A warm thank you to the 2,000 early birds who took advantage of the exclusive offer and subscribed to The Macro Compass premium services!

The ‘‘pay-8-get-12-months’’ offer will not be available anymore.

Yet, given the large amount of requests we decided to extend one last time-limited, seats-limited offer to our TMC readers.

Until December 10th, the first 1,000 subscribers counting from today will be able to get access to TMC content for the entire 2023 by paying only 9 months instead of 12!

From December 11th, no early-bird discounts anymore: full prices will be applicable.

Check out which subscription tier suits you the most and grab your last chance to be an early bird subscriber - the discount code is ‘‘TMC2’’!

Introduction

As my mentor always said: Alf, rule #1 as an investor is not to be stupid.

And trust me, it’s not an easy rule to respect.

As a long-term or tactical macro investor, the emotion-driven biases threatening to kill our performance are countless: recency bias, being in love with a macro narrative even when invalidated by price action, mis-sizing positions and so on.

But over time I learnt the hard way that as a macro investor respecting 3 main principles is in most cases enough to avoid stupid mistakes.

In this short article, we will go through the most common mistakes and how to avoid them by respecting 3 simple principles.

Common Mistakes & How To Avoid Them

Now, picture this.

First month running money as a junior PM, and I want to pitch a trade idea to my senior colleagues.

I really like it - and they go like ‘‘sure Alf, pitch it’’.

Adrenaline running high, I go through every piece of imaginable info and analysis necessary to back the trade.

Finally, I have the pitch in writing. I send it over.

My to-be-mentor walks to my desk and here is how it goes:

Mentor: ‘‘Alf, don’t be stupid.’’

Alf: ’’Oh, you don’t like the trade?’’

Mentor: ’’That doesn’t matter - you sized it wrong and there is no stop loss. No trade.’’

This was my baptism to institutional macro investing, and my first lesson on how to avoid stupid mistakes (spoiler: I made many more in my career).

Now, let’s talk about the three most common mistakes in long-term and tactical macro portfolio management and how to avoid them.

#1: Don’Put All Eggs In One Macro Basket

We all know about the power of diversification.

Many decades ago, Ray Dalio explained how the holy grail for every long-term investor should be to find return-additive, yet not highly correlated assets to add to her portfolio.

But in my experience, macro diversification is a nuanced subject.

To understand what I mean, let’s have a look at what the TMC Quadrant Asset Allocation model is pointing to today:

If you’d take it at face value, you’d be 100% in USD cash.

This would classify as a ‘‘stupid macro mistake’’ - why?

Because however sophisticated your models might be, you can’t predict the future - macro investors instead have to assess future outcomes in a probabilistic way.

Say the Fed really pivots and cuts rates by 300 bps in 2023, and as a result we transition towards Quadrant 1.

And to position for that you buy US and EU bonds, US tech and EU growth stocks.

That is not a macro-diversified portfolio. At all.

You are assigning a 100% probability to a macro-base-case and getting no exposure to other macro factors (e.g. strong growth, persistent inflation) if you are wrong.

Don’t put all your eggs in one macro-base-case-scenario basket.

Instead, think in probabilistic terms and try to add cheap positions that will deliver convex returns if your base case doesn’t realize.

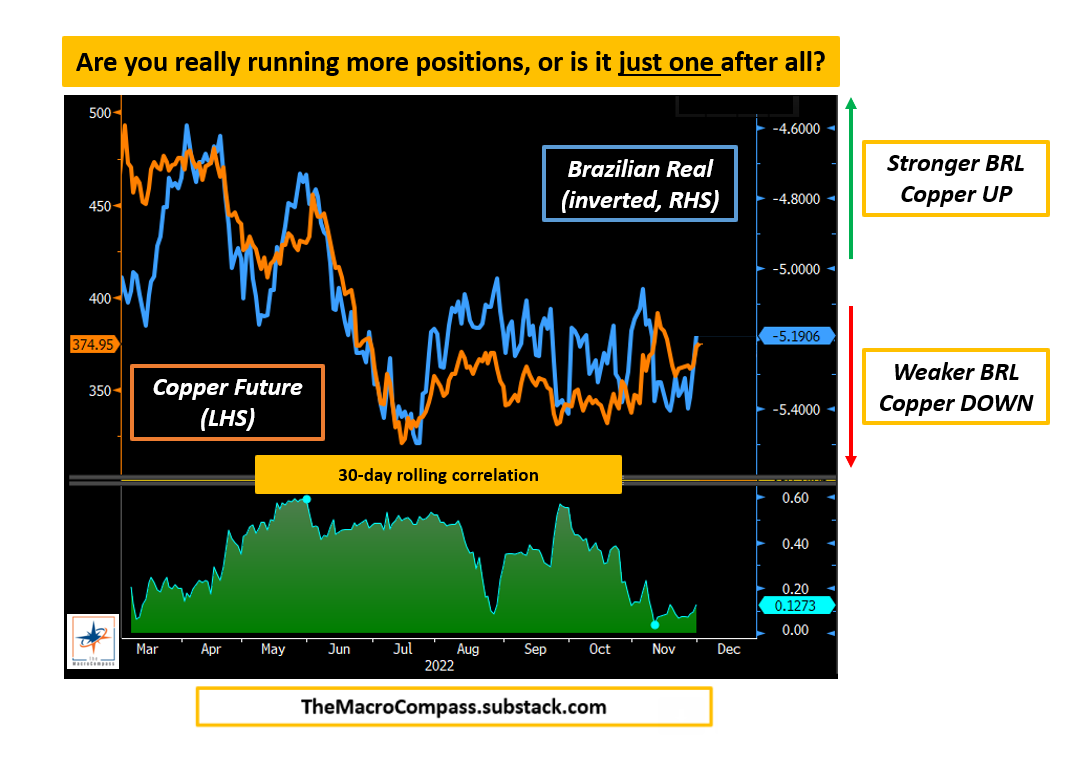

#2: You Sure You’Re Running 5 Positions, Or Is It Just 1?

