Hi everybody, and welcome back to The Macro Compass!

The Three Main Themes of 2023

Last week’s macro data releases provided relevant support to our three most important thesis to start 2023:

1) US nominal growth is fast decelerating

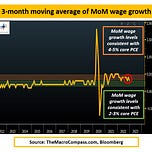

Evidence was provided by sharply declining services PMI and lower momentum of Non-Farm Payrolls: the rate of change for real growth is negative.

Moderating wage growth implies that the rate of change for inflationary pressures is negative too.

2) EUR core inflation keeps marching higher

Inflation is mostly the byproduct of excessive printing of real-economy money that will chase a relatively inelastic basket of goods and services whose supply can’t be easily adjusted.

Europe went ahead with a large amount of real-economy money printing (pandemic fiscal stimulus), so why does European core inflation lag US core inflation by roughly 6 months?

That’s because the European fiscal stimulus (via EU programs) was much more spread out over time in nature and the European labor market is much more rigid – it takes a bit longer for European core inflation to show up.

But it does, and it likely will continue to do so over the next 3-6 months.

This will force the ECB to be (mistakenly so) very hawkish.

3) The Chinese re-opening trade has legs

It’s simple: it takes time to climb a mountain, and it takes time to fully reprice the Chinese re-opening.

After all, how could it all be ‘’priced in’’ when all = the sudden complete re-opening of the second largest economy in the world boosted by 2022 pent-up stimulus waiting to be put at work by consumers?

To that, sum up the fact Emerging Markets fund managers couldn’t literally allocate to China last year: locked-down economy, massive clampdown on tech and real estate, CCP anti-investment behavior etc.

In 2022, most EM fresh money went to Latin America.

In 2023, if you are an EM fund manager you are forced to reallocate to China & co (e.g. Korea etc).

Macro push and pull forces keep dominating 2023.

The gravitational pull is coming from a fast deteriorating picture for global growth and inflation.

The push force comes from the sudden reopening of the Chinese economy.

Wrestling with these macro cross currents, it’s important not to miss the forest for the trees.

What forest?

Let’s dig in.

Subscribe to The Macro Compass to read the rest

Become a paying subscriber of The Macro Compass to get access to this entire macro report, and to the actionable Macro ETF Portfolios and tactical trade ideas.

Hurry up - on Thursday we are releasing our live macro coverage of the US CPI data, its impact on markets and resulting trade ideas - you don’t want to miss that!

The CPI timely report will be available to All-Round and Pro investor subscribers.

A subscription to the All-Round Investor tier gets you:

A weekly macro report and access to our Macro ETF Portfolios;

Additional, deeper & timely macro insights (e.g. US CPI on Thu) during the week;

Tactical trade ideas to generate returns from market mispricings;

Access to our flagship interactive tools to step up your macro investing game;

A monthly Q&A Zoom call with fellow TMC subscribers and myself;

50% (!) off any macro courses we will ever release

Check out all the subscription tiers at this link.

Share this post