024. A strong signal that even more might be needed.

When it comes to the hiking cycle, the Dot Plot allows us to evaluate the distribution of opinions within FOMC members.

While in March only Bullard was voting for Fed Funds at 3% or higher by December, today no FOMC member (!) expects rates to be below 3% by year-end.

Nobody.

2. Powell went to great lengths to explain they are seriously concerned about inflation and inflation expectations. And he means: seriously.

One chart to rule them all: the University of Michigan consumer survey for long-term inflation expectations.

We can talk about inflation swaps or TIPS all we want, but ultimately long-term consumers’ inflation expectations matter the most for Central Bankers.

Based on those, consumers decide whether to borrow/spend more and whether it’s time to push for a stronger nominal wage increase to offset inflationary pressures.

As a Central Banker, you really don’t want these long-term consumer inflation expectations to get de-anchored and we just printed the highest figure since 2008…

And that’s why to top it off, Powell said ‘‘we are not going to declare victory until we achieve a series of consecutive, sharp drops in MoM inflation prints’’.

3. To achieve that, Powell is going to keep pushing until (more than) enough damage has been done.

He sent two very clear messages on that front.

1. ’’Interest rates, yield curve shape, credit spreads and equities are going to tell us how restrictive we are and how successful we are likely to be in slowing inflation down’’.

The Fed will take the foot off the gas pedal only if inflation markedly slows down.

There is NO Fed Put until then. At any level.

2. ‘‘We’d like to see positive real interest rates across the entire curve. That will make us more comfortable inflation will be slowing down’’.

This is a big statement.

Why?

This is the US real yield curve: nominal yields minus inflation expectations.

Despite Fed Funds rate priced to average about 3.5% for the next 2 years, real yields are still deeply negative in the front-end.

That’s because inflation expectations are north of 4.5% there!

Powell is basically telling us that either his tight monetary policy stance translates into lower inflation expectations quick, or he will have to bring Fed Funds rate above levels of realized inflation to mechanically achieve positive real interest rates in the shorter end of the curve.

In short: he’s going to achieve higher real yields one way or another.

So with all of this, why the heck did the market rally?

And can it continue?

The Good Cop & The (Fake) Relief Rally

In my opinion: no, it can’t continue.

Why?

The relief rally started when Powell hinted that:

- 75 bps hikes are not expected to be common practice going forward;

- The Fed will be at neutral (2.5%) later in summer, and from there they lean towards taking a more prudent (read: 25 bps?) hiking approach towards restrictive territory.

Remember: bond traders rarely approach events as black-or-white, binary outcomes. The bond market is rather a probabilistic, consensus-weighting machine and what you see on the screen is nothing else than the resulting base-case priced in.

And Powell had just told bond traders to meaningfully cut their probability the Fed is going to raise by 75 bps multiple times, and to assume once they reach 2.5% Fed Funds they will be more conservative with the pace of hikes.

So the path to reach the terminal rate gets repriced: it will take longer.

Which means 2y Treasuries can rally…but what about inflation swaps?

2-year Treasury yields tanked 25 bps in a few hours (!) while 2-year inflation swaps rose by 5 bps, hence causing a sharp rally in front-end real yields.

As real yields became suddenly lower, a mechanical rally in multiple-intensive equities and credit spreads ensued.

But wait a second: Powell just told us he wants positive real rates across the curve?

On top of that, there are two main things that make this rally unsustainable.

