‘‘The most important rule of trading is to play great defense, not great offense.

Every day I assume every position I have is wrong.

I know where my stops are, and I do that so I can define my maximum drawdown.

At the end of the day, the most important thing is how good you are at risk control.’’Paul Tudor Jones, CEO of Tudor Investments

Different investors perceive and measure risk differently, but there is one common objective they all want to achieve: avoid making stupid mistakes.

For a long-term investor, the worst possible outcome is to experience big enough drawdowns whose magnitude far exceeds her risk tolerance and hence lead to the cardinal sin of them all: ‘‘panic-hit-the-sell-button’’.

This happens when investors assume correlations across asset classes will hold regardless of the macroeconomic regime we are in and/or size their positions without paying attention to the very diverse underlying volatility each asset class has.

In this article, we will:

Discuss the strategic objective and the main risk management pillars a long-term investor should pursue, and why;

Announce a couple of exciting news!

Risk Management Pillars for a Long-Term Investor

Actually, before we jump right in.

In an attempt to reduce my innate ‘‘boomer-ness’’, this week I am launching my Instagram profile (link here)!

Expect plenty of macro charts and short video clips unpacking price action across asset classes.

And when it comes to non-macro content, also expect a healthy dose of Southern Italian food pics and recipes! :)

Jokes aside, if you use Instagram feel free to follow my work there too!

Now, back to it: whether you are a medium to long-term investor or a more short-term oriented trader, a healthy dose of systematic approach to risk management is key if you want to survive and possibly try to generate some decent returns, too.

Let’s look at a medium to long-term investor: what’s her objective in the first place?

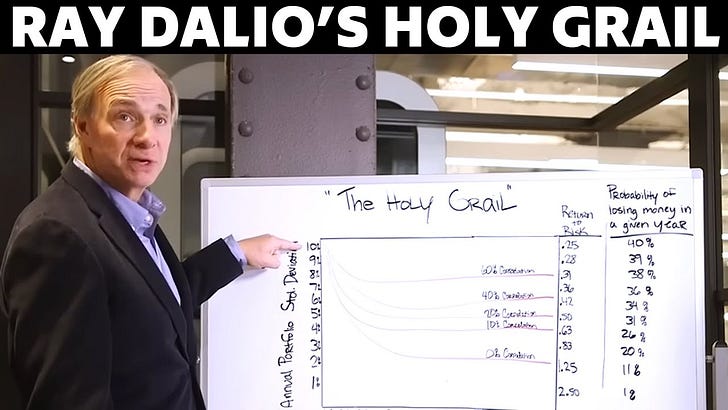

Many decades ago, Ray Dalio explained how the holy grail for every long-term investor should be to find return-additive, yet not highly correlated assets to add to her portfolio.

You see, a long-term investor is paid to harvest risk premia: when you actively decide to provide funding or capital to a public entity (you buy government bonds) or to a private sector entity (e.g. you buy stocks), you are exposing yourself to several risks and therefore you will be demanding some sort of compensation.

There are several risk factors out there: credit, liquidity, growth, inflation, etc.

And for all of those risks you are facing, your main form of compensation should be a long-term, inflation-adjusted positive total return for your investments.

Here is a 200+ years chart of total real returns for US stocks, bonds, gold and USD: it makes a lot of sense, doesn’t it?

But if on a long enough time horizon you can be relatively sure you will be compensated with positive real returns, why would a long-term investor need any systematic approach to risk management in the first place?

Easy: to avoid making stupid mistakes.

The most common being:

A) Assume correlations across asset classes will hold regardless of the macroeconomic regime we are in;

B) Which often contributes to big drawdowns, whose magnitude far exceeds the long-term investor risk tolerance and leads her to the cardinal sin of them all: ‘‘panic-hit-the-sell-button’’ and say goodbye to harvesting long-term risk premia.

How do you avoid these mistakes?

