Hi all, and a warm welcome back!

Quick reminder: from January 1st, getting access to The Macro Compass content will require a paid subscription.

The more I look at what the team is producing for 2023, and the more I get excited about achieving our mission: help people step up their macro game and become better macro investors.

The regular content you are used to on this newsletter will be greatly enhanced: more frequent macro reports, courses, ETF portfolios, tactical trade ideas…

…and most importantly groundbreaking interactive macro tools!

In other words: top quality content, data and tools for a fraction of the cost involved with Wall Street services (e.g. Bloomberg, institutional research).

Not much time left, so what are you waiting for? :)

Check out which subscription tier suits you the most and come join us!

Introduction

The ECB really went for it.

Lagarde was as assertive and committed in her press conference as Draghi was in 2013.

The main difference is that Draghi was unequivocally committed in being dovish and using all the ECB powers to save the Euro.

Lagarde was relentlessly hawkish in an attempt to show unwavering commitment to slaying the European inflation dragon.

Therefore, this was the most iconic ECB meeting since the Draghi era.

And it leaves macro and markets with crucial repercussions across asset classes both in the short and in the medium term.

In this article, we will:

Break down the ECB meeting piece by piece, analyzing the 3 most important parts of the iconic press conference;

Assess the broad impact for markets and discuss the resulting implications for tactical trade ideas and long-term portfolio allocations.

The Most Iconic ECB Meeting In A Decade

In my opinion, the reason why the ECB decided to go ballistic has to do with the nature and timing of the European inflationary shock.

As a reaction to the pandemic, both the US and Europe went ahead with large-scale fiscal stimulus - a ton of newly printed real-economy spendable money at a time when supply can’t adjust is obviously inflationary.

But there were two major differences.

The gigantic US fiscal stimulus was very much concentrated between Q12020 and Q12021, while the European stimulus was mostly implemented through the European Union programs and hence much more spread out over time.

Think about this: a decent portion of the European fiscal stimulus will be reflected only into the 2023 and 2024 single states fiscal budgets.

Additionally, while the US labor market quickly adjusts to the ebbs and flows of the macro cycle the European job market is much more rigid - it takes a while for aggregate demand to reflect into wages.

The result is that European core inflation has lagged US core inflation by 6 months, and looking ahead that means inflationary pressures in Europe might well broaden and persist for another few quarters.

That’s a serious problem for the ECB!

And indeed the ECB still foresees core inflation at 4.2% by December 2023.

Yes, you read that right.

Despite already incorporating the effect of a much tighter monetary policy in their projections, the ECB expects core inflation will be still at more than double (!) its 2% target in 1 year (!) from today.

This ‘‘a-ha’’ moment and its reflection in the updated ECB projections led to the most iconic ECB meeting since the Draghi era.

Lagarde’s hawkish strategy to slay the European inflation dragon revolves around two main pillars: (much) higher interest rates for longer, and QT.

Let’s go into it.

#1: The Inflation Dragon Is Not Slayed With Baby Steps

The chart below is one of the most important I ever produced.

Lagarde is French, and she must remember the sticky inflation experience France had to go through in the ‘90s.

Back then, core inflation averaged almost 4% for 2 years, and the Banque de France was called to tighten monetary policy - but by how much to slay the inflation dragon?

The tightness of monetary policy isn’t measured by looking at absolute interest rates, but at rates relative to equilibrium.

In the ‘90s demographic trends were more promising, productivity slightly stronger and the amount of unproductive debt burdens much lower - in other words, equilibrium interest rates were higher than today (~4.5% in the ‘90s vs ~1.5% today).

So, how much tighter than 4.5% rates was Banque de France forced to go?

A lot: 5y French government bond yields averaged 8% (300+ bps above neutral) for 2 full years before French inflation finally came back to target.

The reason why this matters a lot to the ECB today is that Lagarde understands she might need to push rates as restrictive as 300+ bps above neutral again.

And that means an ECB deposit rate above 4% - oh gosh.

This was a true shock for markets.

You see, so far markets believed the ECB would push as hard as 3% terminal rates: roughly 150 bps above neutral is quite something, and you know - Europe has a lot of fragilities to deal with and they won’t risk it.

The problem is that when core inflation is above 5%, as a Central Banker you are losing control and most likely about to lose any credibility left.

And credibility is the only true weapon a Central Banker has.

Without that, rate hikes/cuts/QE/QT won’t matter much as markets won’t believe you.

So your incentive scheme pushes you to go all-in: this way, chances to get things under control are higher and if you cause a recession you won’t lose your job anyway.

So you go for it.

