‘‘We're in a brave new world of excesses in fiscal and monetary policy, and that's where the bond vigilantes thrive’’

Ed Yardeni

In the ‘80s, independent economist Yardeni coined the term ‘‘bond vigilantes’’ to refer to fixed income investors disciplining authorities for running inflationary fiscal and monetary policies and ultimately restoring order through the bond market.

In 2022, we are witnessing the first preliminary signs of the return of the global macro vigilantes. Amongst others, George Soros is an eminent member of this selected group of macro investors who challenge policymakers across countries and relentlessly chase regime-change narratives once they see a good opportunity.

In this brief article, we will:

Go through some of the ‘‘macro vigilantes’’ price action going on in global macro, and assess to which extent markets are incorporating any meaningful probability of regime changes across asset classes;

Announce an exciting news!

Without further ado, let’s jump right in!

Quite some price action in global macro!

Actually, before we jump right in.

If you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

Back to it: there are some quite interesting moves going on in global macro I’d like to shed some light on, so let’s get into it!

Inflation expectations are talking loudly, while the bond market is whispering

The distribution of market-implied inflation expectations over the next 5 years keeps on moving dangerously to the right.

Investors now expect US CPI to average 3.5% over the next 5 years, way above the Federal Reserve target.

What’s more impressive is that investors assign the same probability to these outcomes unfolding over the next 5 years:

The Fed will be able to get inflation back to their symmetric 2% target

Inflation will print on average above 5%!

Yes, I had to read it twice to check it was true too.

But wait a second, Alf: it seems like the macro vigilantes are back when it comes to short-term inflation expectations, but are we anywhere near pricing a regime change in the bond market?

No.

The chart below shows how the market-implied terminal rate for the current Fed hiking cycle is still below 3%, roundabout where it was trading in 2018.

But back then we had CPI at 2% and inflation expectations stuck around the same level with very thin tails - very few investors were pricing inflation to print above 3%, let alone any higher.

Markets are therefore pricing in a relatively benign scenario where Central Banks proceed with a decent dose of monetary policy tightening and they are happy to see inflation only slowly (very slowly) converging back to their targets.

If you really believe inflationary pressures are not going to slow down at the pace predicted by policymakers and you assign a meaningful probability to a regime-shift there, as a macro vigilante you can’t be happy with US 2y bond yields at 2.32%.

In other words, after making sure inflation expectations reflect a partial regime-change macro vigilantes might decide to seriously challenge the benign assumptions Central Banks and bond markets are using to form their base case today.

Watch out in this space.

2. The Japanese Yen is on the move, and it matters!

The JPY depreciated 10% against other developed market currencies over the last month, which is quite a move in the FX space.

The Bank of Japan has been relentlessly defending the 25 bps yield cap on the domestic 10-year government bonds, and therefore signaling their monetary policy stance isn’t going to move much (or at all) to the hawkish side - quite in stark contrast with all their Central Bank peers.

As interest rates differentials keep increasing (higher rates in EUR, USD etc. versus unchanged in Japan), JPY/xxx keeps depreciating.

But are the macro vigilantes doing the hard work already, or just peeking into this?

Despite the sharp move over the last month, option-derived implied annualized volatility in USD/JPY for the next year still stands below 9%.

This level is still consistent with periods of aligned monetary policy stances across the globe (2003-2007, 2019, 2021) rather than periods of uncertainty and divergence.

Also here, the macro vigilantes are just waking up from their long sleep but they are not yet doing the heavy lifting.

But why does Japan matter, anyway?

Since the 1980s, Japan has been one of the biggest exporters of capital in the world: an ageing population with high propensity to save and a lack of domestic investment opportunities have led Japan to invest large sum of capital abroad, especially in foreign fixed income markets.

Here is what they see when looking at foreign fixed income opportunities.