Around March this year, one of my top hedge fund clients reached out to discuss its portfolio ahead of Q2.

His book could be summarized by something along these lines:

Long Brazilian Real vs US Dollar

Long a basket of industrial commodities (Copper & Co.)

Long Natural Gas futures

Short 2y Treasuries

Some exotic trade in equity derivatives

I told him he was basically running one trade - and that’s dangerous.

His macro narrative was that inflation was gonna massively surprise on the upside, that commodities were gonna contribute and benefit from it together with commodity exporters and that the Fed was gonna be forced to raise rates to 5%+ to fight inflation.

With hindsight today that was brilliantly prescient, wasn’t it?

But the problem was that as he was basically running 4 positions around that very same macro theme, he suffered a material drawdown in June/July and was brutally stopped out despite his main thesis proving to be correct in the end.

One way to avoid this mistake is to ask yourself: how much and to what macro risk factors is my aggregate book exposed to?

If the answer is ‘‘all my trades make or lose money if xyz happens’’, maybe it’s time to re-assess your exposures.

I find Principal Component Analysis (PCA) very useful for that: it decomposes the data into principal components that try to explain as much variance as possible, hence eliminating a lot of noise and identifying the main macro risk factors to which my portfolio is exposed.

PCA will one of the many features available to Pro subscribers in the Portfolio Optimizer macro tool released in 2023.

#3: Do Not Proxy Trade

Let’s say you ran your macro models, and assessed probabilistic outcomes ahead.

You screened different asset classes and found good risk/reward investments that give you a nicely weighted exposure to different macro risk factors.

Now you are looking to implement positions, and in particular your analysis points to a short position in Crude Oil as part of your book.

You go ahead and put a short position on XLE 0.00%↑ ($XLE ETF) as a very clear proxy expression of a short Oil view.

And this happens.

In November, Crude Oil was down 8% while the XLE ETF was up 1%.

Your macro view was right, but you ended up getting exposure to your macro risk factor (short Crude Oil) via a proxy and as the 30-day rolling correlation broke down from its stable .75-.80 range you literally lost money on a good macro view.

Another great example of the dangers of proxy investing/trading is the pain many people who called the massive 2022 inflationary spike right had to suffer as they managed to get a big call right and still lose money.

If your macro call is for higher inflation, pay fixed inflation swaps.

If you can’t, you are forced to look at proxies but be as close as possible to your macro risk factor.

Sell your nominal bonds and buy TIPS.

If you can’t, buy commodities with the tightest long-term correlation to inflation (gold is a real rates play, not an inflation play).

As my mentor used to say: don’t be stupid, Alf.

Don’t proxy trade.

Conclusions

Macro investing is a tough cookie, and being successful over time is very complicated.

But in my experience simply avoiding stupid mistakes sets you up on a pretty decent path already.

A) Don’t put all your eggs in one macro basket

The first thing to remember is that we can’t predict the future with 100% accuracy.

Hence, while building portfolios and tactical trades around your macro-base-case-scenario makes sense you shouldn’t forget to get exposure to opposite macro risk factors too - in case you are wrong, you know.

The best way to do this is to look for positions that will either benefit across macro scenarios or that will deliver asymmetrically positive returns if a low-probability scenario unfolds hence requiring only a small risk exposure in your portfolio.

B) Are you running 10 trades, or is it really 1 trade after all?

Having 10 positions in your book doesn’t guarantee proper macro diversification.

It’s very important to ask yourself what are the macro risk factors behind each position, and whether your book has excessive concentration towards one of them.

The best way to avoid this mistake is to do a PCA analysis, but if you can’t there is a much easier way: write down the top 3 macro drivers behind each position in your book, and check how many times you are exposed to the same driver.

Hint: it shouldn’t be too many.

C) Do Not (!) proxy trade/invest

If you want to be long bonds, be long bonds.

Not long utilities because they are considered a bond proxy.

Don’t be one of the many who succumbed to the sirens of proxy trading.

And this was it for today, thanks for reading!

If you enjoyed the piece, please click on the like button and share it with friends :)

Finally, a quick reminder: from January 1st, getting access to this content (and much more!) will require a paid subscription.

As a loyal TMC reader, you have one last chance to get in with an early bird discount: until December 10th, the first 1,000 subscribers counting from today will be able to get access to TMC content for the entire 2023 by paying only 9 months instead of 12!

From December 11th, no early-bird discounts anymore: full prices will be applicable.

Check out which subscription tier suits you the most and grab your last chance to be an early bird subscriber - the discount code is ‘‘TMC2’’!

Subscribing to any of the tiers above now will guarantee you lock-in early bird prices and your subscription will cover the entire 2023 calendar year.

For more information, here is the website.

I hope to see you onboard!

DISCLAIMER

The content provided on The Macro Compass newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

Share this post