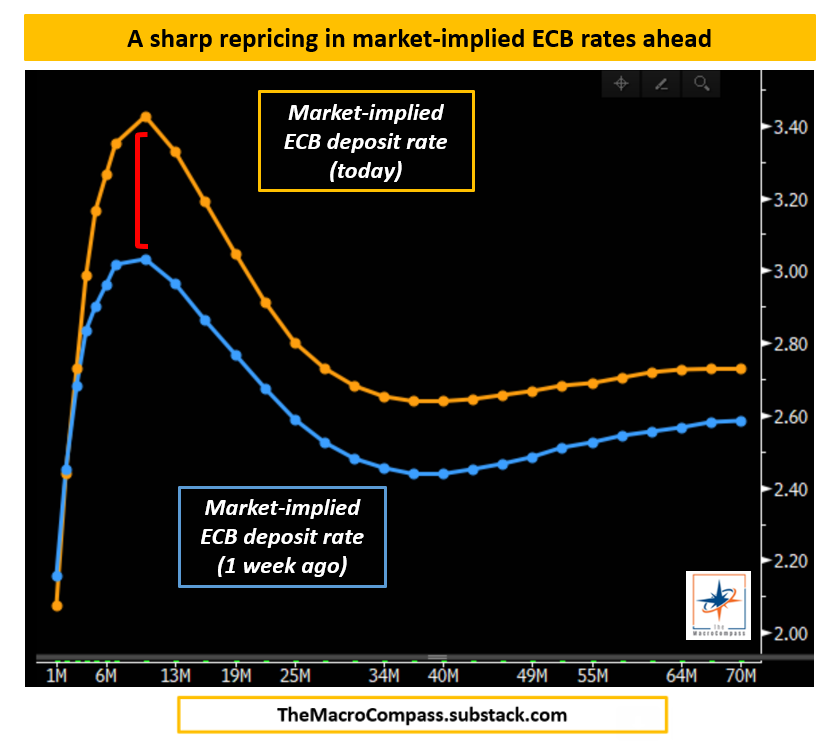

Markets understood the message, but only partially so in my opinion.

Despite the tremendous post-ECB move in bond markets, today (orange curve) the new ECB terminal rate is priced to be at 3.4% in September 2023.

Why is that not enough?

Because it’s 80 bps below the ECB’s own expectations for core inflation.

As any other Central Bank trying to fight inflation, the ECB feels it must bring nominal ECB rates 50-100 bps above (not below) the level of core inflation.

Some basic math for December 2023:

Expected core inflation: 4.2%

Market-implied ECB deposit rate: 3.3%

This doesn’t square.

And indeed, post ECB meeting ‘‘several sources’’ pointed to 3x50 bps hikes over the next 3 meetings.

The ECB will indeed try to get to 4% rates as soon as possible.

4% risk-free rates in Europe begs the question: what about Italy & Co?

#2: QT…in Europe!

To answer this question, we need to talk about QT first.