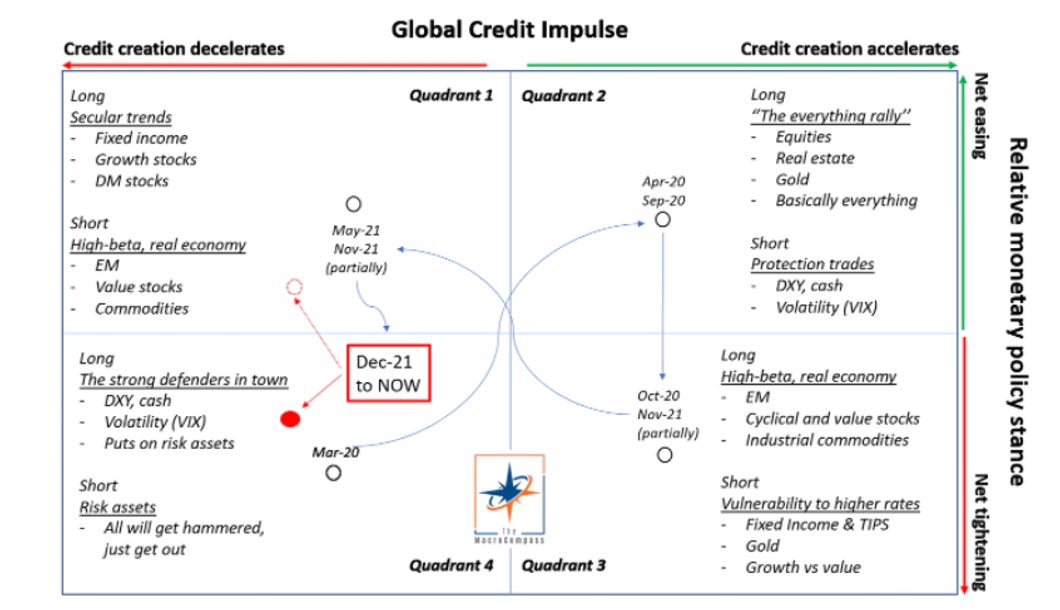

The Macro Compass can help you identifying which macroeconomic regime are we in and hence what to expect from asset classes returns and correlations.

If you want to know how it works in details, check this article.

In today’s macro environment where the economic growth impulse is decelerating and Central Banks are tightening monetary policy more aggressively than expected and pushing risk-free real yields quickly above equilibrium levels, correlation regimes can swiftly change.

At the end of 2021 we moved to Quadrant 4, which sees risk assets’ correlations converging to 1: even the long-standing negative correlation between bonds and stocks doesn’t work anymore as the sharp tightening in monetary policy and hawkish forward guidance prevent bonds from rallying despite a decelerating economic growth impulse.

That led to the ''pain everywhere trade'': the 6-month rolling Sharpe ratio (returns in excess of risk-free rate adjusted for volatility) for a basket of S&P500, Treasuries, corporate bonds and gold reached the worst level seen in over 30 years!

Having a robust framework that helps you navigating different macro cycles and correlation regimes is hence important, and The Macro Compass can help you wit that.

But every long-term investor also has a different tolerance for the severity of portfolio drawdowns she is able to endure before making ‘‘stupid mistakes’’.

Yes, portfolio drawdowns are a function of how truly uncorrelated your holdings are but they are also a function of how big your positions are relative to their underlying volatility: even a well-diversified portfolio throughout different macroeconomic regimes can deliver sub-par returns if positions are not sized correctly.

And talking about position sizing and moves relative to the underlying asset class volatility, it’s now time to go into the details of one of the many macro tools I am going to share with The Macro Compass subscribers over the next months!

Some Exciting News!

Before we go into the details of how this tool works, I want to give you some context about what we are going to do over the next few months.

The Macro Compass is now a community of almost 50,000 macro enthusiasts and investors who are kind enough to follow my macro analysis and subsequent portfolio allocation ideas, and this overwhelming support gives me the motivation to further enhance the experience by providing you with some useful macro tools.