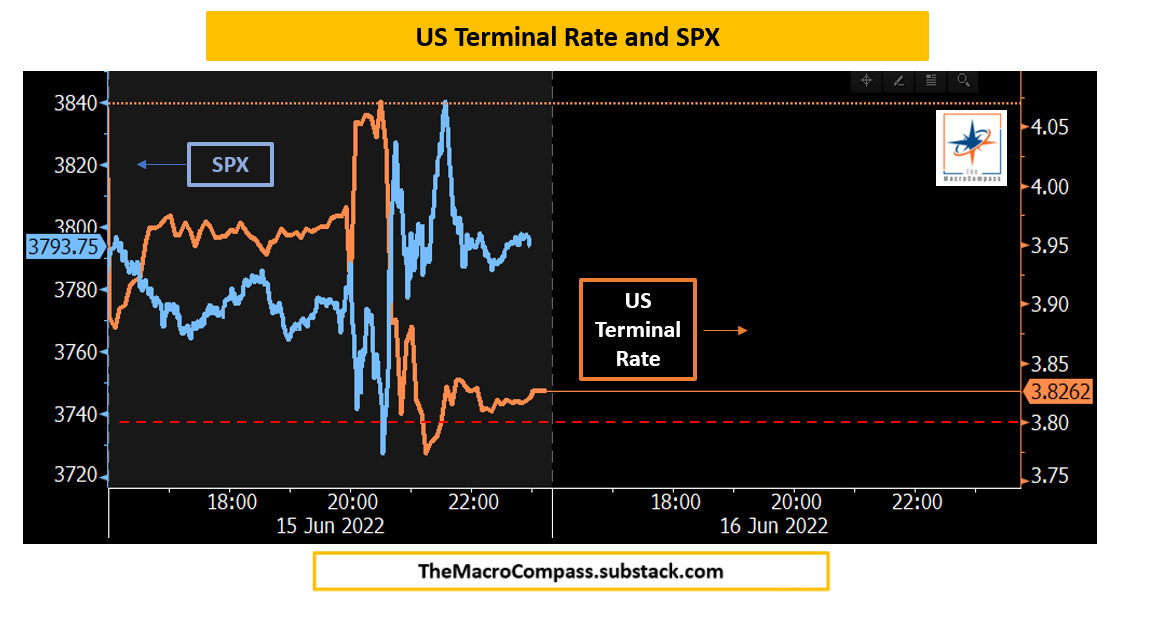

1. Unless inflation markedly slows down, the bond market can’t reasonably price a terminal rate below 3.8% now that the Fed told us we’ll get there.

The chart below shows how the SPX (blue) party-rally was over once the bond market realized it could not meaningfully reprice terminal rates below the red line (3.8%).

And that’s likely to hold true until MoM inflation really slows down.

2. The implied (and realized) volatility in bond markets is too big, and such a high level of uncertainty in the worldwide biggest and most liquid market cripples any meaningful ability to take risks elsewhere.

The chart above represents the level of implied (annualized, in bps) volatility embedded by traders in 5-year US swap yields.

It’s 137 bps, roughly implying a daily move of +/- 8.5 bps. Every day.

Such a high level of implied volatility has last been experienced during the GFC years, and it translates into uncertainty and inability to take big positions in the biggest and most liquid market in the world.

Let alone in riskier markets.

Unless fixed income volatility meaningfully reprices down, risk sentiment will have a hard time improving.

So, the relief rally seems unsustainable to me.

Hence, what do we do here?

What Does It Mean For Your Portfolio?

In a nutshell, bond markets are trying to find the new marginal cost of money at which the private sector will be forced to deleverage: at that point, refinancing your business or getting a mortgage to buy a new house will be so prohibitively expensive you’ll instead prefer to stay put or outright shrink your activities.

Unless inflation slows down materially hence allowing Central Banks to take the foot off the gas pedal, my long-only ETF portfolio will continue to:

Be very cash heavy

Particularly towards USD cash

Contain as little high-beta, valuation-intensive risk assets as possible

I mean, just look at the moves reported in the Volatility Adjusted Macro Dashboard.

A sea of deep red (3+ standard deviation moves!) across the board.

When it comes to my tactical long/short portfolio (1-3 months time horizon), I have instead taken profits on my short BTP/Bund (time stamp here): the ECB is designing a tool to backstop Italian spreads such that their rate hiking path is not hampered by fragmentation issues.

And even if we don’t know how effective the tool is going to be, being short BTP/Bund is an expensive negative carry position while my upside might be limited from now. Time to take profits and screen for new opportunities.

Amongst those, I am starting to consider:

Long JPY/EUR

2s10s US flatteners via futures, or even just outright long TLT!

Short Gold/USD

Any views on these, or suggestions for tactical macro trades?

And this was all for today.

Thanks for reading all the way through, you are my hero! :)

Last but not least: if you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

May I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

See you soon here for another article of The Macro Compass, a community of more than 58.000 worldwide investors and macro enthusiasts!

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post