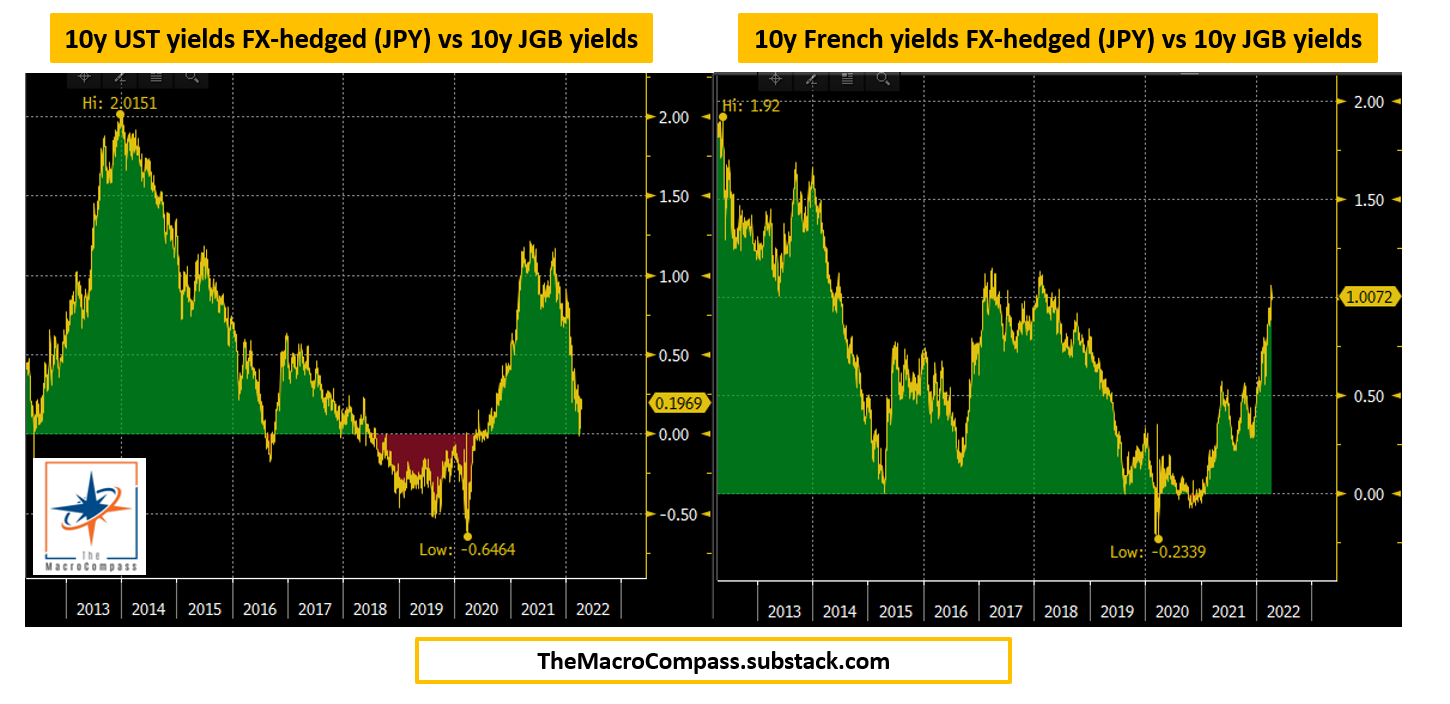

The chart above shows US and French 10y government bond yields after FX hedging costs (for 1 year) versus 10y Japanese bond yields: effectively, it measures what would be the opportunity-cost for a Japanese investor to embark in a foreign bond investment rather than just buying the domestic government bonds.

European government bond yields (France 10y, right side) look much more attractive now than US Treasury yields after FX hedging costs for Japanese investors, but the situation was different in 2021 or 2014.

This is relevant, as ultimately interest rate differentials and FX hedging costs drive Japanese investors’ flow and Japan is amongst the largest worldwide capital exporters.

When it comes to Japan, macro vigilantes have woken up but if you think we’re heading for more uncertain times and divergent monetary policy path there is still plenty to look for in this space!

3. Commodities are rallying! Wait a second, though…

You must have heard about the upcoming commodity super-cycle, and price action in this space has been validating this thesis…hasn’t it?

Well, spot prices of several commodities have accelerated sharply over the last few quarters but long-dated futures haven’t really moved to the same extent.

This has led 21 out of the 28 commodities tracked by Bloomberg into backwardation, a phenomenon occurring when the spot price of an asset is higher than prices trading in the long-dated futures market as a result of a strong and temporary demand/supply imbalance which is expected to fade away as time goes by.

For instance, the May 2025 Copper future is trading at $468/lb while May 2022 Copper is trading at $472/lb.

Same goes for the May 2025 WTI Crude future, which is trading at $77 against spot prices above $100: so much for the commodity super-cycle.

If you believe a long-term structural transition towards a marked demand/supply imbalance in commodities is coming, once you look under the hood you realize that the macro vigilantes have barely started to do their homework.

In markets, it’s always crucial to think in probabilistic scenarios and assess your base case against what’s priced in markets across the board.

While we keep hearing about regime-change narratives and price action seems to validate some, a deeper look into global macro asset classes reveals the base case priced in remains this is all going to be ‘‘transitory’’.

If you have a different base case, there are plenty of regime-change, macro vigilantes trades out there - as always, I’d make sure to look for skewed risk/reward trades and size positions according to the underlying volatility of the asset class and my risk tolerance.

Said that, in May I am going to publish my medium/long-term macro ETF portfolio and therefore looking for inspiration from The Macro Compass community: what good risk/reward macro trades do you like here?

And as we are talking about macro investment ideas, it’s time to share the big news!

The Macro Trading Floor podcast is here!

I am very happy to announce my buddy Andreas Steno Larsen and myself are finally launching our long-awaited podcast called The Macro Trading Floor!

Have you ever listened to a macro or a finance podcast and asked yourself by the end: how do I actually trade the very interesting views I heard for the last 45-60 minutes? Well, look no further – in this podcast we promise you to always become concrete.

Every week we will invite the best worldwide macro minds and risk takers for a discussion on their current macro thesis, but after we’ve unpacked their macro big picture we will ask them to deliver one actionable macro investment idea!

By the end of the show, Andreas and I will debate how to implement the trade (being friendly also to non-institutional investors) and whether we buy or we sell the trade: skin in the game for us too!

Most importantly, this will not only be an educational and actionable macro podcast but also a show full of banter - expect plenty of laughs, funny anecdotes and plenty of Italian accent! :)

The premiere episode will be launched on Sunday, April 17th and our first guest is one of the best macro investors I’ve ever met - make sure to subscribe to The Macro Trading Floor landing page on your preferred podcast app and to the Blockworks Youtube channel (yes, it’s also going to be a Youtube show and not only a podcast).

Links below:

We are very excited to kick-off The Macro Trading Floor, and I am extremely grateful for the support I’ve been receiving here on The Macro Compass.

May I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about the premiere episode of The Macro Trading Floor? Thank you all, and stay tuned for Sunday!

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

If you want more macro insights, you can also follow me on Twitter and Linkedin.

See you soon here for another article of The Macro Compass, a community of more than 38.500+ worldwide investors and macro enthusiasts!

Share this post