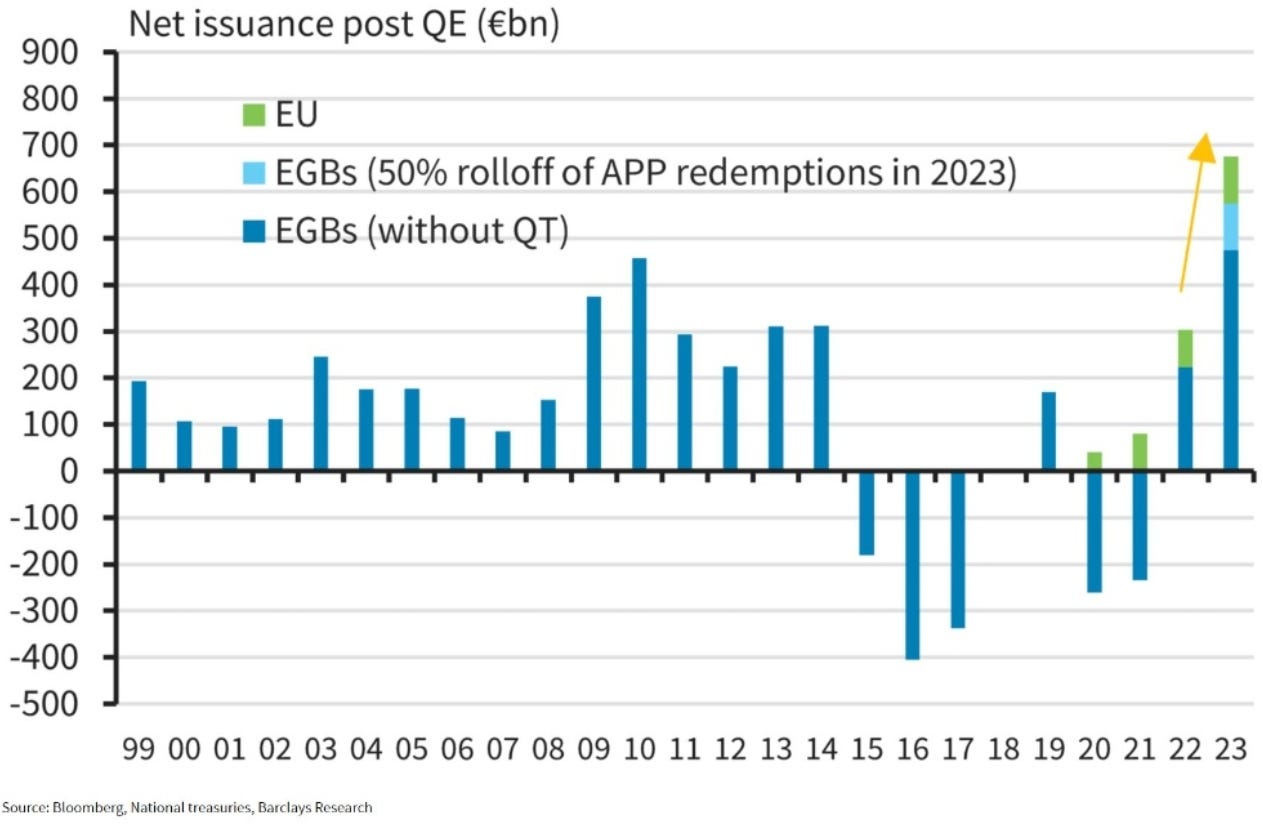

Lagarde announced EUR 15 billion/month of QT starting in Q1-2023, with a clear intention to double the pace to EUR 30 billion/month from Q2-2023.

Again, you read that right: QT in Europe!

To put this into context, please consider that:

Europe doesn’t have any ‘‘reverse repo’’ facility, so no easy way to ‘‘sterilize’’ QT;

The ECB is encouraging banks to repay the cheap pandemic loans (TLTRO), which will contribute to shrinking the ECB balance sheet even further;

Most importantly, consider that for the last 7 years the ECB bought the entire government bond issuance.

All of it.

In some years, it ended up buying even more than that!

But due to rising deficits and QT, in 2023 the situation will drastically change and private investors will instead need to absorb a record amount of bonds.

For countries like Italy, a combination of rapidly shrinking excess reserves and the need for private investors to step up and purchase their new bond issuance in 2023 might well prove very very tricky.

This is how it goes.

Worse macroeconomic conditions lead investors to be more cautious;

Yet, peripheral countries will require more private investors’ sponsorship for their bond issuance in 2023;

But excess reserves will be shrinking, and hence banks (amongst the largest buyers of peripheral bonds) will be taking a more conservative stance;

This lack of sponsorship exactly when needed will reflect into much wider credit spreads required to convince private investor to step in.

The chart below refers to the US and shows how a shrinking amount of reserves tends to require wider credit spreads for investors to sponsor riskier borrowers.

The same is likely to happen in Europe.

Tough times ahead for weak borrowers.

Conclusions & Portfolio Implications

This was the most iconic ECB meeting since the Draghi era.

Lagarde’s unwavering commitment to slay the inflation dragon means that she is going to follow into Powell’s footsteps and drive the European economy into a severe recession, which leaves us macro investors with plenty to chew on.

Short term, tactical trades (1-2 months)

Lagarde literally told us which trades to put on.

During the ECB press conference I released the following trades, which I still believe will deliver meaningful returns over the next 1-2 months.

The short Italian BTPS and German government bonds can be implemented also via ETFs (e.g. BTP2S or BUND2S).

If you are using futures, I’d prefer shorting 2y Schatz futures.

Also, for institutional/sophisticated investors: I really like curve flatteners (2s10s).

These trades are all massively in the money already, and this live coverage/tactical trade ideas will be at the heart of the All-Round Investor package.

I will be much more specific with instruments, implementation, entry, exit etc in 2023.

Medium Term, ETF asset allocation (6-12 months)

The implications here are clear: stay away from European bonds (particularly 2-10y), European credit, real estate and equities as much as you can.

Lagarde is repricing risk-free rates much higher, and as the economy continues to weaken risk assets tend to do poorly.

The good news is that in a few quarters sharp macro investors will be able to pick-up European bonds in the 4% area exactly when it will become increasingly clear we are entering a serious recession.

A historical opportunity to buy EUR bonds at highly discounted prices down the road.

And this was it for today, thanks for reading!

If you enjoyed the piece, please click on the like button and share it with friends :)

But before you leave, an important reminder.

From January 1st getting access to this content (and much more!) will require a paid subscription.

On the TMC platform we will step up the game: unique market insights, courses, ETF portfolios, tactical trade ideas, top notch interactive macro tools and much more.

Subscribers to The Long Term Investor tier will get weekly macro insights backed by an ETF portfolio.

On top of that, subscribers to the All-Round and Pro Investor tiers will get additional timely market reports, tactical trade ideas, interactive macro tools and much more.

Gates are closing soon: check out which subscription tier suits you the most - I’ll be waiting for you to come onboard!

For more information, here is the website.

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post