The main idea is to give you free access to hedge-fund-level market data and macro models - all filtered down to essential, understandable and interactive tools.

Here is what I have in mind, for starters:

The Volatility-Adjusted Market Dashboard (VAMD): an interactive, cross-asset dashboard that provides you with an eye-catching overview of macro price action and highlights the biggest volatility-adjusted market movers on a given time horizon;

The Position Sizing Tool (PST): aimed at more tactical investors or traders, the tool provides you with the right sizing to apply to a new trade given the historical and recent volatility in the underlying instrument, the % of AuM you want to put at risk and the correlation with other asset classes;

The Macro Compass ETF-Only Portfolio (TMC Portfolio): an ETF-only portfolio for medium to long-term investors whose composition is informed by the Quadrant we sit in and the relative risk/return and correlation profile of several macro asset classes.

In case you have further suggestions or ideas, let me know!

But now, meet your new friend: The Volatility-Adjusted Market Dashboard (VAMD).

What’s the rationale behind?

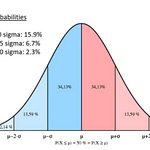

The VAMD shows real-time price development across macro asset classes and it color-codes the market moves by comparing the magnitude of the move against the asset class historical volatility using a rolling 5-year window.

This way, you can have a quick visual of what’s moving, where and how significant is the volatility-adjusted move for any asset class in global macro land.

Why a 5-years history?

Although a longer history would be preferable, 5 years allows for a good quality dataset across assets while ensuring different macro cycles and volatility regimes are captured too.

How does the color-coding work?

The darker the tone, the more significant is the magnitude of the move against the rolling historical volatility in that particular asset class.

Any move above 1 standard deviation starts to get highlighted with a slightly darker tone, with tonalities increasing as we move towards >2 sigma events.

Help me with some of the jargon in the Rates section, Alf!

2s10s and 5s30s: yield curve slopes between 10y and 2y, and 30y versus 5y;

Fed Funs Dec22: market-implied Federal Funds rate by December 2022;

Fed Funds 18m1m forward: the highest Fed Funds rate markets are pricing in for this hiking cycle (a proxy for terminal rate, working on a more accurate version);

5y5y real rate: the market-implied prevailing risk-free real yields for the medium term (2027-2032) calculated as 5y5y OIS swaps minus 5y5y inflation swaps (based on PCE);

EU Rates section: same as for US, but please notice I used ESTER swaps as they represent the purest term structure for European risk-free rates (ECB deposit rates);

Bund Yield, Yen-FX hedged: the yield a Japanese investor can make by purchasing 10y German government bonds and hedging the EUR/JPY FX risk for 12 months.

This is cool! What’s next for the VAMD?

Together with the broad macro template presented above, I am working on more detailed VAMD sections per each asset class.

Once ready, I will upload an interactive version of the VAMD so that you have access to a hedge-fund level global macro screening tool!

In the meanwhile, I will start using the VAMD in our weekly market updates on The Macro Compass so we all get more familiar with the tool.

I am going to post a market update on Thursday, but have a look at the VAMD again: can you spot some of the very important but very overlooked large volatility-adjusted market moves last week?

Thanks for reading all the way through, you are my hero! :)

Last but not least: if you are interested in any kind of partnership, sponsorship, or in bespoke consulting services feel free to reach out at TheMacroCompass@gmail.com.

May I ask you to be so kind and click on the like button and share this article around, so that we can spread the word about The Macro Compass?

It would make my day!

For any inquiries, feel free to get in touch at TheMacroCompass@gmail.com.

For more macro insights, you can also follow me on LinkedIn, Twitter and Instagram.

Feel free also to check out my new podcast The Macro Trading Floor - it’s available on all podcast apps and on the Blockworks Macro YouTube channel.

See you soon here for another article of The Macro Compass, a community of about 50.000 worldwide investors and macro enthusiasts!